WNS (Holdings) Limited (NYSE: WNS), a leading provider of offshore

business process outsourcing (BPO) services, today announced strong

results for the quarter ended June 30, 2007 and reiterated its

guidance for fiscal 2008. �As evidenced by our results, our

momentum coming into fiscal 2008 continues to be very strong,� said

Neeraj Bhargava, Group Chief Executive Officer. �Our strong

operating performance enabled us to exceed our revenue and net

income expectations for the first quarter. Further, we are

encouraged by our continued success with new clients highlighted by

11 new wins and 6 expansions by existing clients.� WNS recorded

basic income per ADS of 20 cents and basic income per ADS

(excluding share-based compensation expense and amortization of

intangible assets) of 26 cents for the quarter. �We were able to

minimize the impact of the rupee appreciation through tight cost

controls, scale benefits and currency hedging,� said Zubin Dubash,

Group Chief Financial Officer. �These factors have collectively

enabled us to achieve results beyond our expectations and give us

confidence about our position in relation to full year guidance.�

Financial Highlights: Fiscal First Quarter Ended June 30, 2007

Quarterly revenue of $112.5 million, up 112.2% from the

corresponding quarter last year. Quarterly revenue less repair

payments of $69.8 million, up 53.3% from the corresponding quarter

last year. Quarterly net income of $8.4 million, up 83.8% from the

corresponding quarter last year. Quarterly net income (excluding

share-based compensation expense and amortization of intangible

assets) of $10.8 million, up 104.2% from the corresponding quarter

last year. Quarterly basic income per ADS of 20 cents, up from 13

cents for the corresponding quarter last year. Quarterly basic

income per ADS (excluding share-based compensation expense and

amortization of intangible assets) of 26 cents, up from 15 cents

for the corresponding quarter last year. Reconciliations of

non-GAAP financial measures to GAAP operating results are included

at the end of this release. Key Announcements WNS was the top

ranked Indian outsourcing provider according to the 4th annual

Black Book of Outsourcing Survey conducted by the Brown Wilson

Group, a leading industry analyst. WNS also made dramatic gains in

this year�s global ranking, overtaking numerous other outsourcing

providers to its new position as #3. As expected, WNS transferred

to AVIVA the Sri Lankan facility dedicated to this client on July

2, 2007, subsequent to AVIVA exercising its call option on January

1, 2007. This transfer was a part of the Build-Operate-Transfer

contract with the client. WNS completed transition to majority

independent Board of Directors with the appointment of Sir Anthony

Greener. Sir Anthony joins WNS after retiring from British Telecom

plc (BT) in September 2006, where he served as Deputy Chairman of

the Board. He was Chairman of Diageo plc through 2000 and Chief

Executive of Dunhill Holdings prior to that. Guy Sochovsky, who has

served on the Board of Directors since January 26, 2006 as a

representative of majority shareholder Warburg Pincus, stepped down

on July 24, 2007. Deborah S. Kops was appointed Chief Marketing

Officer on May 24, 2007. Ms. Kops joins WNS after holding managing

director positions at Deutsche Bank London, where she led global

sourcing transformation efforts, and FleetBoston (now Bank of

America), where she managed corporate administrative services. She

was one of the founding partners of PricewaterhouseCoopers�

business process outsourcing division. Fiscal 2008 Guidance WNS

reiterates its May 15, 2007 guidance for fiscal 2008: Revenue less

repair payments expected to be between $302 million and $307

million Net income (excluding share-based compensation expense and

amortization of intangible assets) expected to be between $41.0

million to $ 43.0 million. Revised exchange rate assumptions for

the above guidance are 40.70 Indian Rupees to 1 US Dollar and 2.03

US Dollars to 1 Pound Sterling for the full fiscal year. �We have

maintained our initial guidance despite the appreciation of the

rupee as we are confident of being able to control costs and

increase SG&A leverage through the year,� said Zubin Dubash,

Group Chief Financial Officer. �Further, we have reduced our

estimate of share-based compensation expense for fiscal 2008 from

$8.8 million to $7.8 million.� Conference Call WNS will host a

conference call on August 16, at 8 a.m. (EDT) to discuss the

company's quarterly results. To participate, callers can dial

800-295-3991 from within the U.S. or +1-617-614-3924 from any other

country. The participant passcode is 1352836. A replay will be made

available online at www.wnsgs.com for a period of three months

beginning two hours after the end of the call. About WNS WNS is a

leading provider of offshore business process outsourcing, or BPO,

services. We provide comprehensive data, voice and analytical

services that are underpinned by our expertise in our target

industry sectors. We transfer the execution of the business

processes of our clients, which are typically companies located in

Europe and North America, to our delivery centers located primarily

in India. We provide high quality execution of client processes,

monitor these processes against multiple performance metrics, and

seek to improve them on an ongoing basis. Our ADSs are listed on

the New York Stock Exchange. For more information, please visit our

website at www.wnsgs.com. About Non-GAAP Financial Measures For

financial statement reporting purposes, the company has two

reportable segments: WNS Global BPO and WNS Auto Claims BPO. In the

auto claims segment, WNS provides claims-handling and

accident-management services, in which it arranges for automobile

repairs through a network of third-party repair centers. In its

accident-management services, WNS acts as the principal in dealings

with the third-party repair centers and clients. The amounts

invoiced to WNS clients for payments made by WNS to third-party

repair centers are reported as revenue. As the company wholly

subcontracts the repairs to the repair centers, it evaluates its

financial performance based on revenue less repair payments to

third party repair centers, which is a non-GAAP measure. WNS

believes revenue less repair payments reflects more accurately the

value addition of the business process services it directly

provides to its clients. The presentation of this non-GAAP

information is not meant to be considered in isolation or as a

substitute for the company's financial results prepared in

accordance with U.S. GAAP. WNS revenue less repair payments may not

be comparable to similarly titled measures reported by other

companies due to potential differences in the method of

calculation. Safe Harbor Statement under the provisions of the

United States Private Securities Litigation Reform Act of 1995 This

news release contains forward-looking statements, as defined in the

safe harbor provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These statements involve a number of risks,

uncertainties and other factors that could cause actual results to

differ materially from�those that may be projected by these forward

looking statements. These risks and uncertainties include but are

not limited to a slowdown in the U.S. and Indian economies and in

the sectors in which our clients are based, a slowdown in the BPO

and IT sectors world-wide, competition, the success or failure of

our past and future acquisitions, attracting, recruiting and

retaining highly skilled employees, technology, legal and

regulatory policy as well as other risks detailed in our reports

filed with the U.S. Securities and Exchange Commission. These

filings are available at www.sec.gov. We may, from time to time,

make additional written and oral forward-looking statements,

including statements contained in our filings with the Securities

and Exchange Commission and our reports to shareholders. You are

cautioned not to place undue reliance on these forward-looking

statements, which reflect management�s current analysis of future

events. We undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. WNS (HOLDINGS) LIMITED CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (Amounts in

thousands, except share and per share data) � June 30, 2007 June

30, 2006 � Revenue 112,523 53,026 Cost of revenue (refer to note

below) 90,206 37,430 Gross Profit 22,317 15,596 Operating expenses:

Selling, general and administrative expenses (refer note as below)

14,722 10,130 Amortization of intangible assets 829 471 Operating

income 6,766 4,995 Other (expense) income, net 2,686 (35 ) Interest

expense - (32 ) Income before income taxes 9,452 4,928 Provision

for income taxes (1,013 ) � (335 ) Net income $8,439 � � $4,593 �

Basic income per share $0.20 $0.13 Diluted income per share $0.20

$0.12 Basic weighted average ordinary shares outstanding 41,892,868

35,220,868 Diluted weighted average ordinary shares outstanding

43,085,843 38,021,949 � Note: a) Includes the following share-based

compensation amounts: Cost of Revenue 516 - Selling, general and

administrative expenses 989 212 Non-GAAP measure note: In addition

to its reported operating results in accordance with U.S. generally

accepted accounting principles (US GAAP). WNS has included in the

table below non-GAAP operating measures that the Securities and

Exchange Commission defines as �non-GAAP financial measures�.

Management believes that such non-GAAP financial measures, when

read in conjunction with the company�s reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the company�s results. The non-GAAP

financial measures disclosed by the company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations to those

financial statements should be carefully evaluated. Reconciliation

of revenue less repair payments (non-GAAP) to revenue (GAAP) Three

months ended June 30, 2007 � June 30, 2006 � Revenue less repair

payments (Non-GAAP) 69,773 45,509 Add: Payments to repair centers

42,750 7,517 Revenue (GAAP) 112,523 53,026 � Reconciliation of cost

of revenue (non-GAAP to GAAP) Three months ended June 30, 2007 �

June 30, 2006 � Cost of revenue (Non-GAAP) 47,456 29,913 Add:

Payments to repair centers 42,750 7,517 Cost of revenue (GAAP)

90,206 37,430 Reconciliation of selling, general and administrative

expense (non-GAAP to GAAP) Three months�ended June�30, 2007 �

June�30, 2006 � Selling, general and administrative expenses

(excluding share-based compensation expense) (Non-GAAP) 13,733

9,918 Add: Share-based compensation expense 989 212 Selling,

general and administrative expenses (GAAP) 14,722 10,130 �

Reconciliation of operating income (non-GAAP to GAAP) Three months

ended June 30, 2007 � June 30, 2006 � Operating income (excluding

share-based compensation expense and amortization of intangible

assets) (Non-GAAP) 9,100 5,678 Less: Share-based compensation

expense 1,505 212 Less: Amortization of intangible assets 829 471

Operating income (GAAP) 6,766 4,995 Reconciliation of net income

(non-GAAP to GAAP) Three months ended June�30, 2007 � June�30, 2006

� Net income (excluding share-based compensation expense and

amortization of intangible assets) (Non-GAAP) 10,773 5,276 Less:

Share-based compensation expense 1,505 212 Less: Amortization of

intangible assets 829 471 Net income (GAAP) 8,439 4,593

Reconciliation of basic income per ADS (non-GAAP to GAAP) Three

months ended June�30, 2007 � June�30, 2006 � Basic income per ADS

(excluding amortization of intangible assets and share based

compensation expense) (Non-GAAP) 0.26 0.15 Less: Adjustments for

amortization of intangible assets and share-based compensation

expense 0.06 0.02 Basic income per ADS (GAAP) 0.20 0.13

Reconciliation of diluted income per ADS (non-GAAP to GAAP) Three

months ended June�30, 2007 June�30, 2006 � Diluted income per ADS

(excluding amortization of intangible assets and share based

compensation expense) (Non-GAAP) 0.25 0.14 Less: Adjustments for

amortization of intangible assets and share-based compensation

expense 0.05 0.02 Diluted income per ADS (GAAP) 0.20 0.12 WNS

(HOLDINGS) LIMITED CONDENSED CONSOLIDATED BALANCE SHEETS (Amounts

in thousands, except share and per share data) � June 30,2007 March

31,2007 (Unaudited) � � ASSETS Current assets Cash and cash

equivalents $75,375 $112,340 Bank deposits 12,000 12,000 Accounts

receivable, net of allowance of $330 and $364, respectively 48,130

40,592 Funds held for clients 7,409 6,589 Employee receivable 1,526

1,289 Prepaid expenses 3,813 2,162 Prepaid income taxes 2,996 3,225

Deferred tax assets 588 701 Other current assets 7,117 � 4,524

Total current assets 158,954 183,422 � Goodwill 62,116 37,356

Intangible assets, net 15,780 7,091 Property and equipment, net

47,343 41,830 Deposits 5,522 3,081 Deferred tax assets 4,587 �

3,101 TOTAL ASSETS $294,302 � $275,881 � LIABILITIES AND

SHAREHOLDERS� EQUITY Current liabilities Accounts payable $16,778

$18,751 Accrued employee costs 15,810 18,492 Deferred revenue �

current 7,459 9,827 Income taxes payable 864 88 Obligations under

capital leases � current 10 13 Deferred tax liabilities 206 ? Other

current liabilities 22,749 � 16,239 Total current liabilities

63,876 63,410 � Deferred revenue � non current 6,462 5,051 Deferred

rent 1,506 1,098 Accrued pension liability 1,104 771 Deferred tax

liabilities � non current 2,372 23 � Shareholders� equity: Ordinary

shares, $0.16 (? 0.10) par value; Authorized 50,000,000 shares

Issued and outstanding: 41,906,477 and 41,842,879 shares,

respectively 6,531 6,519 Additional paid-in-capital 157,150 154,952

Ordinary shares subscribed, 21,006 and 30,022 shares, respectively

117 137 Retained earnings 37,778 30,685 Accumulated other

comprehensive income 17,406 � 13,235 Total shareholders� equity

218,982 � 205,528 TOTAL LIABILITIES AND SHAREHOLDERS� EQUITY

$294,302 � $275,881

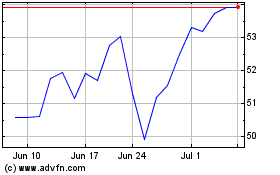

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024