WNS Closes Acquisition of Marketics Technologies

May 14 2007 - 5:45PM

Business Wire

WNS (Holdings) Limited (NYSE: WNS), a leading provider of offshore

business process outsourcing (BPO) services, announced that it

closed its acquisition of Marketics Technologies (India) Private

Limited, a privately-owned leader in offshore analytics services on

May 9, 2007. The total consideration for the acquisition consists

of a $30 million payment at closing and a contingent earn-out of up

to a maximum of $35 million based on the results of operations of

Marketics for the fiscal year ending March 31, 2008. The contingent

earn-out consideration would be computed as 15 times fiscal 2008

net income excluding share-based compensation expense and other

items, as defined in the Sale and Purchase Agreement for the

acquisition, less the $30 million payment at closing. WNS funded

the first payment of $30 million from existing cash and cash

equivalents and intends to fund the contingent earn-out

consideration also from existing cash and cash equivalents. The

offshore analytics market is emerging rapidly as companies look to

find new ways to grow revenue and margins. Over the last 3 years,

Marketics has established itself as a leader and innovator in this

segment by developing a wide range of technology-enabled analytic

services, primarily targeting the sales and marketing organizations

of consumer-centric companies. Marketics� value proposition is

focused on enabling business decision making through the use of

complex analytics. The company provides complex services such as

predictive modeling to understand consumer behavior and sales data

analytics to support inventory allocation. Such services tend to

command high revenue per employee. �Marketics has approximately

doubled its revenue in each of the last three years and is

profitable,� said Neeraj Bhargava, WNS Group Chief Executive

Officer. �We expect Marketics to be accretive to net income

excluding amortization of intangible assets and share-based

compensation expense. This acquisition fits in with our strategy of

acquiring companies that bring new capabilities to WNS.� Through

the acquisition, WNS also gains nine clients many of which are

Fortune 200 companies in customer-centric industries such as

retail, consumer packaged goods, beverages and consumer electronics

and creates a new platform for WNS to expand in these industries.

�We are excited to be part of WNS as we believe that the company

will provide us with the appropriate platform for growth and give

us access to many more new clients,� said Sreenivasan Ramakrishnan,

Marketics� Co-Founder and Chief Executive Officer. �This is a

critical step towards achieving our mission of building a

world-class analytics business.� About WNS WNS is a leading

provider of offshore business process outsourcing, or BPO,

services. We provide comprehensive data, voice and analytical

services that are underpinned by our expertise in our target

industry sectors. We transfer the execution of the business

processes of our clients, which are typically companies located in

Europe and North America, to our delivery centers located primarily

in India. We provide high-quality execution of client processes,

monitor these processes against multiple performance metrics, and

seek to improve them on an ongoing basis. WNS ADSs are listed on

the New York Stock Exchange. For more information, please visit our

website at www.wnsgs.com. Safe Harbor Statement under the

provisions of the United States Private Securities Litigation

Reform Act of 1995 This release contains �forward-looking

statements� that are based on our current expectations,

assumptions, estimates and projections about our company and our

industry. The forward-looking statements are subject to various

risks and uncertainties. Those statements include estimates of the

benefits of the proposed acquisition and future plans of the

company. We caution you that reliance on any forward-looking

statement involves risks and uncertainties, and that although we

believe that the assumptions on which our forward-looking

statements are based are reasonable, any of those assumptions could

prove to be inaccurate, and, as a result, the forward-looking

statements based on those assumptions could be materially

incorrect. These factors include but are not limited to:

technological innovation; telecommunications or technology

disruptions; future regulatory actions and conditions in our

operating areas; our dependence on a limited number of clients in a

limited number of industries; our ability to attract and retain

clients; our ability to expand our business or effectively manage

growth; our ability to hire and retain enough sufficiently trained

employees to support our operations; negative public reaction in

the U.S. or the U.K. to offshore outsourcing; regulatory,

legislative and judicial developments; increasing competition in

the business process outsourcing industry; political or economic

instability in India, Sri Lanka and Jersey; worldwide economic and

business conditions; our ability to successfully consummate

strategic acquisitions; and other risks described from time to time

in our SEC filings, including our registration statement on Form

F-1 (No. 333-135590) filed on July 3, 2006, as amended.

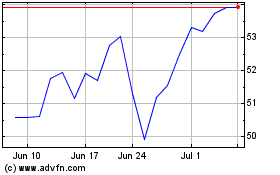

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024