Fitch Places Health Care REIT on Rating Watch Positive

September 14 2006 - 4:58PM

Business Wire

Fitch Ratings has placed the ratings of Health Care REIT (NYSE:HCN)

on Rating Watch Positive following the company's announcement of

its intention to acquire Windrose Medical Properties Trust

(NYSE:WNS or Windrose). The following ratings are affected: --

Issuer default rating 'BBB-'; -- Unsecured bank credit facility

'BBB-'; -- Senior unsecured notes 'BBB-'; -- Preferred stock 'BB+'.

The rating action affects approximately $1.5 billion of outstanding

securities. Fitch notes that the acquisition would increase the

company's asset base by approximately 25% and would broaden its

investment portfolio to include medical office buildings,

outpatient facilities and specialty hospitals. The Windrose

properties are well-leased at 94.2% as of June 30, 2006. The

addition of these facilities to the portfolio will decrease HCN's

reliance on revenue from its top tenants. HCN's top five tenants

represented 42% of its total investment balance as of June 30,

2006. Pro forma for the acquisition, HCN's top five tenants would

represent 35%. Moreover, the acquisition would also reduce HCN's

exposure to government reimbursement risk. Skilled nursing

facilities, which generate the vast majority of revenue from

government sources, would decline from 45% of HCN's total portfolio

to 37% with the addition of the Windrose portfolio. Fitch also

notes that HCN has indicated that it intends to maintain debt

service coverage ratios and leverage within existing ranges after

the closing of the acquisition. HCN's interest coverage as measured

by recurring EBITDA over total interest expense was 3.2 times (x)

for the last 12 months and fixed charge coverage after adjusting

for capital expenditures and preferred dividends was 2.5x for the

last 12 months. HCN's total debt to undepreciated book capital was

44.1% and total debt plus preferred securities to total

undepreciated book capital was 52.4% at June 30, 2006. In addition

to the company's solid operating performance, an important

contributor to HCN's existing ratings is the company's relatively

liquid balance sheet which is due in part to its unsecured funding

strategy. As of June 30, 2006, HCN's portion of secured debt was 4%

of total debt. After the closing of the acquisition, however, HCN's

percentage of secured debt would rise to 13%. Fitch anticipates

that the company would reduce this exposure meaningfully over the

next several quarters. Fitch also notes that there is a moderate

degree of execution risk associated with this acquisition. Although

existing HCN management has limited expertise with respect to

managing a platform of medical office buildings, the company will

retain key executives from Windrose. Fitch would expect to see

evidence of a smooth integration of Windrose into HCN prior to

resolving the Rating Watch. Fitch's rating definitions and the

terms of use of such ratings are available on the agency's public

site, www.fitchratings.com. Published ratings, criteria and

methodologies are available from this site, at all times. Fitch's

code of conduct, confidentiality, conflicts of interest, affiliate

firewall, compliance and other relevant policies and procedures are

also available from the 'Code of Conduct' section of this site.

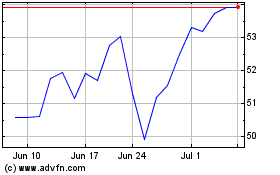

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024