WNS (Holdings) Limited (NYSE: WNS), a leading provider of offshore

business process outsourcing (BPO) services, today announced its

results for the first fiscal quarter ended June 30, 2006. "WNS had

a strong quarter in terms of revenue growth," said Neeraj Bhargava,

Group Chief Executive Officer. "Our employee strength grew by 1,537

associates, or 14.7%, in the quarter, the highest growth that we

have experienced since our inception. We were on target in terms of

profitability and operational ramp up for the quarter and are

pleased with where we stand today as a public company in terms of

achieving our financial and operational goals." Financial

Highlights - First Quarter Fiscal 2007 -- Revenue for the quarter

ended June 30, 2006, was $53.0 million, up 3.6% from $51.2 million

in the quarter ended June 30, 2005. Revenue for the quarter grew

sequentially by 0.2% from $52.9 million in the previous quarter. --

Revenue less repair payments for the quarter ended June 30, 2006,

was $45.5 million, up 37.1% from $33.2 million in the quarter ended

June 30, 2005. Revenue less repair payments for the quarter grew

sequentially by 9.8% from $41.4 million in the previous quarter.**

-- Net income for the quarter ended June 30, 2006, was $4.6

million, up 5.0% from $4.4 million in the quarter ended June 30,

2005. Net income for the quarter grew sequentially by 24.6% from

$3.7 million in the previous quarter. -- Net income (excluding

amortization of intangible assets and share-based compensation

expense) for the quarter ended June 30, 2006, was $5.3 million, up

11.4% from $4.7 million in the quarter ended June 30, 2005. Net

income (excluding amortization of intangible assets and share-based

compensation expense) for the quarter grew sequentially by 19.3%

from $4.4 million in the previous quarter. -- Basic income per

share for the quarter ended June 30, 2006, was 13 cents, compared

with 14 cents for the quarter ended June 30, 2005. Basic income per

share for the previous quarter was 10 cents. (EPS calculation

excludes 4,473,684 shares issued by the company in its initial

public offering, which closed on July 31, 2006.) -- Basic income

per share (excluding amortization of intangible assets and

share-based compensation expense) for the quarter ended June 30,

2006, was 15 cents, compared with 15 cents in the quarter ended

June 30, 2005. Basic income per share (excluding amortization of

intangible assets and share-based compensation expense) for the

previous quarter was 13 cents. (EPS calculation excludes 4,473,684

shares issued by the company in its IPO which closed on July 31,

2006.) ** It is important to note that WNS revenue is generated

primarily from providing BPO services. The company has two

reportable segments for financial statement reporting purposes, WNS

Global BPO and WNS Auto Claims BPO. In the WNS Auto Claims BPO

segment the company provides claims handling and accident

management services, in which it arranges for automobile repairs

through a network of third party repair centers. In its accident

management services, WNS acts as the principal in dealings with the

third party repair centers and clients. The amounts invoiced to WNS

clients for payments made by WNS to third party repair centers is

reported as revenue. Since the company wholly subcontracts the

repairs to the repair centers, it evaluates its financial

performance based on revenue less repair payments to third party

repair centers, which is a non-GAAP measure. WNS believes that

revenue less repair payments reflects more accurately the value

addition of the business process services that it directly provides

to its clients. The presentation of this non-GAAP information is

not meant to be considered in isolation or as a substitute for the

company's financial results prepared in accordance with US GAAP.

WNS revenue less repair payments may not be comparable to similarly

titled measures reported by other companies due to potential

differences in the method of calculation. Operating Highlights --

As of June 30, 2006, WNS had total employees of 11,970, up 49.5%

from 8,009 a year earlier, and 14.7% from 10,433 as of March 31,

2006. -- WNS entered into a definitive contract with a large

client, British Airways, which extended the expiration of the term

of our original contract from March 2007 to May 2012. Under the new

contract, the parties have agreed to change the basis of pricing

for a portion of the contracted services over a transition period

from a per-full-time-equivalent basis to a per-unit-transaction

basis. In WNS' IPO, British Airways, one of the company's selling

shareholders, sold 5,160,000 ordinary shares, reducing its

ownership in WNS (Holdings) Limited to zero from 14.6%. For fiscal

2006, British Airways accounted for 7.2% of WNS' revenue and 9.9%

of its revenue less repair payments. -- WNS also entered into a

definitive amendment to the contract with another large client,

AVIVA, that continues the relationship between the two companies.

Under the contract, the date on which AVIVA could require WNS to

transfer relevant projects and operations back to AVIVA has been

extended to on or after June 30, 2007, for its facility in Sri

Lanka and to on or after December 30, 2007, for a larger facility

in Pune. For fiscal 2006, AVIVA accounted for 9.8% of WNS' revenue

and 13.4% of its revenue less repair payments. Review of operating

results - GAAP basis Results of operations The following table sets

forth certain financial information as a percentage of revenue: -0-

*T Revenue -------------------------------------------------

-------------------- Quarters ended

-------------------------------------------------

-------------------- June March June 30, 31, 30,

------------------------------------------------- ------ ------

------ 2006 2006 2005

------------------------------------------------- ------ ------

------ ------------------------------------------------- ------

------ ------ Cost of revenue 70.6% 70.5% 75.7%

------------------------------------------------- ------ ------

------ Gross profit 29.4% 29.5% 24.3%

------------------------------------------------- ------ ------

------ Operating expenses:

------------------------------------------------- ------ ------

------ Selling, general and administrative expense 19.1% 21.5%

13.8% ------------------------------------------------- ------

------ ------ Amortization of intangible assets 0.9% 1.0% 0.1%

------------------------------------------------- ------ ------

------ Operating income 9.4% 7.0% 10.4%

------------------------------------------------- ------ ------

------ Non-operating income (expense), net (0.1)% 0.4% (0.1)%

------------------------------------------------- ------ ------

------ Provision for income taxes (0.6)% (0.5)% (1.7)%

------------------------------------------------- ------ ------

------ Net income 8.7% 7.0% 8.5%

------------------------------------------------- ------ ------

------ *T -- Revenue for the quarter ended June 30, 2006, was $53.0

million, compared with $51.2 million for the quarter ended June 30,

2005, an increase of 3.6%. Revenue for the quarter increased

sequentially by 0.2% from $52.9 million in the quarter ended March

31, 2006. -- Gross profit for the quarter ended June 30, 2006, was

$15.6 million or 29.4% of revenue, compared with $12.4 million or

24.3% of revenue, in the quarter ended June 30, 2005. The increase

in gross profit percentage in the quarter ended June 30, 2006,

compared with the year-earlier quarter, is due to the loss of a

significant client in WNS Auto Claims BPO which -- when compared

with the rest of the business, contributed to a comparatively lower

gross profit percentage. Gross profit for the quarter ended March

31, 2006 was $15.6 million, or 29.5% of revenue. -- SG&A

expenses for the quarter ended June 30, 2006, were $10.1 million,

or 19.1% of revenue, compared with $7.1 million, or 13.8% of

revenue, in the quarter ended June 30, 2005. The increase in

expenses is on account of higher travel, legal and professional

charges and employee-related costs such as staff welfare and

recruitment expenses. SG&A expenses for the quarter ended March

31, 2006, were $11.4 million, or 21.5% of revenue. This decline in

expenses is attributable to non-recurring expenses of $0.7 million

incurred for quarter ended March 31, 2006 for consulting and audit

fees, representing a portion of the professional fees relating to

preparation for becoming a public company, and $0.3 million, of

decreased travel costs during the quarter ended June 30, 2006. --

Operating income for the quarter ended June 30, 2006, was $5.0

million or 9.4% of revenue, compared with $5.3 million, or 10.4% of

revenue, in the quarter ended June 30, 2005. Operating income for

the quarter ended March 31, 2006, was $3.7 million or 7.0% of

revenue. Review of operating results - On a revenue less repair

payments (non-GAAP) basis Results of operations The following table

sets forth certain financial information as a percentage of revenue

less repair payments: -0- *T Revenue less repair payments

-------------------------------------------------

--------------------

-------------------------------------------------

-------------------- Quarters Ended

-------------------------------------------------

-------------------- June March June 30, 31, 30,

------------------------------------------------- ------ ------

------ 2006 2006 2005

------------------------------------------------- ------ ------

------ ------------------------------------------------- ------

------ ------ Cost of revenue 65.7% 62.4% 62.5%

------------------------------------------------- ------ ------

------ Gross profit 34.3% 37.6% 37.5%

------------------------------------------------- ------ ------

------ Operating expenses:

------------------------------------------------- ------ ------

------ Selling, general and administrative expense 22.3% 27.4%

21.3% ------------------------------------------------- ------

------ ------ Amortization of intangible assets 1.0% 1.2% 0.2%

------------------------------------------------- ------ ------

------ Operating income 11.0% 9.0% 16.0%

------------------------------------------------- ------ ------

------ Non-operating (expense) income, net (0.1)% 0.5% (0.2)%

------------------------------------------------- ------ ------

------ Provision for income taxes (0.7)% (0.6)% (2.6)%

------------------------------------------------- ------ ------

------ Net income 10.1% 8.9% 13.2%

------------------------------------------------- ------ ------

------ SG&A (excluding share-based compensation expense) 21.8%

26.9% 20.4% -------------------------------------------------

------ ------ ------ Operating income (excluding amortization of

intangible assets and share-based compensation expense) 12.5% 10.8%

17.1% ------------------------------------------------- ------

------ ------ *T -- Revenue less repair payments for the quarter

ended June 30, 2006, was $45.5 million, compared with $33.2 million

for the quarter ended June 30, 2005, an increase of 37.1%. Revenue

less repair payments grew sequentially by 9.8% from $41.4 million

for the quarter ended March 31, 2006. -- Gross profit for the

quarter ended June 30, 2006, was $15.6 million, or 34.3% of revenue

less repair payments, compared with $12.4 million, or 37.5% of

revenue less repair payments, in the quarter ended June 30, 2005.

Gross profit for the quarter ended March 31, 2006, was $15.6

million, or 37.6% of revenue less repair payments. This decline in

gross profit percentage in the quarter ended June 30, 2006 is due

to: -0- *T -- Significant increase in the number of new hires who

underwent training and could not be billed at full rates in the WNS

Global BPO and Auto Claims businesses. These employees are expected

to be billed at full rates in subsequent quarters. -- Addition of

three new facilities, which resulted in increased infrastructure

costs -- Incremental salary increase effective from April 1, 2006.

*T -- SG&A expenses (excluding share-based compensation

expense) for the quarter ended June 30, 2006, were $9.9 million, or

21.8% of revenue less repair payment, compared with $6.8 million,

or 20.4% of revenue less repair payment, in the quarter ended June

30, 2005. The increase in expenses is attributable primarily to

higher travel, legal and professional charges and employee-related

costs such as staff welfare and recruitment expenses. SG&A cost

(excluding share-based compensation expense) for the quarter ended

March 31, 2006, was $11.1 million, or 26.9% of revenue less repair

payments. This decline in SG&A expenses in the quarter ended

June 30, 2006 is attributable to non-recurring expenses of $0.7

million incurred for quarter ended March 31, 2006, for consulting

and audit fees representing a portion of the professional fees

relating to WNS' preparation to become a public company, and $0.3

million, reflecting decreased travel during the quarter ended June

30, 2006. -- Operating income (excluding amortization of intangible

assets and share-based compensation expense) for the quarter ended

June 30, 2006, was $5.7 million, or 12.5% of revenue less repair

payments, compared with $5.7 million, or 17.1% of revenue less

repair payments, in the quarter ended June 30, 2005. Operating

income (excluding amortization of intangible assets and share-based

compensation expense) for the quarter ended March 31, 2006, was

$4.5 million, or 10.8% of revenue less repair payments. On July 31,

2006, WNS closed its initial public offering of 12,763,708 ADSs

(including 8,290,024 ADSs offered by selling shareholders) priced

at $20 per ADS, for net proceeds to WNS of $78.1 million

(estimated), after deducting underwriting discounts and commissions

and estimated offering expenses. Fiscal 2007 Guidance WNS provides

the following guidance for the fiscal year ending March 31, 2007:

-- Revenue less repair payments expected to be US$205 million to

US$208 million -- Net income (excluding amortization of intangible

assets and share-based compensation expense expected to be US$30.5

million to US$32.5 million -- Capital expenditure for the year is

expected to be approximately US$25 million "Our sales momentum

continues to be strong both in terms of growth with existing

clients and new additions. Our revenue targets appear achievable

and we will also lower client concentration. As the year

progresses, we expect to get more leverage from our SG&A

expenses and expand our margins" said Neeraj Bhargava, Chief

Executive Officer. Conference call WNS will host a conference call

on Monday, August 21st at 8:00am (ET) to discuss the company's

quarterly results. To listen to this call please call 800-295-3991

from within the US and 617-614-3924 from any other country. The

participant passcode for this call is 13528361. A replay will be

made available on the web site at www.wnsgs.com from two hours

after the end of the call for a period of three months. About WNS

WNS is a leading provider of offshore business process outsourcing,

or BPO, services. We provide comprehensive data, voice and

analytical services that are underpinned by our expertise in our

target industry sectors. We transfer the execution of the business

processes of our clients, which are typically companies located in

Europe and North America, to our delivery centers located primarily

in India. We provide high quality execution of client processes,

monitor these processes against multiple performance metrics, and

seek to improve them on an ongoing basis. Our ADSs are listed on

the New York Stock Exchange. For more information, please visit our

website at www.wnsgs.com. Safe Harbor Statement under the

provisions of the United States Private Securities Litigation

Reform Act of 1995 This news release contains forward-looking

statements, as defined in the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These statements

involve a number of risks, uncertainties and other factors that

could cause actual results to differ materially from those that may

be projected by these forward looking statements. These risks and

uncertainties include but are not limited to a slowdown in the U.S.

and Indian economies and in the sectors in which our clients are

based, a slowdown in the BPO and IT sectors world-wide,

competition, the success or failure of our past and future

acquisitions, attracting, recruiting and retaining highly skilled

employees, technology, legal and regulatory policy as well as other

risks detailed in our reports filed with the U.S. Securities and

Exchange Commission. These filings are available at www.sec.gov. We

may, from time to time, make additional written and oral forward

-looking statements, including statements contained in our filings

with the Securities and Exchange Commission and our reports to

shareholders. You are cautioned not to place undue reliance on

these forward-looking statements, which reflect management's

current analysis of future events. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. -0- *T

WNS (HOLDINGS) LIMITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED) (Amounts in thousands, except share and per share data)

Three months ended ----------------------------------- June 30,

March 31, June 30, ----------- ----------- ----------- 2006 2006

2005 ---------------------------------- ----------- -----------

----------- Revenue $53,026 $52,920 $51,182 Cost of revenue 37,430

37,323 38,736 Gross profit 15,596 15,597 12,446 Operating expenses

Selling, general and administrative expenses (refer note a below)

10,130 11,367 7,069 Amortization of intangible assets 471 508 68

Operating income 4,995 3,722 5,309 Other (expense) income, net (35)

277 68 Interest expense (32) (53) (137) Income before income taxes

4,928 3,946 5,240 Provision for income taxes (335) (261) (864) Net

income 4,593 3,685 4,376 Basic income per share $0.13 $0.10 $0.14

Diluted income per share $0.12 $0.10 $0.13 Basic weighted average

ordinary shares outstanding 35,220,868 35,174,350 31,209,074

Diluted weighted average ordinary shares outstanding 38,021,949

37,724,432 33,655,565 Note: a) Includes the following expense

Share-based compensation 212 231 291

---------------------------------- ----------- -----------

----------- *T Non-GAAP measure note: In addition to its reported

operating results in accordance with U.S. generally accepted

accounting principles (US GAAP). WNS has included in the table

below non-GAAP operating measures as "non-GAAP financial measures".

Management believes that such non-GAAP financial measures, when

read in conjunction with the company's reported results, can

provide useful supplemental information for investors analyzing

period to period comparisons of the company's results. The non-GAAP

financial measures disclosed by the company should not be

considered a substitute for, or superior to, financial measures

calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations to those

financial statements should be carefully evaluated. Reconciliation

of revenue less repair payments (non-GAAP) to revenue (GAAP) -0- *T

Amounts in thousands -------------------------------------------

-------------------------- Quarters ended

-------------------------------------------

-------------------------- June 30, March June 30, 31,

------------------------------------------- -------- --------

-------- 2006 2006 2005 -------------------------------------------

-------- -------- -------- Revenue less repair payments (Non-GAAP)

$45,509 $41,444 $33,188 -------------------------------------------

-------- -------- -------- Add: Payments to repair centers 7,517

11,476 17,994 ------------------------------------------- --------

-------- -------- Revenue (GAAP) $53,026 $52,920 $51,182

------------------------------------------- -------- --------

-------- *T Reconciliation of cost of revenue (non-GAAP to GAAP)

-0- *T Amounts in thousands

-------------------------------------------

-------------------------- Quarters ended

-------------------------------------------

-------------------------- June 30, March June 30, 31,

------------------------------------------- -------- --------

-------- 2006 2006 2005 -------------------------------------------

-------- -------- -------- Cost of revenue (Non- GAAP) $29,913

$25,847 $20,742 -------------------------------------------

-------- -------- -------- Add: Payments to repair centers 7,517

11,476 17,994 ------------------------------------------- --------

-------- -------- Cost of revenue (GAAP) $37,430 $37,323 $38,736

------------------------------------------- -------- --------

-------- *T Reconciliation of selling, general and administrative

expense (non-GAAP to GAAP) -0- *T Amounts in thousands

-------------------------------------------

-------------------------- Quarters ended

-------------------------------------------

-------------------------- June 30, March June 30, 31,

------------------------------------------- -------- --------

-------- 2006 2006 2005 -------------------------------------------

-------- -------- -------- Selling, general and administrative

expenses (excluding share-based compensation expense) (Non- GAAP)

$9,918 $11,136 $6,778 -------------------------------------------

-------- -------- -------- Add: Share-based compensation expense

212 231 291 ------------------------------------------- --------

-------- -------- Selling, general and administrative expenses

(GAAP) $10,130 $11,367 $7,069

------------------------------------------- -------- --------

-------- *T Reconciliation of operating income (non-GAAP to GAAP)

-0- *T Amounts in thousands

-------------------------------------------

-------------------------- Quarters ended

-------------------------------------------

-------------------------- June 30, March June 30, 31,

------------------------------------------- -------- --------

-------- 2006 2006 2005 -------------------------------------------

-------- -------- -------- Operating income (excluding share-based

compensation and amortization of intangible assets) (Non- GAAP)

$5,678 $4,461 $5,668 -------------------------------------------

-------- -------- -------- Less: Share-based compensation expense

212 231 291 ------------------------------------------- --------

-------- -------- Less: Amortization of intangible assets 471 508

68 ------------------------------------------- -------- --------

-------- Operating income (GAAP) $4,995 $3,722 $5,309

------------------------------------------- -------- --------

-------- *T Reconciliation of net income (non-GAAP to GAAP) -0- *T

Amounts in thousands -------------------------------------------

-------------------------- Quarters ended

-------------------------------------------

-------------------------- June 30, March June 30, 31,

------------------------------------------- -------- --------

-------- 2006 2006 2005 -------------------------------------------

-------- -------- -------- Net income (excluding share-based

compensation and amortization of intangible assets) (Non- GAAP)

$5,276 $4,424 $4,735 -------------------------------------------

-------- -------- -------- Less: Share-based compensation expense

212 231 291 ------------------------------------------- --------

-------- -------- Less: Amortization of intangible assets 471 508

68 ------------------------------------------- -------- --------

-------- Net income (GAAP) 4,593 3,685 4,376

------------------------------------------- -------- --------

-------- *T -0- *T WNS (HOLDINGS) LIMITED CONDENSED CONSOLIDATED

BALANCE SHEETS (Amount in thousands, except per share data) June

30, March 31, 2006 2006 (unaudited) ----------- --------- ASSETS

Current assets Cash and cash equivalents $11,645 $18,549 Accounts

receivable, net of allowance of $404 and $373, respectively 30,101

28,081 Funds held for clients 3,001 3,047 Deferred tax assets 339

353 Prepaid expenses 2,578 1,225 Other current assets 7,216 6,140

----------- --------- Total current assets 54,880 57,395 Goodwill

34,542 33,774 Intangible assets, net 8,243 8,713 Property and

equipment, net 34,369 30,623 Deposits 2,394 2,990 Deferred tax

assets 2,604 1,308 ----------- --------- TOTAL ASSETS $137,032

$134,803 =========== ========= LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities Accounts payable $17,286 $23,074 Line of credit

4,347 - Accrued employee costs 8,237 11,336 Deferred revenue 6,810

8,994 Income taxes payable 566 726 Obligations under capital leases

- current 121 184 Deferred tax liabilities 895 368 Other current

liabilities 12,184 8,781 ----------- --------- Total current

liabilities 50,446 53,463 Obligation under capital leases - non

current 21 2 Deferred rent 859 824 Deferred tax liabilities - non

current 2,146 2,350 Shareholders' equity: Preference shares, $0.15

(GBP 0.10) par value Authorized: 1,000,000 shares and one

respectively. Issued and outstanding - none Ordinary shares, $0.15

(GBP 0.10) par value Authorized: 50,000,000 shares and 40,000,000

shares, respectively Issued and outstanding: 35,328,173 and

35,321,511 shares, respectively 5,291 5,290 Additional

paid-in-capital 63,026 62,228 Ordinary shares subscribed, 57,337

and 4,346 shares, respectively 142 10 Retained earnings 8,697 4,104

Deferred share-based compensation (387) (582) Accumulated other

comprehensive income 6,791 7,114 ----------- --------- Total

shareholders' equity 83,560 78,164 ----------- --------- TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $137,032 $134,803 ===========

========= *T

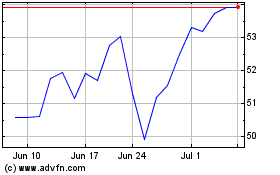

WNS (NYSE:WNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

WNS (NYSE:WNS)

Historical Stock Chart

From Jul 2023 to Jul 2024