As filed with the Securities and Exchange Commission on October 16, 2023

Securities Act File No. 333-270683

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

|

|

|

|

|

|

|

THE SECURITIES ACT OF 1933 |

|

|

|

|

Pre-Effective Amendment No. |

|

☐ |

|

|

Post-Effective Amendment No. 1 |

|

☒ |

WESTERN ASSET MANAGED MUNICIPALS FUND INC.

(Exact Name of Registrant as Specified in Charter)

620 Eighth

Avenue, 47th Floor

New York, New York 10018

(Address of Principal Executive Offices: Number, Street, City, State, Zip Code)

1-888-777-0102

(Area Code and Telephone Number)

Jane Trust

Franklin

Templeton

620 Eighth Avenue, 47th Floor

New York, New York 10018

(Name and Address of Agent for Services)

with

copies to:

|

|

|

| David W. Blass, Esq.

Ryan P. Brizek, Esq.

Simpson Thacher & Bartlett LLP

900 G Street, N.W.

Washington, D.C. 20001 |

|

Marc A. De Oliveira, Esq.

Franklin Templeton

100 First Stamford Place, 6th Floor

Stamford, Connecticut 06902 |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission acting pursuant to said section 8(a), may determine.

EXPLANATORY NOTE

The Proxy Statement/Prospectus and Statement of Additional Information, each in the form filed on May 26, 2023 pursuant

to Rule 424(b)(3) of the General Rules and Regulations under the Securities Act of 1933, as amended (File No. 333-270683), are incorporated herein by reference.

This amendment is being filed in order to file, as Exhibit 12(b) to this Registration Statement, the opinion of Simpson Thacher & Bartlett

LLP supporting tax matters and consequences to stockholders discussed in the Proxy Statement/Prospectus.

PART C

OTHER INFORMATION

Item 15.

Indemnification

The Registrant has entered into an Indemnification Agreement with each director whereby the Registrant has agreed to

indemnify each director against expenses and costs actually and reasonably incurred by such director in connection with any claims, suits or proceedings; provided that no indemnification shall be provided to the extent that the director engaged in

conduct for which indemnification may not lawfully be provided to such director.

Maryland law permits a Maryland corporation to include

in its charter a provision eliminating the liability of its directors and officers to the corporation and its stockholders for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property

or services or (b) active and deliberate dishonesty that is established by a final judgment and is material to the cause of action.

Maryland law requires a Maryland corporation (unless its charter provides otherwise, which the Registrant’s charter does not) to

indemnify a director or officer who has been successful, on the merits or otherwise, in the defense of any proceeding to which he or she is made a party by reason of his or her service in that capacity. Maryland law permits a Maryland corporation to

indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made or threatened to be

made a party by reason of their service in those or other capacities unless it is established that: (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (i) was committed in bad faith or

(ii) was the result of active and deliberate dishonesty; (b) the director or officer actually received an improper personal benefit in money, property or services; or (c) in the case of any criminal proceeding, the director or officer had reasonable

cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify a director or officer for an adverse judgment in a suit by or on behalf of the corporation or if the director or officer

was adjudged liable on the basis that personal benefit was improperly received, unless in either case a court orders indemnification and then only for expenses. In addition, Maryland law permits a Maryland corporation to advance reasonable expenses

to a director or officer, without requiring a preliminary determination of the director’s or officer’s ultimate entitlement to indemnification, upon the corporation’s receipt of (a) a written affirmation by the director or officer of

his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the

corporation if it is ultimately determined that the standard of conduct was not met.

Sections 1, 2 and 3 of Article SEVENTH of the

Registrant’s charter, incorporated by reference as Exhibit 1(a) to this Registration Statement, provides that:

To the fullest

extent permitted by the Maryland General Corporation Law, no director or officer of the Registrant shall have any liability to the Registrant or its stockholders for money damages. This limitation on liability applies to events occurring at the time

a person serves as a director or officer of the Registrant whether or not such person is a director or officer at the time of any proceeding in which liability is asserted.

The Registrant shall indemnify and advance expenses to its currently acting and its former directors and officers to the fullest extent that

indemnification of directors is permitted by the Maryland General Corporation Law, the Securities Act of 1933, as amended (the “Securities Act”), and the Investment Company Act of 1940, as amended. The Board of Directors may by bylaw,

resolution or agreement make further provision for indemnification of directors, officers, employees and agents to the fullest extent permitted by the Maryland General Corporation Law. The foregoing rights of indemnification shall not be exclusive

of any other rights to which those seeking indemnification may be entitled. The Board of Directors may take such action as is

C-1

necessary to carry out these indemnification provisions and is expressly empowered to adopt, approve and amend from time to time such bylaws, resolutions or contracts implementing such provisions

or such further indemnification arrangements as may be permitted by law. This indemnification applies to events occurring at the time a person serves as a director or officer of the Registrant whether or not such person is a director or officer at

the time of any proceeding in which liability is asserted.

No provision of the Registrant’s charter shall be effective to protect or

purport to protect any director or officer of the Registrant against any liability to the Registrant or its security holders to which he or she would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless

disregard of the duties involved in the conduct of his office.

Insofar as indemnification for liability arising under the Securities Act

may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as

expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling

person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its

counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

C-2

Item 16. Exhibits

|

|

|

| Exhibit No. |

|

Exhibit |

|

|

| 1(a) |

|

Articles of Incorporation, dated April 9, 1992.(1) |

|

|

| 1(b) |

|

Articles of Amendment to Articles of Incorporation.(1) |

|

|

| 1(c) |

|

Articles Supplementary designating Western Asset Managed Municipals Fund Inc.’s Municipal Auction Rate Cumulative Preferred Stock.(2)

|

|

|

| 1(d) |

|

Articles Supplementary designating Western Asset Managed Municipals Fund Inc.’s Series 1 Variable Rate Demand Preferred Stock.(3)

|

|

|

| 2 |

|

Third Amended and Restated Bylaws.(4) |

|

|

| 3 |

|

Not applicable. |

|

|

| 4 |

|

Form of Agreement and Plan of Merger is included in Appendix A of the Registration Statement on Form N-14. |

|

|

| 5 |

|

Not applicable |

|

|

| 6(a) |

|

Form of Management Agreement between Registrant and Legg Mason Partners Fund Advisor, LLC with respect to Registrant.(5) |

|

|

| 6(b) |

|

Form of Subadvisory Agreement between Legg Mason Partners Fund Advisor, LLC and Western Asset Management Company, LLC with respect to Registrant.(5)

|

|

|

| 7 |

|

Not applicable. |

|

|

| 8 |

|

Not applicable |

|

|

| 9(a) |

|

Custodian Services Agreement with The Bank of New York Mellon, dated January 1, 2018.(5) |

|

|

| 9(b) |

|

Amendment No. 1 to the Custodian Services Agreement, dated January 2, 2019, with The Bank of New York Mellon, dated January

1, 2018(5) |

|

|

| 9(c) |

|

Amendment No. 2 to the Custodian Services Agreement, dated March 18, 2019, with The Bank of New York Mellon, dated January

1, 2018(5) |

|

|

| 10 |

|

Not applicable. |

|

|

| 11 |

|

Opinion of Venable LLP as to the legality of the securities being registered.(6) |

|

|

| 12(a) |

|

Form of Opinion of Simpson Thacher

& Bartlett LLP supporting tax matters and consequences to stockholders discussed in the Proxy Statement/Prospectus.(5) |

|

|

| 12(b) |

|

Opinion of Simpson Thacher & Bartlett LLP supporting tax matters and consequences to stockholders discussed in the Proxy Statement/Prospectus.* |

|

|

| 13 |

|

Not applicable. |

|

|

| 14(a) |

|

Consent of Independent Registered Public Accounting Firm with respect to Western Asset Managed Municipals Fund Inc.(7) |

|

|

| 14(b) |

|

Consent of Independent Registered Public Accounting Firm with respect to Western Asset Municipal Partners Fund Inc.(7) |

|

|

| 14(c) |

|

Consent of Independent Registered Public Accounting Firm with respect to Western Asset Intermediate Muni Fund Inc.(7) |

|

|

| 15 |

|

Not applicable. |

C-3

| (1) |

Filed on May 14, 1992 with the Registrant’s Registration Statement on Form N-2 (File Nos. 33-37116 and 811-06629) and incorporated by reference herein. |

| (2) |

Filed on May 10, 2002 with the Registrant’s Registration Statement on Form N-2/A (File Nos. 333-76788 and 811-06629) and incorporated by reference herein. |

| (3) |

Filed on July 24, 2015 with the Registrant’s Semiannual Report on Form

NSAR-B (File No. 811-06629) and incorporated by reference herein. |

| (4) |

Filed on August 18, 2020 with the Registrant’s Current Report on Form

8-K (File No. 811-06629) and incorporated by reference herein. |

| (5) |

Filed on March 17, 2023 with the Registrant’s Registration Statement on Form N-14 (File No. 333-270683)

and incorporated by reference herein. |

| (6) |

Filed on May 11, 2023 with the Registrant’s Registration Statement on Form N-14 (File No. 333-270683) and

incorporated by reference herein. |

| (7) |

Filed on May 22, 2023 with the Registrant’s Registration Statement on Form N-14 (File No. 333-270683) and

incorporated by reference herein. |

Item 17. Undertakings.

(1) The

undersigned registrant agrees that prior to any public reoffering of the securities registered through the use of a prospectus which is a part of this registration statement by any person or party who is deemed to be an underwriter within the

meaning of Rule 145(c) of the Securities Act [17 CFR 230.145c], the reoffering prospectus will contain the information called for by the applicable registration form for the reofferings by persons who may be deemed underwriters, in addition to the

information called for by the other items of the applicable form.

(2) The undersigned registrant agrees that every prospectus that is

filed under paragraph (1) above will be filed as a part of an amendment to the registration statement and will not be used until the amendment is effective, and that, in determining any liability under the Securities Act, each post-effective

amendment shall be deemed to be a new registration statement for the securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering of them.

C-4

SIGNATURES

As required by the Securities Act of 1933, as amended, this registration statement has been signed on behalf of the Registrant, in the City of

New York and State of New York, on the 16th day of October, 2023.

|

|

|

| WESTERN ASSET MANAGED MUNICIPALS FUND INC. |

|

|

| By: |

|

/S/ JANE TRUST |

|

|

Jane Trust

Chairman, Chief Executive Officer and President |

As required by the Securities Act of 1933, this registration statement has been signed by the following

persons in the capacities and on the dates indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ JANE TRUST

Jane Trust |

|

Chairman, Chief Executive Officer,

President and Director (Principal Executive Officer) |

|

October 16, 2023 |

|

|

|

| /s/ CHRISTOPHER BERARDUCCI

Christopher Berarducci |

|

Principal Financial Officer

(Principal Financial Officer) |

|

October 16, 2023 |

|

|

|

| /s/ ROBERT D. AGDERN*

Robert D. Agdern |

|

Director |

|

October 16, 2023 |

|

|

|

| /s/ CAROL L. COLMAN*

Carol L. Colman |

|

Director |

|

October 16, 2023 |

|

|

|

| /s/ DANIEL P. CRONIN*

Daniel P. Cronin |

|

Director |

|

October 16, 2023 |

|

|

|

| /s/ PAOLO M. CUCCHI*

Paolo M. Cucchi |

|

Director |

|

October 16, 2023 |

|

|

|

| /s/ EILEEN KAMERICK*

Eileen Kamerick |

|

Director |

|

October 16, 2023 |

|

|

|

| /s/ NISHA KUMAR*

Nisha Kumar |

|

Director |

|

October 16, 2023 |

|

|

|

|

|

| *BY: |

|

/s/ JANE TRUST |

|

|

Jane Trust, |

|

|

Attorney-in-Fact, October 16, 2023 |

The original power of attorney authorizing Jane Trust to execute this Registration Statement, and any

amendments thereto, for each a director of the Registrant on whose behalf this Registration Statement is filed, has been executed and is incorporated by reference herein as Exhibit 16.

EXHIBIT INDEX

Exhibit 12(b)

Simpson Thacher & Bartlett LLP

425 LEXINGTON AVENUE

NEW YORK, NY

10017-3954

TELEPHONE: +1-212-455-2000

FACSIMILE: +1-212-455-2502

October 16, 2023

Western Asset Municipal

Partners Fund Inc.

620 Eighth Avenue, 47th Floor

New York,

New York 10018

Western Asset Managed Municipals Fund Inc.

620 Eighth Avenue, 47th Floor

New York, New York 10018

Ladies and Gentlemen:

We refer to the

Agreement and Plan of Merger, dated as of October 16, 2023 (the “Merger Agreement”), between Western Asset Municipal Partners Fund Inc., a Maryland corporation (the “Acquired Fund”), and Western Asset Managed Municipals Fund

Inc., a Maryland corporation (the “Acquiring Fund”). Pursuant to the Merger Agreement, the Acquired Fund will merge with and into the Acquiring Fund (the “Merger”), with the Acquiring Fund continuing as the surviving corporation.

The time at which the Merger becomes effective pursuant to Section 1.3 of the Merger Agreement is hereafter referred to as the “Effective Time.” We have acted as U.S. counsel to the Acquired Fund and the Acquiring Fund in connection

with the Merger, and this opinion is being delivered pursuant to Section 7.5 of the Merger Agreement.

We have examined (i) the

Merger Agreement, (ii) the registration statement on Form N-14 (Registration No. 333-270683) (as amended, the “Registration Statement”), including

the proxy statement/prospectus constituting a part thereof, filed by the Acquiring Fund with the Securities and Exchange Commission under the Securities Act of 1933, as amended, and (iii) the representation letters of the Acquiring Fund and the

Acquired Fund delivered to us in connection with this opinion (the “Representation Letters”). In addition, we have examined, and have relied as to matters of fact upon, originals, or duplicates or certified or conformed copies, of such

records, agreements, documents and other instruments and such certificates or comparable documents of public officials and of officers and representatives of the Acquiring Fund and the Acquired Fund, and have made such other and further

investigations as we have deemed necessary or appropriate as a basis for the opinion hereinafter set forth. In such examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all

documents submitted to us as originals, the conformity to original documents of all documents submitted to us as duplicates or certified or conformed copies and the authenticity of the originals of such latter documents.

In rendering such opinion, we have assumed, with your permission, that (i) the Merger will

be effected in accordance with the Merger Agreement, (ii) the statements concerning the Merger set forth in the Merger Agreement and the Registration Statement are true, complete and correct and will remain true, complete and correct at all

times up to and including the Effective Time, (iii) the representations made by the Acquiring Fund and the Acquired Fund in their respective Representation Letters are true, complete and correct and will remain true, complete and correct at all

times up to and including the Effective Time and (iv) any representations made in the Merger Agreement or the Representation Letters “to the knowledge of”, or based on the belief of, the Acquiring Fund and/or the Acquired Fund are

true, complete and correct and will remain true, complete and correct at all times up to and including the Effective Time, in each case without such qualification. We have also assumed that each of the Acquiring Fund and the Acquired Fund has

complied with and, if applicable, will continue to comply with, its respective covenants contained in the Merger Agreement at all times up to and including the Effective Time.

Based upon the foregoing, and subject to the qualifications, assumptions and limitations stated herein, we are of the opinion that the Merger

will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”).

We express our opinion herein only as to those matters specifically set forth above and no opinion should be inferred as to the tax

consequences of the Merger under any state, local or foreign law, or with respect to other areas of U.S. federal taxation. We do not express any opinion herein concerning any law other than U.S. federal income tax law.

Our opinion is based on the Code, United States Treasury regulations, administrative interpretations and judicial precedents as of the date

hereof. If there is any subsequent change in the applicable law or regulations, or if there are subsequently any new applicable administrative or judicial interpretations of the law or regulations, or if there are any changes in the facts or

circumstances surrounding the Merger, the opinion expressed herein may become inapplicable.

This opinion letter is rendered to you in

connection with the above-described transaction. This opinion may not be relied upon by you for any other purposes, or relied upon by, or furnished to, any other person, firm or corporation without our prior written consent.

Notwithstanding the foregoing, we hereby consent to the filing of this opinion as Exhibit 12(b) to the Registration Statement and to the

references to our firm name therein.

|

| Very truly yours, |

|

| /s/ Simpson Thacher & Bartlett LLP |

-2-

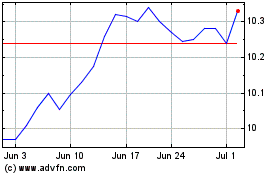

Westerm Asset Managed Mu... (NYSE:MMU)

Historical Stock Chart

From Apr 2024 to May 2024

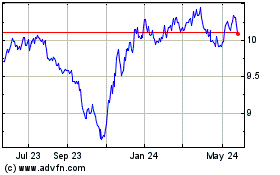

Westerm Asset Managed Mu... (NYSE:MMU)

Historical Stock Chart

From May 2023 to May 2024