UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

__________

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

(Amendment No. 18)(1)

| | | | | | | | | | | | | | |

| United States Cellular Corporation |

| (Name of Issuer) |

| | | | |

| Common Shares ($1.00 par value) |

| (Title of Class of Securities) |

| | | | |

| 911684108 |

| (CUSIP Number) |

| | | | |

LeRoy T. Carlson, Jr. (312) 630-1900

President and Chief Executive Officer

Telephone and Data Systems, Inc.

30 N. LaSalle Street, Suite 4000, Chicago, Illinois 60602 (312) 630-1900 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| | | | |

| August 4, 2023 |

| (Date of Event which Requires Filing of this Statement) |

| | | | | | | | | | | | | | |

| If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐. |

| | | | |

| Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent. |

| | | | |

| (Continued on following pages) |

| (Page 1 of 14 Pages) |

__________________________

(1)The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | | | | | | | | | | |

| SCHEDULE 13D |

| | | | | |

| CUSIP No. 911684108 | 13D | Page 2 of 14 Pages |

| | | | | |

| 1 | NAME OF REPORTING PERSONS

Telephone and Data Systems, Inc. |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a) ☐

(b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS*

OO |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER - 70,788,703 shares - Includes 33,005,877 Series A Common Shares which have ten votes per share on all matters and are convertible on a share-for-share basis into Common Shares and 37,782,826 Common Shares. See Item 5 for further explanation. |

| 8 | SHARED VOTING POWER

-0- |

| 9 | SOLE DISPOSITIVE POWER

Same as 7 above. |

| 10 | SHARED DISPOSITIVE POWER

-0- |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

Same as 7 above. |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) Reporting person beneficially owns 100% of the outstanding Series A Common Shares of the Issuer and approximately 72.3% of the outstanding Common Shares of the Issuer for a combined total of approximately 83.0% of the Issuer’s outstanding classes of capital stock and approximately 96.2% of their combined voting power.(2) |

| 14 | TYPE OF REPORTING PERSON*

HC, CO |

_________________________

(2)Based on 52,266,519 Common Shares and 33,005,877 Series A Common Shares outstanding on June 30, 2023.

| | | | | | | | | | | | | | | | | |

| SCHEDULE 13D |

| | | | | |

| CUSIP No. 911684108 | 13D | Page 3 of 14 Pages |

| | | | | |

| 1 | NAME OF REPORTING PERSONS

The Trustees of Amendment and Restatement (dated as of April 22, 2005) of Voting Trust under Agreement dated as of June 30, 1989 |

| 2 | CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP* (a) ☒ (b) ☐ |

| 3 | SEC USE ONLY |

| 4 | SOURCE OF FUNDS*

OO |

| 5 | CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐ |

| 6 | CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH | 7 | SOLE VOTING POWER

-0- |

| 8 | SHARED VOTING POWER - 70,788,703 shares - Includes 33,005,877 Series A Common Shares which have ten votes per share on all matters and are convertible on a share-for-share basis into Common Shares and 37,782,826 Common Shares. See Item 5 for further explanation. |

| 9 | SOLE DISPOSITIVE POWER

-0- |

| 10 | SHARED DISPOSITIVE POWER

Same as 8 above. |

| 11 | AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

Same as 8 above. |

| 12 | CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* ☐ |

| 13 | PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) Reporting persons may be deemed to beneficially own 100% of the outstanding Series A Common Shares of the Issuer and approximately 72.3% of the outstanding Common Shares of the Issuer for a combined total of approximately 83.0% of the Issuer’s outstanding classes of capital stock and approximately 96.2% of their combined voting power.(3) |

| 14 | TYPE OF REPORTING PERSON*

OO |

_________________________

(3)Based on 52,266,519 Common Shares and 33,005,877 Series A Common Shares outstanding on June 30, 2023.

This Amendment Number 18 to the Amended and Restated Schedule 13D is being filed pursuant to Section 13(d)(2) of the Securities Exchange Act of 1934, as amended (the “Act”), by Telephone and Data Systems, Inc., a Delaware corporation (“TDS”). This amended Schedule 13D relates to the ownership by TDS of Common Shares, par value $1.00 per share (“Common Shares”), and/or Series A Common Shares, par value $1.00 per share (“Series A Common Shares”), which are convertible on a share-for-share basis into Common Shares, of United States Cellular Corporation, a Delaware corporation (the “Issuer”).

Item 1. Security and Issuer.

This statement relates to the Common Shares of the Issuer. The principal executive office of the Issuer is located at 8410 West Bryn Mawr, Chicago, Illinois 60631.

Item 2. Identity and Background.

The following sets forth information with respect to Items 2(a) through 2(f) for TDS and the Trustees of the Voting Trust.

(a-c, f) TDS and the Trustees of Amendment and Restatement (dated as of April 22, 2005) of Voting Trust under Agreement dated June 30, 1989 (the “Voting Trust”), are filing this Schedule 13D amendment concerning their direct and indirect beneficial ownership of Common Shares.

TDS. TDS is a Delaware corporation. The principal business and office address of TDS, is 30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602. TDS’ principal business is that of providing diversified telecommunications services. TDS, directly and through its subsidiaries, has wireless, local telephone, and broadband services operations. The information with respect to the directors and executive officers of TDS is set forth on Appendices A and B attached hereto, and incorporated herein by reference.

The Trustees of the Voting Trust. The principal business address of the Voting Trust is c/o TDS, 30 North LaSalle Street, Suite 4000, Chicago, Illinois 60602. The Voting Trust holds TDS Common Shares and TDS Series A Common Shares and was created to facilitate long-standing relationships among the trust’s certificate holders. Under the terms of the Voting Trust, the trustees hold and vote the TDS Series A Common Shares held in the trust. The information with respect to the trustees of the Voting Trust is set forth in Appendix C hereto, and incorporated herein by reference.

(d) To the knowledge of LeRoy T. Carlson, Jr., during the last five years, none of TDS, the Voting Trust, nor any of the persons named in Appendices A, B and C hereto has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) To the knowledge of LeRoy T. Carlson, Jr., during the last five years, none of TDS, the Voting Trust, nor any of the persons named in Appendices A, B and C hereto was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction, and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or Other Consideration.

The information contained in Item 4 below is incorporated herein by reference.

Item 4. Purpose of Transaction.

TDS and the Voting Trust have changed their intent and have decided to initiate a process (the “Strategic Process”) to explore a range of potential strategic alternatives (each, a “Strategic Alternative”) regarding the Issuer. On August 4, 2023, TDS and the Issuer issued a joint press release announcing the Strategic Process. Strategic Alternatives could take a variety of forms and may result in one or more of the matters specified in (a) through (j) of Item 4 of Schedule 13D.

In connection with the Strategic Process, TDS has engaged and expects to continue to engage in discussions with directors and officers of the Issuer and expects to engage in discussions with third parties (subject to appropriate confidentiality or similar agreements). It is possible that no Strategic Alternative will ultimately be consummated.

The trustees of the Voting Trust have advised TDS that they intend to maintain the ability to keep or dispose of the voting control of TDS. The trustees of the Voting Trust have further advised TDS that, if and to the extent that the Issuer remains a publicly-traded company, the trustees of the Voting Trust intend that TDS maintain the ability to keep or dispose of the voting control of the Issuer.

TDS and the trustees of the Voting Trust also retain the right to change their intent, to acquire additional securities from time to time or to dispose of all or part of the securities beneficially owned by TDS or the Voting Trust in any manner permitted by the terms of the Voting Trust and/or applicable law.

Item 5. Interest in Securities of the Issuer.

(I) TDS.

(a) As of the date of this Amendment Number 18 to the Schedule 13D, TDS may be deemed to beneficially own, pursuant to Rule 13d-3(d)(1)(i), an aggregate of 37,782,826 Common Shares which is approximately 72.3% of such shares outstanding. In addition, TDS owns 33,005,877 Series A Common Shares which have ten votes per share on all matters and are convertible on share-for-basis into Common Shares.

(b) (i) Sole Power to Vote or Direct the Vote:

TDS is the direct beneficial owner of 37,782,826 Common Shares and 33,005,877 Series A Common Shares of the Issuer representing approximately 83.0% of all classes of common shares of the Issuer. The Series A Common Shares have ten votes per share on all matters and are convertible on a share-for-share basis into Common Shares. TDS has sole voting power with respect to an aggregate of 37,782,826 Common Shares and 33,005,877 Series A Common Shares representing approximately 96.2% of the combined voting power of the Common Shares and the Series A Common Shares. As a result of such ownership, TDS has the voting power to elect all of the directors of the Issuer.

(ii) Shared Power to Vote or Direct the Vote:

None.

(iii) Sole Power to Dispose or Direct the Disposition:

TDS has sole power to dispose of 37,782,826 Common Shares and 33,005,877 Series A Common Shares, representing approximately 83.0% of all classes of capital stock outstanding.

(iv) Shared Power to Dispose or Direct the Disposition:

None.

(c) To the knowledge of LeRoy T. Carlson, Jr., no transactions were effected during the past sixty days in Common Shares by TDS, except as may be attributable to TDS pursuant to transactions in the ordinary course under employee benefit plans.

(d) To the knowledge of LeRoy T. Carlson, Jr., no other person is known to have the right of dividends from, or the proceeds from the sale of the shares of Common Shares beneficially owned by TDS.

(e) Not Applicable.

(II) Directors and Executive Officers of TDS.

(a) - (b) See Appendix D attached hereto and incorporated herein by reference.

(c) To the knowledge of LeRoy T. Carlson, Jr., no transactions were effected during the past sixty days in the Common Shares by any Director or Executive Officer of TDS, and except as may be attributable to TDS pursuant to transactions in the ordinary course under employee benefit plans.

(d) To the knowledge of LeRoy T. Carlson, Jr., no person other than the persons listed in Appendix D are known to have the right to receive or the power to direct the receipt of dividends from, or other proceeds from the sale of Common Shares beneficially owned by the persons listed in Appendix D.

(e) Not applicable.

(III) The Voting Trust.

(a) As of the date of this Amendment Number 18 to the Schedule 13D, pursuant to Rule 13d-3(d)(1)(i), the Voting Trust may be deemed to beneficially own an aggregate of 37,782,826 Common Shares representing 72.3% of such shares. In addition, the Voting Trust may be deemed to beneficially own 33,005,877 Series A Common Shares.

(b) (i) Sole Power to Vote or Direct the Vote:

None.

(ii) Shared Power to Vote or Direct the Vote:

The Voting Trust is the direct beneficial owner of TDS Series A Common Shares and TDS Common Shares. The Voting Trust holds and the trustees vote 7,158,020 Series A Common Shares of TDS and 6,258,221 TDS Common Shares, representing approximately 95.7% of the outstanding TDS Series A Common Shares and approximately 5.9% of the outstanding TDS Common Shares, and approximately 56.8% of the combined voting power of all outstanding shares of TDS capital stock with respect to matters other than the election of directors.(4) Therefore, the Voting Trust may direct a majority of the combined voting power of TDS, which has voting power to elect all directors of the Issuer and has approximately 96.2% of the combined voting power of the Issuer with respect to matters other than the election of directors.

(iii) Sole Power to Dispose or Direct the Disposition:

None.

(iv) Shared Power to Dispose or Direct the Disposition:

The information contained in Item 5.III(b)(ii) above is incorporated herein by reference. Through the ability to direct a majority of the combined voting power of TDS, the Voting Trust trustees share the power to direct the disposition of 37,782,826 Common Shares and 33,005,877 Series A Common Shares of the Issuer, representing 83.0% of all classes of capital stock outstanding of the Issuer.

(c) To the knowledge of LeRoy T. Carlson, Jr., no transactions were effected during the past sixty days in Common Shares or Series A Common Shares of the Issuer by the Voting Trust except to the extent disclosed herein.

(d) To the knowledge of LeRoy T. Carlson, Jr., no person other than TDS is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, Common Shares or Series A Common Shares of the Issuer beneficially owned by the Voting Trust.

(e) Not Applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The information contained in Item 4 above is incorporated herein by reference.

The Voting Trust holds TDS Series A Common Shares and TDS Common Shares and was created to facilitate long-standing relationships among the trust’s certificate holders. Under the terms of the Voting Trust, the trustees hold and vote TDS Series A Common Shares and TDS Common Shares held in the trust.

As of June 30, 2023, the Voting Trust holds and the trustees vote 7,158,020 TDS Series A Common Shares and 6,258,221 TDS Common Shares, representing approximately 95.7% of the outstanding TDS Series A Common Shares, and approximately 5.9% of the outstanding TDS Common Shares, and approximately 56.8% of the combined voting power of all outstanding shares of TDS capital stock with respect to matters other than the election of directors.(5) Therefore, the Voting Trust trustees may direct a majority of the combined voting power of TDS which has the voting power to elect all directors of the Issuer and approximately 96.2% of the combined voting power of the Issuer with respect to matters other than the election of directors.

Item 7. Material to be Filed as Exhibits.

None.

____________________

(4)Based on 105,275,435 Common Shares and 7,482,309 Series A Common Shares of TDS on June 30, 2023.

(5)Based on 105,275,435 Common Shares and 7,482,309 Series A Common Shares of TDS on June 30, 2023.

JOINT FILING AGREEMENT

The undersigned hereby agree and consent, pursuant to Rule 13d-1(k), to the joint filing of all Schedules 13D and/or Schedules 13G (including any amendments thereto) on behalf of such parties with respect to the Issuer.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated as of August 4, 2023.

| | | | | | | | | | | | | | |

| TELEPHONE AND DATA SYSTEMS, INC. | | TRUSTEES OF AMENDMENT AND RESTATEMENT (DATED AS OF APRIL 22, 2005) OF VOTING TRUST UNDER AGREEMENT DATED AS OF JUNE 30, 1989 |

| | | | |

| By | /s/ LeRoy T. Carlson, Jr. | | /s/ Walter C. D. Carlson |

| LeRoy T. Carlson, Jr. | | Walter C. D. Carlson |

| President and Chief Executive Officer | | | |

| | | /s/ Letitia G. Carlson, M.D. |

| | | Letitia G. Carlson, M.D. |

| | | | |

| | | /s/ Prudence E. Carlson |

| | | Prudence E. Carlson |

| | | | |

| | | /s/ LeRoy T. Carlson, Jr. |

| | | LeRoy T. Carlson, Jr. |

APPENDIX A

| | | | | | | | |

| DIRECTORS OF TDS |

| (I) | (a) | Name: |

| | Walter C. D. Carlson |

| (b) | Business Address: |

| | Sidley Austin LLP

One S. Dearborn Street

Chicago, Illinois 60603 |

| (c) | Present Principal Occupation or Employment: |

| | Senior Counsel of the law firm of Sidley Austin LLP |

| (f) | Citizenship: |

| | United States |

| (II) | (a) | Name: |

| | LeRoy T. Carlson, Jr. |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| (III) | (a) | Name: |

| | James W. Butman |

| (b) | Business Address: |

| | TDS Telecommunications Corporation

525 Junction Road

Madison, Wisconsin 53717 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of TDS Telecommunications LLC, a wholly-owned subsidiary of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| (IV) | (a) | Name: |

| | Letitia G. Carlson, M.D. |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Physician and Clinical Professor at George Washington University Medical Faculty Associates |

| (f) | Citizenship: |

| | United States |

| | |

| | | | | | | | |

| (V) | (a) | Name: |

| | Prudence E. Carlson |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | United States |

| (VI) | (a) | Name: |

| | Clarence A. Davis |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | United States |

| (VII) | (a) | Name: |

| | Kimberly D. Dixon |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | United States |

| (VIII) | (a) | Name: |

| | George W. Off |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | United States |

| | | | | | | | |

| (IX) | (a) | Name: |

| | Christopher D. O’Leary |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Senior Advisor of Twin Ridge Capital Management |

| (f) | Citizenship: |

| | United States |

| (X) | (a) | Name: |

| | Wade Oosterman |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President of Bell Media and Vice Chair of Bell and BCE |

| (f) | Citizenship: |

| | Canadian |

| (XI) | (a) | Name: |

| | Laurent C. Therivel |

| (b) | Business Address: |

| | United States Cellular Corporation

8410 West Bryn Mawr

Chicago, Illinois 60631 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of United States Cellular Corporation |

| (f) | Citizenship: |

| | United States |

| (XII) | (a) | Name: |

| | Dirk S. Woessner |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | German |

APPENDIX B

| | | | | | | | |

| EXECUTIVE OFFICERS OF TDS |

| (I) | (a) | Name: |

| | LeRoy T. Carlson, Jr. |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| (II) | (a) | Name: |

| | James W. Butman |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of TDS Telecommunications LLC |

| (f) | Citizenship: |

| | United States |

| (III) | (a) | Name: |

| | Joseph R. Hanley |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Senior Vice President - Strategy and Corporate Development of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| (IV) | (a) | Name: |

| | Laurent C. Therivel |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of United States Cellular Corporation |

| (f) | Citizenship: |

| | United States |

| | | | | | | | |

| (V) | (a) | Name: |

| | Vicki L. Villacrez |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Executive Vice President and Chief Financial Officer of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| | |

APPENDIX C

| | | | | | | | |

| TRUSTEES OF THE VOTING TRUST |

| (I) | (a) | Name: |

| | LeRoy T. Carlson, Jr. |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | President and Chief Executive Officer of Telephone and Data Systems, Inc. |

| (f) | Citizenship: |

| | United States |

| (II) | (a) | Name: |

| | Walter C. D. Carlson |

| (b) | Business Address: |

| | Sidley Austin LLP

One S. Dearborn Street

Chicago, Illinois 60603 |

| (c) | Present Principal Occupation or Employment: |

| | Senior Counsel of the law firm of Sidley Austin LLP |

| (f) | Citizenship: |

| | United States |

| (III) | (a) | Name: |

| | Letitia G. Carlson, M.D. |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Physician and Clinical Professor at George Washington University Medical Faculty Associates |

| (f) | Citizenship: |

| | United States |

| (IV) | (a) | Name: |

| | Prudence E. Carlson |

| (b) | Business Address: |

| | Telephone and Data Systems, Inc.

30 North LaSalle Street

Suite 4000

Chicago, Illinois 60602 |

| (c) | Present Principal Occupation or Employment: |

| | Private Investor |

| (f) | Citizenship: |

| | United States |

APPENDIX D

| | | | | | | | | | | | | | |

| Name | | Number of Common Shares Beneficially Owned as of Latest Practicable Date | | Percentage of Class of the Issuer’s Common Shares |

| James W. Butman | | -0- | | — |

| LeRoy T. Carlson, Jr. | | -0- | | — |

| Letitia G. Carlson, M.D. | | -0- | | — |

| Prudence E. Carlson | | -0- | | — |

| Walter C. D. Carlson | | 40,646 | | * |

| Clarence A. Davis | | -0- | | — |

| Kimberly D. Dixon | | -0- | | — |

| Joseph R. Hanley | | -0- | | — |

| George W. Off | | -0- | | — |

| Christopher D. O'Leary | | -0- | | — |

| Wade Oosterman | | -0- | | — |

| Laurent C. Therivel | | 21,874 | | * |

| Vicki L. Villacrez | | -0- | | — |

| Dirk S. Woessner | | -0- | | — |

| TOTAL | | 62,520 | | * |

*Less than 1%

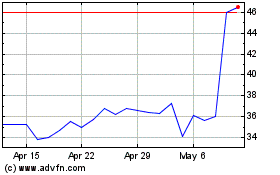

US Cellular (NYSE:USM)

Historical Stock Chart

From Apr 2024 to May 2024

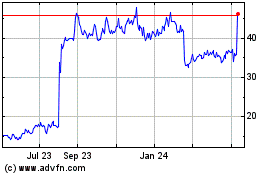

US Cellular (NYSE:USM)

Historical Stock Chart

From May 2023 to May 2024