UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| o | Soliciting Material Under §240.14a-12 |

| | | | | | | | |

| United Natural Foods, Inc. |

| (Name of Registrant as Specified in its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SUPPLEMENT TO PROXY STATEMENT DATED NOVEMBER 8, 2023

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 19, 2023

Dear Fellow Stockholders,

The additional materials provided herein supplement, and should be read in conjunction with, the information regarding Proposal 5 – Approval of the Third Amended and Restated 2020 Equity Incentive Plan contained in the definitive proxy statement (the “Proxy Statement”) of United Natural Foods, Inc. (“we,” “us,” “our” or the “Company”) filed with the Securities and Exchange Commission on November 8, 2023, regarding the annual meeting of stockholders (the “Annual Meeting”) to be held on December 19, 2023, at 4 p.m. ET. The information set forth in the Proxy Statement remains unchanged and should continue to be considered in casting votes by proxy or in person at the Annual Meeting. This additional material solely provides further information to be considered with respect to a stockholder’s evaluation of Proposal 5 of the Proxy Statement. Capitalized terms used herein, unless otherwise defined, have the meanings set forth in the Proxy Statement.

As more specifically described in the Proxy Statement, we are seeking stockholder approval of the Third Amended and Restated 2020 Equity Incentive Plan (the “Third Amended and Restated Plan”), which includes, among other items, an increase in the number of shares available for issuance by 3,700,000 shares. The additional materials herein outline the reasons we believe stockholders should support the proposal.

We ask that you vote “FOR” Proposal 5 – Approval of the Third Amended and Restated 2020 Equity Incentive Plan.

| | | | | |

| | Sincerely, |

| |

| Jack Stahl |

| Independent Chair, on behalf of the Board of Directors of United Natural Foods, Inc. |

Supplemental Information Concerning Proposal No. 5

The following points outline the reasons that we believe our stockholders should support Proposal 5 – Approval of the Third Amended and Restated 2020 Equity Incentive Plan:

1.Our executive compensation program is designed to align our executive compensation with long-term stockholder interests and the achievement of the Company’s strategic initiatives. Without the ability to pay our associates with equity, our associates’ interests will not be as aligned with our stockholders’ interests, which our stockholders have told us is important to them. Additionally, we risk losing talent at a critical time.

•Retention Risk: As noted in the Proxy Statement, we historically make our annual equity grants to employees in October but were unable to do so this year due to insufficient shares available under our existing equity plan. In addition, no cash bonuses were paid this year due to not meeting our short-term incentive targets, and we have delayed discussions of merit increases for our associates until early next calendar year. The Company is undergoing a business transformation and is at risk of losing talent at this critical time if we are unable to competitively compensate our associates. Without this approval, we will not have sufficient shares for grant needs and will lose a critical tool for recruiting, retaining and motivating our associates, which would put us at a competitive disadvantage in attracting and retaining talent.

•Stockholder Interest Alignment: If we do not receive approval for additional shares, we will need to reconsider how to deliver our annual long-term incentive compensation, which would likely include the use of cash-based incentive awards. It is our view, and our stockholders have also told us, that an effective compensation program includes granting equity to our directors and key employees to align their interests with those of our stockholders. We believe that providing at-risk, equity-based compensation is a fundamental component of our compensation program. Further, as evidenced by the 97.7% approval of our Say-on-Pay vote last year and feedback received in our stockholder engagement discussions, we believe our stockholders strongly support our executive compensation program. Approving additional shares under this proposal will allow us to continue to compensate our executives in a manner that has been supported by our stockholders.

•Limited Alternatives Available: As noted above, if we are unable to make our annual equity grants to our associates, we will have to reconsider how to deliver $55 million in incentive value to our associates. If our stockholders do not approve the Third Amended and Restated Plan, any alternatives available, such as issuing cash grants or grants of phantom stock, we believe would not sufficiently align our associates’ interests with those of our other stockholders. In its report, Institutional Shareholder Services (“ISS”) recommended against the approval of our Third Amended and Restated Plan but did not adequately address the limited alternatives available to us or sufficiently consider the interests of our stockholders in the event we do not obtain approval of the Third Amended and Restated Plan. Further, the ISS report did not consider the information we provided on equity grants subject to stockholder approval, which would have demonstrated that we are asking for one year’s worth of shares, as opposed to the several years noted in the ISS report. By asking for one year’s worth of shares for equity grants, we are taking a disciplined approach and intend to return to our stockholders next year for approval of additional shares in order to provide our stockholders with another chance to provide us with their feedback next year.

2.Despite our elevated dilution and burn rate relative to the Comparator Group, we believe stockholders should approve the Third Amended and Restated Plan given our history of prudent grant practices and considering our market capitalization as compared to the Comparator Group.

•Prudent Grant Practices: We operate a larger and more complex business than the Comparator Group as evidenced by revenue size (74th percentile) and employee count (65th percentile). Despite that, for fiscal 2023, our stock compensation expense approximates the Comparator Group’s 35th percentile, 41st percentile as a percent of revenue and 38th percentile of stock expense per employee, demonstrating our commitment to responsible share usage. Additionally, when we acquired SUPERVALU INC. in 2018, we significantly increased the number of

associates receiving equity even though we did not deepen the pool below director level and did not increase grant sizes. We did not recapitalize the combined company, resulting in a larger grant pool on the same number of outstanding shares.

•Dilution: Paying market competitive compensation results in higher dilution for us than for the companies in the Comparator Group. Our market capitalization was in the 10th percentile, and our outstanding share count was approximately 56% of the median number of the outstanding shares most recently reported of the Comparator Group. When we pay at the competitive levels we believe are needed to attract and retain talent, our relatively low market capitalization requires us to utilize more shares to deliver the same value of competitive compensation and results in higher dilution. We also authorized a stock repurchase program in 2022 that provided an opportunity to offset dilution. In fiscal 2023, we repurchased approximately 1,888,000 shares of our common stock compared to the 1,656,475 shares we granted.

•Burn Rate: Our PSU grants for the four most recently completed performance periods have paid out at 54%, 99%, 24% and 5%, respectively, reflecting rigorous performance goals and demonstrating that shares granted under PSUs for purposes of calculating our burn rate have not resulted in the issuance of an equivalent number of shares used to determine actual dilution. We have also maintained disciplined grant practices in recent years as our stock price increased, meaning we have issued less shares as part of our grants as our stock price increased. Further, we do not sell shares withheld to cover taxes and do not recycle those as available shares, resulting in a lower actual dilution than our burn rate would suggest.

3.Through our robust, ongoing stockholder engagement program, we have revised our compensation program over the past few years in response to stockholder feedback and continue to receive positive feedback on our compensation program structure, and the outcomes this past fiscal year reinforce our pay-for-performance philosophy. Approving Proposal 5 would permit us to continue to implement our executive compensation plan that stockholders have consistently approved, which we believe is effectively tied to our financial performance. A vote against Proposal 5 could effectively weaken the competitiveness of our overall executive compensation program and create a risk of losing strong talent, which could result in a negative impact to our strategy and transformation initiatives.

•Short-Term Incentive Program: Our short-term incentive programs are tied to the Company’s financial goals and are intended to align our eligible associates’ rewards with our financial success. All payouts under our short-term incentive (STI) plan are subject to pre-established financial goals that are aligned with strategic initiatives, which for fiscal 2023 were Adjusted EBITDA and Net Sales to support a balanced approach of growing both top and bottom-line results. Although our Net Sales metric was in the payout range for fiscal 2023, Adjusted EBITDA, which serves as a gateway payout metric, was below threshold performance, which resulted in no annual performance-based cash incentive payout for fiscal 2023.

•Long-Term Incentive Program: Our long-term incentives, including restricted stock units (“RSUs”) and performance stock awards (“PSUs”), are designed to attract and retain innovative executives and align their financial interests with those of our stockholders and other stakeholders.

◦The PSUs granted in fiscal 2021 had three weighted metrics: fiscal 2021-2023 adjusted EPS growth (60%), fiscal 2023 adjusted ROIC (20%) and fiscal 2023 Leverage, or Net Debt/adjusted EBITDA (20%). After reviewing performance against the three-year period, the Compensation Committee determined a final weighted payout of 60% before the Relative TSR modifier. After applying the Relative TSR modifier, the number of earned PSUs was adjusted downward by 10%, for a final payout of 54%.

◦Despite the use of the adjusted ROIC performance metric over a one-year period (as opposed to a three-year period for adjusted EBITDA), the targets are set for that period at the time of grant, three years in advance of the completion of the performance period. We believe this aligns with the long-term growth and responsible capital allocation that the metric is designed to incentivize.

•Discretionary Terms: In its report, ISS noted that our change-in-control vesting treatment is discretionary and that the Third Amended and Restated Plan allows broad discretion to accelerate vesting, which is consistent with our current equity plan previously approved by our stockholders.

ISS has raised these concerns previously, and the Compensation Committee, in consultation with its independent consultant, determined that there are already features of our plan that limit the need for discretion, including defined treatment upon death, disability, retirement and Separation from Service without Cause (as defined in the Third Amended and Restated Plan). We believe these features, together with our Compensation Committee’s discipline regarding the use of discretion, are sufficient to mitigate the concerns raised in the report and do not believe these concerns warrant a recommendation against the Third Amended and Restated Plan.

We believe our compensation program appropriately incentivizes and rewards our associates and has been effective in aligning our associates’ interests with those of our stockholders. The approval of additional shares is necessary for the Company to continue to compensate our associates in a manner that has been consistently approved by our stockholders. The Board of Directors urges our stockholders to cast their votes “FOR” Proposal 5 – Approval of the Third Amended and Restated 2020 Equity Incentive Plan.

This supplemental information should be read together with the Proxy Statement, which should be read in its entirety. From and after the date of this supplement, any and all references to the “Proxy Statement” are to the Proxy Statement as supplemented hereby.

Whether or not you plan to attend the Annual Meeting, we encourage you to read the Proxy Statement, as supplemented hereby, and submit your proxy or voting instructions as soon as possible. If you have already returned your proxy card or provided voting instructions to your broker, you do not need to take any action unless you wish to change your vote. Information regarding how to vote your shares and revoke already submitted proxies is available in the Proxy Statement.

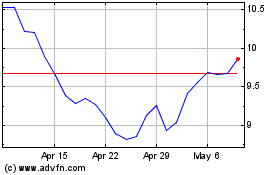

United Natural Foods (NYSE:UNFI)

Historical Stock Chart

From Apr 2024 to May 2024

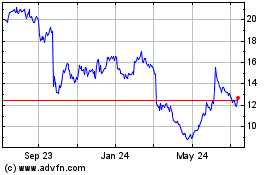

United Natural Foods (NYSE:UNFI)

Historical Stock Chart

From May 2023 to May 2024