Amended Current Report Filing (8-k/a)

December 06 2019 - 7:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2018

|

|

|

|

|

|

|

|

UNITED NATURAL FOODS, INC.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

Delaware

|

001-15723

|

05-0376157

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

313 Iron Horse Way, Providence, RI 02908

|

|

(Address of Principal Executive Offices) (Zip Code)

|

Registrant’s telephone number, including area code: (401) 528-8634

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.05 Costs Associated with Exit of Disposal Activities.

On November 1, 2018, United Natural Foods, Inc. (the “Company”) filed a Current Report on Form 8-K (the “Original 8-K”) announcing its strategic decision to dispose of and exit the SUPERVALU INC. legacy retail operations to focus on the Company’s core wholesale business. At such time, the Company was unable to determine an expected completion date for these activities, or a good faith estimate of the major types of costs or amount or range of amounts that may be incurred in connection with this exit, nor an estimate of the amount or range of amounts of any charges that would result in future cash expenditures, including whether any such charges will be material. The Company is filing this Current Report on Form 8-K/A to amend the Original 8-K to update the disclosures made therein under Item 2.05. No other amendments to the Original 8-K are being made by this Current Report on Form 8-K/A.

On December 6, 2019, the Company announced that it had entered into asset purchase agreements with three buyers to sell an aggregate of 13 Shoppers Food & Pharmacy (“Shoppers”) stores. The Company also announced its intention to close an additional four Shoppers stores. The transactions are subject to customary closing conditions. The Company expects the sales to close beginning in mid-December 2019 through the end of February 2020. The four additional stores are expected to close by the end of January 2020.

At this time, the Company expects to incur approximately $32 million to $42 million in pre-tax aggregate costs and charges related to these transactions, consisting of $13 million to $16 million of estimated severance and employee-related costs, $11 million to $14 million of estimated operating losses during the period of wind-down, primarily related to inventory, $2 million to $3 million of estimated transaction costs, and $6 million to $9 million of estimated non-cash asset impairment charges, primarily associated with real estate assets and leasehold improvements.

At this time, the Company is unable to make a determination of the amount or type of costs and charges expected to be incurred in connection with the remainder of its retail divestiture activities, including without limitation, the likelihood or amount of any withdrawal liability associated with multiemployer pension plans. To the extent required by applicable rules, the Company will continue to file amendments on Form 8-K under this Item 2.05 upon the determination of any further material costs and charges.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

UNITED NATURAL FOODS, INC.

|

|

|

|

|

By:

|

/s/ John W. Howard

|

|

Name:

|

John W. Howard

|

|

Title:

|

Interim Chief Financial Officer

|

Date: December 6, 2019

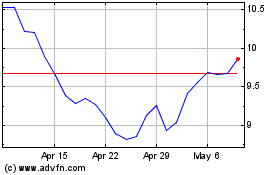

United Natural Foods (NYSE:UNFI)

Historical Stock Chart

From Mar 2024 to Apr 2024

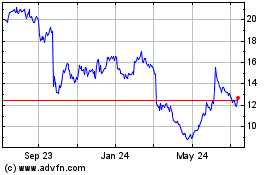

United Natural Foods (NYSE:UNFI)

Historical Stock Chart

From Apr 2023 to Apr 2024