LIVESTOCK HIGHLIGHTS: Top Stories of the Day

October 07 2015 - 6:02PM

Dow Jones News

By Ilan Brat

TOP STORIES

Cargill Looks to Steer Past Beef Pressures -- Market Talk

Struggles in the beef business bruised Cargill's animal-protein

profit in its first-quarter, but there may be hope among the

hamburgers. JPMorgan noted last week that beef-packing margins had

surged and were at the highest seasonal levels in a decade despite

still-tight supply. The bank boosted its expectations for beef at

Tyson (TSN), which could hold hold promise for Cargill, among the

largest U.S. beef processors.

Monsanto to Cut 2,600 Jobs in Restructuring

Monsanto Co., buffeted by a slumping global farm economy,

outlined plans to slash 12% of its workforce and restructure its

business as it reported a larger-than-expected quarterly loss. The

biotech-seed maker said it planned to cut 2,600 jobs while

"streamlining and reprioritizing" commercial and research efforts

as it grapples with declining crop prices that have pinched incomes

for farmers, its main customers. Monsanto projected earnings in its

fiscal 2016 that fell below analysts' expectations. The St. Louis

company also Wednesday unveiled a new stock-buyback program

totaling $3 billion, which it plans to complete within the next six

months. Monsanto shares were down 0.48% at $87.12 in midday

trading. The stock has declined 26% this year. "When you narrow the

lens to the next 12 months, the industry continues to face a

challenging macro environment and we've moderated our outlook, "

said Hugh Grant, Monsanto's chief executive, said on a

post-earnings conference call.

STORIES OF INTEREST

TPP Opens Canada Door Slightly to U.S. Dairy -- Market Talk

It's a marvel that the Trans-Pacific Partnership trade agreement

managed to open Canada's highly protected dairy industry to more

U.S. dairy imports, even if slightly, says Cornell University

professor Andrew Novakovic. The deal, which apparently will allow

in U.S. dairy-product imports equal to 3.25% of the Canadian milk

supply, will give the U.S. industry the opportunity to build

relationships with Canadian companies and trust with Canadian

consumers, he says. "As a beginning, it is assuredly modest, but

what is terribly important is that it is a beginning," he says.

S&P Downgrades DuPont as Challenges Mount -- Market Talk

S&P drops DuPont (DD) a notch to A minus and the ratings

outlook remains negative, meaning further downgrade isn't out of

the question, as the clouds around the agriculture and chemical

conglomerate don't look to clear up soon. S&P notes DuPont has

been "unable to mitigate" persistent weakness in agricultural

markets like Brazil and the dollar's gains, which has dented the

company's sizable overseas sales. "We now believe the impact of

these variables is more severe and sustained than our earlier

assumptions," in reassessing DuPont's prospects following the

abrupt exit announcement for CEO Ellen Kullman.

FUTURES MARKETS

U.S. Live Cattle Futures Climb on Profit-Taking, Bargain-Buying; Hogs Mixed

CHICAGO--U.S. live-cattle futures closed sharply higher for a

second consecutive session on Wednesday, bolstered by

bargain-buying and investors unwinding bets that prices would fall.

October cattle futures hit their daily upper limit of a 4.5 cent

rise before losing some ground and finishing up 4.23 cents, or

3.4%, at $1.294 a pound at the Chicago Mercantile Exchange.

Most-active December cattle futures advanced 2.93 cents to $1.362 a

pound. Feeder-cattle futures for October rose 2.425 cents to

$1.8495 a pound. Concerns that demand for beef would slacken amid

record pork and poultry production have dragged the cattle market

sharply lower in recent weeks, to a level some investors suspect is

beginning to attract bargain-buying. On Wednesday, traders unwound

so-called short bets that prices would fall, which tends to support

prices, and the move was further supported by investors coming in

to buy what they consider relatively cheap futures contracts, said

Tim Hackbarth, a senior market strategist at Chicago brokerage

Zaner Group. Still, he said supply fundamentals are likely to

continue to weigh on the market. Cattle weights are particularly

heavy, and supplies of available cattle are expected to grow in the

months ahead, which has compounded worries about a market that has

suffered weakened demand due to the surge to record-high prices

last year and a stronger dollar that hampers exports. He added that

cattle prices have fallen as a percentage far less than hog prices

this year, auguring a further decrease for cattle futures prices.

Hog futures were mixed, with strength in cash markets bolstering

the short-dated contract even as concerns about the growth of hog

supplies this fall weighs on longer-dated contracts.

CASH MARKETS

Zumbrota, Minn., Hog Market $1.00 higher at $48 - Oct. 7

Barrow and gilt prices at the Zumbrota, Minn., livestock market

today were $1.00 higher at $48.00 per hundredweight. Sow prices

steady. Sows weighing under 450 pounds were at $41.00 to $43.00;

400 to 450 pounds were at $41.00 to $43.00; 450 to 500 pounds were

at $41.00 to $43.00; and those over 500 pounds were at $45.00 to

$47.00.

The day's total run was estimated at 225 head.

Estimated U.S. Pork Packer Margin Index - Oct. 7

Date Standard Estimated margin

Op Mgn at vertically

Index integrated operations*

Oct 7 +$25.80 +$ 36.04

Oct 6 +$25.80 +$ 35.01

Oct 5 +$27.05 +$ 35.87

* Based on Iowa State University's latest estimated cost of

production. A positive number indicates a processing margin above

the cost of production of the animals.

Beef-O-Meter

This report compares the USDA's latest beef and pork carcass

composite values with their respective year-ago prices. The figures

are in percentages of the same-day, year-ago price quotes.

Beef

For Today Choice 82.6

Select 84.3

USDA Boxed Beef, Pork Reports

Wholesale choice-grade beef prices on Wednesday fell 59 cents

per hundred pounds to $203.58, according to the USDA. Select-grade

prices shed $1.17 per hundred pounds to $197.70. The total load

count was 281. Wholesale pork prices advanced 48 cents to $86.50 a

hundred pounds, based on Omaha, Neb., price quotes.

Write to Ilan Brat at ilan.brat@wsj.com

(END) Dow Jones Newswires

October 07, 2015 17:47 ET (21:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

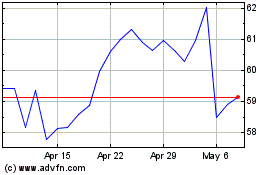

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Jul 2024 to Aug 2024

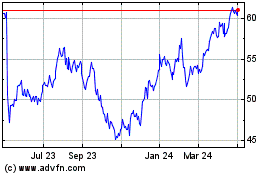

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Aug 2023 to Aug 2024