UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities and Exchange Act of 1934

For May 10, 2019

Commission file number: 1-13.396

Transportadora de Gas del Sur S.A.

Don Bosco 3672, Fifth Floor

1206 Capital Federal

Argentina

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): __

Indicate by check mark if registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to the Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No

X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

|

|

|

Contacts in Buenos Aires, Argentina:

|

|

|

Investor Relations

Leandro Perez Castaño, Finance and IR Manager.

*

leandro_perez@tgs.com.ar

Carlos Almagro, Investor Relations Officer

*

calmagro@tgs.com.ar

(

(+5411) 4865-9077

http://www.tgs.com.ar/en/investors

|

Media Relations

Mario Yaniskowski

(

(+5411) 4865-9050 ext. 1238

|

TGS Announces Results for the First Quarter

ended on March 31, 2019

(1)

Transportadora de Gas del Sur ("TGS" or "the Company") is the leader in Argentina in the transportation of natural gas, transporting approximately 59% of the gas consumed in the country, through more than 5,700 miles of gas pipelines, with a firm contracted capacity of 2.9 Bcf/d. It is one of the main natural gas processors. In addition, TGS’ infrastructure investments in Vaca Muerta basin will allow the Company to grow significantly in the provision of services to natural gas producers, positioning TGS as one of the main Midstreamers in Argentina.

TGS shares are traded on NYSE (New York Stock Exchange) and BYMA (Bolsas y Mercados Argentinos S.A.).

The controlling company of TGS is Compañía de Inversiones de Energía S.A. ("CIESA"), which owns 51% of the total share capital. CIESA’s shareholders are: (i) Pampa Energía S.A. with 50%, (ii) Grupo Investor Petroquímica S.L. (member of the GIP group, led by the Sielecki family), WST S.A. (member of the Werthein Group) and PCT L.L.C. with the remaining 50%.

Stock Information

BYMA Symbol:

TGSU2

NYSE Symbol:

TGS (1 ADS = 5 ordinary shares)

Shareholding structure as of March 31, 2019

TGS holds 794,495,283 issued shares and 780,894,503 outstanding shares.

![[F1Q2019002.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019002.GIF)

Buenos Aires, Argentina, May 10, 2019

During the three-month period ended March 31, 2019 (1Q2019), total income amounted to Ps. 2,379.6 million, or Ps. 3.018 per share (Ps. 15.091 per ADS), compared to Ps. 2,300.6 million, or Ps. 2.896 per share (Ps. 14.478 per ADS) for the same period in 2018 (1Q2018).

![[F1Q2019004.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019004.GIF)

Operating profit for the 1Q2019 amounted to Ps. 3,885.1 million, Ps. 199.1 million above the operating profit recorded in 1Q2018. This variation was mainly due to:

·

Higher revenues of Ps. 1,389.1 million. This increase was mainly related to higher revenues at the Natural Gas Liquids ("Liquids") Production and Commercialization and Natural Gas Transportation segments, which grew by Ps. 917.0 million and Ps. 521.8 million, respectively.

·

Operating costs increased by Ps. 874.5 million, or 24.5% higher than in 1Q2018.

·

Administrative and selling expenses rose by Ps. 294.1 million when compared to 1Q2018.

The financial results had a negative variation of Ps. 468.3 million mainly related to a higher depreciation of the Argentine peso against the US dollar in 1Q2019.

Income tax recorded a positive variation of Ps.

(1)

The financial information presented in this press release is based on consolidated interim financial statements presented in constant Argentine pesos as of March 31, 2019 (Ps.) which is based on the application of the International Financial Reporting Standards (IFRS).

Transportadora de Gas del Sur S.A.

2

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

Quarterly Highlights

Ø

Execution of an ambitious five-year investment plan for the period April 2017 - March 2022 (the “Five-Year Investment Plan”) within the framework of the completion of the Comprehensive Tariff Review ("RTI") process, involving a Ps. 1,040.9 million, over total capital expenditures of Ps. 3,278.8 million for 1Q2019.

Ø

On March 27, 2019, the Board of Directors of the Company approved the third stock buyback program. The program, amounting to a nominal total of Ps. 1,500 million, will expire on September 23, 2019.

Ø

On March 29, 2019, ENARGAS issued Resolution No. 192/2019, which authorizes a new biannual tariff adjustment within the framework of the provisions of the RTI process. The tariff adjustment valid as from April 1, 2019 amounted to 26%.

Ø

Through Resolution No. 82/2019, the Secretary of Energy called on the private sector to present proposals for the construction of a new gas pipeline connecting the Neuquén basin with Greater Buenos Aires and the coastal region, and/or the expansion of the existing natural gas pipeline systems in order to replace the imports of LNG and the use of gas oil. On April 8, 2019, TGS presented its project for the construction of a gas pipeline of more than 600 miles consisting of two sections: Tratayén-Salliqueló and Salliqueló-San Nicolás and expanding the final tranches.

Ø

On April 11, 2019, the Ordinary General Shareholders' Meeting was held, at which, among other things, it was decided the allocation of the total results distributed for the year ended December 31, 2018, amounting to Ps. 13,936.3 million as follows: (i) Ps. 640.1 million to Legal Reserve, (ii) Ps. 6,942.0 million for a cash dividend payment and (iii) Ps. 6,354.2 million to Reserve for Future Capital Expenditures, Acquisition of Treasury Shares and / or Dividends. Also, the Board of Directors of the Company defined the distribution of an additional cash dividend of Ps. 240.5 million.

Ø

On April 16, 2019, TGS’ Board of Directors accepted the resignation of its Chief Executive Officer (“CEO”), the accountant Jorge Javier Gremes Cordero. Engineer Oscar José Sardi was appointed in the position of CEO, both with effect as of April 30, 2019.

Ø

On April 30, 2019, assembly works of the above ground installations located in the connection of the Vaca Muerta Gas Pipeline to Neuba II and the partial enablement of the conditioning plant in Tratayén were concluded. Thus, the first section of this project was enabled, which will provide from May 2019 revenues derived from natural gas transportation firm contracts equivalent to 0.8 MMm

3

/d.

Analysis of the results

1Q2019 vs. 1Q2018

TGS posted total revenues of Ps. 9,179.8 million in the 1Q2019, a Ps. 1,389.1 million increase compared to Ps. 7,790.7 million recorded in the 1Q2018.

Revenues from the

Natural Gas Transportation

segment are mainly derived from firm contracts, under which pipeline capacity is reserved and paid, regardless of actual usage by the shipper. The Natural Gas Transportation business segment represented approximately 43% and 44% of TGS’ total revenues during 1Q2019 and 1Q2018, respectively.

Revenues derived from Natural Gas Transportation segment in 1Q2019 increased by Ps. 521.8 million compared to 1Q2018.

The positive variation is mainly due to the application of the following weighted average tariff increases:

Transportadora de Gas del Sur S.A.

3

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

www.tgs.com.ar/Investors

• Resolution No. 310/2018 starting April 1, 2018, equivalent to a nominal value of 50%; and,

• Resolution No. 265/2018 starting October 1, 2018, equivalent to a nominal value of 19.7%.

The positive effects mentioned above were partially offset by the restatement for inflation in accordance with the provisions of IAS 29 - "Financial Information in Hyperinflationary Economies" ("IAS 29").

This business segment is subject to the ENARGAS regulation.

![[F1Q2019006.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019006.GIF)

Liquids Production and Commercialization

revenues accounted for approximately 53% and 50% of the total revenues in 1Q2019 and 1Q2018, respectively. During 1Q2019, production was 10,909 short tons higher than the production of 1Q2018, reaching 305,068 short tons.

Liquids revenues increased Ps. 917.0 million, amounting Ps. 4,820.5 million in 1Q2019 compared to 1Q2018. This variation was mainly due to the impact of nominal Argentine peso depreciation on U.S.-dollar denominated sales, which amounted to Ps. 2,217.8 million along with the increase in dispatched volumes of products, adding Ps. 400.2 million. On the other hand, during 1Q2019, the nominal variation of international reference prices meant a decrease in revenues of Ps. 451.8 million.

Additionally, total volumes dispatched increased 9.5%, or 27,711 short tons, compared to 1Q2018, which are mainly related to higher quantities sold to foreign market.

The aforementioned positive variations were partially offset by the inflation adjustment effect in accordance with the provisions of IAS 29.

The breakdown of the volumes dispatched by destination market and product is included below:

![[F1Q2019008.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019008.GIF)

Other Services

business segment includes midstream and telecommunication activities. As a percentage of the Company’s total revenues, this segment accounted for approximately 4% and 6% of the revenues in 1Q2019 and 1Q2018, respectively.

Other services revenues decreased by Ps. 49.7 million in 1Q2019 compared to 1Q2018. This decrease was mainly due to the restatement of inflation due to the provisions of IAS 29 for Ps. 147.2 million and the nominal decrease in the operation and maintenance services rendered by Ps. 109.3 million. The aforementioned negative effects were partially offset by

Transportadora de Gas del Sur S.A.

4

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

the increase in the nominal exchange rate of Ps. 202.1 million.

Operating costs and administrative and selling expenses

rose by approximately Ps. 1,168.6 million in the 1Q2019 compared to 1Q2018. This variation is mainly explained by: (i) the increase in the price, measured in Argentine pesos, and volumes of natural gas used as Shrinkage Gas at the Cerri Complex ("RTP") totaling Ps. 645.6 million, (ii) higher turnover tax and tax on exports of Ps. 294.0 million, (iii) higher charges for property, plant and equipment maintenance, including depreciation of Ps. 165.9 million and (iv) higher labor costs by Ps. 53.7 million.

![[F1Q2019010.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019010.GIF)

Other operating results

recorded a negative variation of Ps. 21.4 million in 1Q2019, mainly as a result of the higher charge for provisions for contingencies.

The

financial results

are presented in gross terms considering the effects of change in the currency purchasing power ("Gain on monetary position") in a single separate line. In 1Q2019, financial results experienced a negative variation of Ps. 468.3 million compared to 1Q2018. This variation is mainly due to the impact of: (i) the negative exchange difference for Ps. 463.0 million, (ii) the higher interest generated by financial liabilities, which added to the effect of the higher exchange rate, reported a negative variation of Ps. 205.3 million and (iii) the negative result obtained by the derivative financial instruments for Ps. 124.1 million.

The aforementioned effects were partially offset by the positive variation in: (i) the Gain on monetary position for Ps. 252.3 million as a result of the increase in the net monetary liability position and the higher inflation rate recorded during 1Q2019, and (ii) the higher interest generated by financial assets for Ps. 105.7 million due to higher placement rates obtained.

![[F1Q2019012.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019012.GIF)

For 1Q2019, TGS reported a loss for

income tax

of Ps. 929.7 million, compared to the loss reported in 1Q2018 of Ps. 1,284.9 million. This positive variation is mainly due to the lower charge for current income tax, given the lower comprehensive income before taxes and the effect of the adjustment for tax inflation for taxation purposes in accordance with the provisions of Law No. 27,468 on deferred tax.

Transportadora de Gas del Sur S.A.

5

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

Liquidity and capital resources

The net positive variation in cash and cash equivalents in 1Q2019 and 1Q2018 was as follows:

![[F1Q2019014.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019014.GIF)

The increase in net cash flow in 1Q2019 was Ps. 3,018.1 million lower than 1Q2018.

Net cash flow provided by operating activities

showed a negative variation of Ps. 19.7 million, primarily resulting from higher income tax payment. This effect was partially offset by an improved operating profit and the positive variation in the working capital.

Net cash flow used in investment activities

increased Ps. 2,984.9 million. This was mainly due to additional capital expenditures used to execute the Five-Year Investment Plan and the Vaca Muerta project.

Additionally, at its meetings held on April 11, 2019, the shareholders of the Company and its Board of Directors approved the payment of a cash dividend that amounted to Ps. 7,182.5 million.

First quarter earnings conference call

TGS invites you to participate in the conference call to discuss this 1Q2019 announcement on Monday

May 13, 2019 at 12:00 p.m. New York time / 1:00 p.m. Buenos Aires time

. To listen to the call from USA dial: +1-877-407-9210, and for international calls dial: +1-201-689-8049. To view the webcast, go to http://www.tgs.com.ar/en/home.

Below, financial information is provided.

This press release includes forward-looking statements within the meaning of Section 27 A of the Securities Act of 1933, as amended. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown risks. Although the Company has made reasonable efforts to ensure that the information and assumptions on which these statements and projections are based are current, reasonable and complete, a variety of factors could cause actual results to differ materially from the projections, anticipated results or other expectations contained in this release. Neither the Company nor its management can guarantee that anticipated future results will be achieved. Investors should refer to the Company’s filings with the U.S. Securities and Exchange Commission for a description of important factors that may affect actual results.

Transportadora de Gas del Sur S.A.

6

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

![[F1Q2019016.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019016.GIF)

Consolidated Business Segment Information

for the 1Q2019 and 1Q2018

![[F1Q2019018.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019018.GIF)

![[F1Q2019020.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019020.GIF)

Transportadora de Gas del Sur S.A.

7

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

![[F1Q2019022.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019022.GIF)

Transportadora de Gas del Sur S.A.

8

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

![[F1Q2019024.GIF]](https://content.edgar-online.com/edgar_conv_img/2019/05/10/0000931427-19-000026_F1Q2019024.GIF)

Transportadora de Gas del Sur S.A.

9

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Transportadora de Gas del Sur S.A.

|

|

|

|

|

By:

|

/s/Alejandro M. Basso

|

|

|

|

Name:

|

Alejandro M. Basso

|

|

|

|

Title:

|

Vice President of Administration, Finance and Services

|

|

|

|

|

|

By:

|

/s/Hernán Diego Flores Gómez

|

|

|

Name:

|

Hernán Diego Flores Gómez

|

|

|

Title:

|

Legal Affairs Vice president

|

Date: May 10, 2019

Transportadora de Gas del Sur S.A.

10

3672 Don Bosco St. (1206), Autonomous City of Buenos Aires, Argentina.

http://www.tgs.com.ar/en/investors/our-company

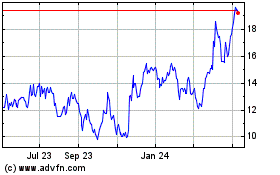

Transportadora De Gas De... (NYSE:TGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

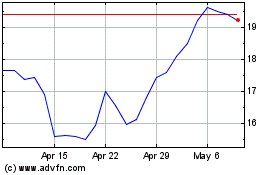

Transportadora De Gas De... (NYSE:TGS)

Historical Stock Chart

From Apr 2023 to Apr 2024