0001260221false00012602212024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 12, 2024

TransDigm Group Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-32833 | | 41-2101738 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) | |

| | | | | | | | | | | | | | | | | |

| 1301 East 9th Street, | Suite 3000, | Cleveland, | Ohio | | 44114 |

| (Address of principal executive offices) | | (Zip Code) |

(216) 706-2960

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol: | | Name of each exchange on which registered: |

| Common Stock, $0.01 par value | | TDG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On February 12, 2024, TransDigm Group Incorporated (“TransDigm Group”) announced that its wholly-owned subsidiary, TransDigm Inc., is planning to offer two new series of senior secured notes for a total of $4,400 million, subject to market and other conditions. The offering is planned to be comprised of $2,200 million of new senior secured notes due 2029 and $2,200 million of new senior secured notes due 2032 to be launched concurrently. TransDigm Group intends to use the net proceeds of the offering of the $4,400 million of new secured debt, together with cash on hand, to repurchase all of TransDigm Inc.’s outstanding 6.25% Senior Secured Notes due 2026 (the “2026 Secured Notes”).

$4,400 Million Senior Secured Notes Offering

TransDigm Inc. is planning to offer $2,200 million aggregate principal amount of senior secured notes due 2029 (the “2029 Secured Notes”) and $2,200 million aggregate principal amount of senior secured notes due 2032 (the “2032 Secured Notes” and, collectively with the 2029 Secured Notes, the “Secured Notes”) pursuant to a confidential offering memorandum in a private placement under Rule 144A and Regulation S of the Securities Act of 1933 (the “Securities Act”). The offering is subject to market and other conditions. Each series of Secured Notes will be guaranteed by TransDigm Group and certain of the Issuer's direct and indirect subsidiaries.

The Secured Notes and related guarantees are being offered only to persons reasonably believed to be qualified institutional buyers in reliance on the exemption from registration set forth in Rule 144A under the Securities Act, and outside the United States to non-U.S. persons in reliance on the exemption from registration set forth in Regulation S under the Securities Act. The Secured Notes and the related guarantees have not been (and will not be) registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act, applicable state securities or blue sky laws and foreign securities laws.

Credit Agreement Amendment

Concurrently with the offering of the Secured Notes, TransDigm Group expects to amend the Second Amended and Restated Credit Agreement, dated as of June 4, 2014 (as amended or modified, the “Credit Agreement”), among TransDigm Inc., TransDigm Group, the subsidiaries of TransDigm Inc. party thereto, the lenders party thereto and Goldman Sachs Bank USA, as administrative agent and collateral agent (as successor to Credit Suisse AG) for the lenders, by entering into an Amendment No. 14 and Incremental Revolving Credit Assumption Agreement (the “Credit Agreement Amendment”), pursuant to which, among other things, TransDigm Inc. will (i) refinance the revolving credit facility by extending its maturity date and increasing the maximum borrowing capacity thereunder and (ii) make certain other amendments to the Credit Agreement. The closing of the offering of the Secured Notes is not conditioned on the closing of the Credit Agreement Amendment, and the closing of the Credit Agreement Amendment is not conditioned on the closing of the offering of the Secured Notes. The completion of the Credit Agreement Amendment is subject to market and other conditions and there can be no assurance as to whether or when the Credit Agreement Amendment may be completed, if at all.

Use of Proceeds

TransDigm Group intends to use the net proceeds of the offering of the Secured Notes, together with cash on hand, to repurchase all of TransDigm Inc.’s outstanding 2026 Secured Notes pursuant to a concurrent tender offer for the 2026 Secured Notes or the redemption of the 2026 Secured Notes following the consummation of the tender offer and to pay related fees and expenses.

The offering of the Secured Notes is not conditioned on any minimum amount of 2026 Secured Notes being repurchased pursuant to the tender offer. Following the tender offer, TransDigm Inc. intends to redeem any of the 2026 Secured Notes that remain outstanding.

* * * * *

This Current Report on Form 8-K shall not constitute an offer to sell, or the solicitation of an offer to buy, any securities, nor shall there be any sales of securities mentioned in this Current Report on Form 8-K in any state or foreign jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or foreign jurisdiction.

This Current Report on Form 8-K is not an offer to purchase or a solicitation of an offer to sell the 2026 Secured Notes, and this Current Report on Form 8-K does not constitute a notice of redemption for the 2026 Secured Notes. The tender offer is being made only by and pursuant to, and on the terms and subject to the conditions set forth in, TransDigm Inc.’s Offer to Purchase, dated February 12, 2024.

The information in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in filings under the Securities Act.

| | |

| Forward-Looking Statements |

The statements in this Current Report on Form 8-K contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All forward-looking statements involve risks and uncertainties that could cause TransDigm Group’s actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, TransDigm Group. These risks and uncertainties include but are not limited to: TransDigm Group’s ability to successfully complete the offering of the Secured Notes and the repurchase of the 2026 Secured Notes pursuant to the tender offer or the redemption of the 2026 Secured Notes using the net proceeds of the offering of the Secured Notes, together with cash on hand; TransDigm Group’s ability to complete the Credit Agreement Amendment; the sensitivity of TransDigm Group’s business to the number of flight hours that TransDigm Group’s customers’ planes spend aloft and its customers’ profitability, both of which are affected by general economic conditions; supply chain constraints; increases in raw material costs, taxes and labor costs that cannot be recovered in product pricing; failure to complete or successfully integrate acquisitions; TransDigm Group’s indebtedness; current and future geopolitical or other worldwide events, including, without limitation, wars or conflicts and public health crises; cybersecurity threats; risks related to the transition or physical impacts of climate change and other natural disasters or meeting sustainability-related voluntary goals or regulatory requirements; TransDigm Group’s reliance on certain customers; the United States defense budget and risks associated with being a government supplier, including government audits and investigations; failure to maintain government or industry approvals; risks related to changes in laws and regulations, including increases in compliance costs; potential environmental liabilities; liabilities arising in connection with litigation; risks and costs associated with TransDigm Group’s international sales and operations; and other factors. Further information regarding the important factors that could cause actual results to differ materially from projected results can be found in TransDigm Group’s Annual Report on Form 10-K for the fiscal year ended September 30, 2023 and other reports that TransDigm Group or its subsidiaries have filed with the Securities and Exchange Commission. Except as required by law, TransDigm Group undertakes no obligation to revise or update any forward-looking statements contained in this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| TRANSDIGM GROUP INCORPORATED |

| |

| By: | | /s/ Sarah Wynne |

| Name: | | Sarah Wynne |

| Title: | | Chief Financial Officer

(Principal Financial Officer) |

| | |

Dated: February 12, 2024

v3.24.0.1

Document and Entity Information

|

Feb. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 12, 2024

|

| Entity Registrant Name |

TransDigm Group Incorporated

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-32833

|

| Entity Tax Identification Number |

41-2101738

|

| Entity Address, Address Line One |

1301 East 9th Street,

|

| Entity Address, Address Line Two |

Suite 3000,

|

| Entity Address, City or Town |

Cleveland,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44114

|

| City Area Code |

216

|

| Local Phone Number |

706-2960

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

TDG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001260221

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

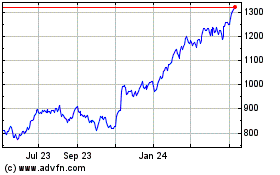

Transdigm (NYSE:TDG)

Historical Stock Chart

From Apr 2024 to May 2024

Transdigm (NYSE:TDG)

Historical Stock Chart

From May 2023 to May 2024