0001598428false00015984282023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported): |

August 3, 2023 |

|

|

|

|

TIMKENSTEEL CORPORATION (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

|

|

|

|

Ohio |

|

1-36313 |

|

46-4024951 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

1835 Dueber Avenue, SW, Canton, OH 44706 |

(Address of Principal Executive Offices) (Zip Code) |

|

(330) 471-7000 |

(Registrant's Telephone Number, Including Area Code) |

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

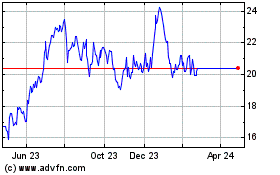

Common Shares, without par value |

TMST |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

On August 3, 2023, TimkenSteel Corporation (the “Company”) issued a press release announcing results for the second quarter of 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 7.01 |

Regulation FD Disclosure. |

On August 3, 2023, the Company posted to the investor relations page of its website at http://timkensteel.com an updated investor presentation, which now includes second quarter of 2023 financial information. This presentation is expected to be used by the Company in connection with certain future presentations to investors and others.

The information contained in Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

TIMKENSTEEL CORPORATION |

|

|

|

|

Date: August 3, 2023 |

By: |

/s/ Kristopher R. Westbrooks |

|

|

|

Kristopher R. Westbrooks |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

TimkenSteel Announces Second-Quarter 2023 Results

•Net sales of $356.6 million, an increase of 10 percent compared with the first quarter of 2023

•Net income of $28.9 million with adjusted EBITDA(1) of $50.5 million

•Operating cash flow of $13.3 million with ending cash and cash equivalents of $221.9 million

•Deployed $11.4 million of cash to repurchase common shares and $8.1 million for capital expenditures

CANTON, Ohio: August 3, 2023 – TimkenSteel (NYSE: TMST), a leader in high-quality specialty steel, manufactured components and supply chain solutions, today reported second-quarter 2023 net sales of $356.6 million and net income of $28.9 million, or $0.62 per diluted share. On an adjusted basis(1), second-quarter 2023 net income was $27.6 million, or $0.60 per diluted share, and adjusted EBITDA was $50.5 million.

This compares with sequential first-quarter 2023 net sales of $323.5 million and net income of $14.4 million, or $0.30 per diluted share. On an adjusted basis(1), first-quarter 2023 net income was $20.8 million, or $0.44 per diluted share, and adjusted EBITDA was $36.0 million.

In the same quarter last year, net sales were $415.7 million with net income of $74.5 million, or $1.42 per diluted share. On an adjusted basis(1), second-quarter 2022 net income was $67.4 million, or $1.29 per diluted share, and adjusted EBITDA was $84.2 million.

“Our firm commitment to enhancing safety performance and productivity has enabled us to deliver our second-quarter earnings guidance including sequential improvements in shipments and adjusted EBITDA. Furthermore, we continued the consistent positive operating cash flow trend while investing in the business and maintaining a robust balance sheet,” stated Mike Williams, president and chief executive officer.

“Additionally, our manufactured components product line continues to be an important part of our service offering to customers. During the second quarter, we shipped 2.7 million pieces to automotive customers from our facility in southwest Ohio and our production efficiency has improved from the prior year. Thanks to our team members, we are successfully supporting increased demand for electric vehicle components and to this end, we recently approved a $5 million investment for two additional manufactured component machining lines. I look forward to continuing our positive momentum into the second half of 2023 with an ongoing focus on safety, manufacturing excellence, customer service and advancing our strategic imperatives to drive sustainable through-cycle profitability and cash flows,” concluded Williams.

SECOND-QUARTER 2023 FINANCIAL SUMMARY

•Net sales of $356.6 million increased 10 percent compared with $323.5 million in the first quarter 2023. The increase in net sales was primarily driven by higher shipments and base sales(1)prices, as well as an increase in average raw material surcharge revenue per ton as a result of higher scrap and alloy prices. Compared with the prior-year second quarter, the decrease in net sales was driven primarily by lower shipments and a reduction in surcharge revenue per ton as a result of lower scrap prices, partially offset by higher base sales(1) prices.

•Ship tons of 177,500 increased 4,600 tons sequentially, or 3 percent, driven by higher industrial shipments. Customer demand was supported by improved operating performance and a higher level of inventory available for shipment. Compared with the prior-year second quarter, ship tons decreased 15 percent as a result of lower shipments across all end markets.

(1)Please see discussion of non-GAAP financial measures in this news release.

1

•Manufacturing costs increased by $6.8 million on a sequential basis, primarily driven by higher first quarter plant costs being recognized in the second quarter as inventory was sold. As anticipated, melt utilization improved to 75 percent from 73 percent in the first quarter. Compared with the prior-year second quarter, manufacturing costs increased $15.3 million, primarily driven by lower cost absorption given the 75 percent melt utilization rate compared with 84 percent in the same quarter last year. Manufacturing costs were also higher compared with the prior-year second quarter due to the inflationary cost environment and increased maintenance costs.

•Other income included an insurance recovery of $1.5 million in the second quarter of 2023, compared with a recovery of $9.8 million recognized in the first quarter of 2023, both related to the recovery of certain costs associated with unplanned downtime in the second half of 2022. Given that the second quarter of 2023 insurance recovery related to last year, the $1.5 million insurance recovery has been excluded from adjusted EBITDA.

CASH, LIQUIDITY AND REPURCHASE ACTIVITY

As of June 30, 2023, the company’s cash and cash equivalents balance was $221.9 million. In the second quarter, operating cash flow was $13.3 million, primarily driven by profitability and insurance recoveries partially offset by higher working capital. Total liquidity(2) was $529.9 million as of June 30, 2023.

In the second quarter, the company repurchased approximately 650,300 common shares in the open market at an aggregate cost of $11.4 million. As of June 30, 2023, the company had $52.2 million remaining on its existing share repurchase program.

2023 OUTLOOK

Given the elements outlined in the outlook below, the company expects adjusted EBITDA to remain strong in the third quarter of 2023.

Commercial:

•Ship tons are expected to modestly increase in the third quarter with steady customer demand and orders booking into the fourth quarter.

•Base price per ton is anticipated to remain strong for the remainder of 2023.

(1)Please see discussion of non-GAAP financial measures in this news release.

(2)The company defines total liquidity as available borrowing capacity plus cash and cash equivalents.

2

Operations:

•The company expects a sequential increase in the average melt utilization rate in the third quarter.

•Inflationary pressure is anticipated to be stable on commodities, consumables and other manufacturing costs in the second half of 2023.

•Annual shutdown maintenance is planned for the second half of 2023 at a cost of approximately $12 million.

Cash and other matters:

•Operating cash flow is expected to be positive in the third quarter, primarily driven by anticipated profitability.

•Planned capital expenditures are expected to be approximately $50 million in 2023, an increase from the previous $45 million guidance.

3

TIMKENSTEEL EARNINGS WEBCAST INFORMATION

TimkenSteel will provide live Internet listening access to its conference call with the financial community scheduled for Friday, August 4, 2023 at 9:00 a.m. ET. The live conference call will be broadcast at investors.timkensteel.com. A replay of the conference call will also be available at investors.timkensteel.com.

ABOUT TIMKENSTEEL CORPORATION

TimkenSteel (NYSE: TMST) manufactures high-performance carbon and alloy steel products from recycled scrap metal in Canton, OH, serving demanding applications in mobile, energy and a variety of industrial end markets. The company is a premier U.S. producer of alloy steel bars (up to 16 inches in diameter), seamless mechanical tubing and manufactured components. In the business of making high-quality steel for more than 100 years, TimkenSteel's proven expertise contributes to the performance of our customers' products. The company employs approximately 1,750 people and had sales of $1.3 billion in 2022. For more information, please visit us at www.timkensteel.com.

-###-

Investor contact:

Jennifer Beeman

P 330.471.7760

ir@timkensteel.com

NON-GAAP FINANCIAL MEASURES

TimkenSteel reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”) and corresponding metrics as non-GAAP financial measures. This earnings release includes references to the following non-GAAP financial measures: adjusted earnings (loss) per share, adjusted net income (loss), EBIT, adjusted EBIT, EBITDA, adjusted EBITDA, free cash flow, base sales, and other adjusted items. These are important financial measures used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting these non-GAAP financial measures is useful to investors as these measures are representative of the company’s performance and provide improved comparability of results. See the attached schedules for definitions of the non-GAAP financial measures referred to above and corresponding reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures. Non-GAAP financial measures should be viewed as additions to, and not as alternatives for, TimkenSteel's results prepared in accordance with GAAP. In addition, the non-GAAP measures TimkenSteel uses may differ from non-GAAP measures used by other companies, and other companies may not define the non-GAAP measures TimkenSteel uses in the same way.

FORWARD-LOOKING STATEMENTS

This news release includes "forward-looking" statements within the meaning of the federal securities laws. You can generally identify the company's forward-looking statements by words such as "will," "anticipate," "aspire," "believe," "could," "estimate," "expect," "forecast," "outlook," "intend," "may," "plan," "possible," "potential," "predict," "project," "seek," "target," "should," "would," "strategy," or "strategic direction" or other similar words, phrases or expressions that convey the uncertainty of future events or outcomes. The company cautions readers that actual results may differ materially from those expressed or implied in forward-looking statements made by or on behalf of the company due to a variety of factors, such as: the potential impact of the COVID-19 pandemic on the company's operations and financial results, including cash flows and liquidity; whether the company is able to successfully implement actions designed to improve profitability on anticipated terms and timetables and whether the company is able to fully realize the expected benefits of such actions; deterioration in world economic conditions, or in economic conditions in any of the geographic regions in which the company conducts business, including additional adverse effects from global economic slowdown, terrorism or hostilities, including political risks associated with the potential instability of governments and legal systems in countries in which the company or its customers conduct business, and changes in currency valuations; the impact of the Russia-Ukraine conflict on the global economy, sourcing of raw materials, and commodity prices; climate-related risks, including environmental and severe weather caused by climate changes, and legislative and regulatory initiatives addressing global climate change or other environmental concerns; the

4

effects of fluctuations in customer demand on sales, product mix and prices in the industries in which the company operates, including the ability of the company to respond to rapid changes in customer demand including but not limited to changes in customer operating schedules due to supply chain constraints, the effects of customer bankruptcies or liquidations, the impact of changes in industrial business cycles, and whether conditions of fair trade exist in U.S. markets; competitive factors, including changes in market penetration, increasing price competition by existing or new foreign and domestic competitors, the introduction of new products by existing and new competitors, and new technology that may impact the way the company's products are sold or distributed; changes in operating costs, including the effect of changes in the company's manufacturing processes, changes in costs associated with varying levels of operations and manufacturing capacity, availability of raw materials and energy, the company's ability to mitigate the impact of fluctuations in raw materials and energy costs and the effectiveness of its surcharge mechanism, changes in the expected costs associated with product warranty claims, changes resulting from inventory management, cost reduction initiatives and different levels of customer demands, the effects of unplanned work stoppages, and changes in the cost of labor and benefits; the success of the company's operating plans, announced programs, initiatives and capital investments, and the company's ability to maintain appropriate relations with the union that represents its associates in certain locations in order to avoid disruptions of business; unanticipated litigation, claims or assessments, including claims or problems related to intellectual property, product liability or warranty, employment matters, and environmental issues and taxes, among other matters; cyber-related risks, including information technology system failures, interruptions and security breaches; with respect to the company's ability to achieve its sustainability goals, including its 2030 environmental goals, the ability to meet such goals within the expected timeframe, changes in laws, regulations, prevailing standards or public policy, the alignment of the scientific community on measurement and reporting approaches, the complexity of commodity supply chains and the evolution of and adoption of new technology, including traceability practices, tools and processes; the availability of financing and interest rates, which affect the company's cost of funds and/or ability to raise capital, including the ability of the company to refinance or repay at maturity the convertible notes due December 1, 2025; the company's pension obligations and investment performance, and/or customer demand and the ability of customers to obtain financing to purchase the company's products or equipment that contain its products; the overall impact of pension and other postretirement benefit mark-to-market accounting; the effects of the conditional conversion feature of the convertible notes due December 1, 2025, which, if triggered, entitles holders to convert the notes at any time during specified periods at their option and therefore could result in potential dilution if the holder elects to convert and the company elects to satisfy a portion or all of the conversion obligation by delivering common shares instead of cash; the consistency of melt production to meet forecasted demand levels following unplanned downtime in the second half of 2022; additional amounts, if any, that the company is able to obtain from its business interruption insurance in connection with the unplanned downtime; availability of property insurance coverage at commercially reasonable rates or insufficient insurance coverage to cover claims or damages; and the impacts from any repurchases of our common shares, including the timing and amount of any repurchases. Further, this news release represents our current policy and intent and is not intended to create legal rights or obligations. Certain standards of measurement and performance contained in this news release are developing and based on assumptions, and no assurance can be given that any plan, objective, initiative, projection, goal, mission, commitment, expectation or prospect set forth in this news release can or will be achieved. Inclusion of information in this news release is not an indication that the subject or information is material to our business or operating results.

Additional risks relating to the company's business, the industries in which the company operates, or the company's common shares may be described from time to time in the company's filings with the SEC. All of these risk factors are difficult to predict, are subject to material uncertainties that may affect actual results and may be beyond the company's control. Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the above list should not be considered to be a complete list. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

5

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(in millions, except per share data) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

356.6 |

|

|

$ |

415.7 |

|

|

$ |

680.1 |

|

|

$ |

767.7 |

|

Cost of products sold |

|

|

302.9 |

|

|

|

334.3 |

|

|

|

586.0 |

|

|

|

626.3 |

|

Gross Profit |

|

|

53.7 |

|

|

|

81.4 |

|

|

|

94.1 |

|

|

|

141.4 |

|

Selling, general & administrative expenses (SG&A) |

|

|

20.4 |

|

|

|

21.7 |

|

|

|

41.4 |

|

|

|

40.2 |

|

Restructuring charges |

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

0.8 |

|

Loss (gain) on sale or disposal of assets, net |

|

|

(2.6 |

) |

|

|

0.5 |

|

|

|

(2.5 |

) |

|

|

0.6 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

26.0 |

|

|

|

11.4 |

|

|

|

43.0 |

|

Other (income) expense, net |

|

|

(2.3 |

) |

|

|

(43.8 |

) |

|

|

(11.1 |

) |

|

|

(59.0 |

) |

Earnings (Loss) Before Interest and Taxes (EBIT)(1) |

|

|

38.2 |

|

|

|

76.6 |

|

|

|

54.9 |

|

|

|

115.8 |

|

Interest (income) expense, net |

|

|

(1.7 |

) |

|

|

0.6 |

|

|

|

(3.2 |

) |

|

|

1.8 |

|

Income (Loss) Before Income Taxes |

|

|

39.9 |

|

|

|

76.0 |

|

|

|

58.1 |

|

|

|

114.0 |

|

Provision (benefit) for income taxes |

|

|

11.0 |

|

|

|

1.5 |

|

|

|

14.8 |

|

|

|

2.4 |

|

Net Income (Loss) |

|

$ |

28.9 |

|

|

$ |

74.5 |

|

|

$ |

43.3 |

|

|

$ |

111.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.66 |

|

|

$ |

1.60 |

|

|

$ |

0.99 |

|

|

$ |

2.40 |

|

Diluted earnings (loss) per share(2, 3) |

|

$ |

0.62 |

|

|

$ |

1.42 |

|

|

$ |

0.92 |

|

|

$ |

2.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

43.8 |

|

|

|

46.6 |

|

|

|

43.8 |

|

|

|

46.5 |

|

Weighted average shares outstanding - diluted(2, 3) |

|

|

47.3 |

|

|

|

52.8 |

|

|

|

47.8 |

|

|

|

53.3 |

|

(1) EBIT is defined as net income (loss) before interest (income) expense, net and income taxes. EBIT is an important financial measure used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT is useful to investors as this measure is representative of the company's performance.

(2) For the three and six months ended June 30, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.7 million shares and 2.1 million shares, respectively) and common share equivalents for shares issuable for equity-based awards (1.8 million shares and 1.9 million shares, respectively) were included in the computation of diluted earnings (loss) per share, as they were considered dilutive. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.2 million and $0.5 million for the three and six months ended June 30, 2023, respectively, of convertible notes interest expense (including amortization of convertible notes issuance costs).

(3) For the three and six months ended June 30, 2022, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (4.0 million shares and 4.6 million shares, respectively) and common share equivalents for shares issuable for equity-based awards (2.2 million shares for both respective periods) were included in the computation of diluted earnings (loss) per share, as they were considered dilutive. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.5 million and $1.2 million for the three and six months ended June 30, 2022, respectively, of convertible notes interest expense (including amortization of convertible notes issuance costs).

6

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

(Dollars in millions) (Unaudited) |

|

June 30,

2023 |

|

|

December 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

221.9 |

|

|

$ |

257.2 |

|

Accounts receivable, net of allowances |

|

|

133.3 |

|

|

|

79.4 |

|

Inventories, net |

|

|

266.0 |

|

|

|

192.4 |

|

Deferred charges and prepaid expenses |

|

|

3.2 |

|

|

|

6.4 |

|

Other current assets |

|

|

2.3 |

|

|

|

21.2 |

|

Total Current Assets |

|

|

626.7 |

|

|

|

556.6 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

485.3 |

|

|

|

486.1 |

|

Operating lease right-of-use assets |

|

|

11.6 |

|

|

|

12.5 |

|

Pension assets |

|

|

18.7 |

|

|

|

19.4 |

|

Intangible assets, net |

|

|

3.9 |

|

|

|

5.0 |

|

Other non-current assets |

|

|

2.3 |

|

|

|

2.4 |

|

Total Assets |

|

$ |

1,148.5 |

|

|

$ |

1,082.0 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Accounts payable |

|

$ |

164.6 |

|

|

$ |

113.2 |

|

Salaries, wages and benefits |

|

|

20.5 |

|

|

|

21.2 |

|

Accrued pension and postretirement costs |

|

|

2.0 |

|

|

|

2.0 |

|

Current operating lease liabilities |

|

|

5.8 |

|

|

|

6.0 |

|

Current convertible notes, net |

|

|

13.1 |

|

|

|

20.4 |

|

Other current liabilities |

|

|

13.8 |

|

|

|

23.9 |

|

Total Current Liabilities |

|

|

219.8 |

|

|

|

186.7 |

|

|

|

|

|

|

|

|

Credit agreement |

|

|

— |

|

|

|

— |

|

Non-current operating lease liabilities |

|

|

5.8 |

|

|

|

6.5 |

|

Accrued pension and postretirement costs |

|

|

168.1 |

|

|

|

162.9 |

|

Deferred income taxes |

|

|

26.7 |

|

|

|

25.9 |

|

Other non-current liabilities |

|

|

16.3 |

|

|

|

13.5 |

|

Total Liabilities |

|

|

436.7 |

|

|

|

395.5 |

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Additional paid-in capital |

|

|

841.2 |

|

|

|

847.0 |

|

Retained deficit |

|

|

(79.8 |

) |

|

|

(123.1 |

) |

Treasury shares |

|

|

(63.1 |

) |

|

|

(52.1 |

) |

Accumulated other comprehensive income (loss) |

|

|

13.5 |

|

|

|

14.7 |

|

Total Shareholders' Equity |

|

|

711.8 |

|

|

|

686.5 |

|

Total Liabilities and Shareholders' Equity |

|

$ |

1,148.5 |

|

|

$ |

1,082.0 |

|

7

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in millions) (Unaudited) |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

CASH PROVIDED (USED) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

28.9 |

|

|

$ |

74.5 |

|

|

$ |

43.3 |

|

|

$ |

111.6 |

|

Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

14.3 |

|

|

|

14.7 |

|

|

|

28.8 |

|

|

|

29.3 |

|

Amortization of deferred financing fees |

|

|

0.2 |

|

|

|

0.2 |

|

|

|

0.3 |

|

|

|

0.4 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

26.0 |

|

|

|

11.4 |

|

|

|

43.0 |

|

Loss (gain) on sale or disposal of assets, net |

|

|

(2.6 |

) |

|

|

0.5 |

|

|

|

(2.5 |

) |

|

|

0.6 |

|

Deferred income taxes |

|

|

— |

|

|

|

(0.1 |

) |

|

|

0.7 |

|

|

|

(0.2 |

) |

Stock-based compensation expense |

|

|

2.9 |

|

|

|

2.2 |

|

|

|

5.5 |

|

|

|

4.3 |

|

Pension and postretirement expense (benefit), net |

|

|

2.0 |

|

|

|

(39.1 |

) |

|

|

5.8 |

|

|

|

(49.8 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(6.0 |

) |

|

|

(25.0 |

) |

|

|

(53.5 |

) |

|

|

(59.4 |

) |

Inventories, net |

|

|

(21.0 |

) |

|

|

(31.8 |

) |

|

|

(73.0 |

) |

|

|

(50.8 |

) |

Accounts payable |

|

|

(14.7 |

) |

|

|

18.7 |

|

|

|

49.0 |

|

|

|

47.0 |

|

Other accrued expenses |

|

|

(0.2 |

) |

|

|

9.6 |

|

|

|

(13.0 |

) |

|

|

(10.5 |

) |

Pension and postretirement contributions and payments |

|

|

(0.4 |

) |

|

|

(0.3 |

) |

|

|

(1.9 |

) |

|

|

(4.0 |

) |

Deferred charges and prepaid expenses |

|

|

1.4 |

|

|

|

0.2 |

|

|

|

3.2 |

|

|

|

0.5 |

|

Other, net |

|

|

8.5 |

|

|

|

0.4 |

|

|

|

19.0 |

|

|

|

2.0 |

|

Net Cash Provided (Used) by Operating Activities |

|

|

13.3 |

|

|

|

50.7 |

|

|

|

23.1 |

|

|

|

64.0 |

|

Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(8.1 |

) |

|

|

(3.5 |

) |

|

|

(18.7 |

) |

|

|

(10.0 |

) |

Proceeds from disposals of property, plant and equipment |

|

|

0.2 |

|

|

|

0.1 |

|

|

|

1.7 |

|

|

|

0.1 |

|

Net Cash Provided (Used) by Investing Activities |

|

|

(7.9 |

) |

|

|

(3.4 |

) |

|

|

(17.0 |

) |

|

|

(9.9 |

) |

Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of treasury shares |

|

|

(11.4 |

) |

|

|

(9.3 |

) |

|

|

(20.8 |

) |

|

|

(12.7 |

) |

Proceeds from exercise of stock options |

|

|

0.5 |

|

|

|

1.5 |

|

|

|

1.8 |

|

|

|

7.8 |

|

Shares surrendered for employee taxes on stock compensation |

|

|

— |

|

|

|

(0.1 |

) |

|

|

(3.4 |

) |

|

|

(1.7 |

) |

Repayments on convertible notes |

|

|

— |

|

|

|

(40.8 |

) |

|

|

(18.7 |

) |

|

|

(67.6 |

) |

Net Cash Provided (Used) by Financing Activities |

|

|

(10.9 |

) |

|

|

(48.7 |

) |

|

|

(41.1 |

) |

|

|

(74.2 |

) |

Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash |

|

|

(5.5 |

) |

|

|

(1.4 |

) |

|

|

(35.0 |

) |

|

|

(20.1 |

) |

Cash, cash equivalents, and restricted cash at beginning of period |

|

|

228.3 |

|

|

|

240.9 |

|

|

|

257.8 |

|

|

|

259.6 |

|

Cash, Cash Equivalents, and Restricted Cash at End of Period |

|

$ |

222.8 |

|

|

$ |

239.5 |

|

|

$ |

222.8 |

|

|

$ |

239.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the Consolidated Balance Sheets that sum to the total of the same such amounts shown in the Consolidated Statements of Cash Flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

221.9 |

|

|

$ |

238.5 |

|

|

$ |

221.9 |

|

|

$ |

238.5 |

|

Restricted cash reported in other current assets |

|

|

0.9 |

|

|

|

1.0 |

|

|

|

0.9 |

|

|

|

1.0 |

|

Total cash, cash equivalents, and restricted cash shown in the Consolidated Statements of Cash Flows |

|

$ |

222.8 |

|

|

$ |

239.5 |

|

|

$ |

222.8 |

|

|

$ |

239.5 |

|

8

Reconciliation of Free Cash Flow(1) to GAAP Net Cash Provided (Used) by Operating Activities:

This reconciliation is provided as additional relevant information about the company's financial position. Free cash flow is an important financial measure used in the management of the business. Management believes that free cash flow is useful to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of its business strategy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(Dollars in millions) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net Cash Provided (Used) by Operating Activities |

|

$ |

13.3 |

|

|

$ |

50.7 |

|

|

$ |

23.1 |

|

|

$ |

64.0 |

|

Less: Capital expenditures |

|

|

(8.1 |

) |

|

|

(3.5 |

) |

|

|

(18.7 |

) |

|

|

(10.0 |

) |

Free Cash Flow(1) |

|

$ |

5.2 |

|

|

$ |

47.2 |

|

|

$ |

4.4 |

|

|

$ |

54.0 |

|

(1) Free Cash Flow is defined as net cash provided (used) by operating activities less capital expenditures.

9

Reconciliation of adjusted net income (loss)(2) to GAAP net income (loss) and adjusted diluted earnings (loss) per share(2) to GAAP diluted earnings (loss) per share for the three months ended June 30, 2023, June 30, 2022, and March 31, 2023:

Adjusted net income (loss) and adjusted diluted earnings (loss) per share are financial measures not required by, or presented in accordance with GAAP. These Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with GAAP, and a reconciliation of these financial measures to the most comparable GAAP financial measures is presented. Management believes this data provides investors with additional useful information on the underlying operations and trends of the business and enables period-to-period comparability of the company’s financial performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, 2023 |

|

|

Three Months Ended

June 30, 2022 |

|

|

Three Months Ended

March 31, 2023 |

|

(Dollars in millions) (Unaudited) |

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(1) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(8) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(9) |

|

As reported |

|

$ |

28.9 |

|

|

$ |

0.62 |

|

|

$ |

74.5 |

|

|

$ |

1.42 |

|

|

$ |

14.4 |

|

|

$ |

0.30 |

|

Adjustments:(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

Loss (gain) on sale or disposal of assets, net(3) |

|

|

(2.6 |

) |

|

|

(0.06 |

) |

|

|

0.5 |

|

|

|

0.01 |

|

|

|

0.1 |

|

|

0.00 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

26.0 |

|

|

|

0.49 |

|

|

|

11.4 |

|

|

|

0.23 |

|

Loss (gain) from remeasurement of benefit plans, net |

|

|

0.5 |

|

|

|

0.01 |

|

|

|

(35.5 |

) |

|

|

(0.67 |

) |

|

|

2.2 |

|

|

|

0.05 |

|

Business transformation costs(4) |

|

|

0.3 |

|

|

|

0.01 |

|

|

|

0.2 |

|

|

0.00 |

|

|

|

0.1 |

|

|

0.00 |

|

IT transformation costs(5) |

|

|

1.3 |

|

|

|

0.03 |

|

|

|

1.3 |

|

|

|

0.03 |

|

|

|

0.8 |

|

|

|

0.02 |

|

Insurance recoveries(6) |

|

|

(1.5 |

) |

|

|

(0.03 |

) |

|

|

— |

|

|

|

— |

|

|

|

(9.8 |

) |

|

|

(0.20 |

) |

Accelerated depreciation and amortization |

|

|

0.3 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

0.3 |

|

|

|

0.01 |

|

Tax effect on above adjustments(7) |

|

|

0.4 |

|

|

|

0.01 |

|

|

NA |

|

|

NA |

|

|

|

1.3 |

|

|

|

0.03 |

|

As adjusted |

|

$ |

27.6 |

|

|

$ |

0.60 |

|

|

$ |

67.4 |

|

|

$ |

1.29 |

|

|

$ |

20.8 |

|

|

$ |

0.44 |

|

(1) For the three months ended June 30, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.7 million shares) and common share equivalents for shares issuable for equity-based awards (1.8 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the three months ended June 30, 2023 was 47.3 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.2 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

(2) Adjusted net income (loss) and adjusted diluted earnings (loss) per share are defined as net income (loss) and diluted earnings (loss) per share, respectively, excluding, as applicable, adjustments listed in the foregoing table.

(3) For the three months ended June 30, 2023 the gain on sale or disposal of assets, net, primarily consisted of the small-diameter seamless mechanical tubing machinery and equipment, partially offset by assets removed from service. For the three months ended June 30, 2022 and March 31, 2023, loss on sale or disposal of assets consisted of write-offs of aged assets removed from service.

(4) Business transformation costs consist of items that are non-routine in nature. These costs are primarily related to professional service fees associated with strategic initiatives and organizational changes.

(5) For the three months ended June 30, 2023, June 30, 2022, and March 31, 2023, IT transformation costs were primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(6) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. TimkenSteel recognized an insurance recovery of $11.3 million related to the unplanned downtime in the first half of 2023, of which $9.8 million was recorded during the first quarter and $1.5 million was recorded in the second quarter.

(7) Tax effect on above adjustments includes the tax impact related to the adjustments shown above.

(8) For the three months ended June 30, 2022, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (4.0 million shares) and common share equivalents for shares issuable for equity-based awards (2.2 million shares) were included in the computation of as

10

reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the three months ended June 30, 2022 was 52.8 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.5 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

(9) For the three months ended March 31, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (2.6 million shares) and common share equivalents for shares issuable for equity-based awards (2.1 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the three months ended March 31, 2023 was 48.7 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.3 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

11

Reconciliation of adjusted net income (loss)(2) to GAAP net income (loss) and adjusted diluted earnings (loss) per share(2) to GAAP diluted earnings (loss) per share for the six months ended June 30, 2023 and June 30, 2022:

Adjusted net income (loss) and adjusted diluted earnings (loss) per share are financial measures not required by, or presented in accordance with GAAP. These Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with GAAP, and a reconciliation of these financial measures to the most comparable GAAP financial measures is presented. Management believes this data provides investors with additional useful information on the underlying operations and trends of the business and enables period-to-period comparability of the company’s financial performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, 2023 |

|

|

Six Months Ended

June 30, 2022 |

|

(Dollars in millions) (Unaudited) |

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(1) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(8) |

|

As reported |

|

$ |

43.3 |

|

|

$ |

0.92 |

|

|

$ |

111.6 |

|

|

$ |

2.12 |

|

Adjustments:(2) |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

|

|

0.02 |

|

Loss (gain) on sale or disposal of assets, net(3) |

|

|

(2.5 |

) |

|

|

(0.05 |

) |

|

|

0.6 |

|

|

|

0.01 |

|

Loss on extinguishment of debt |

|

|

11.4 |

|

|

|

0.24 |

|

|

|

43.0 |

|

|

|

0.81 |

|

Loss (gain) from remeasurement of benefit plans, net |

|

|

2.7 |

|

|

|

0.06 |

|

|

|

(42.0 |

) |

|

|

(0.79 |

) |

Business transformation costs(4) |

|

|

0.4 |

|

|

|

0.01 |

|

|

|

0.7 |

|

|

|

0.01 |

|

IT transformation costs(5) |

|

|

2.1 |

|

|

|

0.04 |

|

|

|

1.3 |

|

|

|

0.02 |

|

Insurance recoveries(6) |

|

|

(11.3 |

) |

|

|

(0.24 |

) |

|

|

— |

|

|

|

— |

|

Accelerated depreciation and amortization |

|

|

0.6 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

Tax effect on above adjustments(7) |

|

|

1.7 |

|

|

|

0.04 |

|

|

NA |

|

|

NA |

|

As adjusted |

|

$ |

48.4 |

|

|

$ |

1.03 |

|

|

$ |

116.0 |

|

|

$ |

2.20 |

|

(1) For the six months ended June 30, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (2.1 million shares) and common share equivalents for shares issuable for equity-based awards (1.9 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the six months ended June 30, 2023 was 47.8 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.5 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

(2) Adjusted net income (loss) and adjusted diluted earnings (loss) per share are defined as net income (loss) and diluted earnings (loss) per share, respectively, excluding, as applicable, adjustments listed in the foregoing table.

(3) For the six months ended June 30, 2023 the gain on sale or disposal of assets, net, primarily consisted of the small-diameter seamless mechanical tubing machinery and equipment, partially offset by assets removed from service. For the six months ended June 30, 2022, loss on sale or disposal of assets, net, primarily consisted of write-offs of aged assets removed from service.

(4) Business transformation costs consist of items that are non-routine in nature. These costs are primarily related to professional service fees associated with organizational changes.

(5) For the six months ended June 30, 2023 and June 30, 2022, IT transformation costs were primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(6) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. TimkenSteel recognized an insurance recovery of $11.3 million related to the unplanned downtime in the first half of 2023, of which $9.8 million was recorded during the first quarter and $1.5 million was recorded in the second quarter.

(7) Tax effect on above adjustments includes the tax impact related to the adjustments shown above.

(8) For the six months ended June 30, 2022, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (4.6 million shares) and common share equivalents for shares issuable for equity-based awards (2.2 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the six months

12

ended June 30, 2022 was 53.3 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $1.2 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

13

Reconciliation of Earnings (Loss) Before Interest and Taxes (EBIT)(2), Adjusted EBIT(4), Earnings (Loss) Before Interest, Taxes, Depreciation and Amortization (EBITDA)(3) and Adjusted EBITDA(5) to GAAP Net Income (Loss):

This reconciliation is provided as additional relevant information about the company's performance. EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA are important financial measures used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA is useful to investors as these measures are representative of the company's performance. Management also believes that it is appropriate to compare GAAP net income (loss) to EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

|

Three Months Ended

March 31, |

|

(Dollars in millions) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Net Income (loss) |

|

$ |

28.9 |

|

|

$ |

74.5 |

|

|

$ |

43.3 |

|

|

$ |

111.6 |

|

|

$ |

14.4 |

|

Net Income Margin (1) |

|

|

8.1 |

% |

|

|

17.9 |

% |

|

|

6.4 |

% |

|

|

14.5 |

% |

|

|

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes |

|

|

11.0 |

|

|

|

1.5 |

|

|

|

14.8 |

|

|

|

2.4 |

|

|

|

3.8 |

|

Interest expense, net |

|

|

(1.7 |

) |

|

|

0.6 |

|

|

|

(3.2 |

) |

|

|

1.8 |

|

|

|

(1.5 |

) |

Earnings Before Interest and Taxes (EBIT) (2) |

|

$ |

38.2 |

|

|

$ |

76.6 |

|

|

$ |

54.9 |

|

|

$ |

115.8 |

|

|

$ |

16.7 |

|

EBIT Margin (2) |

|

|

10.7 |

% |

|

|

18.4 |

% |

|

|

8.1 |

% |

|

|

15.1 |

% |

|

|

5.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

14.3 |

|

|

|

14.7 |

|

|

|

28.8 |

|

|

|

29.3 |

|

|

|

14.5 |

|

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (3) |

|

$ |

52.5 |

|

|

$ |

91.3 |

|

|

$ |

83.7 |

|

|

$ |

145.1 |

|

|

$ |

31.2 |

|

EBITDA Margin (3) |

|

|

14.7 |

% |

|

|

22.0 |

% |

|

|

12.3 |

% |

|

|

18.9 |

% |

|

|

9.6 |

% |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

(0.4 |

) |

|

|

— |

|

|

|

(0.8 |

) |

|

|

— |

|

Accelerated depreciation and amortization (EBIT only) |

|

|

(0.3 |

) |

|

|

— |

|

|

|

(0.6 |

) |

|

|

— |

|

|

|

(0.3 |

) |

Gain (loss) from remeasurement of benefit plans, net |

|

|

(0.5 |

) |

|

|

35.5 |

|

|

|

(2.7 |

) |

|

|

42.0 |

|

|

|

(2.2 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

(26.0 |

) |

|

|

(11.4 |

) |

|

|

(43.0 |

) |

|

|

(11.4 |

) |

Business transformation costs (6) |

|

|

(0.3 |

) |

|

|

(0.2 |

) |

|

|

(0.4 |

) |

|

|

(0.7 |

) |

|

|

(0.1 |

) |

IT transformation costs (8) |

|

|

(1.3 |

) |

|

|

(1.3 |

) |

|

|

(2.1 |

) |

|

|

(1.3 |

) |

|

|

(0.8 |

) |

Gain (loss) on sale or disposal of assets, net (7) |

|

|

2.6 |

|

|

|

(0.5 |

) |

|

|

2.5 |

|

|

|

(0.6 |

) |

|

|

(0.1 |

) |

Insurance recoveries (9) |

|

|

1.5 |

|

|

|

— |

|

|

|

11.3 |

|

|

|

— |

|

|

|

9.8 |

|

Adjusted EBIT (4) |

|

$ |

36.5 |

|

|

$ |

69.5 |

|

|

$ |

58.3 |

|

|

$ |

120.2 |

|

|

$ |

21.8 |

|

Adjusted EBIT Margin (4) |

|

|

10.2 |

% |

|

|

16.7 |

% |

|

|

8.6 |

% |

|

|

15.7 |

% |

|

|

6.7 |

% |

Adjusted EBITDA (5) |

|

$ |

50.5 |

|

|

$ |

84.2 |

|

|

$ |

86.5 |

|

|

$ |

149.5 |

|

|

$ |

36.0 |

|

Adjusted EBITDA Margin (5) |

|

|

14.2 |

% |

|

|

20.3 |

% |

|

|

12.7 |

% |

|

|

19.5 |

% |

|

|

11.1 |

% |

(1) Net Income Margin is defined as net income (loss) as a percentage of net sales.

(2) EBIT is defined as net income (loss) before interest (income) expense, net and income taxes. EBIT Margin is EBIT as a percentage of net sales.

(3) EBITDA is defined as net income (loss) before interest (income) expense, net, income taxes, depreciation and amortization. EBITDA Margin is EBITDA as a percentage of net sales.

(4) Adjusted EBIT is defined as EBIT excluding, as applicable, adjustments listed in the table above. Adjusted EBIT Margin is Adjusted EBIT as a percentage of net sales.

(5) Adjusted EBITDA is defined as EBITDA excluding, as applicable, adjustments listed in the table above. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of net sales.

(6) Business transformation costs consist of items that are non-routine in nature. These costs were primarily related to professional service fees associated with strategic initiatives and organizational changes.

(7) For the three and six months ended June 30, 2023, the gain on sale or disposal of assets, net, primarily consisted of the small-diameter seamless mechanical tubing machinery and equipment, partially offset by assets removed from service. For the three and six months ended June 30, 2022 as well as the three months ended March 31, 2023, the loss on sale or disposal of assets consisted of write-offs of aged assets removed from service.

14

(8) IT transformation costs are primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(9) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. TimkenSteel recognized an insurance recovery of $11.3 million related to the unplanned downtime in the first half of 2023, of which $9.8 million was recorded during the first quarter and $1.5 million was recorded in the second quarter.

15

Reconciliation of Base Sales by end market sector to GAAP Net Sales by end-market sector:

The tables below present net sales by end-market sector, adjusted to exclude surcharges, which represents a financial measure that has not been determined in accordance with GAAP. We believe presenting net sales by end-market sector, both on a gross basis and on a per ton basis, adjusted to exclude raw material and natural gas surcharges, provides additional insight into key drivers of net sales such as base price and product mix. Due to the fact that the surcharge mechanism can introduce volatility to our net sales, net sales adjusted to exclude surcharges provides management and investors clarity of our core pricing and results. Presenting net sales by end-market sector, adjusted to exclude surcharges including on a per ton basis, allows management and investors to better analyze key market indicators and trends and allows for enhanced comparison between our end-market sectors.

When surcharges are included in a customer agreement and are applicable (i.e., reach the threshold amount), based on the terms outlined in the respective agreement, surcharges are then included as separate line items on a customer’s invoice. These additional surcharge line items adjust base prices to match cost fluctuations due to market conditions. Each month, the company will post on the surcharges page of its external website, as well as our customer portal, the scrap, alloy, and natural gas surcharges that will be applied (as a separate line item) to invoices dated in the following month (based upon shipment volumes in the following month). All surcharges invoiced are included in GAAP net sales.

End-Market Sector Sales Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in millions, tons in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2023 |

|

|

|

Industrial |

|

|

Mobile |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Tons |

|

|

78.4 |

|

|

|

79.5 |

|

|

|

19.6 |

|

|

|

— |

|

|

|

177.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

168.8 |

|

|

$ |

136.9 |

|

|

$ |

45.9 |

|

|

$ |

5.0 |

|

|

$ |

356.6 |

|

Less: Surcharges |

|

|

51.0 |

|

|

|

37.6 |

|

|

|

15.5 |

|

|

|

— |

|

|

|

104.1 |

|

Base Sales |

|

$ |

117.8 |

|

|

$ |

99.3 |

|

|

$ |

30.4 |

|

|

$ |

5.0 |

|

|

$ |

252.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

2,153 |

|

|

$ |

1,722 |

|

|

$ |

2,342 |

|

|

$ |

— |

|

|

$ |

2,009 |

|

Surcharges / Ton |

|

$ |

651 |

|

|

$ |

472 |

|

|

$ |

792 |

|

|

$ |

— |

|

|

$ |

586 |

|

Base Sales / Ton |

|

$ |

1,502 |

|

|

$ |

1,250 |

|

|

$ |

1,550 |

|

|

$ |

— |

|

|

$ |

1,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2022 |

|

|

|

Industrial |

|

|

Mobile |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Tons |

|

|

102.1 |

|

|

|

85.4 |

|

|

|

21.4 |

|

|

|

— |

|

|

|

208.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

208.2 |

|

|

$ |

152.9 |

|

|

$ |

46.3 |

|

|

$ |

8.3 |

|

|

$ |

415.7 |

|

Less: Surcharges |

|

|

80.0 |

|

|

|

55.2 |

|

|

|

17.0 |

|

|

|

— |

|

|

|

152.2 |

|

Base Sales |

|

$ |

128.2 |

|

|

$ |

97.7 |

|

|

$ |

29.3 |

|

|

$ |

8.3 |

|

|

$ |

263.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

2,039 |

|

|

$ |

1,790 |

|

|

$ |

2,164 |

|

|

$ |

— |

|

|

$ |

1,990 |

|

Surcharges / Ton |

|

$ |

783 |

|

|

$ |

646 |

|

|

$ |

795 |

|

|

$ |

— |

|

|

$ |

729 |

|

Base Sales / Ton |

|

$ |

1,256 |

|

|

$ |

1,144 |

|

|

$ |

1,369 |

|

|

$ |

— |

|

|

$ |

1,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2023 |

|

|

|

Industrial |

|

|

Mobile |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Tons |

|

|

72.2 |

|

|

|

80.4 |

|

|

|

20.3 |

|

|

|

— |

|

|

|

172.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

143.7 |

|

|

$ |

127.8 |

|

|

$ |

46.2 |

|

|

$ |

5.8 |

|

|

$ |

323.5 |

|

Less: Surcharges |

|

|

38.0 |

|

|

|

31.7 |

|

|

|

13.1 |

|

|

|

— |

|

|

|

82.8 |

|

Base Sales |

|

$ |

105.7 |

|

|

$ |

96.1 |

|

|

$ |

33.1 |

|

|

$ |

5.8 |

|

|

$ |

240.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

1,990 |

|

|

$ |

1,590 |

|

|

$ |

2,276 |

|

|

$ |

— |

|

|

$ |

1,871 |

|

Surcharges / Ton |

|

$ |

526 |

|

|

$ |

394 |

|

|

$ |

645 |

|

|

$ |

— |

|

|

|

479 |

|

Base Sales / Ton |

|

$ |

1,464 |

|

|

$ |

1,196 |

|

|

$ |

1,631 |

|

|

$ |

— |

|

|

$ |

1,392 |

|

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in millions, tons in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2023 |

|

|

|

Industrial |

|

|

Mobile |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Tons |

|

|

150.6 |

|

|

|

159.9 |

|

|

|

39.9 |

|

|

|

— |

|

|

|

350.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

312.5 |

|

|

$ |

264.7 |

|

|

$ |

92.1 |

|

|

$ |

10.8 |

|

|

$ |

680.1 |

|

Less: Surcharges |

|

|

89.0 |

|

|

|

69.3 |

|

|

|

28.6 |

|

|

|

— |

|

|

|

186.9 |

|

Base Sales |

|

$ |

223.5 |

|

|

$ |

195.4 |

|

|

$ |

63.5 |

|

|

$ |

10.8 |

|

|

$ |

493.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

2,075 |

|

|

$ |

1,655 |

|

|

$ |

2,308 |

|

|

$ |

— |

|

|

$ |

1,941 |

|

Surcharges /Ton |

|

$ |

591 |

|

|

$ |

433 |

|

|

$ |

717 |

|

|

$ |

— |

|

|

$ |

533 |

|

Base Sales / Ton |

|

$ |

1,484 |

|

|

$ |

1,222 |

|

|

$ |

1,591 |

|

|

$ |

— |

|

|

$ |

1,408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2022 |

|

|

|

Industrial |

|

|

Mobile |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Tons |

|

|

197.0 |

|

|

|

174.3 |

|

|

|

34.0 |

|

|

|

— |

|

|

|

405.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

383.2 |

|

|

$ |

297.0 |