SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

September, 2020

Commission File

Number 001-14491

TIM PARTICIPAÇÕES

S.A.

(Exact name of registrant

as specified in its charter)

TIM PARTICIPAÇÕES

S.A.

(Translation of Registrant's

name into English)

Avenida João

Cabral de Melo Neto, nº 850, Torre Norte, 12º andar – Sala 1212,

Barra da Tijuca - Rio de Janeiro, RJ, Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No ___X____

TIM S.A.

Publicly-Held Company

CNPJ/ME 02.421.421/0001-11

NIRE 333.0032463-1

MINUTES OF THE BOARD OF DIRECTORS’

MEETING

HELD ON SEPTEMBER 10th,

2020

DATE, TIME AND PLACE: September

10th, 2020, at 10.00 a.m., by videoconference

PRESENCE: The Board of

Directors’ Meeting of the TIM S.A. (“Company”) was held at the date, time and place mentioned above, with the

presence of Messrs. Nicandro Durante, Agostino Nuzzolo, Carlo Filangieri, Carlo Nardello, Elisabetta Romano, Flavia Maria Bittencourt,

Gesner José de Oliveira Filho, Herculano Aníbal Alves, Sabrina Di Bartolomeo e Pietro Labriola, as provided in the

2nd paragraph of Section 25, of the Company’s By-laws.

BOARD: Mr. Nicandro Durante

– Chairman; and Mr. Jaques Horn – Secretary.

AGENDA: (1) To acknowledge

on the activities carried out by the Statutory Audit Committee; (2) To acknowledge on the activities carried out by the

Control and Risks Committee; (3) Presentation on the Brazilian General Data Protection Law (LGPD); (4) To acknowledge

on the Company’s Informe de Governança Corporativa; (5) Presentation on the ESG (Environment, Social

Responsibility and Governance); (6) To resolve on the amendment proposal of the Company’s financial thresholds; (7)

To acknowledge on the progress of the negotiations regarding the acquisition of the assets of the mobile services business of Grupo

Oi; and (8) Presentation on Business Continuity.

RESOLUTIONS: Upon the review

of the material presented and filed at the Company’s head office, and based on the information provided and discussions of

the subjects included on the Agenda, the Board Members, unanimously by those present and with the abstention of the legally restricted,

decided to register the discussions as follows:

(1) Acknowledged on the

activities carried out by the Statutory Audit Committee (“CAE”), at its meeting held on September 9th, 2020,

as per Mr. Gesner José de Oliveira Filho’s report, Coordinator of the CAE.

(2) Acknowledged on the

activities carried out by the Control and Risks Committee (“CCR”) at its meeting held on September 9th,

2020, as per Mr. Herculano Aníbal Alves’ report, Chairman of the CCR.

(3)

Acknowledged on the plan/schedule of the Company's project on the General

Data Protection Law (LGPD), containing the phases and respective macro activities, including the deadlines established for the

execution of each of the indicated phases, due to the prevision of effectiveness of the LGPD.

(4)

Acknowledged on the evolution and current position of the Company in relation

to the Informe de Governança Corporativa, introduced by ICVM No. 586, which

shall be filed this month.

(5)

Acknowledged on the Company's actions aiming the adoption of the best

ESG - Environmental, Social Responsibility and Governance practices.

(6) Based on the favorable opinion

of the CCR, at its meeting held on September 9th, 2020, and in accordance with the provisions of Section 22, sole paragraph,

of the Company's By-laws, the Board members approved the new limits of authority of the Statutory Officers and attorneys-in-fact,

as follows: (i) Diretor Presidente (Chief Executive Officer): full power to, acting individually, carry out, sign

and represent the Company in any and all act and/or legal transaction, or before any public authority, including without limitations,

any contracts that may result in the purchase of goods or services, divestiture, donation, assignment or encumbrance of assets,

waiver of rights, and in acts of liberality, up to the amount of R$50.000.000,00 (fifty million Reais) per operation or series

of operations related; (ii) Diretor Financeiro (Chief Financial Officer): full power to, acting individually, carry

out, sign and represent the Company in relation to activities of the financial area, including without limitations, financial and

treasury operations contracts, including, guarantee agreements in general, including borrowing and lending, assignment and discount

of securities, up to the amount of R$50.000.000,00 (fifty million Reais) per operation or series of operations related, and to

individually, carry out, sign and represent the Company in any and all act and/or legal transaction, or before any public authority,

including without limitations, any contracts that may result in the purchase of goods or services, divestiture, donation, assignment

or encumbrance of assets, waiver of rights, and in acts of liberality, within its area of activity up to the amount of R$10.000.000,00

(ten million Reais) per operation or series of operations related; and (iii) the other Statutory Officers of the Company: Diretor

de Relações com

Investidores (Investor Relations Officer);

Business Support Officer; Regulatory and Institutional Affairs Officer; Diretor Jurídico

(Legal Officer); Chief Technology Information Officer and Chief Revenue Officer shall have full

power and the authority to, acting individually, carry out, sign and represent the Company in any and all act and/or legal transaction,

or before any public authority, including without limitations, any contracts that may result in the purchase of goods or services,

divestiture, donation, assignment or encumbrance of assets, waiver of rights, and in acts of liberality, within their respective

areas of activity, up to the amount of R$10.000.000,00 (ten million Reais) per operation or series of operations related. The limits

of authority approved herein are subject to the financial limits established in the By-laws, and must be observed solely and exclusively

for the implementation of the transaction and/or for the execution of legal transactions that result in the assumption of obligations

and/or in the waiver of rights by the Company. In this sense, such limits of authority will not be applied in the following situations,

among others: (i) in the execution of agreements for the sale of goods and services that represent revenue; (ii)

in the practice of acts of simple administrative routines before legal entities of internal public law, public companies or companies

that make up the indirect administration, and others of the same nature; and (iii) in the execution of acts of the Company's

financial operational routine, such as the authorization and/or payment of taxes or any obligations, transfers of funds between

accounts of the same ownership, applications and redemptions of financial resources of the Company, opening or closing of current

accounts, and request and cancellation of access to any systems made available by financial institutions in general. Lastly, all

Statutory Officers may perform any acts and sign any and all documents, on behalf of the Company, that have been previously approved

by the competent corporate bodies, regardless of the limits of authority established herein.

Additionally, the Board members established

that, for the purposes of determining the competent body for the approval of contracts entered with related parties, the amount

of the respective contracts shall be considered individually, without summing these amounts.

(7) Further to the discussions

and analyses held at this Board’s meeting on March 10, 2020, and the resolutions recorded at the meetings of July 17, 2020

and July 27, 2020, the Board members acknowledged on the proposal presented jointly with Telefónica Brasil

S.A. ("Vivo") and Claro S.A. ("Claro"), all jointly named "Offerors", on September 7, 2020, in accordance

with the Material Fact disclosed to the market on the same date, in replacement of the revised binding offer submitted by the Offerors

to the Oi Group on July 27, 2020 (“Revised Offer”).

(8) The Directors acknowledged

on the latest preventive measures adopted by the Company’s management for the employees’ return to the offices, with

the recommendation of continuous monitoring, and report to this Board whenever necessary.

CLOSING: With no further

issues to discuss, the meeting was adjourned, and these minutes drafted as summary, read, approved and signed by all attendees

Board Members.

I herein certify that these minutes are

the faithful copy of the original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), September 10th,

2020.

JAQUES HORN

Secretary

SIGNATURE

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

TIM PARTICIPAÇÕES S.A.

|

|

|

|

|

|

|

|

Date: September 10, 2020

|

By:

|

/s/ Adrian Calaza

|

|

|

|

|

|

|

|

|

|

Name: Adrian Calaza

|

|

|

|

|

Title: Chief Financial Officer and Investor Relations Officer

TIM Participações S.A.

|

|

FORWARD-LOOKING

STATEMENTS

This press

release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on

management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial

results. The words "anticipates", "believes", "estimates", "expects", "plans"

and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding

the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure

plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations

are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number

of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating

factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

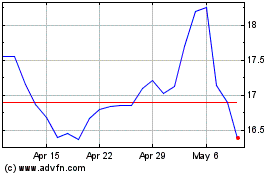

TIM (NYSE:TIMB)

Historical Stock Chart

From Aug 2024 to Sep 2024

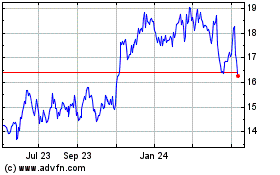

TIM (NYSE:TIMB)

Historical Stock Chart

From Sep 2023 to Sep 2024