Amended Current Report Filing (8-k/a)

November 19 2019 - 5:23PM

Edgar (US Regulatory)

true 0000816761 0000816761 2019-11-04 2019-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 4, 2019

TERADATA CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-33458

|

|

75-3236470

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

17095 Via Del Campo

San Diego, California

|

|

92127

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number including area code: (866) 548-8348

N/A

(Former Name or Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbols

|

|

Name of Each Exchange

on which Registered

|

|

Common Stock, $0.01 par value

|

|

TDC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY NOTE

On November 7, 2019, Teradata Corporation (the “Company” or “Teradata”) filed a Current Report on Form 8-K (“Original Form 8-K”) reporting that, on November 4, 2019, the Company’s Board of Directors (the “Board”) elected Victor L. Lund as Interim President and Chief Executive Officer (“CEO”) of the Company, effective as of November 5, 2019, with Mr. Lund also remaining on the Board as its Executive Chairman. At the time of filing of the Original Form 8-K, Mr. Lund’s compensation arrangements as Interim President and CEO had not yet been determined. In accordance with Instruction 2 to Item 5.02 of Form 8-K, the Company is filing this Current Report on Form 8-K/A to disclose certain compensation arrangements granted to Mr. Lund in connection with such election. No other changes have been made to the Original Form 8-K.

|

Item 5.02

|

Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

|

In connection with his election as Interim President and CEO, Mr. Lund’s base salary was increased from $600,000, which he received as Teradata’s Executive Chairman, to $1 million per year to reflect his additional responsibilities. Mr. Lund will be eligible to participate in the Company’s change in control plan; however, he will not be eligible to participate in any other Company severance plan or in any Company annual incentive bonus plan. Mr. Lund will otherwise continue to be eligible to participate in the Company’s health and welfare benefit plans generally made available to the Company’s executives.

In connection with this election, on November 15, 2019, Mr. Lund was granted an award (the “Interim CEO Award”) of 160,668 service-based restricted share units (“RSUs”) under the Company’s 2019 long-term incentive program. The RSUs shall vest in three equal annual installments. The RSUs have been granted pursuant to the terms of the Company’s standard award agreement for service-based restricted share units, except that the following vesting terms shall apply (the “Special Vesting Provisions”): (i) Mr. Lund’s continued service as a director on the Board shall constitute continued employment for purposes of the vesting provisions applicable to the RSUs; and (ii) the vesting of any unvested RSUs shall accelerate in full in the event that (a) the Company’s terminates Mr. Lund’s employment for any reason (other than for cause), (b) Mr. Lund resigns as a director after, or in connection with, the election of a successor President and CEO, provided that Mr. Lund agrees to cooperate in good faith to transition his duties as President and CEO, or (c) Mr. Lund is not nominated by the Board for re-election as a director. If Mr. Lund voluntarily resigns as Interim President and CEO other than in connection with the election of a successor President and CEO (a “Voluntary Termination”), any RSUs that are unvested at the time of his resignation will be cancelled and forfeited. Except for the Interim CEO Award, Mr. Lund shall not be eligible for consideration for any long-term incentive awards until November 5, 2020.

Also in connection with his election, Mr. Lund’s outstanding, unvested RSUs and performance-based restricted share unit (“PBRSU”) awards granted to him in connection with the Company’s 2018 long-term incentive program while he previously was serving as President and CEO were amended to apply the Special Vesting Provisions to such awards; provided, however, that (i) any such PBRSUs shall vest based upon actual performance during the entire performance period, and shall become payable at the same time that the applicable awards are payable to other participants for such performance period, and (ii) any unvested PBRSUs will be cancelled and forfeited in the event of a Voluntary Termination.

Mr. Lund will not become subject to the Company’s stock ownership guidelines applicable to the chief executive officer position but will remain subject to the stock ownership guidelines applicable to outside directors.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Teradata Corporation

|

|

|

|

|

|

By:

|

|

/s/ Laura K. Nyquist

|

|

|

|

Laura K. Nyquist

|

|

|

|

General Counsel

|

Dated: November 19, 2019

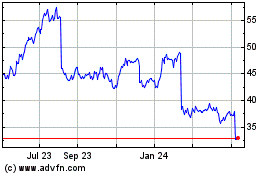

Teradata (NYSE:TDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

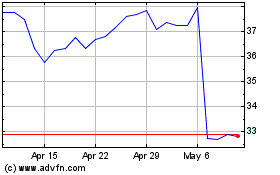

Teradata (NYSE:TDC)

Historical Stock Chart

From Apr 2023 to Apr 2024