Global Telecoms Turning to Green Bond Market, Fitch Says

February 07 2019 - 12:41PM

Dow Jones News

By Colin Kellaher

Global telecommunications companies appear to have found a new

funding source--the environmental, social and governance, or ESG,

sector, Fitch Ratings said Thursday.

The agency said Verizon Communications Inc.'s (VZ) sale of $1

billion in green bonds this week, which followed last month's issue

by Spain's Telefonica S.A. (TEF), could be the start of a trend

among telecoms. Telefonica said its sale of 1 billion euros ($1.14)

in bonds marked the first green issuance in the telecommunications

sector.

There are about $484 billion of green bonds outstanding,

including roughly $167 billion sold last year, according to Climate

Bonds Initiative, a London-based not-for-profit that acts as a de

facto watchdog for the market.

Investors now consider ESG factors across $12 trillion of

professionally managed assets, a 38% increase since 2016, with

climate change/carbon being a top issue, Fitch said, citing a

report from the Forum for Sustainable & Responsible

Investment.

Fitch said green bonds don't have socially responsible or

governance characteristics, but said they are typically used to

fund projects with environmental or climate benefits.

The ratings agency said issuances of green bonds may help

companies diversify their funding sources by appealing to the

growing market of ESG investors. Fitch also noted, however, that

ESG risks generally have a low level of direct impact on corporate

credit ratings due the agency's integrated scoring system.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

February 07, 2019 12:26 ET (17:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

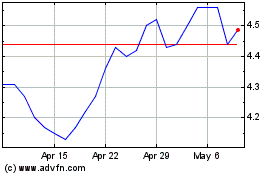

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

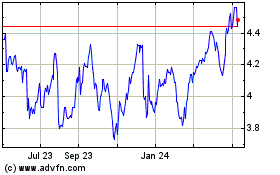

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024