Report of Foreign Issuer (6-k)

July 21 2020 - 2:40PM

Edgar (US Regulatory)

Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July 2020

Commission File Number: 001-13464

Telecom Argentina S.A.

(Translation of registrant’s name into English)

Alicia Moreau de Justo, No. 50, 1107

Buenos Aires, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Table of Contents

Telecom Argentina S.A. Announces Satisfaction of Minimum Issuance Condition and Extension of Early Participation Date of the Exchange Offer and Consent Solicitation Relating to its 6.500% Notes due 2021.

July 21, 2020 — Buenos Aires, Argentina

On July 7, 2020, the Company announced the commencement of (i) its offer to exchange (the “Exchange Offer”) any and all of the outstanding 6.500% Notes due June 15, 2021 (the “Old Notes”) for newly issued 8.500% Senior Amortizing Notes due 2025 of Telecom (the “New Notes”) and Cash Consideration (as defined below) and (ii) its solicitation of consents (the “Consent Solicitation”) to vote in favor of certain amendments in respect of the indenture governing the Old Notes and the Old Notes (the “Proposed Amendments”), each upon the terms and subject to the conditions set forth in the offering memorandum (the “Exchange Offer and Consent Solicitation Memorandum”), dated July 7, 2020, the related eligibility letter (the “Eligibility Letter”), the related proxies to vote in favor of the Proposed Amendments (the “Proxy Documents”) and, where applicable, the related Letter of Transmittal, as defined below (together the “Exchange Offer and Consent Solicitation Documents”).

Telecom hereby announces that, as of July 20, 2020, approximately U.S.$295,098,000 in aggregate principal amount of Old Notes, representing 63.35% of aggregate principal outstanding Old Notes, have been tendered in the Exchange Offer. The Withdrawal Date has expired and eligible holders may no longer validly withdraw Old Notes tendered in the Exchange Offer or validly revoke their Proxies delivered in the Consent Solicitation. Based on the participation received to date, the Company has also obtained Proxies delivered by eligible holders representing the requisite majority to vote in favor of eliminating or amending certain covenants and events of default and related provisions of the indenture governing the Old Notes and the Old Notes at the noteholders meeting on first call, which is expected to be held on August 5, 2020. Accordingly, as of the date hereof, the Old Notes tendered together with the New Notes offered for cash concurrently with the Exchange Offer to be issued in furtherance of the indications of interest received to date will satisfy the Minimum Issuance Condition (as defined in the Exchange Offer and Consent Solicitation Documents).

Telecom also announces that it is extending the early participation date to 11:59 p.m., New York City time, on August 3, 2020 (the “Early Participation Date”) from the previously announced early participation date of 5:00 p.m., New York City Time, on July 20, 2020 (the “Original Early Participation Date”). Eligible holders who validly tendered Old Notes and delivered their Proxy Documents on or prior to the Early Participation Date, and whose Old Notes are accepted for exchange by us, will receive U.S.$700 principal amount of New Notes and U.S.$320 in cash, for each $1,000 principal amount of Old Notes so tendered.

The other terms of the Exchange Offer (including the Withdrawal Date) remain unchanged. The terms and conditions are described in the Exchange Offer and Consent Solicitation Memorandum dated July 7, 2020, and in the Press Release dated July 7, 2020.

Telecom also announces the following clarifications to the Exchange Offer and Consent Solicitation Memorandum:

1. The New Notes will be issued pursuant to an indenture to be executed with Citibank, N.A. on or about the Settlement Date of the Exchange Offer, which will be subject to the terms and conditions set forth in the “Description of the Notes” section of the Exchange Offer and Consent Solicitation Memorandum (the “New Notes Indenture”); and

2. Section 2(b) of the Proposed Amendments set forth in Annex A of the Exchange Offer and Consent Solicitation Memorandum shall read as follows “(b) Section 4.04 (Laws, Licenses and Permits) of the Old Notes Indenture is hereby deleted in its entirety and replaced by the following: “Intentionally omitted”.”

If and when issued, the New Notes will not be registered under the Securities Act or any state securities laws. Therefore, the New Notes may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and any applicable state securities laws.

Table of Contents

Global Bondholder Services Corporation is acting as the Information and Exchange Agent for the Exchange Offer and Consent Solicitation. Questions or requests for assistance related to the Exchange Offer and Consent Solicitation or for additional copies of the Exchange Offer and Consent Solicitation Documents may be directed to Global Bondholder Services Corporation at (866) 470-3800 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Exchange Offer and Consent Solicitation. The Exchange Offer and Consent Solicitation Documents are available for Eligible Holders at the following web address: https://gbsc-usa.com/eligibility/telecom.

Citigroup Global Markets Inc., Santander Investment Securities Inc., HSBC Securities (USA) Inc., Itau BBA USA Securities, Inc. and J.P. Morgan Securities LLC are acting as dealer managers (the “Dealer Managers”) for the Exchange Offer and Consent Solicitation.

Subject to applicable law, the Exchange Offer and Consent Solicitation may be amended in any respect, extended or, upon failure of a condition to be satisfied or waived prior to the Expiration Date or Settlement Date, as the case may be, terminated, at any time and for any reason. Although we have no present plans or arrangements to do so, we reserve the right to amend, at any time, the terms of the Exchange Offer and Consent Solicitation (including, without limitation, the conditions thereto) in accordance with applicable law. We will give Eligible Holders notice of any amendments and will extend the Expiration Date if required by applicable law.

Eligible Holders of Old Notes are advised to check with any bank, securities broker or other intermediary through which they hold Old Notes as to when such intermediary would need to receive instructions from an Eligible Holder in order for that Eligible Holder to be able to participate in, or withdraw their instruction to participate in, the Exchange Offer and Consent Solicitation before the deadlines specified in the Exchange Offer and Consent Solicitation Documents. The deadlines set by any such intermediary for the submission of instructions will be earlier than the relevant deadlines specified above.

Important Notice

This announcement is not an offer of securities for sale in the United States, and none of the New Notes (as defined in the Exchange Offer and Consent Solicitation Memorandum) has been or will be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or any state securities law. They may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons except pursuant to an exemption from, or in a transaction not subject to the registration requirements of the Securities Act. This press release does not constitute an offer of the New Notes for sale, or the solicitation of an offer to buy any securities, in any state or other jurisdiction in which any offer, solicitation or sale would be unlawful. Any person considering making an investment decision relating to any securities must inform itself independently based solely on an offering memorandum to be provided to eligible investors in the future in connection with any such securities before taking any such investment decision.

This announcement is directed only to holders of Old Notes who are (A) “qualified institutional buyers” as defined in Rule 144A under the Securities Act or (B) (x) outside the United States as defined in Regulation S under the Securities Act, (y) if located within a Member State of the European Economic Area (“EEA”) or in the United Kingdom, “qualified investors” as defined in Regulation (EU) 2017/1129 (the “Prospectus Regulation”) and (z) if outside the EEA or the UK, are eligible to receive this offer under the laws of its jurisdiction (each an “Eligible Holder”). No offer of any kind is being made to any beneficial owner of Eligible Bonds who does not meet the above criteria or any other beneficial owner located in a jurisdiction where the Exchange Offer and Consent Solicitation is not permitted by law.

The distribution of materials relating to the Exchange Offer and Consent Solicitation may be restricted by law in certain jurisdictions. The Exchange Offer and Consent Solicitation is void in all jurisdictions where it is prohibited. If materials relating to the Exchange Offer and Consent Solicitation come into your possession, you are required by the Company to inform yourself of and to observe all of these restrictions. The materials relating to the Exchange Offer and Consent Solicitation, including this communication, do not constitute, and may not be used in connection with, an offer or solicitation in any place where offers or solicitations are not permitted by law. If a jurisdiction requires that the Exchange Offer and Consent Solicitation be made by a licensed broker or dealer and a dealer manager or any affiliate of a dealer manager is a licensed broker or dealer in that jurisdiction, the Exchange Offer and Consent Solicitation shall be deemed to be made by the dealer manager or such affiliate on behalf of the Company in that jurisdiction.

Table of Contents

Forward-Looking Statements

All statements in this press release, other than statements of historical fact, are forward-looking statements. These statements are based on expectations and assumptions on the date of this press release and are subject to numerous risks and uncertainties which could cause actual results to differ materially from those described in the forward-looking statements. Risks and uncertainties include, but are not limited to, market conditions, and factors over which the Company has no control. The Company assumes no obligation to update these forward-looking statements, and does not intend to do so, unless otherwise required by law.

Notice to Investors in the European Economic Area and the United Kingdom

The New Notes are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA or in the United Kingdom. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (the “Insurance Distribution Directive”), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (the “Prospectus Regulation”). Consequently no key information document required by Regulation (EU) 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the New Notes or otherwise making them available to retail investors in the EEA or in the United Kingdom has been prepared and therefore otherwise offering or selling the New Notes or otherwise making them available to any retail investor in the EEA or in the United Kingdom may be unlawful under the PRIIPs Regulation

United Kingdom

For the purposes of section 21 of the Financial Services and Markets Act 2000, to the extent that this announcement constitutes an invitation or inducement to engage in investment activity, such communication falls within Article 34 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Financial Promotion Order”), being a non-real time communication communicated by and relating only to controlled investments issued, or to be issued, by the Company.

Other than with respect to distributions by the Company, this announcement is for distribution only directed at: (i) persons who are outside the United Kingdom; or (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Financial Promotion Order”); or (iii) persons falling within Articles 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Financial Promotion Order; or (iv) persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the FSMA) in connection with the issue or sale of any New Notes may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). (all such persons together being referred to as “relevant persons”). This announcement is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is available only to relevant persons and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such New Notes will be engaged in only with relevant persons.

Table of Contents

The Information and Exchange Agent for the Exchange Offer and Consent Solicitation is:

|

Global Bondholder Services Corporation

|

|

|

|

65 Broadway – Suite 404

|

|

New York, New York 10006

|

|

Attn: Corporate Actions

Email: contact@gbsc-usa.com

|

|

|

|

Banks and Brokers call: (212) 430-3774

Toll free: (866)-470-3800

|

|

|

|

By facsimile:

(For Eligible Institutions only):

(212) 430-3775/3779

|

|

|

|

By Mail:

65 Broadway — Suite 404

New York, NY 10006

|

By Overnight Courier:

65 Broadway – Suite 404

New York, New York 10006

|

By Hand:

65 Broadway — Suite 404

New York, NY 10006

|

|

|

Any question regarding the terms of the Exchange Offer and Consent Solicitation should be directed to the Dealer Managers.

The Dealer Managers for the Exchange Offer and Consent Solicitation are:

|

Citigroup Global

Markets Inc.

|

Santander

Investment

Securities Inc.

|

HSBC Securities

(USA) Inc.

|

Itau BBA USA

Securities, Inc.

|

J.P. Morgan

Securities LLC

|

The Exchange Offer and Consent Solicitation shall be available online at https://gbsc-usa.com/eligibility/telecom until the consummation or termination of the Exchange Offer and Consent Solicitation.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Telecom Argentina S.A.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

July 21, 2020

|

By:

|

/s/ Fernando J. Balmaceda

|

|

|

|

|

Name:

|

Fernando J. Balmaceda

|

|

|

|

|

Title:

|

Responsible for Market Relations

|

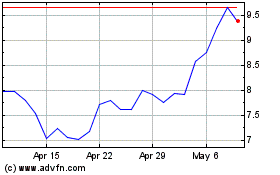

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Aug 2024 to Sep 2024

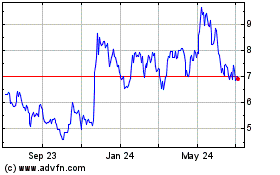

Telecom Argentina (NYSE:TEO)

Historical Stock Chart

From Sep 2023 to Sep 2024