PanAmSat Announces Tentative Pricing of Tender Offers for Its Outstanding 8 1/2% Senior Notes due 2012 and 6 1/8% Notes due 2005

August 06 2004 - 6:35PM

PR Newswire (US)

PanAmSat Announces Tentative Pricing of Tender Offers for Its

Outstanding 8 1/2% Senior Notes due 2012 and 6 1/8% Notes due 2005

WILTON, Conn., Aug. 6 /PRNewswire-FirstCall/ -- PanAmSat

Corporation (the "Company" or "PanAmSat") (NASDAQ:SPOT) announced

today that it had determined tentative pricing information in

connection with the cash tender offer (and related consent

solicitation) relating to the $800 million outstanding principal

amount of its 8 1/2% Senior Notes due 2012 ("8 1/2% Notes") (the "8

1/2% Notes Tender Offer") and the cash tender offer relating to the

$275 million outstanding principal amount of its 6 1/8% Notes due

2005 ("6 1/8% Notes" and, together with the 8 1/2% Notes, the

"Notes") (the "6 1/8% Notes Tender Offer" and, together with the

81/2% Notes Tender Offer, the "Offers"). If the Offers expire on

August 20, 2004, as currently scheduled, the Company will pay

$1,164.20 for each $1,000 principal amount of 8 1/2% Notes

purchased in the 8 1/2% Notes Tender Offer and $1,015.63 for each

$1,000 principal amount of 6 1/8% Notes purchased in the 6 1/8%

Notes Tender Offer, plus in each case accrued and unpaid interest

from the last interest payment date up to, but not including, the

settlement date. The Company reserves the right to extend the

expiration time of the Offers subject to applicable law. In the

event that the Offers are extended for any period of time longer

than ten full business days from the currently scheduled expiration

time, a new price determination date will be established with

respect to the Offers. In the event that the Offers are extended

for any period of time less than ten full business days from the

currently scheduled expiration time, a new price determination date

may be established. In such case, the expiration time for the

Offers will be not less than two nor more than ten full business

days after such new price determination date. If the Offers expire

at the currently scheduled expiration time of 5:00 p.m., New York

City time, on August 20, 2004, the Company expects to have the

settlement date on August 24, 2004, subject to satisfying various

conditions, including all conditions precedent to the sale of

PanAmSat to affiliates of Kohlberg Kravis Roberts & Co. L.P.,

The Carlyle Group and Providence Equity Partners, Inc. As

previously announced, the propulsion system failure on the

Company's Galaxy 10R satellite allows the purchasers to not

consummate the contemplated transactions. The purchase price for

the 8 1/2% Notes includes a consent payment of $20.00 per $1,000

principal amount of 8 1/2% Notes, and the purchase price for the 6

1/8% Notes includes an early tender premium of $20.00 per $1,000

principal amount of 6 1/8% Notes. All holders who validly tender

their Notes pursuant to the Offers prior to the expiration time

(currently 5:00 p.m., New York City time, on August 20, 2004 unless

the expiration time is extended) will receive the respective

consent payment or early tender payment. The purchase price for the

8 1/2% Notes was determined by reference to a fixed spread of 50

basis points over the bid side yield (as quoted on Bloomberg screen

PX5 at 2:00 p.m., New York City time, on August 6, 2004) of the

2.250% U.S. Treasury Note due February 15, 2007. The purchase price

for the 6 1/8% Notes was determined by reference to a fixed spread

of 50 basis points over the bid side yield (as quoted on Bloomberg

screen PX3 at 2:00 p.m., New York City time, on August 6, 2004) of

the 1.750% U.S. Treasury Note due December 31, 2004. Citigroup

Global Markets Inc. is acting as dealer manager and solicitation

agent for the 8 1/2% Notes Tender Offer. The information agent for

the 8 1/2% Notes Tender Offer is Global Bondholder Services

Corporation. The tender agent for the 8 1/2% Notes Tender Offer is

The Bank of New York. Questions regarding the 8 1/2% Notes Tender

Offer may be directed to Citigroup Global Markets Inc., telephone

number (800) 558-3745 (toll free) and (212) 723-6106 (call

collect). Requests for copies of the 8 1/2% Notes Offer to Purchase

and related documents may be directed to Global Bondholder Services

Corporation, telephone number (866) 952-2200 (toll free) and (212)

430-3774. Citigroup Global Markets Inc. is acting as dealer manager

for the 6 1/8% Notes Tender Offer. The information agent for the 6

1/8% Notes Tender Offer is Global Bondholder Services Corporation.

The tender agent for the 61/8% Notes Tender Offer is JPMorgan Chase

Bank. Questions regarding the 6 1/8% Notes Tender Offer may be

directed to Citigroup Global Markets Inc., telephone number (800)

558-3745 (toll free) and (212) 723-6106 (call collect). Requests

for copies of the 6 1/8% Notes Offer to Purchase and related

documents may be directed to Global Bondholder Services

Corporation, telephone number (866) 952-2200 (toll free) and (212)

430-3774. This announcement is not an offer to purchase, a

solicitation of an offer to purchase, or a solicitation of consents

with respect to the 8 1/2% Notes or the 6 1/8% Notes nor is this

announcement an offer or solicitation of an offer to sell any

securities. The 8 1/2% Notes Tender Offer and 6 1/8% Notes Tender

Offer are made solely by means of the 8 1/2% Notes Offer to

Purchase and 6 1/8% Notes Offer to Purchase, respectively. Through

its owned and operated fleet of 24 satellites, PanAmSat is a

leading global provider of video, broadcasting and network

distribution and delivery services. In total, the Company's

in-orbit fleet is capable of reaching over 98 percent of the

world's population through cable television systems, broadcast

affiliates, direct-to-home operators, Internet service providers

and telecommunications companies. In addition, PanAmSat supports

the largest concentration of satellite-based business networks in

the U.S., as well as specialized communications services in remote

areas throughout the world. This document contains forward-looking

statements within the meaning of the safe harbor provisions of the

Securities Litigation Reform Act of 1995. Terms such as "will,"

"expect," "believe," "continue," and "grow," as well as similar

comments, are intended to identify forward-looking statements and

information. You are cautioned not to place undue reliance on these

forward- looking statements, which speak only as of their dates.

These forward-looking statements are based on estimates and

assumptions by the Company's management that, although the Company

believes to be reasonable, are inherently uncertain and subject to

a number of risks and uncertainties. Factors that could cause

actual results to differ materially from the Company's expectations

include general business and economic conditions, competitive

factors, and fluctuations in demand. The Company undertakes no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as otherwise required by law. Please refer to the Company's

Securities and Exchange Commission filings for further information.

DATASOURCE: PanAmSat Corporation CONTACT: Kathryn Lancioni of

PanAmSat Corporation, +1-646-293-7415 Web site:

http://www.panamsat.com/

Copyright

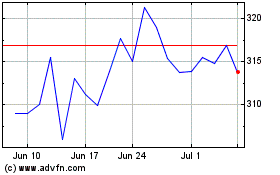

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

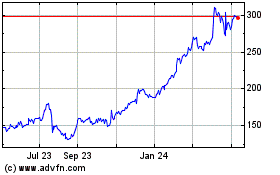

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024