PanAmSat Reports Second Quarter 2004 Results WILTON, Conn., July 29

/PRNewswire-FirstCall/ -- PanAmSat Corporation (the "Company or

"PanAmSat") (NASDAQ:SPOT) today reported financial results for the

second quarter and six months ended June 30, 2004. In the second

quarter, the Company generated revenues of $206.8 million compared

to $203.6 million in the second quarter of 2003. Earnings per share

(EPS) for the second quarter of 2004 were $0.07 per share compared

to EPS of $0.20 for the second quarter of 2003. The primary reason

for the reduction in EPS was an unusual non-cash charge of

approximately $29.6 million ($18.8 million after taxes) recorded in

the second quarter of 2004. This charge related to the write-off of

a customer's receivable balance resulting from PanAmSat's

termination of the customer's agreement for non-payment. In

addition, the Company recorded a $5.5 million non-cash charge ($3.5

million after taxes) in interest expense for the write-off of debt

issuance costs as a result of the early repayment of the Company's

Term B-1 facility. Without these non-cash charges, EPS in the

second quarter of 2004 would have been $0.22 per share (2) as

compared to the reported EPS of $0.07 per share. For the six months

ended June 30, 2004, total revenues were $412.3 million compared to

$403.3 million for the same period in 2003 and EPS was ($0.14) per

share compared to $0.41 per share for the same period in 2003. The

$35.1 million of unusual non-cash charges recorded in the second

quarter of 2004 related to the customer termination and debt

repayment described above plus the unusual non-cash PAS-6

impairment charge of $99.9 million recorded in the first quarter of

2004 resulted in reported EPS for the six months ended June 30,

2004 being reduced from $0.43 to $(0.14)(2). Financial Results for

Three Months Ended June 30, 2004 Total revenues for the second

quarter of 2004 were $206.8 million, compared to revenues of $203.6

million for the second quarter of 2003. Operating lease revenues

were $202.7 million for the second quarter of 2004, compared to

$199.4 million for the same period in 2003. The increase in

operating lease revenues was primarily attributable to additional

government services revenues related to our Government Services

(G2) operating segment and an increase in network services revenues

related to data services within the Middle East and VSAT

applications in North America. These increases were partially

offset by lower video services revenues primarily due to customer

credit-related issues in international regions, some of which

resulted in the second quarter 2004 unusual non-cash charge related

to the customer termination described above. Total direct operating

costs and selling, general & administrative expenses for the

three months ended June 30, 2004 were $90.4 million compared to

$53.6 million for the same period in 2003. This increase was

primarily attributable to the unusual non-cash charge related to a

customer termination recorded during the second quarter of 2004.

Also, direct operating costs increased from growth of services to

the U.S. government. Further, additional direct operating costs

were recorded during the second quarter of 2004 related to Sonic

Telecommunications International Ltd, which was acquired during

2003. For the three months ended June 30, 2004, net income was

$10.7 million, compared to $30.3 million for the same period in

2003. EPS was $0.07 per share for the second quarter of 2004

compared to $0.20 per share for the second quarter of 2003. The

change in net income and earnings per share was primarily due to

the unusual non-cash charges in EBITDA(1) and interest expense

described above. For the three months ended June 30, 2004, EBITDA

was $115.8 million(1), compared to $149.4 million(1) for the same

period in 2003. The decrease in EBITDA was primarily attributable

to the unusual non-cash charge related to a customer's termination

recorded during the second quarter of 2004 and a change in the

revenue mix of the Company's services, including the previously

mentioned increase in G2 revenue. Excluding the write-off of the

customer's receivable balance during the second quarter of 2004,

our EBITDA would have been $145.4 million(2). Financial Results for

Six Months Ended June 30, 2004 Total revenues for the first six

months of 2004 were $412.3 million, compared to revenues of $403.3

million for the same period in 2003. Operating lease revenues were

$403.9 million for the first six months of 2004, compared to $394.8

million for the first six months in 2003. The increase in operating

lease revenues was primarily attributable to additional government

services revenues related to our G2 operating segment and an

increase in network services revenues related to network resellers,

data services within the Middle East and additional revenues

related to VSAT applications in North America. These increases were

partially offset by lower video services revenues primarily due to

customer credit-related issues in international regions, some of

which resulted in the second quarter 2004 unusual non-cash charge

described above. Total direct operating costs and selling, general

& administrative expenses for the six months ended June 30,

2004 were $147.6 million compared to $104.8 million for the same

period in 2003. This increase was primarily attributable to costs

related to revenues from our G2 operating segment and the non-cash

charge related to a customer termination described above. For the

six months ended June 30, 2004, net income (loss) was ($21.3)

million, compared to $61.2 million for the same period in 2003. EPS

was ($0.14) per share for the first six months of 2004 compared to

$0.41 per share for the first six months of 2003. The change in net

income and earnings per share was primarily due to the PAS-6

impairment loss recorded in the first quarter of 2004, the write

off of the customer receivable balances recorded during the second

quarter of 2004, the write off of debt issuance costs for the early

repayment of debt, as well as the other changes in EBITDA described

below and the related income tax effect. On March 17, 2004 and on

April 1, 2004, our PAS-6 satellite suffered anomalies resulting in

a loss of power and the deorbiting of the satellite. As a result,

we recorded a non-cash impairment charge of $99.9 million within

income from operations ($63.3 million charge to net income after

taxes) in the first quarter of 2004. PAS-6 had been previously

replaced, was used as a backup for another satellite and therefore

this event did not affect service to any of our customers or our

revenues. Excluding the PAS-6 impairment loss recorded during the

first quarter of 2004 and the write-off of the customer's

receivable balance and debt issuance costs during the second

quarter of 2004, our earnings per share would have been $0.43 per

share(2). For the six months ended June 30, 2004, EBITDA(1) was

$162.2 million, compared to $297.9 million for the same period in

2003. This decrease was primarily due to the PAS-6 impairment loss

and the charges noted above recorded during the second quarter of

2004. Excluding the PAS-6 impairment loss recorded during the first

quarter of 2004 and the write-off of the customer's receivable

balance during the second quarter of 2004, our EBITDA would have

been $291.8 million(2). Segment Information Our operations are

comprised of the following two operating segments: Fixed Satellite

Services -- Through our Fixed Satellite Services ("FSS") segment,

we lease transponder capacity to customers for various

applications, including broadcasting, news gathering, Internet

access and transmission, private voice and data networks, business

television, distance learning and direct-to-home television ("DTH")

and provide telemetry, tracking and control services ("TT&C")

and network services to customers. Government Services -- Through

G2, we provide global satellite and related telecommunications

services to the U.S. government, international government entities,

and their contractors. FSS Segment: Three Months Six Months Ended

June 30, Ended June 30, 2004 2003 2004 2003 Revenue $188,782

$193,582 $378,209 $389,254 Income from operations $40,942 $72,205

$10,269 $146,619 EBITDA (2) $111,912 $147,072 $156,136 $293,743 For

the Three Months Ended June 30, 2004 FSS revenues for the three

months ended June 30, 2004 decreased $4.8 million compared to the

same period in 2003. This decease was primarily due to lower

program distribution and DTH video revenues, partially offset by

higher network services revenues. Video services revenues of $115.6

million for the three months ended June 30, 2004 decreased $9.2

million from the $124.8 million recorded during the same period in

2003. This decrease was primarily due to customer credit-related

issues in international regions, some of which resulted in the

second quarter 2004 charge, which is more fully described above.

Network services revenues of $55.9 million for the three months

ended June 30, 2004 increased $3.1 million from the $52.7 million

recorded during the same period in 2003. The increase in network

services revenues was primarily related to an increase in revenue

from customers with data services in the Middle East and customers

with VSAT applications in North America. EBITDA and income from

operations for the three months ended June 30, 2004 decreased by

$35.2 million and $63.8 million, respectively, compared to the same

period in 2003. These decreases were primarily due to the lower

revenue as described above and a non-cash write-off of a customer's

receivables described above. Excluding this non-cash charge, the

EBITDA and income from operations of the FSS segment would have

been $141.5 million(2) and $70.5 million(2), respectively. For the

Six Months Ended June 30, 2004 FSS revenues for the six months

ended June 30, 2004 decreased $11.0 million compared to the same

period in 2003. This decease was primarily due to lower program

distribution and DTH video revenues partially offset by higher

network services revenues. Video services revenues of $231.2

million for the six months ended June 30, 2004 decreased $20.3

million from the $251.5 million recorded during the same period in

2003. This decrease was primarily due to customer credit-related

issues in international regions, some of which resulted in the

second quarter 2004 charge of $29.6 million, which is more fully

described above. Network services revenues of $110.9 million for

the six months ended June 30, 2004 increased $7.8 million from the

$103.2 million recorded during the same period in 2003. The

increase in network services revenues is due to additional revenue

from network resellers, customers with data services in the Middle

East and additional revenues from customers with VSAT applications

in North America. EBITDA and income from operations for the six

months ended June 30, 2004 decreased by $137.6 million and $136.4

million, respectively, compared to the same period in 2003. This

decrease was primarily the result of the PAS-6 impairment loss and

the charges noted above recorded during the second quarter of 2004.

Excluding the PAS-6 impairment loss recorded during the first

quarter of 2004 and the write-off of the customer's receivable

balance during the second quarter of 2004, the EBITDA and income

from operations of the FSS segment would have been $285.7 million

(2) and $139.8 million(2), respectively. G2 Segment: Three Months

Six Months Ended June 30, Ended June 30, 2004 2003 2004 2003

Revenue $22,605 $15,402 $44,421 $25,033 Income from operations

$3,575 $2,246 $5,325 $4,107 EBITDA (2) $3,917 $2,288 $6,105 $4,159

For the Three Months Ended June 30, 2004 The increase in G2 segment

revenues of $7.2 million was primarily due to an increase of $4.3

million from our long-term construction arrangement with a customer

to construct an L-Band navigational payload on our Galaxy 1R

replacement satellite (Galaxy 15). The increase in revenue was also

due to an increase in equipment-based and non-satellite bandwidth

sales as compared to the same period in 2003. The G2 segment EBITDA

and income from operations for the three months ended June 30, 2004

increased by $1.6 million and $1.3 million, respectively, as

compared to the same period in 2003. These increases were primarily

a result of higher revenue as discussed above, partially offset by

the related direct operating costs. The G2 segment's gross margins

remained relatively flat period over period. For the Six Months

Ended June 30, 2004 The increase in G2 segment revenues of $19.4

million in 2004 reflects a full six months of operations in 2004

for the HGS and Esatel acquisitions made during 2003, as well as an

increase in equipment-based and non-satellite bandwidth sales, as

compared to the same period in 2003. The increase was also due to

an increase of $6.7 million in revenues earned from our long-term

construction arrangement with a customer to construct an L-band

navigational payload on our Galaxy 1R replacement satellite (Galaxy

15). The construction of the L-band navigational payload began in

the third quarter of 2003. The G2 segment EBITDA and income from

operations for the three months ended June 30, 2004 increased by

$1.9 million and $1.2 million, respectively, as compared to the

same period in 2003. These increases were primarily a result of

higher revenue as discussed above, partially offset by the related

direct operating costs. The G2 segment's gross margins remained

relatively flat period over period. Repayment of Term B-1 Facility

In June 2004, we repaid the $349.1 million outstanding balance

under our Term B-1 Facility from available cash on hand. In

conjunction with this repayment, we recorded a charge of $5.5

million within interest expense as a result of the write-off of

related debt issuance costs and a charge of $0.5 million within

interest expense representing the amount accumulated within other

comprehensive income related to an interest rate hedge entered into

in connection with the Term B-1 Facility. The hedge liability was

not impacted by the repayment of the Term B-1 Facility. Satellite

Insurance During the second quarter of 2004, adjustments to our

satellite insurance coverage were made as part of our normal

reevaluation process. As of June 30, 2004, we had in effect launch

and in-orbit insurance policies covering seven of our satellites in

the aggregate amount of approximately $846.1 million, with such

satellites having an aggregate net book value and other insurable

costs of $927.2 million. More detailed information with respect to

our satellite insurance coverage is found in our Form 10-Q for the

quarterly period ended June 30, 2004, which is being filed

contemporaneously with this press release. NON-GAAP FINANCIAL

RECONCILIATION SCHEDULES The tables below reconcile our non-GAAP

financial measures to the most directly comparable GAAP financial

measure. Management encourages readers to use GAAP disclosures

referred to earlier in this release to evaluate the Company's

results of operations. These non-GAAP tables are included to aid

the reader in understanding our GAAP financial statements. The

following table sets forth a reconciliation of net income (loss) to

EBITDA on a consolidated basis and a reconciliation of Income from

operations to EBITDA for our FSS Operating Segment and our G2

Operating Segment for the periods indicated: Three Months Ended Six

Months Ended June 30, June 30, 2004 2003 2004 2003 (In thousands)

Reconciliation of Net Income (loss) to EBITDA: Consolidated: Net

income (loss) $10,666 $30,298 $(21,263) $61,156 Interest expense,

net 33,623 33,132 64,709 67,407 Income tax expense (benefit) 228

11,021 (27,852) 22,163 Depreciation and amortization 71,312 74,909

146,647 147,176 EBITDA (1) $115,829 $149,360 $162,241 $297,902

Three Months Ended Six Months Ended June 30, June 30, 2004 2003

2004 2003 (In thousands) Reconciliation of Income from operations

to EBITDA: FSS Operating Segment: Income from operations $40,942

$72,205 $10,269 $146,619 Depreciation and amortization 70,970

74,867 145,867 147,124 EBITDA (1) $111,912 $147,072 $156,136

$293,743 G2 Operating Segment: Income from operations $3,575 $2,246

$5,325 $4,107 Depreciation and amortization 342 42 780 52 EBITDA

(1) $3,917 $2,288 $6,105 $4,159 (1) EBITDA, a measure used by

management to measure operating performance, is defined as net

income plus net interest expense, income tax expense (benefit) and

depreciation and amortization. EBITDA is not a presentation made in

accordance with GAAP, and is not a measure of financial condition

or profitability, and should not be considered as an alternative to

(1) net income (loss) determined in accordance with GAAP or (2)

operating cash flows determined in accordance with GAAP. PanAmSat's

management uses EBITDA to evaluate the operating performance of its

business, and as a measure of performance for incentive

compensation purposes. PanAmSat believes EBITDA is a measure of

performance used by some investors, equity analysts and others to

make informed investment decisions. PanAmSat's management also uses

this metric to measure income generated from operations that could

be used to service debt, fund future capital expenditures or pay

taxes. In addition, multiples of current or projected EBITDA are

used to estimate current or prospective enterprise value.

Additionally, EBITDA is not intended to be a measure of free cash

flow for management's discretionary use, as it does not consider

certain cash requirements such as interest payments, tax payments

and debt service requirements. Because not all companies use

identical calculations, this presentation of EBITDA may not be

comparable to other similarly titled measures of other companies.

Reconciliation Schedule For Unusual Items The following schedule

reconciles certain amounts presented in the attached Summary of

Operating Results and Selected Segment Data to amounts reflected

within this earnings release which exclude the impact of the PAS-6

impairment loss recorded during the first quarter of 2004, the

write-off of a customer's long and short-term receivable balances

during the second quarter of 2004 and the write-off of debt

issuance costs as a result of the early repayment of the Company's

Term B-1 facility during the second quarter of 2004. For the three

months ended June 30, 2004 EBITDA (1) Income from Net Income

Earnings Operations (loss) (loss) per share Consolidated Reported

$115,829 $10,666 $0.07 Customer Write-off 29,601 18,758 0.13

Write-off of debt issuance costs -- 3,456 0.02 Excluding unusual

items (2) $145,430 $32,880 $0.22 FSS Reported $111,912 $40,942 N/A

N/A Customer Write-off 29,601 29,601 Excluding unusual items (2)

$141,513 $70,543 For the six months ended June 30, 2004 EBITDA (1)

Income from Net Income Earnings Operations (loss) (loss) per share

Consolidated Reported $162,241 $(21,263) $(0.14) PAS-6 Impairment

loss 99,946 63,336 0.42 Customer Write-off 29,601 18,758 0.13

Write-off of debt issuance costs -- 3,456 0.02 Excluding unusual

items (2) $291,788 $64,287 $0.43 FSS Reported $156,136 $10,269 N/A

N/A PAS-6 Impairment loss 99,946 99,946 Customer Write-off 29,601

29,601 Excluding unusual items (2) $285,683 $139,816 (2) Excluding

unusual items - Amounts indicated are non-GAAP financial measures

as they exclude the impact of the PAS-6 impairment loss recorded

during the first quarter of 2004, the write-off of a customer's

long and short-term receivable balances during the second quarter

of 2004 and the write-off of debt issuance costs as a result of the

early repayment of the Company's Term B-1 facility during the

second quarter of 2004. These measures should be used in

conjunction with GAAP financial measures presented in the attached

Summary of Operating Results and Selected Segment Data and should

not be considered as an alternative to (1) net income (loss)

determined in accordance with GAAP or (2) operating cash flows

determined in accordance with GAAP. Since these items are unusual

charges, we believe that excluding them is important to an

understanding of the Company's ongoing results of operations. We

believe these adjusted amounts may be more comparable to our

historical and future operating results and therefore should be

used in conjunction with our GAAP financial measures when

evaluating our operating performance. For more detailed information

about our financial guidance and trends, please visit the

"Financial Guidance/Recent Presentations" page of the Investor

Relations section of our website located at

http://www.panamsat.com/. About PanAmSat Through its owned and

operated fleet of 24 satellites, PanAmSat (NASDAQ:SPOT) is a

leading global provider of video, broadcasting and network

distribution and delivery services. In total, the Company's

in-orbit fleet is capable of reaching over 98 percent of the

world's population through cable television systems, broadcast

affiliates, direct-to-home operators, Internet service providers

and telecommunications companies. In addition, PanAmSat supports

the largest concentration of satellite-based business networks in

the U.S., as well as specialized communications services in remote

areas throughout the world. PanAmSat is 80.4 percent owned by The

DIRECTV Group Inc. For more information, visit the Company's web

site at http://www.panamsat.com/. The DIRECTV Group, Inc. The

DIRECTV Group, Inc. (NYSE:DTV) formerly Hughes Electronics Corp.

(NYSE:HS), is a world-leading provider of digital multichannel

television entertainment, broadband satellite networks and

services, and global video and data broadcasting. The DIRECTV

Group, Inc. is 34 percent owned by Fox Entertainment Group, which

is approximately 82 percent owned by News Corporation Ltd. NOTE:

The Private Securities Litigation Reform Act of 1995 provides a

"safe harbor" for certain forward-looking statements so long as

such information is identified as forward-looking and is

accompanied by meaningful cautionary statements identifying

important factors that could cause actual results to differ

materially from those projected in the information. When used in

this press release, the words "estimate," "plan," "project,"

"anticipate," "expect," "intend," "outlook," "believe," and other

similar expressions are intended to identify forward-looking

statements and information. Actual results may differ materially

from anticipated results due to certain risks and uncertainties,

which are more specifically set forth in the "Financial

Guidance/Recent Presentations" page of the Investor Relations

section of our website and the Company's annual report on Form 10-K

for the year ended December 31, 2003 on file with the Securities

and Exchange Commission. The risks and uncertainties that could

cause our actual results to differ, include but are not limited to

(i) risks associated with operating our in-orbit satellites, (ii)

risks of launch failures, launch and construction delays and

in-orbit failures or reduced performance, (iii) risk that we may

not be able to obtain new or renewal satellite insurance policies

on commercially reasonable terms or at all, (iv) risks related to

possible future losses on satellites that are not adequately

covered by insurance, (v) risks related to domestic and

international government regulation, (vi) risks related to the

Company's contracted backlog for future services, (vii) risks of

doing business internationally, (viii) risks of inadequate access

to capital for growth, (ix) risks related to competition, (x) risks

related to customer defaults, (xi) risks relating to pricing

pressure and overcapacity in markets in which we operate, (xii)

risks associated with the Company's indebtedness, (xiii) risks

related to control by our majority stockholder and (xiv)

litigation. PanAmSat cautions that the foregoing list of important

factors is not exclusive, and PanAmSat undertakes no obligation to

publicly update any forward-looking statement. Further, PanAmSat

operates in an industry sector where securities values may be

volatile and may be influenced by economic and other factors beyond

the Company's control. FINANCIAL INFORMATION TO FOLLOW Summary of

Operating Results For the Three Months Ended June 30, 2004 and 2003

Amounts in thousands (except share data) PanAmSat PanAmSat 6/30/04

6/30/03 Revenues Operating leases, satellite services and other

$202,732 $199,400 Outright sales and sales-type leases 4,093 4,193

Total revenues 206,825 203,593 Costs and expenses Direct operating

costs (exclusive of depreciation and amortization) 40,167 32,232

Selling, general & administrative expenses 50,256 21,338 PAS-6

impairment loss -- -- Facilities restructuring and severance costs

573 663 Total 90,996 54,233 EBITDA 115,829 149,360 Depreciation and

amortization expense 71,312 74,909 Income from operations 44,517

74,451 Interest expense, net 33,623 33,132 Income before income

taxes 10,894 41,319 Income tax expense 228 11,021 Net income

$10,666 $30,298 Earnings per share $0.07 $0.20 Weighted average

common shares outstanding 150.2 150.1 Summary of Operating Results

For the Six Months Ended June 30, 2004 and 2003 Amounts in

thousands (except share data) PanAmSat PanAmSat 6/30/04 6/30/03

Revenues Operating leases, satellite services and other $403,897

$394,820 Outright sales and sales-type leases 8,358 8,529 Total

revenues 412,255 403,349 Costs and Expenses Direct operating costs

(exclusive of depreciation and amortization) 79,835 65,420 Selling,

general & administrative expenses 67,805 39,364 PAS-6

impairment loss 99,946 -- Facilities restructuring and severance

costs 2,428 663 Total 250,014 105,447 EBITDA 162,241 297,902

Depreciation and amortization expense 146,647 147,176 Income from

operations 15,594 150,726 Interest expense, net 64,709 67,407

Income (loss) before income taxes (49,115) 83,319 Income tax

expense (benefit) (27,852) 22,163 Net income (loss) ($21,263)

$61,156 Earnings (loss) per share $(0.14) $0.41 Weighted average

common shares outstanding 150.2 150.0 Summarized Balance Sheets As

of June 30, 2004 and December 31, 2003 (Amounts in thousands)

6/30/04 12/31/03 ASSETS CURRENT ASSETS Cash and cash equivalents

$627,751 $511,248 Short-term investments 9,957 38,936 Accounts

receivable, net 72,206 77,006 Net investment in sales-type leases

24,332 23,068 Prepaid expenses and other 29,911 20,428 Insurance

claim receivable -- 260,000 Deferred income taxes 6,933 7,688

Assets held for sale 3,257 -- Total current assets 774,347 938,374

SATELLITES AND OTHER PROPERTY AND EQUIPMENT, Net 2,092,796

2,306,705 NET INVESTMENT IN SALES-TYPE LEASES 100,573 116,653

GOODWILL 2,244,553 2,243,611 DEFERRED CHARGES AND OTHER ASSETS, NET

137,887 129,534 TOTAL ASSETS $5,350,156 $5,734,877 LIABILITIES AND

STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable and

accrued liabilities $63,607 $71,794 Current portion of long-term

debt 275,000 3,500 Current portion of satellite incentive

obligations 13,413 12,654 Accrued interest payable 45,344 45,462

Deferred revenues 26,788 22,436 Total current liabilities 424,152

155,846 LONG-TERM DEBT 1,075,000 1,696,500 DEFERRED INCOME TAXES

399,755 430,512 DEFERRED CREDITS AND OTHER 287,648 273,261 TOTAL

LIABILITIES 2,186,555 2,556,119 COMMITMENTS AND CONTINGENCIES

STOCKHOLDERS' EQUITY 3,163,601 3,178,758 TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $5,350,156 $5,734,877 Summarized Statements of

Cash Flows For the Six Months Ended June 30, 2004 and 2003 (Amounts

in thousands) 6/30/04 6/30/03 CASH FLOWS PROVIDED BY OPERATING

ACTIVITIES Net Income (loss) $(21,263) $61,156 Depreciation and

amortization expense 146,647 147,176 PAS-6 impairment loss 99,946

-- Facilities restructuring and severance costs 2,021 663 Changes

in working capital and other accounts (5,093) (30,129) NET CASH

PROVIDED BY OPERATING ACTIVITIES 222,259 229,166 CASH FLOWS FROM

INVESTING ACTIVITIES Capital expenditures (including capitalized

interest) (a) (83,886) (54,744) Insurance proceeds from satellite

recoveries 286,915 -- Net sales of short-term investments 28,948

43,704 Acquisitions, net of cash acquired (522) (8,352) NET CASH

PROVIDED BY (USED IN) INVESTING ACTIVITIES 231,455 (19,392) CASH

FLOWS FROM FINANCING ACTIVITIES Repayments of debt (350,000)

(200,000) New incentive obligations 16,250 5,642 Repayment of

incentive obligations (6,818) (5,734) Stock issued in connection

with employee benefit plans 3,493 1,437 NET CASH USED IN FINANCING

ACTIVITIES (337,075) (198,655) EFFECT OF EXCHANGE RATE CHANGES ON

CASH (136) 203 NET INCREASE IN CASH AND CASH EQUIVALENTS 116,503

11,322 CASH AND CASH EQUIVALENTS, beginning of period 511,248

783,998 CASH AND CASH EQUIVALENTS, end of period $627,751 $795,320

(a) Includes Capitalized Interest of $2.1 million and $8.5 million

for the six months ended June 30, 2004 and 2003, respectively.

Selected Segment Data: Three Months Ended Six Months Ended June 30,

June 30, (in 000's) (in 000's) 2004 2003 2004 2003 FSS Revenue

$188,782 $193,582 $378,209 $389,254 EBITDA (2) 111,912 147,072

156,136 293,743 Depreciation and Amortization Expense 70,970 74,867

145,867 147,124 Income from operations 40,942 72,205 10,269 146,619

Capital Expenditures 62,202 21,663 83,886 54,744 G2 Revenue 22,605

15,402 44,421 25,033 EBITDA (2) 3,917 2,288 6,105 4,159

Depreciation and Amortization Expense 342 42 780 52 Income from

operations 3,575 2,246 5,325 4,107 Capital Expenditures -- -- -- --

Eliminations Revenue (4,562) (5,391) (10,375) (10,938) Total

Revenue 206,825 203,593 412,255 403,349 EBITDA (2) 115,829 149,360

162,241 297,902 Depreciation and Amortization Expense 71,312 74,909

146,647 147,176 Income from operations 44,517 74,451 15,594 150,726

Capital Expenditures 62,202 21,663 83,886 54,744 DATASOURCE:

PanAmSat Corporation CONTACT: Kathryn Lancioni, Media/Investors of

PanAmSat Corporation, +1-203-210-8649 Web site:

http://www.panamsat.com/

Copyright

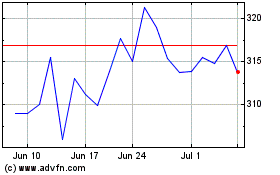

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

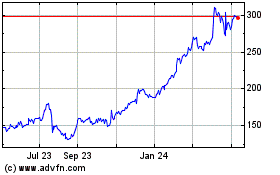

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024