Spotify's Loss Narrows but Misses Expectations -- 3rd Update

May 02 2018 - 7:47PM

Dow Jones News

By Anne Steele

Spotify Technology SA's shares took a hit after hours as its

first earnings report as a publicly traded company met the

company's own guidance but fell short of Wall Street

expectations.

The report Wednesday was Spotify's first since going public last

month. Shares in the Stockholm-based company fell 7.7% after hours

in New York to $156.99.

Spotify added a net four million paid subscribers -- its most

lucrative type of customer -- during the quarter, bringing the

total to 75 million. Still, most of its users are on its free,

ad-supported tier. Including those, the company said it now has 170

million monthly active users. Both results came at the high end of

the company's forecast.

In the company's first earnings call, Chief Executive Daniel Ek

batted away questions about competition heating up with Spotify's

top rivals.

"We don't see any kind of meaningful impact of competition," he

said in response to a question about Apple Inc.'s recent surge in

subscription growth. "We don't think this is a winner-take-all

market. Multiple services will exist in the market, and we're

focused on growing that market."

He added that Spotify is more focused on meeting its own

targets. "We're looking pretty good," he said.

As for Amazon.com Inc.'s voice-activated Echo speaker, with its

Alexa virtual assistant, Mr. Ek called such technology an

opportunity.

"Voice is growing, and Spotify is an application available both

on Alexa speakers and Google Home," he said. "We view that as a

long-term opportunity, not a threat."

It isn't unusual for tech companies to disappoint in their first

earnings reports after going public. Facebook Inc., Twitter Inc.

and, most recently, Snap Inc. all struggled to meet investor

expectations initially.

Spotify, which has reported net losses every year since it

launched in 2008, narrowed its first-quarter loss to EUR169 million

($202 million), or EUR1.01 a share, from EUR173 million, or

EUR1.15, in the same period a year earlier. Analysts polled by

Thomson Reuters were expecting a loss of 36 European cents.

Revenue grew 26% to EUR1.1 billion, in line with the company's

and analysts' guidance.

The company has said it is prioritizing growth over profit -- a

strategy executives believe will make the business more valuable

long term. None of Spotify's streaming competitors has ever

reported a profit.

Free cash flow -- a measure of the cash a company generates that

many investors view as a good proxy for performance -- was EUR74

million in the quarter, up from EUR64 million a year earlier.

For the second quarter, Spotify said it expects monthly active

users to reach 175 million to 180 million and to have 79 million to

83 million premium subscribers. The company forecast that revenue

will be in a range of EUR1.1 billion to EUR1.3 billion.

Spotify backed its previously offered guidance for the year that

revenue would increase by as much as 30% and premium subscribers

would increase by as much as 36% year over year.

Last month, Spotify said it added more features for its popular

free tier, which serves as a funnel to the subscription service

that generates more of its revenue. The company is now offering

on-demand listening to free users, who were previously able to

listen to albums and playlists with their songs in a shuffled

order.

During Wednesday's call, Mr. Ek said early customer feedback has

been "really, really good."

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 02, 2018 19:32 ET (23:32 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

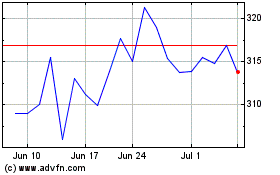

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

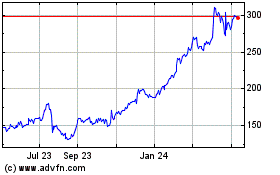

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024