PanAmSat Reports First Quarter 2004 Results Company Revenues

Increase as First U.S. High-Definition Satellite Neighborhood Is

Turned On; Transaction With KKR Announced WILTON, Conn., May 3

/PRNewswire-FirstCall/ -- PanAmSat Corporation today reported

financial results for the first quarter ended March 31, 2004 during

which total revenues increased to $205.4 million compared to $199.8

million in 2003. An unusual non-cash charge of approximately $100

million resulted in reported earnings per share (EPS) being reduced

from $0.21 to $(0.21)(3). Without this charge and the related

income tax effect, the Company met or exceeded its guidance

including maintaining a strong financial position with Free Cash

Flow (1) of $57.6 million for the first quarter compared to $37.8

million in the same period of 2003. The Company also ended the

first quarter of 2004 with a cash balance of $612 million versus

$511 million at the end of 2003 even after paying down $850 million

in debt last year. "Despite this weak market, we continued to

deliver strong cash flow and profitability. Our reported financials

were affected by an unusual non-cash charge that was due to an

impairment loss on one of our in-orbit international spares, PAS-6,

after the March 2004 failure of the satellite's power system. There

were no customers on this satellite and there is no impact on our

revenues," said Joe Wright, president and CEO of PanAmSat. "During

the quarter, we launched the first high-definition (HD)

neighborhood on Galaxy 13 and signed one of the largest contracts

in our history with the Fox Entertainment Group. As a result,

PanAmSat has the industry's leading HD satellite neighborhoods with

such powerhouses as Bravo HD+, Cinemax HD, ESPN HD, Encore HD, HBO

HD, HDNet, HDNet Movies, Showtime HD, Starz! HD, TNT HD, the WB HD

and Wealth TV. In fact, every major cable movie network is

leveraging the power of the Galaxy fleet to launch their HD

services. With more than 2,100 cable and broadcast channels already

coming through our network, it is easy to see why the major

programmers come to us to deliver their content," said Wright. On

April 20, 2004, PanAmSat and its 80.5 percent stakeholder, The

DIRECTV Group, Inc. announced that they signed a definitive

transaction agreement with affiliates of Kohlberg Kravis Roberts

& Co. ("KKR") for the sale of PanAmSat Corp. at $23.50 in cash

per share. The aggregate transaction value, including the expected

assumption of approximately $750 million of net debt, is

approximately $4.3 billion. Subject to applicable regulatory

approvals, including the Federal Communications Commission and

approval by the stockholders of PanAmSat, the transaction is

expected to be completed in the second half of 2004. The boards of

directors of both PanAmSat Corp. and The DIRECTV Group voted

unanimously in favor of the transaction. Wright continued, "For the

past three years we have focused on improving the fundamentals of

our business and we are now ready for growth. Over the course of

the next several years, we will launch two more satellites to

expand our HD offering and continue to develop our services to the

U.S. Government, which is the single largest user of FSS services

in the world. We will also continue to bring satellite-based

products and services to market in partnership with our customers.

Recently, we launched PASPort, our global hybrid satellite and

fiber network as well as several new products under our PanAmSat On

Demand brand. These include QuickSPOT, a family of auto-acquisition

satellite terminals. We are also co-marketing with BT SatNet, skIP

Broadband Services and others. As we move ahead, we will continue

to focus on the delivery of strong financial results while

maintaining our leadership in the delivery of advanced digital

applications in the air and on the ground. We are delighted that

KKR selected PanAmSat as its platform for growth in our industry.

They, as we, have a well-deserved reputation for excellence and the

delivery of results for their investors." Financial Results for

Three Months Ended March 31, 2004 Total revenues for the first

quarter of 2004 were $205.4 million, compared to revenues of $199.8

million for the first quarter of 2003. Operating lease revenues

were $201.2 million for the first quarter of 2004, compared to

$195.4 million for the same period in 2003. The increase in

operating lease revenues was primarily attributable to additional

government services revenue related to our G2 Satellite Solutions

segment (G2) and an increase in network services revenue. These

increases were partially offset by lower video services revenues

recorded primarily due to customer credit-related issues. Total

sales and sales-type lease revenues were $4.2 million for the

quarter ended March 31, 2004, compared to $4.3 million for the same

period in 2003. Total direct operating costs and selling, general

& administrative costs for the three months ended March 31,

2004 were $57.2 million compared to $51.2 million for the same

period in 2003. This increase is primarily attributable to costs

related to revenues from G2. On March 17, 2004, our PAS-6 satellite

suffered an anomaly resulting in a loss of power. On April 1, 2004,

this satellite experienced another anomaly and more significant

loss of power. Following that event, we commenced deorbiting the

satellite. As a result of the March 17 event, we recorded a

non-cash impairment charge of $99.9 million within income from

operations in the first quarter of 2004. This resulted in an

approximate $63.3 million non-cash charge to net income after

taxes. PAS-6 had been previously replaced and was used as a backup

for another satellite. Accordingly, this event has not affected

service to any of our customers and we anticipate that it will not

affect our revenues in 2004. We do not plan to replace this

satellite. For the three months ended March 31, 2004, operating

profit before depreciation and amortization(2) was $46.4 million,

as compared to $148.5 million for the same period in 2003. This

decrease was primarily the result of the PAS-6 impairment loss and

a change in the revenue mix of the Company's services, including

the previously mentioned increase in G2 revenue. Excluding the

PAS-6 impairment loss recorded during the first quarter of 2004,

our operating profit before depreciation and amortization and

income from operations would have been $146.4 million(3) and $71.0

million(3), respectively. For the three months ended March 31,

2004, net income (loss) was ($31.9) million, compared to $30.9

million for the same period in 2003. EPS was ($0.21) per share for

the first quarter of 2004 compared to $0.21 per share for the first

quarter of 2003. The change in net income and earnings per share

was primarily due to the PAS-6 impairment loss and related income

tax effect recorded during the first quarter of 2004 and the other

changes in operating profit before depreciation and amortization

described above. Excluding the PAS-6 impairment loss recorded

during the first quarter of 2004, our earnings per share would have

been $0.21 per share(3). Segment Information Our operations are

comprised of the following two segments: Fixed Satellite Services

("FSS") -- We lease transponder capacity to customers for various

applications, including broadcasting, news gathering, Internet

access and transmission, private voice and data networks, business

television, distance learning and direct-to-home television ("DTH")

and provide telemetry, tracking and control services ("TT&C")

and network services to customers. Government Services ("G2

Satellite Solutions" [G2]) -- We provide global satellite and

related telecommunications services to the Federal government,

international government entities, and their contractors through

our wholly owned subsidiary, formerly a division of ours. FSS

Segment: Three Months Ended March 31, 2004 2003 Revenue $189,427

$195,672 Operating Profit Before Depreciation and Amortization(2)

$44,224 $146,671 Income (Loss) From Operations ($ 30,673) $74,414

FSS revenues for the three months ended March 31, 2004 decreased

$6.2 million compared to the same period in 2003. This decease was

primarily due to lower program distribution and DTH video revenues

attributable to lower net new business and customer credit issues,

partially offset by higher network services revenues and revenues

related to satellite capacity leased to the G2 operating segment.

Video services revenues of $115.7 million for the three months

ended March 31, 2004 decreased $11.1 million from the $126.8

million recorded during the same period in 2003. This decrease was

primarily a result of lower DTH revenues due to customer credit

issues and capacity reduction, which were largely associated with

two customers. Network services revenues of $55.1 million for the

three months ended March 31, 2004 increased $4.7 million from the

$50.4 million recorded during the same period in 2003. The increase

in network services revenues is primarily a result of net new

business recorded from network resellers. These increases were

partially offset by lower Internet related revenues as a result of

contract expirations. Operating profit before depreciation and

amortization and income from operations for the three months ended

March 31, 2004 decreased by $102.4 million and $105.1 million,

respectively, as compared to the same period in 2003. These

decreases were primarily due to the loss on the impairment of PAS-6

of $99.9 million and lower revenue as described above. Excluding

the PAS-6 impairment loss recorded during the first quarter of

2004, the operating profit before depreciation and amortization and

income from operations of the FSS segment would have been $144.2

million(3) and $69.3 million(3), respectively. G2 Segment: Three

Months Ended March 31, 2004 2003 Revenue $21,816 $9,631 Operating

Profit Before Depreciation and Amortization(2) $2,188 $1,871 Income

From Operations $1,750 $1,861 The increase in G2 segment revenues

of $12.2 million in 2004 reflects a full quarter of the

acquisitions made during 2003, including Hughes Global Services and

Esatel, as well as an increase in equipment-based sales as compared

to the same period in 2003. The increase in G2 segment operating

profit before depreciation and amortization of $0.3 million

resulted from higher revenue that includes a larger mix of

equipment and non-satellite bandwidth sales, which carry lower

margins. In addition, income from operations remained flat as a

result of a full quarter of depreciation in 2004 on the Silver

Spring teleport acquired with the Esatel business. Financial

Guidance for Second Quarter and Full-Year 2004 The Company projects

its financial results for the second quarter and full-year 2004

will be as follows: Consolidated Second Quarter 2004 Full Year 2004

Total revenues $200 - $215 million $835 - $865 million Operating

profit before depreciation and amortization(2) $135 - $150 million

$475 - $495 million Depreciation and amortization $70 - $80 million

$280 - $310 million Income from operations $60 - $75 million $165 -

$195 million Earnings per share $0.17 - $0.23 per share $0.40 -

$0.55 per share Capital expenditures $50 - $70 million $165 - $195

million Segments Second Quarter 2004 Full Year 2004 Revenues: FSS

$182 - 192 million $755 - 775 million G2 $20 - 30 million $90 -

$110 million Operating profit before depreciation and

amortization(2): FSS $135 - 145 million $465 - 480 million G2 $ 1 -

5 million $ 10 - 15 million Income from operations: FSS $60 - 70

million $155 - 180 million G2 $ 1 - 5 million $ 10 - 15 million

NON-GAAP FINANCIAL RECONCILIATION SCHEDULES The tables below are

non-GAAP disclosures. Management encourages readers to use GAAP

disclosures referred to earlier in this release to evaluate the

Company's results of operations. These non-GAAP tables are included

to aid the reader in understanding our GAAP financial statements.

Second Consolidated PanAmSat First First Quarter Full Year Quarter

Quarter 2004 2004 2004 2003 Guidance Guidance Actual Actual

Operating profit before depreciation and amortization(2) $ 46.4M

$148.5M $135 - 150M $475 - 495M Less: Depreciation and amortization

75.3M 72.2M $70 - 80M $280 - 310M Income (loss) from operations

$(28.9M) $ 76.3M $60 - 75M $165 - 195M Net cash flow provided by

operating activities: $ 79.8M $ 79.1M Net cash flow provided by N/A

N/A (used in) investing activities: 6.7M (42.1)M (Sale)/Purchase of

short-term investments: (28.9)M 0.8M Free Cash Flow(1) $57.6M

$37.8M First First Second FSS Segment Quarter Quarter Quarter Full

Year 2004 2003 2004 2004 Actual Actual Guidance Guidance Operating

profit before depreciation and amortization(2) $ 44.2M $146.6M $135

- 145M $465 - 480M Less: Depreciation and amortization 74.9M 72.2M

$70 - 80M $280 - 310M Income (loss) from operations $ (30.7M) $

74.4M $60 -70M $155 - 180M First First Second G2 Segment Quarter

Quarter Quarter Full Year 2004 2003 2004 2004 Actual Actual

Guidance Guidance Operating profit before depreciation and

amortization(2) $ 2.2M $ 1.9M $1 - 5M $10 - 15 M Less: Depreciation

and amortization 0.4M - M - M - M Income from operations $ 1.8M $

1.9M $1 - 5M $10 - 15 M (1) Free Cash Flow, which is a non-GAAP

financial measure, equals net cash provided by operating activities

plus (less) net cash provided by (used in) investing activities

(excluding purchases and sales of short-term investments) as

presented in the attached Summarized Statements of Cash Flows. This

measure should be used in conjunction with other GAAP financial

measures and is not presented as an alternative measure of cash

flow as determined in accordance with accounting principles

generally accepted in the United States of America. PanAmSat's

management uses Free Cash Flow to evaluate the operating

performance of its business, and as a measure of performance for

incentive compensation purposes. PanAmSat believes Free Cash Flow

is a measure of performance used by some investors, equity analysts

and others to make informed investment decisions. PanAmSat's

management also uses this metric to measure cash flows generated

from operations that could be used to service debt, fund future

capital expenditures or pay taxes. Free Cash Flow does not give

effect to cash used for debt service requirements, and thus does

not reflect funds available for investment or other discretionary

uses. Free Cash Flow as presented herein may not be comparable to

similarly titled measures reported by other companies. (2)

Operating profit before depreciation and amortization, which is a

non-GAAP financial measure, is the sum of income (loss) from

operations and depreciation and amortization as presented in the

attached Summaries of Operating Results and Selected Segment Data.

This measure should be used in conjunction with other GAAP

financial measures and is not presented as an alternative measure

of operating results or cash flow from operations, as determined in

accordance with accounting principles generally accepted in the

United States of America. PanAmSat's management uses Operating

profit before depreciation and amortization to evaluate the

operating performance of its business, and as a measure of

performance for incentive compensation purposes. PanAmSat believes

Operating profit before depreciation and amortization is a measure

of performance used by some investors, equity analysts and others

to make informed investment decisions. PanAmSat's management also

uses this metric to measure income generated from operations that

could be used to service debt, fund future capital expenditures or

pay taxes. In addition, multiples of current or projected Operating

profit before depreciation and amortization are used to estimate

current or prospective enterprise value. Operating profit before

depreciation and amortization does not give effect to cash used for

debt service requirements, and thus does not reflect funds

available for investment or other discretionary uses. Operating

profit before depreciation and amortization as presented herein may

not be comparable to similarly titled measures reported by other

companies. PAS - 6 IMPAIRMENT LOSS RECONCILIATION SCHEDULE The

following schedule reconciles certain amounts presented in the

attached Summary of Operating Results and Selected Segment Data to

amounts reflected within this earnings release which exclude the

impact of the PAS-6 impairment loss recorded during the first

quarter of 2004. For the three months ended March 31, 2004

Operating profit before Income Earnings depreciation and (loss)

from Net Income (loss) per amortization(2) Operations (loss) share

Consolidated Reported $46,412 $(28,923) $(31,929) $(0.21) PAS-6

Impairment loss 99,946 99,946 63,336 0.42 Adjusted(3) $146,358

$71,023 $31,407 $0.21 FSS Reported $44,224 $(30,673) N/A N/A PAS-6

Impairment loss 99,946 99,946 Adjusted(3) $144,170 $69,273 (3)

Amounts indicated are non-GAAP financial measures as they exclude

the impact of the PAS-6 impairment loss recorded during the first

quarter of 2004. These measures should be used in conjunction with

GAAP financial measures presented in the attached Summary of

Operating Results and Selected Segment Data and are not presented

as an alternative measure of operating results as determined in

accordance with accounting principles generally accepted in the

United States of America. As the PAS-6 impairment loss is an

unusual charge, we believe that the Company's operating results,

excluding the impact of the PAS-6 impairment loss, are important to

an understanding of the Company's ongoing results of operations. We

believe these adjusted amounts may be more comparable to our

historical and future operating results and therefore should be

used in conjunction with our GAAP financial measures when

evaluating our operating performance. For more detailed information

about our financial guidance and trends, please visit the

"Financial Guidance/Recent Presentations" page of the Investor

Relations section of our website located at

http://www.panamsat.com/. PanAmSat will hold a conference call at

11:00 a.m. ET on May 3, 2004 to discuss its first quarter 2004

financial results, as well as its financial outlook for 2004. The

dial-in number is 1-800-406-5356 (domestic) or 1-913-981-5572

(international). To listen to the call live via web cast, please

visit http://www.panamsat.com/. About PanAmSat PanAmSat Corporation

(NASDAQ:SPOT) is one of the world's top three satellite operators

managing a global fleet of 29 satellites, 24 of which are

wholly-owned by the Company, for the delivery of news, sports and

other television programming. In total, this fleet is capable of

reaching more than 98 percent of the world's population through

cable television systems, broadcast affiliates, direct-to-home

operators, Internet service providers and telecommunications

companies. In addition, PanAmSat supports the largest concentration

of satellite-based business networks in the U.S., as well as

specialized communications services in remote areas throughout the

world. PanAmSat is 80.5 percent owned by The DIRECTV Group Inc. For

more information, visit the Company's web site at

http://www.panamsat.com/. The DIRECTV Group, Inc. The DIRECTV

Group, Inc. (NYSE:DTV) formerly Hughes Electronics Corp. (NYSE:HS),

is a world-leading provider of digital multichannel television

entertainment, broadband satellite networks and services, and

global video and data broadcasting. The DIRECTV Group, Inc. is 34

percent owned by Fox Entertainment Group, which is approximately 82

percent owned by News Corporation Ltd. NOTE: The Private Securities

Litigation Reform Act of 1995 provides a "safe harbor" for certain

forward-looking statements so long as such information is

identified as forward-looking and is accompanied by meaningful

cautionary statements identifying important factors that could

cause actual results to differ materially from those projected in

the information. When used in this press release, the words

"estimate," "plan," "project," "anticipate," "expect," "intend,"

"outlook," "believe," and other similar expressions are intended to

identify forward-looking statements and information. Actual results

may differ materially from anticipated results due to certain risks

and uncertainties, which are more specifically set forth in the

"Financial Guidance/Recent Presentations" page of the Investor

Relations section of our website and the Company's annual report on

Form 10-K for the year ended December 31, 2003 on file with the

Securities and Exchange Commission. These risks and uncertainties

include but are not limited to (i) risks of launch failures, launch

and construction delays and in-orbit failures or reduced

performance, (ii) risk that we may not be able to obtain new or

renewal satellite insurance policies on commercially reasonable

terms or at all, (iii) risks related to domestic and international

government regulation, (iv) risks of doing business

internationally, (v) risks related to possible future losses on

satellites that are not adequately covered by insurance, (vi) risks

of inadequate access to capital for growth, (vii) risks related to

competition, (viii) risks related to the Company's contracted

backlog for future services, (ix) risks associated with the

Company's indebtedness, (x) risks related to control by our

majority stockholder and (xi) litigation. PanAmSat cautions that

the foregoing list of important factors is not exclusive. Further,

PanAmSat operates in an industry sector where securities values may

be volatile and may be influenced by economic and other factors

beyond the Company's control. Summary of Operating Results For the

Three Months Ended March 31, 2004 and 2003 Amounts in thousands

(except share data) PanAmSat PanAmSat 3/31/04 3/31/03 Revenues

Operating leases, satellite services and other $201,165 $195,420

Outright sales and sales-type leases 4,265 4,336 Total Revenues

205,430 199,756 Costs and Expenses Direct operating costs

(exclusive of depreciation and amortization) 39,668 33,188 Selling,

general & administrative costs 17,549 18,026 PAS-6 impairment

loss 99,946 -- Facilities restructuring and severance costs 1,855

-- Total 159,018 51,214 Operating income before depreciation and

amortization 46,412 148,542 Depreciation and amortization expense

75,335 72,267 Income (loss) from operations (28,923) 76,275

Interest expense, net 31,086 34,275 Income (loss) before income

taxes (60,009) 42,000 Income tax expense (benefit) (28,080) 11,142

Net income (loss) ($31,929) $30,858 Earnings (loss) per share

$(0.21) $0.21 Weighted average common shares outstanding 150.2

150.0 Summarized Balance Sheets As of March 31, 2004 and December

31, 2003 (Amounts in thousands) 3/31/04 12/31/03 ASSETS CURRENT

ASSETS Cash and cash equivalents $612,339 $511,248 Short-term

investments 10,013 38,936 Accounts receivable, net 71,008 77,006

Net investment in sales-type leases 23,707 23,068 Prepaid expenses

and other 21,931 20,428 Insurance claim receivable -- 260,000

Deferred income taxes 6,940 7,688 Total current assets 745,938

938,374 SATELLITES AND OTHER PROPERTY AND EQUIPMENT, Net 2,105,976

2,306,705 NET INVESTMENT IN SALES-TYPE LEASES 106,841 116,653

GOODWILL 2,244,553 2,243,611 RESTRICTED CASH 287,041 -- DEFERRED

CHARGES 172,591 129,534 TOTAL ASSETS $5,662,940 $5,734,877

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts

payable and accrued liabilities $60,125 $71,794 Current portion of

long-term debt 278,500 3,500 Current portion of satellite incentive

obligations 13,476 12,654 Accrued interest payable 19,660 45,462

Deferred revenues 24,322 22,436 Total current liabilities 396,083

155,846 LONG-TERM DEBT 1,420,625 1,696,500 DEFERRED INCOME TAXES

399,261 430,512 DEFERRED CREDITS AND OTHER 296,807 273,261 TOTAL

LIABILITIES 2,512,776 2,556,119 COMMITMENTS AND CONTINGENCIES

STOCKHOLDERS' EQUITY 3,150,164 3,178,758 TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $5,662,940 $5,734,877 Summarized Statements of

Cash Flows For the Three Months Ended March 31, 2004 and 2003

(Amounts in thousands) 3/31/04 3/31/03 CASH FLOWS PROVIDED BY

OPERATING ACTIVITIES Net Income (loss) $(31,929) $30,858

Depreciation and amortization expense 75,335 72,267 PAS-6

impairment loss 99,946 -- Facilities restructuring and severance

costs 1,855 -- Changes in working capital and other accounts

(65,392) (24,006) NET CASH PROVIDED BY OPERATING ACTIVITIES 79,815

79,119 CASH FLOWS FROM INVESTING ACTIVITIES Capital expenditures

(including capitalized interest)(a ) (21,684) (33,081) Net sales

(purchases) of short-term investments 28,939 (830) Acquisitions,

net of cash acquired (522) (8,216) NET CASH PROVIDED BY (USED IN)

INVESTING ACTIVITIES 6,733 (42,127) CASH FLOWS FROM FINANCING

ACTIVITIES Repayments of debt (875) (200,000) New incentive

obligations 16,250 -- Repayment of incentive obligations (3,413)

(2,829) Stock issued in connection with employee benefit plans

2,615 1,008 NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES

14,577 (201,821) EFFECT OF EXCHANGE RATE CHANGES ON CASH (34) --

NET INCREASE (DECREASE)IN CASH AND CASH EQUIVALENTS 101,091

(164,829) CASH AND CASH EQUIVALENTS, beginning of period 511,248

783,998 CASH AND CASH EQUIVALENTS, end of period $612,339 $619,169

(a) Includes Capitalized Interest of $0.2 million and $4.9 million

for the quarter ended March 31, 2004 and 2003, respectively.

Selected Segment Data: Three Months Ended March 31, (in 000's) 2004

2003 FSS Revenue $189,427 $195,672 Operating profit before

depreciation and amortization(2) 44,224 146,671 Depreciation and

Amortization Expense 74,897 72,257 Income (loss) from operations

(30,673) 74,414 Capital Expenditures 21,684 33,081 G2 Revenue

21,816 9,631 Operating profit before depreciation and

amortization(2) 2,188 1,871 Depreciation and Amortization Expense

438 10 Income from operations 1,750 1,861 Capital Expenditures --

-- Eliminations Revenue (5,813) (5,547) Total Revenue 205,430

199,756 Operating profit before depreciation and amortization(2)

46,412 148,542 Depreciation and Amortization Expense 75,335 72,267

Income (loss) from operations (28,923) 76,275 Capital Expenditures

21,684 33,081 DATASOURCE: PanAmSat Corporation CONTACT: Kathryn

Lancioni, PanAmSat Corporation, +1-646-293-7415 Web site:

http://www.panamsat.com/

Copyright

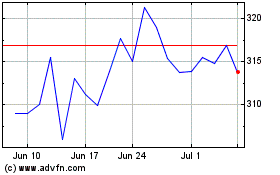

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

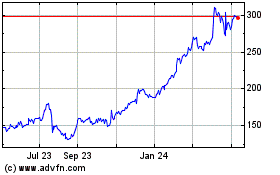

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024