Assa Abloy Completes $4.3 Billion Home-Improvement Buy

June 21 2023 - 3:40AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Assa Abloy said late Tuesday that it has completed

the $4.3 billion acquisition of Spectrum Brands' hardware and home

improvement division and the $800 million divestment of Emtek and

its smart residential business in the U.S. and Canada to Fortune

Brands Innovations.

The Swedish lock maker announced plans to buy HHI in September

2021 but the U.S. Department of Justice sued to block the deal,

saying it would diminish competition in the residential door

hardware industry and raise prices.

However, a deal was reached last month to settle the litigation,

with Assa Abloy agreeing to divestments in order clear the HHI

buy.

HHI reported sales of $1.65 billion in the fiscal year ending

September 2022, with an adjusted earnings before interest, taxes,

depreciation and amortization margin of 15.6%.

The acquisition is expected to be initially dilutive to the

group's operating margin and earnings per share, but operating

profit synergies are expected to reach around $100 million within a

five-year period, it said.

The Emtek and smart residential business in the U.S. and Canada

divested to Fortune Brands represented sales of about $400 million

in 2022.

Assa Abloy said the preliminary divestment result, net of exit

costs and before taxes, is estimated to be about $300 million.

In a separate announcement, the company said it will book a 2.2

billion Swedish kronor ($203.9 million) impairment of goodwill and

other intangible assets in the second quarter of 2023, primarily

related to its Citizen ID business.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

June 21, 2023 03:25 ET (07:25 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From Apr 2024 to May 2024

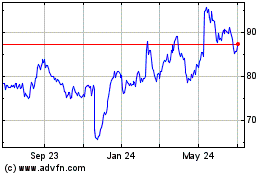

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From May 2023 to May 2024