false--04-01Q1000009089620230000090896us-gaap:OperatingSegmentsMembersky:USFactoryBuiltHousingMember2022-04-032022-07-020000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMembersky:ConsolidatedTotalNetLeverageRatioEqualToOrGreaterThanTwoPointTwoFiveToOneMemberus-gaap:BaseRateMember2023-05-182023-05-180000090896us-gaap:InsuranceClaimsMember2023-07-010000090896srt:MinimumMemberus-gaap:LandImprovementsMember2023-07-010000090896us-gaap:BuildingAndBuildingImprovementsMember2023-07-010000090896srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-07-010000090896us-gaap:RetainedEarningsMember2022-04-020000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-010000090896sky:USFactoryBuiltHousingMembersky:CommercialMember2022-04-032022-07-020000090896us-gaap:AdditionalPaidInCapitalMember2023-04-010000090896us-gaap:ConstructionInProgressMember2023-07-010000090896sky:USFactoryBuiltHousingMember2023-04-022023-07-010000090896sky:CommercialMember2022-04-032022-07-020000090896us-gaap:CommonStockMember2023-04-010000090896srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-07-010000090896us-gaap:RetainedEarningsMember2022-04-032022-07-020000090896sky:CorporateOtherMember2023-04-022023-07-010000090896country:US2023-04-022023-07-010000090896us-gaap:CollectibilityOfReceivablesMember2023-07-010000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMember2023-04-022023-07-010000090896us-gaap:ConstructionInProgressMember2023-04-010000090896us-gaap:CorporateNonSegmentMember2023-04-022023-07-010000090896us-gaap:IndemnificationGuaranteeMember2023-07-010000090896us-gaap:CorporateNonSegmentMember2023-07-010000090896sky:TransportationMember2022-04-032022-07-020000090896us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersky:CreditAgreementMembersky:ConsolidatedTotalNetLeverageIsBelowZeroPointFiveToOneMember2023-05-182023-05-180000090896sky:ConsolidatedTotalNetLeverageMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMembersky:CreditAgreementMember2023-05-182023-05-180000090896sky:CanadianFactoryBuiltHousingMember2023-04-022023-07-010000090896us-gaap:AdditionalPaidInCapitalMember2022-04-032022-07-020000090896sky:CorporateOtherMember2022-04-032022-07-020000090896sky:CanadianFactoryBuiltHousingMember2022-04-032022-07-020000090896us-gaap:LetterOfCreditMembersky:CreditAgreementMember2023-07-010000090896sky:IndustrialRevenueBondsMember2023-07-010000090896us-gaap:OperatingSegmentsMembersky:USFactoryBuiltHousingMember2023-04-010000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-032022-07-020000090896country:CA2023-04-022023-07-010000090896us-gaap:OperatingSegmentsMembersky:CanadianFactoryBuiltHousingMember2023-07-010000090896sky:ManufacturingAndRetailMembersky:USFactoryBuiltHousingMember2022-04-032022-07-0200000908962023-07-240000090896us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-04-010000090896us-gaap:OperatingSegmentsMembersky:USFactoryBuiltHousingMember2023-07-010000090896sky:ManufacturingAndRetailMembersky:CanadianFactoryBuiltHousingMember2022-04-032022-07-020000090896us-gaap:CommonStockMember2023-04-022023-07-0100000908962023-04-010000090896us-gaap:RetainedEarningsMember2023-04-022023-07-0100000908962023-07-010000090896us-gaap:CommonStockMember2023-07-010000090896sky:AltaCimaCorporationMember2022-07-310000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-010000090896sky:TransportationMembersky:CorporateOtherMember2023-04-022023-07-010000090896us-gaap:BuildingAndBuildingImprovementsMember2023-04-010000090896us-gaap:MaterialReconcilingItemsMember2023-04-010000090896sky:ManufacturingAndRetailMembersky:USFactoryBuiltHousingMember2023-04-022023-07-010000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMember2021-07-070000090896us-gaap:OperatingSegmentsMembersky:CanadianFactoryBuiltHousingMember2023-04-010000090896sky:ManufacturingAndRetailMember2023-04-022023-07-010000090896us-gaap:StandbyLettersOfCreditMember2023-07-010000090896sky:ManufacturingAndRetailMember2022-04-032022-07-020000090896us-gaap:RetainedEarningsMember2023-07-010000090896us-gaap:AdditionalPaidInCapitalMember2022-07-020000090896us-gaap:TradeNamesMember2023-04-010000090896sky:TransportationMember2023-04-022023-07-010000090896us-gaap:TradeNamesMember2023-07-010000090896us-gaap:CommonStockMember2022-04-020000090896us-gaap:MaterialReconcilingItemsMember2023-07-010000090896us-gaap:CustomerRelationshipsMember2023-07-010000090896us-gaap:MaterialReconcilingItemsMember2022-04-032022-07-020000090896us-gaap:MaterialReconcilingItemsMember2023-04-022023-07-010000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-020000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-020000090896sky:TransportationMembersky:CorporateOtherMember2022-04-032022-07-020000090896us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersky:CreditAgreementMembersky:ConsolidatedTotalNetLeverageRatioEqualToOrGreaterThanTwoPointTwoFiveToOneMember2023-05-182023-05-1800000908962022-04-020000090896srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-07-010000090896us-gaap:MachineryAndEquipmentMember2023-04-010000090896us-gaap:LandImprovementsMember2023-07-010000090896sky:IndustrialRevenueBondsMember2023-04-022023-07-010000090896us-gaap:CorporateNonSegmentMember2023-04-010000090896country:US2023-07-010000090896us-gaap:CustomerRelationshipsMember2023-04-010000090896us-gaap:CommonStockMember2022-07-020000090896us-gaap:VehiclesMembersrt:MinimumMember2023-07-010000090896us-gaap:OperatingSegmentsMembersky:CanadianFactoryBuiltHousingMember2023-04-022023-07-010000090896sky:IndustrialRevenueBondsMember2023-04-010000090896us-gaap:AdditionalPaidInCapitalMember2022-04-020000090896us-gaap:OperatingSegmentsMembersky:CanadianFactoryBuiltHousingMember2022-04-032022-07-020000090896us-gaap:AdditionalPaidInCapitalMember2023-07-010000090896us-gaap:CommonStockMember2022-04-032022-07-020000090896us-gaap:RetainedEarningsMember2022-07-020000090896us-gaap:LetterOfCreditMembersky:CreditAgreementMember2021-07-070000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMember2023-05-1800000908962022-07-020000090896sky:ConsolidatedTotalNetLeverageMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMembersky:CreditAgreementMember2023-05-182023-05-180000090896sky:ManufacturingAndRetailMembersky:CanadianFactoryBuiltHousingMember2023-04-022023-07-010000090896sky:RevolvingCreditFacilityMaturingInTwoThousandTwentySixMember2023-07-010000090896us-gaap:CorporateNonSegmentMember2022-04-032022-07-020000090896srt:MaximumMemberus-gaap:LandImprovementsMember2023-07-010000090896us-gaap:LandImprovementsMember2023-04-010000090896us-gaap:AdditionalPaidInCapitalMember2023-04-022023-07-010000090896us-gaap:MachineryAndEquipmentMember2023-07-010000090896sky:RevolvingCreditFacilityMaturingInTwoThousandTwentySixMember2023-04-010000090896sky:USFactoryBuiltHousingMember2022-04-032022-07-0200000908962023-04-022023-07-010000090896us-gaap:SuretyBondMember2023-07-010000090896us-gaap:RetainedEarningsMember2023-04-010000090896us-gaap:AccountingStandardsUpdate201613Membersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-07-010000090896us-gaap:OperatingSegmentsMembersky:USFactoryBuiltHousingMember2023-04-022023-07-010000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMembersky:ConsolidatedTotalNetLeverageIsBelowZeroPointFiveToOneMemberus-gaap:BaseRateMember2023-05-182023-05-1800000908962022-04-032022-07-020000090896us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-022023-07-010000090896us-gaap:RevolvingCreditFacilityMembersky:CreditAgreementMember2021-07-03xbrli:puresky:Centeriso4217:USDxbrli:sharessky:Facilityxbrli:sharessky:Segmentiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended July 1, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-04714

Skyline Champion Corporation

(Exact name of registrant as specified in its charter)

|

|

|

Indiana |

|

35-1038277 |

(State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

755 West Big Beaver Road, Suite 1000 |

|

|

Troy, Michigan |

|

48084 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

SKY |

|

New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filers,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:):

|

|

|

|

|

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of common stock outstanding as of July 24, 2023: 57,133,392

SKYLINE CHAMPION CORPORATION

FORM 10-Q

TABLE OF CONTENTS

|

|

PART I – FINANCIAL INFORMATION |

|

|

|

Item 1. Financial Statements |

|

Condensed Consolidated Balance Sheets as of July 1, 2023 (unaudited) and April 1, 2023 |

1 |

Condensed Consolidated Income Statements (unaudited) for the three months ended July 1, 2023 and July 2, 2022 |

2 |

Condensed Consolidated Statements of Comprehensive Income (unaudited) for the three months ended July 1, 2023 and July 2, 2022 |

3 |

Condensed Consolidated Statements of Cash Flows (unaudited) for the three months ended July 1, 2023 and July 2, 2022 |

4 |

Condensed Consolidated Statements of Stockholders’ Equity (unaudited) for the three months ended July 1, 2023 and July 2, 2022 |

5 |

Notes to Condensed Consolidated Financial Statements |

6 |

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

14 |

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk |

21 |

|

|

Item 4. Controls and Procedures |

22 |

|

|

PART II – OTHER INFORMATION |

|

|

|

Item 1. Legal Proceedings |

23 |

|

|

Item 6. Exhibits |

24 |

|

|

SIGNATURES |

25 |

i

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

Skyline Champion Corporation

Condensed Consolidated Balance Sheets

(Dollars and shares in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

July 1,

2023 |

|

|

April 1,

2023 |

|

|

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

797,717 |

|

|

$ |

747,453 |

|

Trade accounts receivable, net |

|

|

50,678 |

|

|

|

67,296 |

|

Inventories, net |

|

|

196,510 |

|

|

|

202,238 |

|

Other current assets |

|

|

34,123 |

|

|

|

26,479 |

|

Total current assets |

|

|

1,079,028 |

|

|

|

1,043,466 |

|

Long-term assets: |

|

|

|

|

|

|

Property, plant, and equipment, net |

|

|

184,259 |

|

|

|

177,125 |

|

Goodwill |

|

|

196,574 |

|

|

|

196,574 |

|

Amortizable intangible assets, net |

|

|

42,383 |

|

|

|

45,343 |

|

Deferred tax assets |

|

|

18,746 |

|

|

|

17,422 |

|

Other noncurrent assets |

|

|

96,669 |

|

|

|

82,794 |

|

Total assets |

|

$ |

1,617,659 |

|

|

$ |

1,562,724 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

47,218 |

|

|

$ |

44,702 |

|

Other current liabilities |

|

|

198,726 |

|

|

|

204,215 |

|

Total current liabilities |

|

|

245,944 |

|

|

|

248,917 |

|

Long-term liabilities: |

|

|

|

|

|

|

Long-term debt |

|

|

12,430 |

|

|

|

12,430 |

|

Deferred tax liabilities |

|

|

6,305 |

|

|

|

5,964 |

|

Other liabilities |

|

|

62,059 |

|

|

|

62,412 |

|

Total long-term liabilities |

|

|

80,794 |

|

|

|

80,806 |

|

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

|

|

Common stock, $0.0277 par value, 115,000 shares authorized, 57,133 and 57,108 shares issued as of July 1, 2023 and April 1, 2023, respectively |

|

|

1,586 |

|

|

|

1,585 |

|

Additional paid-in capital |

|

|

524,907 |

|

|

|

519,479 |

|

Retained earnings |

|

|

775,980 |

|

|

|

725,672 |

|

Accumulated other comprehensive loss |

|

|

(11,552 |

) |

|

|

(13,735 |

) |

Total stockholders’ equity |

|

|

1,290,921 |

|

|

|

1,233,001 |

|

Total liabilities and stockholders’ equity |

|

$ |

1,617,659 |

|

|

$ |

1,562,724 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

1

Skyline Champion Corporation

Condensed Consolidated Income Statements

(Unaudited, dollars in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Net sales |

|

$ |

464,769 |

|

|

$ |

725,881 |

|

Cost of sales |

|

|

335,096 |

|

|

|

496,546 |

|

Gross profit |

|

|

129,673 |

|

|

|

229,335 |

|

Selling, general, and administrative expenses |

|

|

70,439 |

|

|

|

72,282 |

|

Operating income |

|

|

59,234 |

|

|

|

157,053 |

|

Interest (income) expense, net |

|

|

(9,301 |

) |

|

|

90 |

|

Other (income) |

|

|

— |

|

|

|

(634 |

) |

Income before income taxes |

|

|

68,535 |

|

|

|

157,597 |

|

Income tax expense |

|

|

17,266 |

|

|

|

40,446 |

|

Net income |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

Net income per share: |

|

|

|

|

|

|

Basic |

|

$ |

0.90 |

|

|

$ |

2.06 |

|

Diluted |

|

$ |

0.89 |

|

|

$ |

2.04 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

2

Skyline Champion Corporation

Condensed Consolidated Statements of Comprehensive Income

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Net income |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

2,183 |

|

|

|

(2,304 |

) |

Total comprehensive income |

|

$ |

53,452 |

|

|

$ |

114,847 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

3

Skyline Champion Corporation

Condensed Consolidated Statements of Cash Flows

(Unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Cash flows from operating activities |

|

|

|

|

|

|

Net income |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

7,592 |

|

|

|

5,616 |

|

Amortization of deferred financing fees |

|

|

69 |

|

|

|

95 |

|

Equity-based compensation |

|

|

5,428 |

|

|

|

3,960 |

|

Deferred taxes |

|

|

(997 |

) |

|

|

1,685 |

|

Loss on disposal of property, plant, and equipment |

|

|

1 |

|

|

|

6 |

|

Foreign currency transaction (gain) loss |

|

|

(207 |

) |

|

|

351 |

|

Change in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

16,676 |

|

|

|

(38,141 |

) |

Inventories |

|

|

6,173 |

|

|

|

(48,855 |

) |

Other assets |

|

|

(6,974 |

) |

|

|

(11,084 |

) |

Accounts payable |

|

|

1,375 |

|

|

|

(15,931 |

) |

Accrued expenses and other liabilities |

|

|

(5,548 |

) |

|

|

32,569 |

|

Net cash provided by operating activities |

|

|

74,857 |

|

|

|

47,422 |

|

Cash flows from investing activities |

|

|

|

|

|

|

Additions to property, plant, and equipment |

|

|

(10,341 |

) |

|

|

(9,435 |

) |

Investment in floor plan loans |

|

|

(18,466 |

) |

|

|

— |

|

Proceeds from floor plan loans |

|

|

3,184 |

|

|

|

— |

|

Acquisitions, net of cash acquired |

|

|

— |

|

|

|

(9,553 |

) |

Proceeds from disposal of property, plant, and equipment |

|

|

8 |

|

|

|

17 |

|

Net cash used in investing activities |

|

|

(25,615 |

) |

|

|

(18,971 |

) |

Cash flows from financing activities |

|

|

|

|

|

|

Changes in floor plan financing, net |

|

|

— |

|

|

|

2,398 |

|

Stock option exercises |

|

|

— |

|

|

|

9 |

|

Tax payments for equity-based compensation |

|

|

(961 |

) |

|

|

(351 |

) |

Net cash (used in) provided by financing activities |

|

|

(961 |

) |

|

|

2,056 |

|

Effect of exchange rate changes on cash and cash equivalents |

|

|

1,983 |

|

|

|

(2,142 |

) |

Net increase in cash and cash equivalents |

|

|

50,264 |

|

|

|

28,365 |

|

Cash and cash equivalents at beginning of period |

|

|

747,453 |

|

|

|

435,413 |

|

Cash and cash equivalents at end of period |

|

$ |

797,717 |

|

|

$ |

463,778 |

|

See accompanying Notes to Condensed Consolidated Financial Statements.

4

Skyline Champion Corporation

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited, dollars and shares in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 1, 2023 |

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional

Paid in

Capital |

|

|

Retained

Earnings |

|

|

Accumulated

Other

Comprehensive

Loss |

|

|

Total |

|

Balance at April 1, 2023 |

|

|

57,108 |

|

|

$ |

1,585 |

|

|

$ |

519,479 |

|

|

$ |

725,672 |

|

|

$ |

(13,735 |

) |

|

$ |

1,233,001 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

51,269 |

|

|

|

— |

|

|

|

51,269 |

|

Equity-based compensation |

|

|

— |

|

|

|

— |

|

|

|

5,428 |

|

|

|

— |

|

|

|

— |

|

|

|

5,428 |

|

Net common stock issued under equity-based compensation plans |

|

|

25 |

|

|

|

1 |

|

|

|

— |

|

|

|

(961 |

) |

|

|

— |

|

|

|

(960 |

) |

Foreign currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,183 |

|

|

|

2,183 |

|

Balance at July 1, 2023 |

|

|

57,133 |

|

|

$ |

1,586 |

|

|

$ |

524,907 |

|

|

$ |

775,980 |

|

|

$ |

(11,552 |

) |

|

$ |

1,290,921 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 2, 2022 |

|

|

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Additional

Paid in

Capital |

|

|

Retained

Earnings |

|

|

Accumulated

Other

Comprehensive

Loss |

|

|

Total |

|

Balance at April 2, 2022 |

|

|

56,838 |

|

|

$ |

1,573 |

|

|

$ |

502,846 |

|

|

$ |

327,902 |

|

|

$ |

(7,208 |

) |

|

$ |

825,113 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

117,151 |

|

|

|

— |

|

|

|

117,151 |

|

Equity-based compensation |

|

|

— |

|

|

|

— |

|

|

|

3,960 |

|

|

|

— |

|

|

|

— |

|

|

|

3,960 |

|

Net common stock issued under equity-based compensation plans |

|

|

10 |

|

|

|

— |

|

|

|

9 |

|

|

|

(351 |

) |

|

|

— |

|

|

|

(342 |

) |

Foreign currency translation adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,304 |

) |

|

|

(2,304 |

) |

Balance at July 2, 2022 |

|

|

56,848 |

|

|

$ |

1,573 |

|

|

$ |

506,815 |

|

|

$ |

444,702 |

|

|

$ |

(9,512 |

) |

|

$ |

943,578 |

|

Components of accumulated other comprehensive loss consisted solely of foreign currency translation adjustments.

See accompanying Notes to Condensed Consolidated Financial Statements.

5

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements

1. Basis of Presentation and Business

Nature of Operations: Skyline Champion Corporation's (the “Company”) operations consist of manufacturing, retail, construction services, and transportation activities. At July 1, 2023, the Company operated 39 manufacturing facilities throughout the United States (“U.S.”) and five manufacturing facilities in western Canada that primarily construct factory-built, timber-framed manufactured and modular houses that are sold primarily to independent retailers, builders/developers, and manufactured home community operators. In addition to its core home building business, the Company provides construction services to install and set-up factory-built homes. The Company’s retail operations consist of 31 sales centers that sell manufactured houses to consumers across the U.S. The Company’s transportation business engages independent owners/drivers to transport recreational vehicles throughout the U.S. and Canada and manufactured houses in certain regions of the U.S. The Company also has a holding company located in the Netherlands.

Basis of Presentation: The accompanying unaudited condensed consolidated financial statements of the Company have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) for Quarterly Reports on Form 10-Q and Article 10 of SEC Regulation S-X. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with United States Generally Accepted Accounting Principles (“U.S. GAAP”) have been condensed or omitted pursuant to such rules and regulations.

The condensed consolidated financial statements include the accounts of the Company and its majority-owned subsidiaries after elimination of intercompany balances and transactions. In the opinion of management, these statements include all normal recurring adjustments necessary to fairly state the Company’s consolidated results of operations, cash flows, and financial position. The Company has evaluated subsequent events after the balance sheet date through the date of the filing of this report with the SEC. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes to the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K, which was filed with the SEC on May 30, 2023 (the “Fiscal 2023 Annual Report”).

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and the accompanying notes thereto. Actual results could differ from those estimates. The condensed consolidated income statements, condensed consolidated statements of comprehensive income, and condensed consolidated statements of cash flows for the interim periods are not necessarily indicative of the results of operations or cash flows for the full year.

The Company’s fiscal year is a 52- or 53-week period that ends on the Saturday nearest to March 31. The Company’s current fiscal year, “fiscal 2024,” will end on March 30, 2024 and will include 52 weeks. References to “fiscal 2023” refer to the Company’s fiscal year ended April 1, 2023. The three months ended July 1, 2023 and July 2, 2022 each included 13 weeks.

The Company’s allowance for credit losses on financial assets measured at amortized cost reflects management’s estimate of credit losses over the remaining expected life of such assets, measured primarily using historical experience, as well as current economic conditions and forecasts that affect the collectability of the reported amount. Expected credit losses for newly recognized financial assets, as well as changes to expected credit losses during the period, are recognized in earnings. Accounts receivable are reflected net of reserves of $2.8 million and $1.7 million at July 1, 2023 and April 1, 2023, respectively.

Floor plan receivables consist of $18.5 million of loans the Company purchased from an independent financial institution in the first quarter of fiscal 2024, which the Company intends to hold until maturity or payoff, and amounts loaned by the Company through the independent financial institution to certain independent retailers for purchases of homes manufactured and sold by the Company, both of which are carried net of payments received and recorded at amortized cost. These loans are serviced by the financial institution for which we pay a servicing fee. Upon execution of the financing arrangement, the loans are generally payable at the earlier of the sale of the underlying home or two years from the origination date. At July 1, 2023, Floor Plan Receivables are included in Other Current Assets and Other Noncurrent Assets in the Condensed Consolidated Balance Sheets.

The floor plan receivables are collateralized by the related homes, mitigating loss exposure. The Company and the financial institution evaluate the credit worthiness of each independent retailer prior to credit approval, including reviewing the independent retailer’s payment history, financial condition, and overall economic environment. We evaluate the risk of credit loss in aggregate on existing loans with similar terms, based on historic experience and current economic conditions, as well as individual retailers with past due balances or other indications of heightened credit risk. The allowance for credit losses related to floor plan receivables was not material as of July 1, 2023. Loans are considered past due if any required interest or curtailment payment remains unpaid 30 days after the due date. Receivables are placed on non-performing status if any interest or installment payments are past due over 90 days. Loans are placed on nonaccrual status when interest payments are past due over 90 days. At July 1, 2023, there were no floor plan receivables on nonaccrual status and the weighted-average age of the floor plan receivables was nine months.

6

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

Interest income from floor plan receivables is recognized on an accrual basis and is included in Interest Income in the accompanying Condensed Consolidated Income Statements. Interest income for the three months ended July 1, 2023 was $0.3 million. There were no floor plan receivables as of July 2, 2022 or interest income for the three months then ended.

In May 2022, the Company acquired certain operating assets from Manis Custom Builders, Inc. ("Manis"). In July 2022, the Company acquired 12 Factory Expo retail sales centers from Alta Cima Corporation. The purchase price and net assets acquired for both transactions were not material to the accompanying condensed consolidated financial statements.

There were no accounting standards recently issued that are expected to have a material impact on the Company’s financial position or results of operations.

2. Inventories, net

The components of inventory, net of reserves for obsolete inventory, were as follows:

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

April 1,

2023 |

|

Raw materials |

|

$ |

95,137 |

|

|

$ |

100,379 |

|

Work in process |

|

|

24,715 |

|

|

|

23,157 |

|

Finished goods and other |

|

|

76,658 |

|

|

|

78,702 |

|

Total inventories, net |

|

$ |

196,510 |

|

|

$ |

202,238 |

|

At July 1, 2023 and April 1, 2023, reserves for obsolete inventory were $9.1 million and $7.9 million, respectively.

3. Property, Plant, and Equipment

Property, plant, and equipment are stated at cost. Depreciation is calculated primarily on a straight-line basis, generally over the following estimated useful lives: land improvements – 3 to 10 years; buildings and improvements – 8 to 25 years; and vehicles and machinery and equipment – 3 to 8 years. Depreciation expense for the three months ended July 1, 2023 and July 2, 2022 was $4.6 million and $3.7 million, respectively.

The components of property, plant, and equipment were as follows:

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

April 1,

2023 |

|

Land and improvements |

|

$ |

42,079 |

|

|

$ |

41,749 |

|

Buildings and improvements |

|

|

123,799 |

|

|

|

119,226 |

|

Machinery and equipment |

|

|

96,094 |

|

|

|

91,007 |

|

Construction in progress |

|

|

31,896 |

|

|

|

30,010 |

|

Property, plant, and equipment, at cost |

|

|

293,868 |

|

|

|

281,992 |

|

Less: accumulated depreciation |

|

|

(109,609 |

) |

|

|

(104,867 |

) |

Property, plant, and equipment, net |

|

$ |

184,259 |

|

|

$ |

177,125 |

|

7

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

4. Goodwill, Intangible Assets, and Cloud Computing Arrangements

Goodwill

Goodwill represents the excess of the cost of an acquired business over the fair value of the identifiable tangible and intangible assets acquired and liabilities assumed in a business combination. At both July 1, 2023 and April 1, 2023, the Company had goodwill of $196.6 million. At July 1, 2023, there were no accumulated impairment losses related to goodwill.

Intangible Assets

The components of amortizable intangible assets were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1, 2023 |

|

|

April 1, 2023 |

|

|

|

Customer

Relationships

& Other |

|

|

Trade

Names |

|

|

Total |

|

|

Customer

Relationships

& Other |

|

|

Trade

Names |

|

|

Total |

|

Gross carrying amount |

|

$ |

66,129 |

|

|

$ |

21,543 |

|

|

$ |

87,672 |

|

|

$ |

66,013 |

|

|

$ |

21,497 |

|

|

$ |

87,510 |

|

Accumulated amortization |

|

|

(34,702 |

) |

|

|

(10,587 |

) |

|

|

(45,289 |

) |

|

|

(32,103 |

) |

|

|

(10,064 |

) |

|

|

(42,167 |

) |

Amortizable intangibles, net |

|

$ |

31,427 |

|

|

$ |

10,956 |

|

|

$ |

42,383 |

|

|

$ |

33,910 |

|

|

$ |

11,433 |

|

|

$ |

45,343 |

|

During the three months ended July 1, 2023 and July 2, 2022, amortization of intangible assets was $3.0 million and $1.9 million, respectively.

Cloud Computing Arrangements

The Company capitalizes costs associated with the development of cloud computing arrangements in a manner consistent with internally developed software. At July 1, 2023 and April 1, 2023, the Company had capitalized cloud computing costs, net of amortization of $24.9 million and $25.0 million, respectively. Cloud computing costs are included in other noncurrent assets in the accompanying condensed consolidated balance sheets. Amortization of capitalized cloud computing costs for both the three months ended July 1, 2023 and July 2, 2022 was $0.2 million.

5. Other Current Liabilities

The components of other current liabilities were as follows:

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

April 1,

2023 |

|

Customer deposits |

|

$ |

64,768 |

|

|

$ |

69,285 |

|

Accrued volume rebates |

|

|

25,080 |

|

|

|

25,084 |

|

Accrued warranty obligations |

|

|

27,705 |

|

|

|

28,576 |

|

Accrued compensation and payroll taxes |

|

|

31,172 |

|

|

|

41,422 |

|

Accrued insurance |

|

|

15,973 |

|

|

|

15,075 |

|

Other |

|

|

34,028 |

|

|

|

24,773 |

|

Total other current liabilities |

|

$ |

198,726 |

|

|

$ |

204,215 |

|

8

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

6. Accrued Warranty Obligations

Changes in the accrued warranty obligations were as follows:

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Balance at beginning of period |

|

$ |

35,961 |

|

|

$ |

32,832 |

|

Warranty expense |

|

|

12,856 |

|

|

|

11,921 |

|

Cash warranty payments |

|

|

(13,727 |

) |

|

|

(11,598 |

) |

Balance at end of period |

|

|

35,090 |

|

|

|

33,155 |

|

Less: noncurrent portion in other long-term liabilities |

|

|

(7,385 |

) |

|

|

(7,026 |

) |

Total current portion |

|

$ |

27,705 |

|

|

$ |

26,129 |

|

7. Debt

Long-term debt consisted of the following:

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

April 1,

2023 |

|

Obligations under industrial revenue bonds due 2029 |

|

$ |

12,430 |

|

|

$ |

12,430 |

|

Revolving credit facility maturing in 2026 |

|

|

— |

|

|

|

— |

|

Total long-term debt |

|

$ |

12,430 |

|

|

$ |

12,430 |

|

On July 7, 2021, the Company entered into an Amended and Restated Credit Agreement with a syndicate of banks that provides for a revolving credit facility of up to $200.0 million, including a $45.0 million letter of credit sub-facility ("Amended Credit Agreement"). The Amended Credit Agreement replaced the Company's previously existing $100.0 million revolving credit facility. The Amended Credit Agreement allows the Company to draw down, repay and re-draw loans on the available facility during the term, subject to certain terms and conditions, matures in July 2026, and has no scheduled amortization.

On May 18, 2023, the Company further amended the Amended Credit Agreement, which removed references to the London Interbank Offer Rate ("LIBOR") and clarified language pertaining to the Secured Overnight Financing Rate ("SOFR") in regards to the interest rate on borrowings. The interest rate on borrowings under the Amended Credit Agreement is based on SOFR plus a SOFR adjustment, plus an interest rate spread. The interest rate spread adjusts based on the consolidated total net leverage of the Company from a high of 1.875% when the consolidated total net leverage ratio is equal to or greater than 2.25:1.00, to a low of 1.125% when the consolidated total net leverage ratio is below 0.50:1.00. Alternatively for same day borrowings, the interest rate is based on an Alternative Base Rate ("ABR") plus an interest rate spread that ranges from a high of 0.875% to a low of 0.125% based on the consolidated total net leverage ratio. In addition, the Company is obligated to pay an unused line fee ranging between 0.15% and 0.3% depending on the consolidated total net leverage ratio, in respect of unused commitments under the Amended Credit Agreement. At July 1, 2023 the interest rate under the Amended Credit Agreement was 6.36% and letters of credit issued under the Amended Credit Agreement totaled $34.0 million. Available borrowing capacity under the Amended Credit Agreement as of July 1, 2023 was $166.0 million.

Obligations under industrial revenue bonds are supported by letters of credit and bear interest based on a municipal bond index rate. The weighted-average interest rate at July 1, 2023, including related costs and fees, was 5.61%. The industrial revenue bonds require lump-sum payments of principal upon maturity in 2029 and are secured by the assets of certain manufacturing facilities.

9

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

The Amended Credit Agreement contains covenants that restrict the amount of additional debt, liens and certain payments, including equity buybacks, investments, dispositions, mergers and consolidations, among other restrictions as defined. The Company was in compliance with all covenants of the Amended Credit Agreement as of July 1, 2023.

8. Revenue Recognition

The following tables disaggregate the Company’s revenue by sales category:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 1, 2023 |

|

(Dollars in thousands) |

|

U.S.

Factory-Built

Housing |

|

|

Canadian

Factory-Built

Housing |

|

|

Corporate/

Other |

|

|

Total |

|

Manufacturing and retail |

|

$ |

428,785 |

|

|

$ |

26,120 |

|

|

$ |

— |

|

|

$ |

454,905 |

|

Transportation |

|

|

— |

|

|

|

— |

|

|

|

9,864 |

|

|

|

9,864 |

|

Total |

|

$ |

428,785 |

|

|

$ |

26,120 |

|

|

$ |

9,864 |

|

|

$ |

464,769 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 2, 2022 |

|

(Dollars in thousands) |

|

U.S.

Factory-Built

Housing |

|

|

Canadian

Factory-Built

Housing |

|

|

Corporate/

Other |

|

|

Total |

|

Manufacturing and retail |

|

$ |

660,811 |

|

|

$ |

45,062 |

|

|

$ |

— |

|

|

$ |

705,873 |

|

Commercial |

|

|

270 |

|

|

|

— |

|

|

|

— |

|

|

|

270 |

|

Transportation |

|

|

— |

|

|

|

— |

|

|

|

19,738 |

|

|

|

19,738 |

|

Total |

|

$ |

661,081 |

|

|

$ |

45,062 |

|

|

$ |

19,738 |

|

|

$ |

725,881 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Income Taxes

For the three months ended July 1, 2023 and July 2, 2022, the Company recorded $17.3 million and $40.4 million of income tax expense and had an effective tax rate of 25.2% and 25.7%, respectively.

The Company’s effective tax rate for the three months ended July 1, 2023 differs from the federal statutory income tax rate of 21.0% due primarily to the effect of state and local income taxes, non-deductible expenses, tax credits, and results in foreign jurisdictions. The Company’s effective tax rate for the three months ended July 2, 2022 differs from the federal statutory income tax rate of 21.0% due primarily to the effect of state and local income taxes, non-deductible expenses, tax credits, and results in foreign jurisdictions.

At July 1, 2023, the Company had no unrecognized tax benefits.

10. Earnings Per Share

Basic net income per share attributable to the Company was computed by dividing net income attributable to the Company by the average number of common shares outstanding during the period. Diluted earnings per share is calculated using our weighted-average outstanding common shares, including the dilutive effect of stock awards as determined under the treasury stock method.

10

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

The following table sets forth the computation of basic and diluted earnings per common share:

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

(Dollars and shares in thousands, except per share data) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Numerator: |

|

|

|

|

|

|

Net income attributable to the Company's common shareholders |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

Denominator: |

|

|

|

|

|

|

Basic weighted-average shares outstanding |

|

|

57,183 |

|

|

|

56,910 |

|

Dilutive securities |

|

|

475 |

|

|

|

387 |

|

Diluted weighted-average shares outstanding |

|

|

57,658 |

|

|

|

57,297 |

|

|

|

|

|

|

|

|

Basic net income per share |

|

$ |

0.90 |

|

|

$ |

2.06 |

|

Diluted net income per share |

|

$ |

0.89 |

|

|

$ |

2.04 |

|

11. Segment Information

Financial results for the Company's reportable segments have been prepared using a management approach, which is consistent with the basis and manner in which financial information is evaluated by the Company's chief operating decision maker in allocating resources and in assessing performance. The Company’s chief operating decision maker, the Chief Executive Officer, evaluates the performance of the Company’s segments primarily based on net sales, before elimination of inter-company shipments, earnings before interest, taxes, depreciation, and amortization (“EBITDA”) and operating assets.

The Company operates in two reportable segments: (i) U.S. Factory-built Housing, which includes manufacturing and retail housing operations and (ii) Canadian Factory-built Housing. Corporate/Other includes the Company’s transportation operations, corporate costs directly incurred for all segments and intersegment eliminations. Segments are generally determined by geography. Segment data includes intersegment revenues and corporate office costs that are directly and exclusively incurred for each segment. Total assets for Corporate/Other primarily include cash and certain U.S. deferred tax items not specifically allocated to another segment.

11

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

Selected financial information by reportable segment was as follows:

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Net sales: |

|

|

|

|

|

|

U.S. Factory-built Housing |

|

$ |

428,785 |

|

|

$ |

661,081 |

|

Canadian Factory-built Housing |

|

|

26,120 |

|

|

|

45,062 |

|

Corporate/Other |

|

|

9,864 |

|

|

|

19,738 |

|

Consolidated net sales |

|

$ |

464,769 |

|

|

$ |

725,881 |

|

Operating income: |

|

|

|

|

|

|

U.S. Factory-built Housing EBITDA |

|

$ |

74,233 |

|

|

$ |

161,565 |

|

Canadian Factory-built Housing EBITDA |

|

|

4,764 |

|

|

|

11,327 |

|

Corporate/Other EBITDA |

|

|

(12,171 |

) |

|

|

(9,589 |

) |

Other (income) |

|

|

— |

|

|

|

(634 |

) |

Depreciation |

|

|

(4,633 |

) |

|

|

(3,670 |

) |

Amortization |

|

|

(2,959 |

) |

|

|

(1,946 |

) |

Consolidated operating income |

|

$ |

59,234 |

|

|

$ |

157,053 |

|

Depreciation: |

|

|

|

|

|

|

U.S. Factory-built Housing |

|

$ |

4,128 |

|

|

$ |

3,037 |

|

Canadian Factory-built Housing |

|

|

356 |

|

|

|

281 |

|

Corporate/Other |

|

|

149 |

|

|

|

352 |

|

Consolidated depreciation |

|

$ |

4,633 |

|

|

$ |

3,670 |

|

Amortization of U.S. Factory-built Housing intangible assets: |

|

$ |

2,959 |

|

|

$ |

1,946 |

|

Capital expenditures: |

|

|

|

|

|

|

U.S. Factory-built Housing |

|

$ |

9,678 |

|

|

$ |

8,933 |

|

Canadian Factory-built Housing |

|

|

466 |

|

|

|

361 |

|

Corporate/Other |

|

|

197 |

|

|

|

141 |

|

Consolidated capital expenditures |

|

$ |

10,341 |

|

|

$ |

9,435 |

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

April 1,

2023 |

|

Total Assets: |

|

|

|

|

|

|

U.S. Factory-built Housing (1) |

|

$ |

691,008 |

|

|

$ |

708,573 |

|

Canadian Factory-built Housing (1) |

|

|

129,233 |

|

|

|

124,673 |

|

Corporate/Other (1) |

|

|

797,418 |

|

|

|

729,478 |

|

Consolidated total assets |

|

$ |

1,617,659 |

|

|

$ |

1,562,724 |

|

(1)Deferred tax assets for the Canadian operations are reflected in the Canadian Factory-built Housing segment. U.S. deferred tax assets are presented in Corporate/Other because an allocation between segments is not practicable.

12. Commitments, Contingencies, and Legal Proceedings

Repurchase Contingencies and Guarantees

The Company is contingently liable under terms of repurchase agreements with lending institutions that provide wholesale floor plan financing to retailers. These arrangements, which are customary in the manufactured housing industry, provide for the repurchase of products sold to retailers in the event of default by the retailer on its agreement to pay the financial institution. The risk of loss from these agreements is significantly reduced by the potential resale value of any products that are subject to repurchase and is spread over numerous retailers. The repurchase price is generally determined by the original sales price of the product less contractually defined curtailment payments. Based on these repurchase agreements and our historical loss experience, we established an associated loss reserve which was $2.2 million and $2.5 million at July 1, 2023 and April 1, 2023, respectively. Excluding the resale value of the homes, the contingent repurchase obligation as of July 1, 2023 was estimated to be $333.7 million. Losses incurred on homes repurchased were immaterial during the three months ended July 1, 2023 and July 2, 2022.

12

Skyline Champion Corporation

Notes to Condensed Consolidated Financial Statements - Continued

At July 1, 2023, the Company was contingently obligated for $34.0 million under letters of credit, consisting of $12.6 million to support long-term debt, $21.1 million to support the casualty insurance program, and $0.3 million to support bonding agreements. The letters of credit are issued from a sub-facility of the Amended Credit Agreement. The Company was also contingently obligated for $31.2 million under surety bonds, generally to support performance on long-term construction contracts and license and service bonding requirements.

The Company has received claims for damage related to water intrusion in homes built in one of its manufacturing facilities. The Company is investigating the cause of the damage and assessing its responsibility to remediate. While it is reasonably possible that the Company will receive future claims that could result in additional costs to repair that could be significant in the aggregate, the Company is unable to estimate the number of such claims or the amount or range of any potential losses associated with such claims at this time.

In the normal course of business, the Company’s former subsidiaries that operated in the United Kingdom historically provided certain guarantees to two customers. Those guarantees provide contractual liability for proven construction defects up to 12 years from the date of delivery of certain products. The guarantees remain a contingent liability of the Company which declines over time through October 2027. As of the date of this report, the Company expects few, if any, claims to be reported under the terms of the guarantees.

Legal Proceedings

The Company has agreed to indemnify counterparties in the ordinary course of its business in agreements to acquire and sell business assets and in financing arrangements. The Company is subject to various legal proceedings and claims that arise in the ordinary course of its business. As of the date of this filing, the Company believes the ultimate liability with respect to these contingent obligations will not have, either individually or in the aggregate, a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

13

Item 2. MANAGEMENT’ S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following should be read in conjunction with Skyline Champion Corporation’s condensed consolidated financial statements and the related notes that appear in Item 1 of this Report.

Overview

Skyline Champion Corporation (the “Company”) is a leading producer of factory-built housing in the U.S. and Canada. The Company serves as a complete solutions provider across complementary and vertically integrated businesses including manufactured construction, company-owned retail locations, construction services, and transportation logistics services. The Company markets its homes under several nationally recognized brand names including Skyline Homes, Champion Home Builders, Genesis Homes, Athens Park Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit, New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest, and Titan Homes in the U.S., and Moduline and SRI Homes in western Canada. The Company operates 39 manufacturing facilities throughout the U.S. and five manufacturing facilities in western Canada that primarily construct factory-built, timber-framed, manufactured and modular houses that are sold primarily to independent retailers, builders/developers, and manufactured home community operators. The Company’s retail operations consist of 31 sales centers that sell manufactured homes to consumers across the U.S. The Company’s transportation business engages independent owners/drivers to transport manufactured homes, recreational vehicles, and other products throughout the U.S. and Canada.

Acquisitions and Expansions

Over the last several years, demand for affordable housing in the U.S. has increased. As a result, the Company focused on operational improvements to increase capacity utilization and profitability at its existing manufacturing facilities as well as executed measured expansion of its manufacturing footprint through facility and equipment investments and acquisitions. During fiscal 2023, robust demand began to slow as inflation and higher interest rates made housing less affordable. Even though demand in the housing markets has normalized, the Company continues to focus on growing in strong housing markets across the U.S. and Canada, as well as expanding products and services to provide more holistic solutions to homebuyers.

In July 2022, the Company acquired 12 Factory Expo retail sales centers from Alta Cima Corporation, which expanded the internal retail network across a broader portion of the U.S. In May 2022, the Company acquired Manis Custom Builders, Inc. ("Manis") in order to expand its manufacturing footprint and further streamline its product offering in the Southeast U.S. In February 2021, the Company acquired ScotBilt Homes, LLC and related companies (collectively, "Scotbilt"), which operated two manufacturing facilities in Georgia providing affordable housing throughout Alabama, Florida, Georgia and the Carolinas. The ScotBilt acquisition complemented the Company’s prior manufacturing footprint in the attractive mid-south region.

In addition to those acquisitions, the Company is also focused on growing its U.S. manufacturing production capacity through various plant start-ups. The Company began production in a previously idled facility in Decatur, Indiana in the first quarter of fiscal 2024. In January 2021, the Company acquired two idle facilities in Pembroke, North Carolina, one of which began production in the fourth quarter of fiscal 2023. In June 2021, the Company acquired two idle facilities in Navasota, Texas and began production at one of those facilities during the fourth quarter of fiscal 2022. The Company is also in the process of opening a previously idled facility in Bartow, Florida, which is expected to begin production in fiscal 2024.

The Company's acquisitions and investments are part of a strategy to grow and diversify revenue with a focus on increasing the Company’s homebuilding presence in the U.S. as well as improving the results of operations through streamlining production of similar product categories. These acquisitions and investments are included in the Company's consolidated results for periods subsequent to their respective acquisition dates.

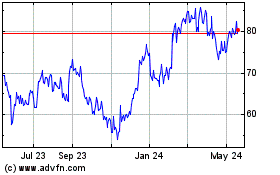

Industry and Company Outlook

Since July 2020, the U.S. and Canadian housing industry demand has generally been robust. The limited availability of existing homes for sale and the broader need for newly built affordable, single-family housing has driven demand for new homes in those markets. In recent years, manufactured home construction experienced revenue growth due to a number of favorable demographic trends and demand drivers in the U.S., including underlying growth trends in key homebuyer groups, such as the population over 55 years of age, the population of first-time homebuyers, and the population of households earning less than $60,000 per year. More recently, we have seen a number of market trends pointing to increased sales of accessory dwelling units ("ADUs") and urban-to-rural migration as customers accommodate working-from-home patterns, as well as people seeking rent-to-own single-family options.

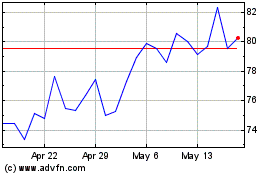

The rise in interest rates in response to inflation have impacted the demand for the Company's products in both the U.S. and Canada. In addition, many of our community customers have reduced order rates in response to excess inventory in their sales channels. As a result, the Company's backlog was $260.0 million as of July 1, 2023 compared to $1.4 billion as of July 2, 2022. Cancellation of end-consumer orders, at the retail level, have been minimal.

14

For the three months ended July 1, 2023, approximately 86% of the Company’s U.S. manufacturing sales were generated from the manufacture of homes that comply with the U.S. Department of Housing and Urban Development ("HUD") code construction standard in the U.S. Industry shipments of HUD-code homes are reported on a one-month lag. According to data reported by the Manufactured Housing Institute, HUD-code industry home shipments were 22,217 and 31,893 units during the three months ended May 31, 2023 and 2022, respectively. Based on industry data, the Company’s U.S. wholesale market share of HUD code homes sold was 17.9% and 18.0%, for the three months ended May 31, 2023 and 2022, respectively. Annual HUD-code industry shipments have generally increased since calendar year 2009 when only 50,000 HUD-coded manufactured homes were shipped, the lowest level since the industry began recording statistics in 1959. While shipments of HUD-coded manufactured homes have improved modestly in recent years, manufactured housing’s most recent annual shipment levels still operate at lower levels than the long-term historical average of over 200,000 units annually. Manufactured home sales represent approximately 11% of all of U.S. single family home starts. Our market share in the U.S. total housing market was approximately 2.2% for the twelve months ended July 1, 2023.

UNAUDITED INCOME STATEMENTS FOR THE FIRST QUARTER OF FISCAL 2024 VS. 2023

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

Results of Operations Data: |

|

|

|

|

|

|

Net sales |

|

$ |

464,769 |

|

|

$ |

725,881 |

|

Cost of sales |

|

|

335,096 |

|

|

|

496,546 |

|

Gross profit |

|

|

129,673 |

|

|

|

229,335 |

|

Selling, general, and administrative expenses |

|

|

70,439 |

|

|

|

72,282 |

|

Operating income |

|

|

59,234 |

|

|

|

157,053 |

|

Interest (income) expense, net |

|

|

(9,301 |

) |

|

|

90 |

|

Other (income) |

|

|

— |

|

|

|

(634 |

) |

Income before income taxes |

|

|

68,535 |

|

|

|

157,597 |

|

Income tax expense |

|

|

17,266 |

|

|

|

40,446 |

|

Net income |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA: |

|

|

|

|

|

|

Net income |

|

$ |

51,269 |

|

|

$ |

117,151 |

|

Income tax expense |

|

|

17,266 |

|

|

|

40,446 |

|

Interest (income) expense, net |

|

|

(9,301 |

) |

|

|

90 |

|

Depreciation and amortization |

|

|

7,592 |

|

|

|

5,616 |

|

Transaction costs |

|

|

— |

|

|

|

338 |

|

Other |

|

|

— |

|

|

|

(973 |

) |

Adjusted EBITDA |

|

$ |

66,826 |

|

|

$ |

162,668 |

|

As a percent of net sales: |

|

|

|

|

|

|

Gross profit |

|

|

27.9 |

% |

|

|

31.6 |

% |

Selling, general, and administrative expenses |

|

|

15.2 |

% |

|

|

10.0 |

% |

Operating income |

|

|

12.7 |

% |

|

|

21.6 |

% |

Net income |

|

|

11.0 |

% |

|

|

16.1 |

% |

Adjusted EBITDA |

|

|

14.4 |

% |

|

|

22.4 |

% |

15

NET SALES

The following table summarizes net sales for the three months ended July 1, 2023 and July 2, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

|

$

Change |

|

|

%

Change |

|

Net sales |

|

$ |

464,769 |

|

|

$ |

725,881 |

|

|

$ |

(261,112 |

) |

|

|

(36.0 |

%) |

U.S. manufacturing and retail net sales |

|

$ |

428,785 |

|

|

$ |

661,081 |

|

|

$ |

(232,296 |

) |

|

|

(35.1 |

%) |

U.S. homes sold |

|

|

4,817 |

|

|

|

6,813 |

|

|

|

(1,996 |

) |

|

|

(29.3 |

%) |

U.S. manufacturing and retail average home selling price |

|

$ |

89.0 |

|

|

$ |

97.0 |

|

|

$ |

(8.0 |

) |

|

|

(8.2 |

%) |

Canadian manufacturing net sales |

|

$ |

26,120 |

|

|

$ |

45,062 |

|

|

$ |

(18,942 |

) |

|

|

(42.0 |

%) |

Canadian homes sold |

|

|

221 |

|

|

|

352 |

|

|

|

(131 |

) |

|

|

(37.2 |

%) |

Canadian manufacturing average home selling price |

|

$ |

118.2 |

|

|

$ |

128.0 |

|

|

$ |

(9.8 |

) |

|

|

(7.7 |

%) |

Corporate/Other net sales |

|

$ |

9,864 |

|

|

$ |

19,738 |

|

|

$ |

(9,874 |

) |

|

|

(50.0 |

%) |

U.S. manufacturing facilities in operation at end of period |

|

|

39 |

|

|

|

37 |

|

|

|

|

|

|

|

U.S. retail sales centers in operation at end of period |

|

|

31 |

|

|

|

19 |

|

|

|

|

|

|

|

Canadian manufacturing facilities in operation at end of period |

|

|

5 |

|

|

|

5 |

|

|

|

|

|

|

|

Net sales for the three months ended July 1, 2023 were $464.8 million, a decrease of $261.1 million, or 36.0%, compared to the three months ended July 2, 2022. The following is a summary of the change by operating segment.

U.S. Factory-built Housing:

Net sales for the Company’s U.S. manufacturing and retail operations decreased by $232.3 million, or 35.1%, for the three months ended July 1, 2023 compared to the three months ended July 2, 2022. The decrease was primarily due to a 29.3% decrease in the number of homes sold during the period, as well as an 8.2% decrease in the average home selling price. The decrease in the number of homes sold was due to lower customer orders and lower production volume compared to the prior-year. The average selling price decrease was due, in part, to the impact of disaster relief housing sales of $82.5 million to the Federal Emergency Management Agency ("FEMA") in the first quarter of fiscal 2023, as well as customers electing fewer and lower cost options on new homes and price decreases of certain products to respond to market dynamics. FEMA units generally have more specifications than our typical products and therefore drive a higher average selling price per home. The decline in sales was partially offset by the fiscal 2023 acquisitions and plant start-up activities.

Canadian Factory-built Housing:

The Canadian Factory-built Housing segment net sales decreased by $18.9 million, or 42.0% for the three months ended July 1, 2023 compared to the same period in the prior fiscal year, primarily due to a 37.2% decrease in homes sold and a 7.7% decrease in average home selling price. The decrease in homes sold is due to slowing demand. We also reduced prices on certain models in order to respond to changes in demand. On a constant currency basis, net sales for the Canadian segment were unfavorably impacted by approximately $1.7 million due to fluctuations in the translation of the Canadian dollar to the U.S. dollar during the three months ended July 1, 2023 as compared to the same period of the prior fiscal year.

Corporate/Other:

Net sales for Corporate/Other includes the Company’s transportation business and the elimination of intersegment sales. For the three months ended July 1, 2023, net sales decreased $9.9 million, or 50.0%, primarily attributable to the decrease in recreational vehicle shipments.

GROSS PROFIT

The following table summarizes gross profit for the three months ended July 1, 2023 and July 2, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

|

|

(Dollars in thousands) |

|

July 1,

2023 |

|

|

July 2,

2022 |

|

|

$

Change |

|

|

%

Change |

|

Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Factory-built Housing |

|

$ |

118,424 |

|

|

$ |

209,637 |

|

|

$ |

(91,213 |

) |

|

|

(43.5 |

%) |

Canadian Factory-built Housing |

|

|

7,028 |

|

|

|

14,795 |

|

|

|

(7,767 |

) |

|

|

(52.5 |

%) |

Corporate/Other |

|

|

4,221 |

|

|

|

4,903 |

|

|

|

(682 |

) |

|

|

(13.9 |

%) |

Total gross profit |

|

$ |

129,673 |

|

|

$ |

229,335 |

|

|

$ |

(99,662 |

) |

|

|

(43.5 |

%) |

Gross profit as a percent of net sales |

|

|

27.9 |

% |

|

|

31.6 |

% |

|

|

|

|

|

|

16

Gross profit as a percent of sales during the three months ended July 1, 2023 was 27.9% compared to 31.6% during the three months ended July 2, 2022. The following is a summary of the change by operating segment.

U.S. Factory-built Housing: