Report of Foreign Issuer (6-k)

April 26 2019 - 2:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF APRIL 2019

Commission File Number:

333-04906

SK Telecom Co., Ltd.

(Translation of registrant’s name into English)

65 Euljiro,

Jung-gu

Seoul 04539, Korea

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is

submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Decision on SK Broadband’s Merger with Tbroad, Tbroad Dongdaemun and KDMC

On April 26, 2019, the board of directors of SK Broadband Co., Ltd. (“SK Broadband”), a subsidiary of SK Telecom Co., Ltd. (the

“Company”), approved SK Broadband’s merger (the “Merger”) with Tbroad Co., Ltd. (“Tbroad”), Tbroad Dongdaemun Broadcasting Co., Ltd. (“Tbroad Dongdaemun”) and Korea Digital Cable Media Center

(“KDMC,” and together with Tbroad and Tbroad Dongdaemun, the “Merging Companies”).

|

|

|

|

|

1. Method of Merger

|

|

The Merging Companies will merge with and into SK Broadband, the surviving company.

|

|

|

|

|

2. Purpose of Merger

|

|

To improve the competitiveness of SK Broadband’s comprehensive media business and pursue synergies.

|

|

|

|

|

3. Merger Ratio

|

|

SK Broadband : Tbroad : Tbroad Dongdaemun : KDMC

= 1 : 1.6860091 : 2.2095367 : 0.1693414

|

|

|

|

|

4. Calculation of Merger Ratio

|

|

SK Broadband and the Merging Companies are all unlisted stock companies. There are no laws or regulations providing for the method of

calculation of the merger ratio for a merger among unlisted stock companies, and pursuant to Article

165-4

of the Financial Investment Services and Capital Markets Act of Korea (“FSCMA”) and Article

176-5

of the Enforcement Decree of the FSCMA, no assessment of the fairness of the merger consideration by an external assessment institution is required. However, SK Broadband voluntarily received such assessment

in order to determine the appropriate value of the Merging Companies.

The assessment

method pursuant to the Inheritance Tax and Gift Tax Act of Korea, which is used for purposes of imposing tax or reducing

tax-related

disadvantages, is generally considered to be unsuitable for assessing fair

value. Accordingly, SK Broadband considered the various assessment methods generally used for valuing companies based on asset value, revenue and market value, and selected the discounted cash flow (“DCF”) model, which is a method based on

revenue, for calculating the merger ratio. The DCF model is the most widely used method in practice, and SK Broadband determined it to be the most suitable method for assessing a company’s corporate value in general, because it reflects the

company’s future revenue stream or ability to generate cash. In particular, as the Merger combines four companies, the DCF model is the most rational method as it can take into account the expected changes to each company’s business in the

medium- to long-term.

Results of Assessment

The estimated values per share of SK Broadband, Tbroad, Tbroad Dongdaemun and KDMC are

Won 12,044, Won 20,306, Won 26,611 and Won 2,040, respectively, resulting in the merger ratio agreed among the merger parties of 1 : 1.6860091 : 2.2095367 : 0.1693414.

|

|

|

|

|

5. Number of New Shares to be Issued in the Merger

|

|

102,864,815 common shares

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Merging Companies

|

|

Tbroad

|

|

Company Name

|

|

Tbroad Co., Ltd.

|

|

|

Principal Business

|

|

Fixed-line, satellite and other broadcasting

|

|

|

Relationship to Company

|

|

—

|

|

|

Separate Financial Information as of or for the Year Ended

December 31, 2018

(in millions of Won)

|

|

Total assets

|

|

1,141,733

|

|

Share capital

|

|

74,094

|

|

|

Total liabilities

|

|

124,700

|

|

Revenue

|

|

667,129

|

|

|

Total equity

|

|

1,017,033

|

|

Profit for the year

|

|

77,871

|

|

|

Tbraod

Dongdaemun

|

|

Company Name

|

|

Tbroad Dongdaemun Broadcasting Co., Ltd.

|

|

|

Principal Business

|

|

Fixed-line, satellite and other broadcasting

|

|

|

Relationship to Company

|

|

—

|

|

|

Separate Financial Information as of or for the Year Ended

December 31, 2018

(in millions of Won)

|

|

Total assets

|

|

27,754

|

|

Share capital

|

|

4,000

|

|

|

Total liabilities

|

|

1,731

|

|

Revenue

|

|

12,622

|

|

|

Total equity

|

|

26,022

|

|

Profit for the year

|

|

1,412

|

|

|

KDMC

|

|

Company Name

|

|

Korea Digital Cable Media Center

|

|

|

Principal Business

|

|

Fixed-line, satellite and other broadcasting

|

|

|

Relationship to Company

|

|

—

|

|

|

Separate Financial Information as of or for the Year Ended December 31, 2018

(in millions of Won)

|

|

Total assets

|

|

28,478

|

|

Share capital

|

|

11,880

|

|

|

Total liabilities

|

|

4,566

|

|

Revenue

|

|

30,278

|

|

|

Total equity

|

|

23,912

|

|

Profit for the year

|

|

1,081

|

|

7. Merger Timetable

|

|

Shareholder Meeting

|

|

November 29, 2019

|

|

|

Submission Period of Dissent by Creditors

|

|

November 29, 2019 – December 31,

2019

|

|

|

Date of Merger

|

|

January 1, 2020

|

|

|

Registration of Merger

|

|

January 7, 2020

|

|

|

|

|

|

Issuance of New Stock

|

|

January 21, 2020

|

|

8. Appraisal Rights

|

|

—

|

|

9. Date of Board Resolution

|

|

April 26, 2019

|

|

|

|

|

|

• Attendance of Outside Directors

|

|

Present

|

|

4

|

|

|

Absent

|

|

0

|

3

|

|

|

|

|

10. Other Important Matters Relating to Investment Decision

|

|

• The Merger timetable above is an estimate as of the date of this filing, and it

may change subject to discussions with, or approvals by, relevant authorities.

• In connection with “8. Appraisal Rights” above, the Company, which owns all outstanding

shares of SK Broadband, has consented to the Merger and delivered a letter to SK Broadband waiving its appraisal rights. Therefore, SK Broadband will not conduct appraisal procedures for the Merger.

• Pursuant to Article 522 and

Article 434 of the Korea Commercial Code, the Merger may be canceled if it fails to be approved by SK Broadband’s shareholders. The approval of the Merger agreement (the “Agreement”) requires at least

two-thirds

of the voting shares present at the extraordinary meeting of shareholders and

one-third

of all total outstanding shares.

• The Agreement may be

terminated before the date of the Merger if any of the following events occur:

1) Any circumstance that has or would reasonably expected to have a material adverse effect on the

property and business conditions of a party to the Merger is identified between the date of the Agreement and the date of the Merger;

2) As of the end of the applicable exercise period for appraisal rights, the aggregate amount of shares

of the Merging Companies for which appraisal rights have been exercised exceeds or is reasonably expected to exceed Won 20 billion;

3) The Merger is not completed by January 31, 2020; or

4) In connection with requisite

government approvals:

i. Government approvals that are material to the businesses of the parties to the Merger or the

Merger process are conclusively denied; or

ii. Government approvals that are obtained include conditions that are impossible to comply with or that

would reasonably be expected to have a material adverse effect on the business and property of the surviving company following the Merger.

|

Information about SK Broadband

|

|

|

|

|

Company Name

|

|

SK Broadband Co., Ltd.

|

|

|

|

|

Representative

|

|

Jung Ho Park

|

|

|

|

|

Principal Business

|

|

Fixed-line telecommunications, broadcasting and new media businesses

|

|

|

|

|

Material Subsidiary

|

|

Yes

|

|

|

|

|

Total Assets (Won)

|

|

4,284,571,852,075

|

|

|

|

|

Consolidated Total Assets of Company (Won)

|

|

42,369,110,923,939

|

|

|

|

|

Ratio of SK Broadband’s Total Assets to the Company’s

Consolidated Total Assets (%)

|

|

10.11

|

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

SK T

ELECOM

C

O

., L

TD

.

|

|

(Registrant)

|

|

|

|

By: /s/ Jeong Hwan Choi

|

|

(

Signature

)

|

|

Name:

|

|

Jeong Hwan Choi

|

|

Title:

|

|

Senior Vice President

|

Date: April 26, 2019

5

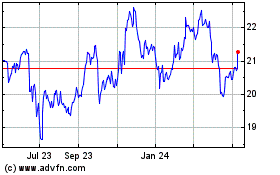

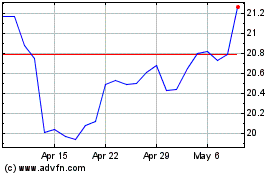

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Mar 2024 to Apr 2024

SK Telecom (NYSE:SKM)

Historical Stock Chart

From Apr 2023 to Apr 2024