Simon Closes Klepierre Acquisition - Analyst Blog

March 15 2012 - 11:45AM

Zacks

Simon Property Group Inc. (SPG), a leading real

estate investment trust (REIT), has recently completed the

acquisition of a 28.7% equity stake (54.43 million shares) in

Klépierre – a Paris-based real estate company that owns, manages

and develops shopping centers, retail properties and offices across

Continental Europe. Earlier in the month, Simon Property had

acquired the ownership interests in Klépierre from BNP Paribas for

$2.0 billion.

Klépierre’s portfolio includes 271 shopping centers in 13

countries, with 50% of its properties in France and Belgium, 25% in

Scandinavia, and the remainder in Central and Southern Europe. The

acquisition has strengthened the international footprint of Simon

Property and is expected to be accretive to earnings.

Simon Property had also purchased its joint venture partner’s

(Farallon Capital Management, L.L.C.) ownership stake in 26 assets

of The Mills Limited Partnership, in a transaction valued at $1.5

billion. The purchase price included the repayment of senior loan

facility and mezzanine loan of the JV, and the retirement of

preferred stock. The Mills acquisition is likely to be completed in

the next week.

The company had funded both the acquisitions from the proceeds

of a just-concluded secondary and debt offering. Simon Property

sold 9.1375 million common shares at $137.00 each, including the

partial exercise of the over-allotment options by the

underwriters.

At the same time, Simon Property also sold $1.75 billion worth

of aggregate principal amount of its senior unsecured notes

consisting of $600 million of 2.150% notes due 2017, $600 million

of 3.375% notes due 2022, and $550 million of 4.750% notes due

2042.

Headquartered in Indianapolis, Indiana, Simon Property is the

largest publicly traded retail real estate company in North America

with assets in almost all retail distribution channels. The company

acquires, owns and leases a diverse portfolio of shopping malls in

North America, Europe and Asia.

Simon Property’s international presence gives it a more

sustainable long-term growth story than its domestically focused

peers. The geographic and product diversity of the company also

insulates it from market volatility to a great extent and provides

a steady source of income.

We maintain our Neutral recommendation on the stock, which

presently has a Zacks #2 Rank translating into a short-term Buy

rating. We also have a Neutral recommendation and a Zacks #3 Rank

(short-term Hold) for Macerich Co. (MAC), one of

the competitors of Simon Property.

MACERICH CO (MAC): Free Stock Analysis Report

SIMON PROPERTY (SPG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

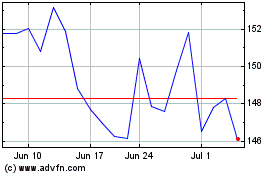

Simon Property (NYSE:SPG)

Historical Stock Chart

From Jun 2024 to Jul 2024

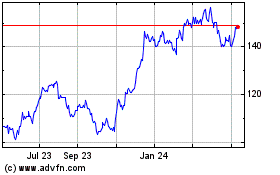

Simon Property (NYSE:SPG)

Historical Stock Chart

From Jul 2023 to Jul 2024