Table of Contents

As filed with the Securities and Exchange Commission on August 24, 2020

Registration Statement No. 333-227263

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

Form F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sasol Limited

(Exact Name of Registrant as Specified in its Charter)

Republic of South Africa

(State or Other Jurisdiction of Incorporation or Organization)

Not Applicable

(I.R.S. Employer Identification Number)

Sasol Place, 50 Katherine Street, Sandton, 2196

South Africa

Tel: +27 10 344 5000

(Address and Telephone Number of Registrant’s Principal Executive Offices)

Sasol Financing USA LLC

(Exact Name of Registrant as Specified in its Charter)

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

Not Applicable

(I.R.S. Employer Identification Number)

12120 Wickchester Lane

Houston, Texas 77079, USA

Tel: +1 281-588-3000

(Address and Telephone Number of Registrant’s Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011, USA

Tel: +1 404-888-6494

(Name, Address and Telephone Number of Agent for Service)

Copies to:

Trevor Ingram

Shearman & Sterling (London) LLP

9 Appold Street

London EC2A 2AP, England

Tel: +44 (20) 7655-5000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. x

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company o

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

|

Amount to be

Registered/Proposed

Maximum Offering Price

Per Unit/Proposed

Maximum Aggregate

Offering Price

|

|

Amount of

Registration

Fee

|

|

Ordinary shares of Sasol Limited (including ordinary shares represented by American Depositary Shares)(1)

|

|

Indeterminate(2)

|

|

$0(3)

|

|

Rights to purchase ordinary shares of Sasol Limited (including ordinary shares represented by American Depositary Shares)(1)

|

|

Indeterminate(2)

|

|

$0(3)

|

(1) A portion of the ordinary shares, no par value, of Sasol Limited may be represented by American Depositary Shares, each of which represents one ordinary share.

(2) An indeterminate aggregate initial offering price or number of the securities of each identified class is being registered as may from time to time be offered at indeterminate prices. Separate consideration may or may not be received for securities that are issuable on exercise, conversion or exchange of other securities or that are issued in units or represented by depositary shares.

(3) In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrants are deferring payment of all of the registration fee.

Table of Contents

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form F-3 (File No. 333-227263) (the “Registration Statement”) of Sasol Limited and Sasol Financing USA LLC is being filed for the purposes of (i) registering, in addition to the indeterminate amount of debt securities and guarantees previously registered on the Registration Statement, an indeterminate amount of ordinary shares of Sasol Limited (including ordinary shares represented by American Depositary Shares) and rights to purchase ordinary shares of Sasol Limited (including ordinary shares represented by American Depositary Shares), (ii) filing a prospectus relating to the ordinary shares of Sasol Limited and the rights to purchase such ordinary shares, to be issued from time to time by Sasol Limited, (iii) filing as a new Exhibit 4.4, the Agreement of Resignation, Appointment and Acceptance, dated as of August 5, 2020, by and among Sasol Financing USA LLC, Sasol Limited, Citibank, N.A. and Wilmington Savings Fund Society, FSB, to confirm the succession of Wilmington Savings Fund Society, FSB as the trustee under the Sasol Financing USA LLC guaranteed debt indenture, (iv) filing a new Form T-1 relating to the eligibility of Wilmington Savings Fund Society, FSB to replace the previously filed Exhibit 25.1 and (v) filing additional exhibits to the Registration Statement. No changes or additions are being made hereby to the existing prospectus dated September 10, 2018 relating to guaranteed debt securities to be issued from time to time by Sasol Financing USA LLC, which remains a part of the Registration Statement, and therefore it is omitted from this filing. This Post-Effective Amendment No. 1 to the Registration Statement shall become effective immediately upon filing with the Securities and Exchange Commission.

Table of Contents

Prospectus

Sasol Limited

(incorporated in the Republic of South Africa with limited liability)

This prospectus offers:

Ordinary Shares, no par value,

including Ordinary Shares represented by American Depositary Shares

Rights to Subscribe for Ordinary Shares

We will provide the specific terms of the securities that may be offered, and the manner in which they are being offered, in one or more supplements to this prospectus. Any supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and any prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information”, before investing in our securities. The amount and price of the offered securities will be determined at the time of the offering.

Our ordinary shares are listed on the Main Board of the JSE Limited under the symbol “SOL”. The American depositary shares, or ADSs, each representing one ordinary share, are listed on the New York Stock Exchange under the symbol “SSL”.

Investing in these securities involves risks that are described in the “Risk Factors” section contained in the applicable prospectus supplement and may be described in certain of the documents we incorporate by reference in this prospectus.

Neither the United States Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is August 24, 2020.

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-3 that has been filed with the Securities and Exchange Commission, which we refer to as the “SEC”, using a “shelf” registration process. Under this shelf registration process, we may offer and sell any combination of the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities we may offer. Each time we use this prospectus to offer the offered securities, we will provide one or more prospectus supplements that will contain specific information about the offering and the terms of those securities and the extent to which such terms differ from the general terms described in this prospectus. The prospectus supplements may also add, update or change the information contained in this prospectus. You should read this prospectus and any applicable prospectus supplement(s), together with the additional information described under the heading “Where You Can Find More Information”, prior to purchasing any of the securities offered by this prospectus.

All references to the “group”, “us”, “we”, “our”, “company”, or “Sasol” in this prospectus are to Sasol Limited, its group of subsidiaries and its interests in associates, joint arrangements and structured entities. All references in this prospectus are to Sasol Limited or the companies comprising the group, as the context may require. All references to “(Pty) Ltd” refer to Proprietary Limited, a form of corporation in South Africa which restricts the right of transfer of its shares and prohibits the public offering of its shares.

WHERE YOU CAN FIND MORE INFORMATION

We file annual and other reports with the SEC. The SEC maintains a website (http://www.sec.gov) on which our annual and other reports are made available. You may also read and copy these documents at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005. Copies of certain information filed by us with the SEC are also available on our website at www.sasol.com. Our website is not a part of this prospectus and is not incorporated by reference in this prospectus.

The SEC allows us to “incorporate by reference” the information we file with the SEC, which means that we can disclose important information to you by referring you to those documents that are considered part of this prospectus. Information that we file with the SEC in the future and incorporate by reference will automatically update and supersede the previously filed information. We incorporate by reference the document listed below:

· Our annual report on Form 20-F for the year ended June 30, 2020 filed with the SEC on August 24, 2020 (our “Form 20-F”).

We also incorporate by reference in this prospectus all subsequent annual reports filed with the SEC on Form 20-F under the Securities Exchange Act of 1934 and those of our reports submitted to the SEC on Form 6-K that we specifically identify in such form as being incorporated by reference in this prospectus after the date hereof and prior to the completion of an offering of securities under this prospectus. This prospectus is part of a registration statement filed with the SEC.

As you read the above documents, this prospectus and any prospectus supplement, you may find inconsistencies in information from one document to another. If you find inconsistencies you should rely on the statements made in the most recent document, including this prospectus and any prospectus supplement. All information appearing in this prospectus is qualified in its entirety by the information and financial statements, including the notes thereto, contained in the documents we have incorporated by reference.

Upon written or oral request, we will provide to any person, at no cost to such person, including any beneficial owner to whom a copy of this prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with this prospectus. You may make such a request by writing or telephoning us at the following address or telephone number:

Senior Vice President: Legal, Intellectual Property & Regulatory Services

Sasol South Africa Ltd

Sasol Place

50 Katherine Street

1

Table of Contents

Sandton 2196

South Africa

Telephone: +27 10 344 6390

Fax: +27 11 522 8538

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus and in any prospectus supplement or free writing prospectus prepared by us or on our behalf or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell or to buy only the securities referred to herein, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the cover page of those documents.

FORWARD-LOOKING STATEMENTS

This prospectus includes and incorporates by reference forward-looking statements. We have based these forward-looking statements on our current expectations and projections of future events. These forward-looking statements are subject to risks, uncertainties and assumptions about our business. You should consider any forward-looking statements in light of the risks and uncertainties described in the information contained or incorporated by reference in this prospectus. See “Where You Can Find More Information”. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the future events described in this prospectus may not occur.

ENFORCEABILITY OF CERTAIN CIVIL LIABILITIES

Sasol Limited is incorporated under the laws of the Republic of South Africa (“South Africa”). Most of Sasol Limited’s directors and officers, and the experts named herein, reside outside the United States, principally in South Africa. You may not be able, therefore, to effect service of process within the United States upon those directors and officers with respect to matters arising under the federal securities laws of the United States.

In addition, most of our assets and the assets of our directors and officers are located outside the United States. As a result, you may not be able to enforce against us or our directors and officers judgments obtained in U.S. courts predicated on the civil liability provisions of the federal securities laws of the United States.

We have been advised by Edward Nathan Sonnenbergs Inc., our South African counsel, that any foreign judgment obtained in respect of the Registration Statement will, subject to the permission of the Minister of Trade and Industry of South Africa (if the Protection of Businesses Act, 1978 (Act No. 99 of 1978) (the “Businesses Act”) is applicable), be recognised and enforced in accordance with the ordinary procedures applicable under South African law for the enforcement of foreign judgments, provided that:

· the judgment is final and conclusive and the judgement has not been superannuated or, if an appeal is pending, the court may use its discretion to stay the proceedings pending the appeal;

· the recognition and enforcement of the judgment is not against public policy in that, among other things, the judgment was not obtained by fraud or rendered contrary to natural justice, and does not involve the enforcement of foreign penal or revenue laws;

· the recognition and enforcement of the judgment does not contravene section 1A of the Businesses Act, which prohibits the payment of multiple or punitive damages;

· the foreign court in question had jurisdiction and international competence according to the principles recognised by the laws of South Africa and, in regard to these principles, and foreign judgments based on money claims, the courts of South Africa recognise jurisdiction and international competence on the basis of the submission, whether by agreement or by conduct, of the defendant to the jurisdiction of the foreign court or the residence of the defendant in the area of the foreign court at the time of the commencement of the action.

SASOL LIMITED

Sasol is an international integrated chemicals and energy company that, through its talented people, uses selected technologies to safely and sustainably source, produce and market chemical and energy products competitively to create superior value for our customers, shareholders and other stakeholders.

Sasol Limited, which is the ultimate holding company of our group, is a public company. It was incorporated under the laws of the Republic of South Africa in 1979 and has been listed on the JSE Limited (“JSE”) since October 1979 and our ADRs have been listed on the New York Stock Exchange (“NYSE”) since April 2003. Our registered office and corporate headquarters are at Sasol Place, 50 Katherine Street, Sandton, Johannesburg 2196, South Africa and our telephone number is +27 10 344 5000. Our general website is at www.sasol.com. Information contained on our website is not, and shall not be deemed to be, part of this prospectus.

RISK FACTORS

For a description of some of the risks that could materially affect an investment in the securities being offered, you should read the discussion of risk factors in “Item 3D: Risk Factors”, starting on page 7 in our Form 20-F, and identified in our future filings with the SEC, incorporated herein by reference, and in any applicable prospectus supplement in relation to an offering of securities. Additional risk factors not presently known to us or that we currently deem immaterial may also impair our business operations.

2

Table of Contents

REASONS FOR THE OFFERING AND USE OF PROCEEDS

Except as may be described otherwise in a prospectus supplement, we will add the net proceeds from our sale of the securities under this prospectus to our general funds and will use them for our general corporate purposes, including for repayment of existing indebtedness, funding our working capital, project development or capital expenditure requirements.

We may designate a specific allocation of the net proceeds of an offering of securities by us to a specific purpose, if any, at the time of the offering and will describe any allocation in the related prospectus supplement.

PROSPECTUS SUPPLEMENT

This prospectus provides you with a general description of the securities that may be offered. Unless the context otherwise requires, we will refer to the ordinary shares, ADSs and rights as the “offered securities”. Each time offered securities are subscribed for, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add to, update or change information contained in this prospectus. Accordingly, to the extent inconsistent, information in this prospectus is superseded by the information in the prospectus supplement. You should read both this prospectus and any prospectus supplement together with the additional information described under the heading “Where You Can Find More Information” prior to purchasing any of the securities offered by this prospectus and the applicable prospectus supplement.

The prospectus supplement to be attached to the front of this prospectus will describe the terms of the offering, including the amount and more detailed terms of offered securities, the initial public offering price, the price paid for the offered securities, net proceeds to us, the expenses of the offering, the terms of offers and sales outside of the United States, if any, our capitalization, the nature of the plan of distribution, the other specific terms related to the offering, and any U.S. federal income tax consequences and South African tax considerations applicable to the offered securities.

For more detail on the terms of the offered securities, you should read the exhibits filed with, or incorporated by reference into, our registration statement on Form F-3.

SOUTH AFRICAN RESERVE BANK APPROVAL

The issuance of securities under this prospectus may be subject to the approval of the South African Reserve Bank.

DESCRIPTION OF SHARE CAPITAL

For a description of our share capital, including the rights and obligations attached thereto, please refer to “Item 10. Additional Information—10.B Memorandum and articles of association” in our Form 20-F, incorporated by reference herein.

DESCRIPTION OF ADSS

For a description of our ADSs, including the rights and obligations attached thereto, please refer to “Item 12.D American depositary shares” in our Form 20-F and Exhibit 2.2 to our Form 20-F, incorporated by reference herein.

DESCRIPTION OF RIGHTS TO SUBSCRIBE FOR ORDINARY SHARES

We may issue subscription rights to subscribe for our ordinary shares. We may issue these rights independently or together with any other offered security. The rights may or may not be transferable in the hands of their holders.

The applicable prospectus supplement will describe the specific terms of any subscription rights offering, including:

3

Table of Contents

· the title of the subscription rights;

· the securities for which the subscription rights are exercisable;

· the exercise price for the subscription rights;

· the number of subscription rights issued;

· the extent to which the subscription rights are transferable;

· if applicable, a discussion of the material U.S. federal or other income tax considerations applicable to the issuance or exercise of the subscription rights;

· any other terms of the subscription rights, including terms, procedures and limitations relating to the exchange and exercise of the subscription rights;

· if applicable, the record date to determine who is entitled to the subscription rights and the ex-rights date;

· the date on which the rights to exercise the subscription rights will commence, and the date on which the rights will expire;

· the extent to which the offering includes an over-subscription privilege with respect to unsubscribed securities; and

· if applicable, the material terms of any standby or other underwriting arrangement we enter into in connection with the offering.

Each subscription right will entitle its holder to subscribe for cash a number of our ordinary shares, ADSs or any combination thereof at an exercise price described in the applicable prospectus supplement. Subscription rights may be exercised at any time up to the close of business on the expiration date set forth in the prospectus supplement. After the close of business on the expiration date, all unexercised subscription rights will become void.

Upon receipt of payment and the subscription form properly completed at the subscription rights agent’s office or another office indicated in the applicable prospectus supplement, we will, as soon as practicable, deliver our ordinary shares or ADSs purchasable with this exercise. Rights to purchase ordinary shares represented by ADSs will be evidenced by certificates issued by our ADS rights agent upon receipt by the ADS depositary of the rights to subscribe for ordinary shares registered hereby. The applicable prospectus supplement may offer more details on how to exercise the subscription rights.

We may determine to offer subscription rights to our shareholders only or additionally to persons other than shareholders as described in the applicable prospectus supplement. In the event subscription rights are offered to our shareholders only and their rights remain unexercised, we may determine to offer the unsubscribed offered securities to persons other than shareholders. In addition, we may enter into a standby or other underwriting arrangement with one or more underwriters under which the underwriter(s) will subscribe for any offered securities remaining unsubscribed for after the offering, as described in the applicable prospectus supplement.

TAXATION

The prospectus supplement will describe certain material U.S. federal income tax consequences of the ownership and disposition of any securities offered under this prospectus to certain United States persons (within the meaning of the U.S. Internal Revenue Code of 1986, as amended) who are initial investors.

The prospectus supplement will describe certain material South African income tax consequences to an initial investor who is a non-resident of South Africa of acquiring, owning and disposing of any securities offered under this prospectus, including whether the payments of dividends, if any, on the ordinary shares will be subject to South African withholding tax.

4

Table of Contents

PLAN OF DISTRIBUTION

The offered securities may be sold, and the underwriters may resell these offered securities, directly or through agents in one or more transactions, including negotiated transactions, at a fixed public offering price or prices, which may be changed, or at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. The offered securities may be sold in portions outside the United States at an offering price and on terms specified in the applicable prospectus supplement relating to a particular issue of these offered securities. Without limiting the generality of the foregoing, any one or more of the following methods may be used when selling the offered securities:

· ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

· block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction;

· purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

· an exchange distribution in accordance with the rules of the applicable exchange;

· privately negotiated transactions;

· settlement of short sales entered into after the date of this prospectus;

· sales in which broker-dealers agree with us to sell a specified number of securities at a stipulated price per security;

· through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

· by pledge to secure debts or other obligations;

· by an underwritten public offering;

· in a combination of any of the above; or

· any other method permitted pursuant to applicable law.

In addition, the offered securities may be sold by way of exercise of rights granted pro rata to our existing shareholders.

The offered securities may also be sold short and securities covered by this prospectus may be delivered to close out such short positions, or the securities may be loaned or pledged to broker-dealers that in turn may sell them. Options, swaps, derivatives or other transactions may be entered into with broker-dealers or other financial institutions which require the delivery to such broker-dealer or other financial institution of the offered securities and ordinary shares, respectively, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Any underwriters or agents will be identified and their compensation described in the applicable prospectus supplement.

In connection with the sale of offered securities, the underwriters or agents may receive compensation from us or from purchasers of the offered securities for whom they may act as agents. The underwriters may sell offered securities to or through dealers, who may also receive compensation from the underwriters or from purchasers of the offered securities for whom they may act as agents. Compensation may be in the form of discounts, concessions or commissions. Underwriters, dealers and agents that participate in the distribution of the offered securities may be deemed to be underwriters as defined in the U.S. Securities Act of 1933, as amended, or the U.S. Securities Act, and any discounts or commissions received by them from us and any profit on the resale of the offered securities by them may be treated as underwriting discounts and commissions under the U.S. Securities Act.

We may enter into agreements that will entitle the underwriters, dealers and agents to indemnification by us against and contribution toward certain liabilities, including liabilities under the U.S. Securities Act.

5

Table of Contents

Certain underwriters, dealers and agents and their associates may be customers of, engage in transactions with or perform commercial banking, investment banking, advisory or other services for us, including our subsidiaries, in the ordinary course of their business.

If so indicated in the applicable prospectus supplement relating to a particular issue of offered securities, the underwriters, dealers or agents will be authorized to solicit offers by certain institutions to purchase the offered securities under delayed delivery contracts providing for payment and delivery at a future date. These contracts will be subject only to those conditions set forth in the applicable prospectus supplement, and the prospectus supplement will set forth the commission payable for solicitation of these contracts.

LEGAL MATTERS

Certain legal matters with respect to South African law will be passed upon for us by our South African counsel, Edward Nathan Sonnenbergs Inc. Certain legal matters with respect to United States and New York law will be passed upon for us by Shearman & Sterling (London) LLP, who may rely, without independent investigation, on Edward Nathan Sonnenbergs Inc. regarding certain South African legal matters.

EXPERTS

The financial statements and management's assessment of the effectiveness of internal control over financial reporting (which is included in Management's Annual Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the Annual Report on Form 20-F for the year ended June 30, 2020 have been so incorporated in reliance on the report (which contains an explanatory paragraph relating to the Company's ability to continue as a going concern as described in Note 2 to the financial statements and which contains an adverse opinion on the effectiveness of internal control over financial reporting) of PricewaterhouseCoopers Inc., an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

6

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 8. Indemnification of Directors and Officers

South African law

Clause 36 of the Memorandum of Incorporation of Sasol Limited provides that, subject to the provisions of the South Africa Companies Act 2008, Sasol Limited will indemnify its directors, prescribed officers or any member of any committee of the board of Sasol Limited against liability or all costs, losses and expenses they may incur or become liable to pay by reason of any act or omission done or omitted to be done by them in the discharge of their duties.

According to Section 78(6) of the South Africa Companies Act 2008, a company may not indemnify a director or prescribed officer in respect of any liability for any loss, damages or costs arising as a direct or indirect consequence of:

· the director or prescribed officer having acted in the name of the company, signed anything on behalf of the company, or purported to bind the company or authorize the taking of any action by or on behalf of the company, despite knowing that he or she lacked the authority to do so;

· the director or prescribed officer having acquiesced in the carrying on of the company’s business despite knowing that it was being conducted recklessly, with gross negligence, with intent to defraud any person or for any fraudulent purposes;

· the director or officer having been a party to an act or omission by the company despite knowing that the act or omission was calculated to defraud a creditor, employee or shareholder of the company, or had another fraudulent purpose; or

· wilful misconduct or wilful breach of trust on the part of the director or prescribed officer; and

· a company may not indemnify a director in respect of any fine that may be imposed on a director or prescribed officer as a consequence of that director having been convicted of an offense under national legislation, unless the conviction was based on strict liability.

According to Section 77(7) of the South African Companies Act 2008, proceedings against directors and prescribed officers to recover any loss, damages or costs for which such a person is or may be held liable under Section 77 may generally not be commenced more than three years after the act of omission that gave rise to that liability.

A company may in, in accordance with Section 78(8) of the South African Companies Act 2008, claim reimbursement from any director or officer of the company for any money paid directly or indirectly to or on behalf of such director or officer in any manner inconsistent with the provisions of the South Africa Companies Act 2008, particularly Section 78 thereof.

Section 78(7) of the South Africa Companies Act 2008 provides that, except to the extent that the company’s Memorandum of Incorporation disallows it, a company may purchase insurance to protect a director or prescribed officer against any liability or expense for which the company may lawfully indemnify a director or prescribed officer and any expenses that the company is permitted to advance to a director or officer.

Item 9. Exhibits

Exhibits:

|

*1.1

|

|

Form of underwriting agreement for guaranteed debt securities of Sasol Financing USA LLC.

|

|

*1.2

|

|

Form of underwriting agreement for equity securities of Sasol Limited.

|

|

4.1

|

|

Form of indenture for guaranteed debt securities of Sasol Financing USA LLC, among Sasol Financing USA LLC, as issuer, Sasol Limited, as guarantor, and Citibank, N.A., as trustee.(1)

|

II-1

Table of Contents

|

4.2

|

|

Form of guaranteed fixed rate note of Sasol Financing USA LLC.(1)

|

|

*4.3

|

|

Form of letter of allocation to exercise rights to purchase ordinary shares.

|

|

4.4

|

|

Agreement of Resignation, Appointment and Acceptance, dated as of August 5, 2020, by and among Sasol Financing USA LLC, Sasol Limited, Citibank, N.A. and Wilmington Savings Fund Society, FSB.

|

|

5.1

|

|

Opinion of Shearman & Sterling (London) LLP, U.S. counsel, as to the validity of the debt securities.(1)

|

|

5.2

|

|

Opinion of Edward Nathan Sonnenbergs Inc., South African counsel to Sasol Limited, as to the validity of the debt securities.(1)

|

|

5.3

|

|

Opinion of Edward Nathan Sonnenbergs Inc., South African counsel to Sasol Limited, as to the validity of the ordinary shares and rights.

|

|

23.1

|

|

Consent of PricewaterhouseCoopers Inc., independent registered public accounting firm.

|

|

23.2

|

|

Consent of Shearman & Sterling (London) LLP (included in its opinion filed as Exhibit 5.1).

|

|

23.3

|

|

Consent of Edward Nathan Sonnenbergs Inc. (included in its opinions filed as Exhibit 5.2 and Exhibit 5.3).

|

|

24.1

|

|

Powers of Attorney (included on the signature pages).(1)

|

|

25.1

|

|

Statement of eligibility of Wilmington Savings Fund Society, FSB, as trustee, under the Trust Indenture Act of 1939 on Form T-1.

|

* To be filed on a Form 6-K depending on the nature of the offering, if any, pursuant to this registration statement.

(1) Previously filed with the Sasol Limited Registration Statement on Form F-3 on September 10, 2018.

II-2

Table of Contents

Item 10. Undertakings

(a) Each of the undersigned registrants hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by such registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) To file a post-effective amendment to the registration statement to include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a continuous offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act of 1933 need not be furnished, provided, that the registrant includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least as current as the date of those financial statements. Notwithstanding the foregoing, with respect to registration statements on Form F-3, a post-effective amendment need not be filed to include financial statements and information required by Section 10(a)(3) of the Securities Act of 1933 or Rule 3-19 if such financial statements and information are contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the Form F-3.

(5) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by such registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first

II-3

Table of Contents

contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6) That, for the purpose of determining liability of such registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: Each of the undersigned registrants undertakes that in a primary offering of securities of such undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, such undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of such undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of such undersigned registrant or used or referred to by such undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about such undersigned registrant or its securities provided by or on behalf of such undersigned registrant; and

(iv) Any other communication that is an offer in the offering made by such undersigned registrant to the purchaser.

(b) Each undersigned registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing of such registrant’s annual reports pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of any registrant pursuant to the foregoing provisions, or otherwise, each registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act of 1933, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by such registrant of expenses incurred or paid by a director, officer or controlling person of such registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, such registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

(d) Each undersigned registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to

II-4

Table of Contents

the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

II-5

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant, Sasol Limited, a corporation organized and existing under the laws of the Republic of South Africa, certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form F-3 and has duly caused this Post-Effective Amendment No. 1 to its registration statement on Form F-3 to be signed on its behalf by the undersigned, thereunto duly authorized, in Johannesburg, South Africa on the 24 day of August, 2020.

|

|

SASOL LIMITED

|

|

|

|

|

By:

|

|

|

|

/s/ Paul Victor

|

|

|

|

|

Name:

|

Paul Victor

|

|

|

|

|

Title:

|

Chief Financial Officer

|

POWER OF ATTORNEY

Each of Fleetwood Grobler, Vuyo Kahla, Moveshen Moodley, Sipho Abednego Nkosi and Katherine Harper does hereby constitute and appoint Paul Victor his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, in his or her name, place and stead, in any and all capacities (including his or her capacity as a director and/or officer of the registrant), to sign any and all amendments and post-effective amendments and supplements to this registration statement, and including any registration statement for the same offering that is to be effective upon filing pursuant to Rule 462(b) under the Securities Act, and to file the same, with all exhibits thereto and other documents in connection therewith, with the SEC, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Post-Effective Amendment No. 1 to the Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

Signature

|

|

Title

|

|

|

|

|

|

|

|

|

|

/s/ Fleetwood Grobler

|

|

Executive Director and President and Chief Executive Officer

|

|

August 24, 2020

|

|

Fleetwood Grobler

|

|

|

|

|

|

|

|

|

|

|

/s/ Paul Victor

|

|

Executive Director and

Chief Financial Officer

(Principal Financial Officer)

|

|

August 24, 2020

|

|

Paul Victor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Moveshen Moodley

|

|

Senior Vice President: Financial Control

Services

(Principal Accounting Officer)

|

|

August 24, 2020

|

|

Moveshen Moodley

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Vuyo Kahla

|

|

Executive Director and

Executive Vice President: Advisory,

Assurance and Supply Chain

|

|

August 24, 2020

|

|

Vuyo Kahla

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

|

|

August 24, 2020

|

|

Colin Beggs

|

|

Director

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

|

|

August 24, 2020

|

|

Manual Cuambe

|

|

Director

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

|

|

August 24, 2020

|

|

Nomgando Matyumza

|

|

Director

|

|

|

II-6

Table of Contents

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Moses Mkhize

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Peter Robertson

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Stephen Westwell

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Beatrix Kennealy

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Mpho Nkeli

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Muriel Dube

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Independent Non-Executive

Director

|

|

August 24, 2020

|

|

Martina Flöel

|

|

|

|

|

|

|

|

|

|

|

/s/ Sipho Abednego Nkosi

|

|

Independent Non-Executive

Director and Chairman

|

|

August 24, 2020

|

|

Sipho Abednego Nkosi

|

|

|

|

|

|

|

|

|

|

|

/s/ Katherine Harper

|

|

Independent Non-Executive

|

|

August 24, 2020

|

|

Katherine Harper

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jennifer Gallagher

|

|

Authorized Representative in the

United States

|

|

August 24, 2020

|

|

Jennifer Gallagher

|

|

|

|

*By:

|

/s/ Paul Victor

|

|

Attorney-in-fact

|

|

August 24, 2020

|

|

Paul Victor

|

|

|

|

|

II-7

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant, Sasol Financing USA LLC, a limited liability company organized and existing under the laws of the State of Delaware, certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form F-3 and has duly caused this this Post-Effective Amendment No. 1 to its registration statement on Form F-3 to be signed on its behalf by the undersigned, thereunto duly authorized, in Houston, Texas on the 24 day of August, 2020.

|

|

SASOL FINANCING USA LLC

|

|

|

|

|

|

By:

|

|

|

|

/s/ Paul Victor

|

|

|

|

Name:

|

Paul Victor

|

|

|

|

Title:

|

Authorized Signatory

|

Pursuant to the requirements of the Securities Act of 1933, this Post-Effective Amendment No. 1 to the Registration Statement has been signed by the following persons in the capacities and on the date indicated.

|

Signature

|

|

Title

|

|

|

|

|

|

|

|

|

|

*

|

|

Director and Chairman

|

|

August 24, 2020

|

|

Frederick Colin Meyer

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

August 24, 2020

|

|

Michael S. Thomas

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

August 24, 2020

|

|

Nina Stofberg

|

|

(Principal Financial Officer and Principal

|

|

|

|

|

|

Accounting Officer)

|

|

|

|

|

|

|

|

|

*By:

|

/s/ Paul Victor

|

|

Attorney-in-fact

|

|

August 24, 2020

|

|

Paul Victor

|

|

|

|

|

II-8

Table of Contents

EXHIBITS

|

Exhibit

Number

|

|

Description

|

|

*1.1

|

|

Form of underwriting agreement for guaranteed debt securities of Sasol Financing USA LLC.

|

|

*1.2

|

|

Form of underwriting agreement for equity securities of Sasol Limited.

|

|

4.1

|

|

Form of indenture for guaranteed debt securities of Sasol Financing USA LLC, among Sasol Financing USA LLC, as issuer, Sasol Limited, as guarantor, and Citibank, N.A., as trustee.(1)

|

|

4.2

|

|

Form of guaranteed fixed rate note of Sasol Financing USA LLC.(1)

|

|

*4.3

|

|

Form of letter of allocation to exercise rights to purchase ordinary shares.

|

|

4.4

|

|

Agreement of Resignation, Appointment and Acceptance, dated as of August 5, 2020, by and among Sasol Financing USA LLC, Sasol Limited, Citibank, N.A. and Wilmington Savings Fund Society, FSB.

|

|

5.1

|

|

Opinion of Shearman & Sterling (London) LLP, U.S. counsel, as to the validity of the debt securities.(1)

|

|

5.2

|

|

Opinion of Edward Nathan Sonnenbergs Inc., South African counsel to Sasol Limited, as to the validity of the debt securities.(1)

|

|

5.3

|

|

Opinion of Edward Nathan Sonnenbergs Inc., South African counsel to Sasol Limited, as to the validity of the ordinary shares and rights.

|

|

23.1

|

|

Consent of PricewaterhouseCoopers Inc., independent registered public accounting firm.

|

|

23.2

|

|

Consent of Shearman & Sterling (London) LLP (included in its opinion filed as Exhibit 5.1).

|

|

23.3

|

|

Consent of Edward Nathan Sonnenbergs Inc. (included in its opinions filed as Exhibit 5.2 and Exhibit 5.3).

|

|

24.1

|

|

Powers of Attorney (included on the signature pages).(1)

|

|

25.1

|

|

Statement of eligibility of Wilmington Savings Fund Society, FSB, as trustee, under the Trust Indenture Act of 1939 on Form T-1.

|

* To be filed on a Form 6-K depending on the nature of the offering, if any, pursuant to this registration statement.

(1) Previously filed with the Sasol Limited Registration Statement on Form F-3 on September 10, 2018.

II-9

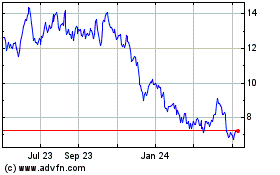

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

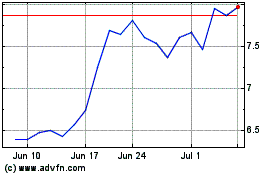

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024