SCHEDULE

OF INVESTMENTS

ROYCE

SMALL-CAP TRUST

SEPTEMBER

30, 2024 (UNAUDITED)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS – 98.4% | |

| | | |

| | |

| | |

| | | |

| | |

| Communication Services – 2.5% | |

| | | |

| | |

| Diversified Telecommunication Services - 0.2% | |

| | | |

| | |

| Cogent Communications Holdings 1 | |

| 18,181 | | |

$ | 1,380,301 | |

| IDT Corporation Cl. B | |

| 62,622 | | |

| 2,390,282 | |

| Liberty

Latin America Cl. C 1,2,3 | |

| 83,228 | | |

| 789,834 | |

| | |

| | | |

| 4,560,417 | |

| Entertainment - 0.3% | |

| | | |

| | |

| IMAX Corporation 3 | |

| 262,660 | | |

| 5,387,156 | |

| Interactive Media & Services - 1.6% | |

| | | |

| | |

| Cars.com 3 | |

| 182,200 | | |

| 3,053,672 | |

| QuinStreet 1,3 | |

| 203,754 | | |

| 3,897,814 | |

| Reddit Cl. A 3 | |

| 40,000 | | |

| 2,636,800 | |

| Shutterstock | |

| 83,950 | | |

| 2,969,312 | |

| TripAdvisor 3 | |

| 57,090 | | |

| 827,234 | |

| Yelp 3 | |

| 44,076 | | |

| 1,546,186 | |

| Ziff Davis 1,3 | |

| 359,944 | | |

| 17,514,875 | |

| | |

| | | |

| 32,445,893 | |

| Media - 0.4% | |

| | | |

| | |

| AMC Networks Cl. A 3 | |

| 129,951 | | |

| 1,129,274 | |

| John Wiley & Sons Cl. A | |

| 32,953 | | |

| 1,589,982 | |

| Scholastic Corporation | |

| 42,194 | | |

| 1,350,630 | |

| TechTarget 1,2,3 | |

| 30,000 | | |

| 733,500 | |

| Thryv Holdings 3 | |

| 133,046 | | |

| 2,292,383 | |

| | |

| | | |

| 7,095,769 | |

| Wireless Telecommunication Services - 0.0% | |

| | | |

| | |

| Gogo 3 | |

| 123,910 | | |

| 889,674 | |

| Total | |

| | | |

| 50,378,909 | |

| | |

| | | |

| | |

| Consumer Discretionary – 8.7% | |

| | | |

| | |

| Automobile Components - 1.8% | |

| | | |

| | |

| Dorman

Products 1,2,3 | |

| 128,067 | | |

| 14,486,939 | |

| Gentex Corporation 1 | |

| 66,445 | | |

| 1,972,752 | |

| LCI Industries 1 | |

| 83,706 | | |

| 10,089,921 | |

| Modine Manufacturing 3 | |

| 35,528 | | |

| 4,717,763 | |

| Patrick Industries 1 | |

| 31 | | |

| 4,414 | |

| PHINIA | |

| 15,109 | | |

| 695,467 | |

| Standard Motor Products | |

| 40,437 | | |

| 1,342,509 | |

| Visteon Corporation 3 | |

| 24,480 | | |

| 2,331,475 | |

| | |

| | | |

| 35,641,240 | |

| Broadline Retail - 0.2% | |

| | | |

| | |

| Ollie’s Bargain Outlet Holdings 3 | |

| 40,386 | | |

| 3,925,519 | |

| Diversified Consumer Services - 0.8% | |

| | | |

| | |

| Adtalem Global Education 3 | |

| 5,768 | | |

| 435,369 | |

| Bright Horizons Family Solutions 3 | |

| 4,000 | | |

| 560,520 | |

| Perdoceo Education | |

| 78,696 | | |

| 1,750,199 | |

| Stride 3 | |

| 26,578 | | |

| 2,267,369 | |

| Universal Technical Institute 3 | |

| 639,032 | | |

| 10,390,660 | |

| | |

| | | |

| 15,404,117 | |

| Hotels, Restaurants & Leisure - 0.3% | |

| | | |

| | |

| Bloomin’ Brands 1 | |

| 2,891 | | |

| 47,788 | |

| DraftKings Cl. A 3 | |

| 8,000 | | |

| 313,600 | |

| Kura Sushi USA Cl. A 3 | |

| 4,000 | | |

| 322,240 | |

| Lindblad Expeditions Holdings 3 | |

| 373,700 | | |

| 3,456,725 | |

| Monarch Casino & Resort | |

| 16,999 | | |

| 1,347,511 | |

| | |

| | | |

| 5,487,864 | |

| Household Durables - 1.1% | |

| | | |

| | |

| Cavco

Industries 1,2,3 | |

| 15,793 | | |

| 6,763,194 | |

| Champion Homes 3 | |

| 29,355 | | |

| 2,784,322 | |

| Ethan Allen Interiors 1 | |

| 13,459 | | |

| 429,208 | |

| Installed Building Products | |

| 13,696 | | |

| 3,372,914 | |

| M/I Homes 3 | |

| 30,246 | | |

| 5,182,955 | |

| Meritage Homes | |

| 7,562 | | |

| 1,550,739 | |

| Tri Pointe Homes 3 | |

| 35,532 | | |

| 1,609,955 | |

| Worthington Enterprises | |

| 35,681 | | |

| 1,478,977 | |

| | |

| | | |

| 23,172,264 | |

| Leisure Products - 0.4% | |

| | | |

| | |

| Brunswick Corporation 1 | |

| 48,749 | | |

| 4,086,141 | |

| Vista Outdoor 3 | |

| 13,132 | | |

| 514,512 | |

| YETI Holdings 3 | |

| 90,078 | | |

| 3,695,900 | |

| | |

| | | |

| 8,296,553 | |

| Specialty Retail - 3.4% | |

| | | |

| | |

| Abercrombie & Fitch Cl. A 3 | |

| 7,457 | | |

| 1,043,234 | |

| Academy Sports & Outdoors | |

| 190,100 | | |

| 11,094,236 | |

| Advance Auto Parts | |

| 178,950 | | |

| 6,977,261 | |

| American Eagle Outfitters | |

| 29,343 | | |

| 656,990 | |

| America’s

Car-Mart 1,2,3 | |

| 87,700 | | |

| 3,676,384 | |

| Asbury Automotive Group 3 | |

| 15,500 | | |

| 3,698,145 | |

| AutoCanada 3 | |

| 625,600 | | |

| 7,442,718 | |

| Guess? | |

| 49,808 | | |

| 1,002,635 | |

| Monro | |

| 41,756 | | |

| 1,205,078 | |

| Murphy USA | |

| 15,803 | | |

| 7,788,825 | |

| ODP Corporation (The) 3 | |

| 32,067 | | |

| 953,993 | |

| 1-800-FLOWERS.COM Cl. A 3 | |

| 76,000 | | |

| 602,680 | |

| OneWater Marine Cl. A 3 | |

| 209,873 | | |

| 5,018,063 | |

| Signet Jewelers | |

| 94,382 | | |

| 9,734,560 | |

| Valvoline 3 | |

| 204,548 | | |

| 8,560,334 | |

| | |

| | | |

| 69,455,136 | |

| Textiles, Apparel & Luxury Goods - 0.7% | |

| | | |

| | |

| Carter’s | |

| 32,352 | | |

| 2,102,233 | |

| G-III Apparel Group 3 | |

| 33,186 | | |

| 1,012,837 | |

| Kontoor Brands | |

| 16,895 | | |

| 1,381,673 | |

| Movado Group | |

| 91,275 | | |

| 1,697,715 | |

| Ralph Lauren Cl. A | |

| 14,350 | | |

| 2,782,034 | |

| Steven Madden | |

| 112,321 | | |

| 5,502,606 | |

| | |

| | | |

| 14,479,098 | |

| Total | |

| | | |

| 175,861,791 | |

| | |

| | | |

| | |

| Consumer Staples – 2.0% | |

| | | |

| | |

| Beverages - 0.1% | |

| | | |

| | |

| Celsius Holdings 3 | |

| 1,000 | | |

| 31,360 | |

| Primo Water | |

| 88,896 | | |

| 2,244,624 | |

| | |

| | | |

| 2,275,984 | |

| Consumer Staples Distribution & Retail - 0.1% | |

| | | |

| | |

| PriceSmart | |

| 24,094 | | |

| 2,211,347 | |

| Food Products - 1.2% | |

| | | |

| | |

| Cal-Maine Foods | |

| 7,633 | | |

| 571,254 | |

| Freshpet 1,3 | |

| 3,500 | | |

| 478,695 | |

| John B. Sanfilippo & Son | |

| 17,763 | | |

| 1,675,228 | |

| Nomad Foods 1 | |

| 486,865 | | |

| 9,279,647 | |

| Seneca Foods Cl. A 3 | |

| 183,460 | | |

| 11,435,062 | |

| WK Kellogg | |

| 71,987 | | |

| 1,231,697 | |

| | |

| | | |

| 24,671,583 | |

| Household Products - 0.1% | |

| | | |

| | |

| Central Garden & Pet 3 | |

| 28,350 | | |

| 1,033,924 | |

| Central Garden & Pet Cl. A 3 | |

| 3,379 | | |

| 106,101 | |

| WD-40 Company | |

| 1,799 | | |

| 463,926 | |

| | |

| | | |

| 1,603,951 | |

| Personal Care Products - 0.5% | |

| | | |

| | |

| Inter Parfums 1 | |

| 67,092 | | |

| 8,687,072 | |

| USANA Health Sciences 3 | |

| 30,892 | | |

| 1,171,425 | |

| | |

| | | |

| 9,858,497 | |

| Tobacco - 0.0% | |

| | | |

| | |

| Universal Corporation | |

| 11,105 | | |

| 589,787 | |

| Total | |

| | | |

| 41,211,149 | |

| | |

| | | |

| | |

| Energy – 2.0% | |

| | | |

| | |

| Energy Equipment & Services - 1.1% | |

| | | |

| | |

| Bristow Group 1,3 | |

| 219,464 | | |

| 7,613,206 | |

| Cactus Cl. A | |

| 10,960 | | |

| 653,983 | |

| Core Laboratories 1 | |

| 108,413 | | |

| 2,008,893 | |

| Helmerich & Payne | |

| 31,688 | | |

| 963,949 | |

| Liberty Energy Cl. A | |

| 47,855 | | |

| 913,552 | |

| Pason Systems | |

| 901,197 | | |

| 8,882,366 | |

| RPC | |

| 248,385 | | |

| 1,579,729 | |

| Tidewater 3 | |

| 2,750 | | |

| 197,422 | |

| | |

| | | |

| 22,813,100 | |

| Oil, Gas & Consumable Fuels - 0.9% | |

| | | |

| | |

| California Resources | |

| 21,286 | | |

| 1,116,877 | |

| CONSOL Energy 1 | |

| 8,628 | | |

| 902,920 | |

| Crescent Energy Cl. A | |

| 92,678 | | |

| 1,014,824 | |

| CVR Energy | |

| 93,631 | | |

| 2,156,322 | |

| Dorchester Minerals L.P. 1 | |

| 279,148 | | |

| 8,416,312 | |

| Matador Resources | |

| 19,580 | | |

| 967,644 | |

| Northern Oil & Gas | |

| 26,470 | | |

| 937,303 | |

| Par Pacific Holdings 3 | |

| 11,457 | | |

| 201,643 | |

| REX American Resources 3 | |

| 30,990 | | |

| 1,434,527 | |

| | |

| | | |

| 17,148,372 | |

| Total | |

| | | |

| 39,961,472 | |

| | |

| | | |

| | |

| Financials – 19.6% | |

| | | |

| | |

| Banks - 4.0% | |

| | | |

| | |

| Atlantic Union Bankshares | |

| 36,000 | | |

| 1,356,120 | |

| Axos Financial 3 | |

| 22,919 | | |

| 1,441,147 | |

| Banc of California | |

| 230,698 | | |

| 3,398,181 | |

| Bank of N.T. Butterfield & Son 1 | |

| 226,503 | | |

| 8,353,431 | |

| BankUnited 1 | |

| 262,336 | | |

| 9,559,524 | |

| Cathay General Bancorp | |

| 44,805 | | |

| 1,924,375 | |

| Central Pacific Financial | |

| 26,738 | | |

| 789,038 | |

| Customers Bancorp 3 | |

| 23,423 | | |

| 1,087,998 | |

| Dime Community Bancshares | |

| 19,002 | | |

| 547,258 | |

| Eagle Bancorp | |

| 59,998 | | |

| 1,354,755 | |

| First Bancorp | |

| 14,000 | | |

| 582,260 | |

| First Citizens BancShares Cl. A | |

| 5,087 | | |

| 9,364,913 | |

| First Commonwealth Financial | |

| 39,517 | | |

| 677,717 | |

| First Financial Bancorp | |

| 80,853 | | |

| 2,039,921 | |

| Fulton Financial | |

| 39,362 | | |

| 713,633 | |

| Hanmi Financial | |

| 184,712 | | |

| 3,435,643 | |

| HBT Financial | |

| 20,000 | | |

| 437,600 | |

| Hingham Institution for Savings | |

| 14,999 | | |

| 3,649,407 | |

| Home BancShares | |

| 152,117 | | |

| 4,120,849 | |

| Hope Bancorp | |

| 49,189 | | |

| 617,814 | |

| OceanFirst Financial | |

| 40,266 | | |

| 748,545 | |

| OFG Bancorp | |

| 2,076 | | |

| 93,254 | |

| Origin Bancorp | |

| 231,986 | | |

| 7,460,670 | |

| Pathward Financial | |

| 12,614 | | |

| 832,650 | |

| Preferred Bank | |

| 21,970 | | |

| 1,763,092 | |

| Provident Financial Services | |

| 41,284 | | |

| 766,231 | |

| S&T Bancorp | |

| 41,545 | | |

| 1,743,644 | |

| Seacoast Banking Corporation of Florida | |

| 15,500 | | |

| 413,075 | |

| TowneBank | |

| 20,000 | | |

| 661,200 | |

| TrustCo Bank Corp NY | |

| 15,835 | | |

| 523,663 | |

| Veritex Holdings | |

| 31,816 | | |

| 837,397 | |

| WaFd | |

| 32,663 | | |

| 1,138,306 | |

| Westamerica Bancorporation | |

| 19,170 | | |

| 947,381 | |

| Western Alliance Bancorp 1 | |

| 71,738 | | |

| 6,204,620 | |

| WSFS Financial | |

| 29,681 | | |

| 1,513,434 | |

| | |

| | | |

| 81,098,746 | |

| Capital Markets - 6.8% | |

| | | |

| | |

| Ares Management Cl. A 1 | |

| 34,800 | | |

| 5,423,232 | |

| Artisan Partners Asset Management Cl. A 1 | |

| 244,515 | | |

| 10,592,390 | |

| Bolsa Mexicana de Valores | |

| 1,723,106 | | |

| 2,788,999 | |

| BrightSphere Investment Group | |

| 45,916 | | |

| 1,166,266 | |

| Brookfield Asset Management Cl. A | |

| 7,378 | | |

| 348,906 | |

| Cohen & Steers | |

| 8,369 | | |

| 803,006 | |

| Donnelley

Financial Solutions 1,2,3 | |

| 35,500 | | |

| 2,336,965 | |

| Evercore Cl. A | |

| 26,511 | | |

| 6,716,297 | |

| GCM Grosvenor Cl. A | |

| 801,494 | | |

| 9,072,912 | |

| Houlihan Lokey Cl. A 1 | |

| 32,953 | | |

| 5,207,233 | |

| Lazard 1 | |

| 104,915 | | |

| 5,285,618 | |

| Marex Group | |

| 256,417 | | |

| 6,056,569 | |

| MarketWise Cl. A | |

| 500,000 | | |

| 334,150 | |

| Morningstar 1 | |

| 15,516 | | |

| 4,951,466 | |

| Onex Corporation | |

| 171,437 | | |

| 12,008,005 | |

| Perella Weinberg Partners Cl. A | |

| 196,149 | | |

| 3,787,637 | |

| SEI Investments 1 | |

| 324,994 | | |

| 22,486,335 | |

| Silvercrest Asset Management Group Cl. A | |

| 27,000 | | |

| 465,480 | |

| Sprott | |

| 264,413 | | |

| 11,458,646 | |

| Tel Aviv Stock Exchange 4 | |

| 221,179 | | |

| 2,092,386 | |

| TMX Group | |

| 478,421 | | |

| 14,995,206 | |

| Tradeweb Markets Cl. A | |

| 53,197 | | |

| 6,578,873 | |

| Virtu Financial Cl. A | |

| 65,000 | | |

| 1,979,900 | |

| | |

| | | |

| 136,936,477 | |

| Consumer Finance - 1.1% | |

| | | |

| | |

| Bread Financial Holdings 1 | |

| 113,616 | | |

| 5,405,849 | |

| Encore

Capital Group 1,2,3 | |

| 25,000 | | |

| 1,181,750 | |

| Enova International 3 | |

| 61,604 | | |

| 5,161,799 | |

| FirstCash Holdings | |

| 47,183 | | |

| 5,416,609 | |

| PRA Group 3 | |

| 98,876 | | |

| 2,210,867 | |

| PROG Holdings | |

| 37,270 | | |

| 1,807,222 | |

| World Acceptance 3 | |

| 4,624 | | |

| 545,540 | |

| | |

| | | |

| 21,729,636 | |

| Financial Services - 1.6% | |

| | | |

| | |

| Banco Latinoamericano de Comercio Exterior Cl. E | |

| 73,446 | | |

| 2,386,261 | |

| Burford Capital | |

| 175,000 | | |

| 2,320,500 | |

| Compass

Diversified Holdings 1,2 | |

| 99,872 | | |

| 2,210,167 | |

| ECN Capital | |

| 888,800 | | |

| 1,445,791 | |

| EVERTEC | |

| 9,593 | | |

| 325,107 | |

| Jackson Financial | |

| 9,318 | | |

| 850,081 | |

| Merchants Bancorp | |

| 58,992 | | |

| 2,652,280 | |

| NCR Atleos 3 | |

| 21,973 | | |

| 626,890 | |

| NewtekOne | |

| 314,894 | | |

| 3,923,579 | |

| NMI Holdings 3 | |

| 133,007 | | |

| 5,478,558 | |

| Payoneer Global 3 | |

| 209,925 | | |

| 1,580,735 | |

| Radian Group | |

| 83,689 | | |

| 2,903,171 | |

| Repay Holdings Cl. A 3 | |

| 146,697 | | |

| 1,197,048 | |

| Shift4 Payments Cl. A 3 | |

| 50,000 | | |

| 4,430,000 | |

| WEX 3 | |

| 5,470 | | |

| 1,147,223 | |

| | |

| | | |

| 33,477,391 | |

| Insurance - 6.1% | |

| | | |

| | |

| Abacus Life 3 | |

| 40,000 | | |

| 404,800 | |

| Ambac Financial Group 3 | |

| 36,919 | | |

| 413,862 | |

| Assured Guaranty | |

| 323,561 | | |

| 25,729,571 | |

| Axis Capital Holdings | |

| 45,304 | | |

| 3,606,652 | |

| Berkley (W.R.) | |

| 110,054 | | |

| 6,243,363 | |

| E-L Financial | |

| 21,650 | | |

| 19,209,583 | |

| Employers Holdings | |

| 34,393 | | |

| 1,649,832 | |

| Erie Indemnity Cl. A | |

| 22,600 | | |

| 12,199,932 | |

| First American Financial | |

| 20,000 | | |

| 1,320,200 | |

| Genworth Financial 3 | |

| 233,645 | | |

| 1,600,468 | |

| Hagerty Cl. A 3 | |

| 485,700 | | |

| 4,939,569 | |

| HCI Group | |

| 5,371 | | |

| 575,019 | |

| International General Insurance Holdings | |

| 566,599 | | |

| 10,765,381 | |

| Lincoln National | |

| 37,296 | | |

| 1,175,197 | |

| ProAssurance

Corporation 1,2,3 | |

| 298,675 | | |

| 4,492,072 | |

| RenaissanceRe Holdings | |

| 29,646 | | |

| 8,075,570 | |

| RLI Corp. 1 | |

| 37,118 | | |

| 5,752,548 | |

| SiriusPoint 3 | |

| 132,883 | | |

| 1,905,542 | |

| Skyward Specialty Insurance Group 3 | |

| 19,596 | | |

| 798,145 | |

| White Mountains Insurance Group | |

| 7,074 | | |

| 11,998,919 | |

| | |

| | | |

| 122,856,225 | |

| Total | |

| | | |

| 396,098,475 | |

| | |

| | | |

| | |

| Health Care – 10.7% | |

| | | |

| | |

| Biotechnology - 1.5% | |

| | | |

| | |

| Alkermes 3 | |

| 52,628 | | |

| 1,473,058 | |

| Alvotech 3 | |

| 19,000 | | |

| 226,100 | |

| ARS Pharmaceuticals 3 | |

| 63,500 | | |

| 920,750 | |

| Avid Bioservices 3 | |

| 246,500 | | |

| 2,805,170 | |

| BridgeBio Pharma 3 | |

| 65,201 | | |

| 1,660,018 | |

| Catalyst Pharmaceuticals 3 | |

| 502,207 | | |

| 9,983,875 | |

| Dynavax Technologies 3 | |

| 99,453 | | |

| 1,107,906 | |

| Halozyme Therapeutics 3 | |

| 27,950 | | |

| 1,599,858 | |

| Insmed 3 | |

| 50,735 | | |

| 3,703,655 | |

| Ironwood Pharmaceuticals Cl. A 3 | |

| 650,242 | | |

| 2,678,997 | |

| PureTech Health 3,4 | |

| 120,000 | | |

| 235,905 | |

| United Therapeutics 3 | |

| 10,000 | | |

| 3,583,500 | |

| Viking Therapeutics 3 | |

| 7,093 | | |

| 449,058 | |

| | |

| | | |

| 30,427,850 | |

| Health Care Equipment & Supplies - 4.2% | |

| | | |

| | |

| Alphatec Holdings 3 | |

| 419,219 | | |

| 2,330,858 | |

| Embecta Corp. | |

| 62,659 | | |

| 883,492 | |

| Enovis Corporation 3 | |

| 572,942 | | |

| 24,665,153 | |

| Envista Holdings 3 | |

| 80,706 | | |

| 1,594,751 | |

| Haemonetics Corporation 3 | |

| 263,752 | | |

| 21,200,386 | |

| Integer

Holdings 1,2,3 | |

| 45,700 | | |

| 5,941,000 | |

| Omnicell 3 | |

| 14,958 | | |

| 652,169 | |

| OraSure Technologies 3 | |

| 71,524 | | |

| 305,407 | |

| QuidelOrtho Corporation 3 | |

| 37,679 | | |

| 1,718,162 | |

| RxSight 3 | |

| 25,215 | | |

| 1,246,377 | |

| TransMedics Group 3 | |

| 150,000 | | |

| 23,550,000 | |

| Varex Imaging 3 | |

| 37,500 | | |

| 447,000 | |

| | |

| | | |

| 84,534,755 | |

| Health Care Providers & Services - 1.1% | |

| | | |

| | |

| Addus HomeCare 1,3 | |

| 7,784 | | |

| 1,035,505 | |

| AMN

Healthcare Services 1,2,3 | |

| 20,474 | | |

| 867,893 | |

| Astrana Health 3 | |

| 11,940 | | |

| 691,804 | |

| CorVel Corporation 3 | |

| 960 | | |

| 313,814 | |

| Cross Country Healthcare 3 | |

| 127,100 | | |

| 1,708,224 | |

| Hims & Hers Health Cl. A 3 | |

| 38,000 | | |

| 699,960 | |

| Owens & Minor 3 | |

| 73,829 | | |

| 1,158,377 | |

| PACS Group 3 | |

| 17,648 | | |

| 705,391 | |

| Pediatrix Medical Group 3 | |

| 183,828 | | |

| 2,130,567 | |

| Premier Cl. A | |

| 21,293 | | |

| 425,860 | |

| Select Medical Holdings | |

| 95,900 | | |

| 3,344,033 | |

| Surgery Partners 3 | |

| 272,205 | | |

| 8,775,889 | |

| | |

| | | |

| 21,857,317 | |

| Health Care Technology - 0.3% | |

| | | |

| | |

| Evolent Health Cl. A 3 | |

| 20,000 | | |

| 565,600 | |

| Simulations Plus 1 | |

| 74,858 | | |

| 2,396,953 | |

| Veradigm 3,5 | |

| 232,501 | | |

| 2,255,260 | |

| | |

| | | |

| 5,217,813 | |

| Life Sciences Tools & Services - 2.4% | |

| | | |

| | |

| Azenta 1,2,3 | |

| 295,120 | | |

| 14,295,613 | |

| BioLife Solutions 3 | |

| 142,252 | | |

| 3,561,990 | |

| Bio-Techne 1 | |

| 130,411 | | |

| 10,423,751 | |

| Maravai LifeSciences Holdings Cl. A 3 | |

| 476,346 | | |

| 3,958,435 | |

| Mesa Laboratories 1 | |

| 102,093 | | |

| 13,257,797 | |

| Stevanato Group | |

| 172,899 | | |

| 3,457,980 | |

| | |

| | | |

| 48,955,566 | |

| Pharmaceuticals - 1.2% | |

| | | |

| | |

| Amphastar Pharmaceuticals 3 | |

| 6,630 | | |

| 321,754 | |

| Axsome Therapeutics 3 | |

| 5,000 | | |

| 449,350 | |

| Collegium Pharmaceutical 3 | |

| 40,441 | | |

| 1,562,640 | |

| Corcept Therapeutics 3 | |

| 280,800 | | |

| 12,995,424 | |

| Harmony

Biosciences Holdings 1,2,3 | |

| 75,070 | | |

| 3,002,800 | |

| Innoviva 3 | |

| 49,627 | | |

| 958,298 | |

| Intra-Cellular Therapies 3 | |

| 10,000 | | |

| 731,700 | |

| Ligand Pharmaceuticals 3 | |

| 4,659 | | |

| 466,319 | |

| Prestige Consumer Healthcare 3 | |

| 56,300 | | |

| 4,059,230 | |

| | |

| | | |

| 24,547,515 | |

| Total | |

| | | |

| 215,540,816 | |

| | |

| | | |

| | |

| Industrials – 25.3% | |

| | | |

| | |

| Aerospace & Defense - 1.6% | |

| | | |

| | |

| AeroVironment 3 | |

| 2,000 | | |

| 401,000 | |

| HEICO

Corporation 1,2 | |

| 31,030 | | |

| 8,113,724 | |

| HEICO Corporation Cl. A 1 | |

| 36,533 | | |

| 7,443,964 | |

| Leonardo DRS 3 | |

| 371,340 | | |

| 10,479,215 | |

| Magellan Aerospace | |

| 943,092 | | |

| 6,478,114 | |

| National Presto Industries | |

| 6,844 | | |

| 514,258 | |

| | |

| | | |

| 33,430,275 | |

| Air Freight & Logistics - 0.3% | |

| | | |

| | |

| Forward Air 1,3 | |

| 81,064 | | |

| 2,869,666 | |

| Hub Group Cl. A | |

| 50,596 | | |

| 2,299,588 | |

| | |

| | | |

| 5,169,254 | |

| Building Products - 2.0% | |

| | | |

| | |

| American Woodmark 3 | |

| 13,078 | | |

| 1,222,139 | |

| Apogee Enterprises | |

| 22,197 | | |

| 1,554,123 | |

| AZZ 1 | |

| 20,000 | | |

| 1,652,200 | |

| Carlisle Companies | |

| 9,400 | | |

| 4,227,650 | |

| CSW Industrials | |

| 45,000 | | |

| 16,487,550 | |

| Gibraltar Industries 3 | |

| 22,028 | | |

| 1,540,418 | |

| Insteel Industries | |

| 13,432 | | |

| 417,601 | |

| Janus International Group 3 | |

| 271,838 | | |

| 2,748,282 | |

| MasterBrand 3 | |

| 89,549 | | |

| 1,660,238 | |

| Quanex Building Products | |

| 16,702 | | |

| 463,481 | |

| Resideo Technologies 3 | |

| 20,988 | | |

| 422,698 | |

| Simpson Manufacturing 1 | |

| 14,900 | | |

| 2,849,923 | |

| UFP Industries | |

| 33,241 | | |

| 4,361,552 | |

| | |

| | | |

| 39,607,855 | |

| Commercial Services & Supplies - 2.1% | |

| | | |

| | |

| ACV Auctions Cl. A 3 | |

| 128,800 | | |

| 2,618,504 | |

| Brady Corporation Cl. A 1 | |

| 269,610 | | |

| 20,660,214 | |

| CompX International Cl. A 1 | |

| 183,197 | | |

| 5,351,185 | |

| Healthcare Services Group 3 | |

| 350,541 | | |

| 3,915,543 | |

| Liquidity Services 3 | |

| 16,780 | | |

| 382,584 | |

| Montrose Environmental Group 3 | |

| 78,167 | | |

| 2,055,792 | |

| RB Global 1 | |

| 40,437 | | |

| 3,254,774 | |

| UniFirst Corporation | |

| 10,100 | | |

| 2,006,365 | |

| Vestis Corporation | |

| 129,942 | | |

| 1,936,136 | |

| VSE Corporation | |

| 7,500 | | |

| 620,475 | |

| | |

| | | |

| 42,801,572 | |

| Construction & Engineering - 5.0% | |

| | | |

| | |

| APi

Group 1,2,3 | |

| 492,120 | | |

| 16,249,803 | |

| Arcosa 1 | |

| 201,429 | | |

| 19,087,412 | |

| Badger Infrastructure Solutions | |

| 15,127 | | |

| 411,268 | |

| Bowman Consulting Group 3 | |

| 6,705 | | |

| 161,457 | |

| Comfort Systems USA 1 | |

| 2,838 | | |

| 1,107,813 | |

| EMCOR Group | |

| 2,095 | | |

| 901,960 | |

| IES

Holdings 1,2,3 | |

| 193,468 | | |

| 38,620,082 | |

| Limbach Holdings 3 | |

| 54,936 | | |

| 4,161,951 | |

| MasTec 3 | |

| 78,980 | | |

| 9,722,438 | |

| Valmont Industries 1 | |

| 31,492 | | |

| 9,131,106 | |

| WillScot Holdings 3 | |

| 50,000 | | |

| 1,880,000 | |

| | |

| | | |

| 101,435,290 | |

| Electrical Equipment - 2.0% | |

| | | |

| | |

| Atkore | |

| 66,287 | | |

| 5,617,160 | |

| LSI Industries | |

| 496,657 | | |

| 8,021,011 | |

| Nextracker Cl. A 3 | |

| 25,831 | | |

| 968,146 | |

| nVent Electric | |

| 53,554 | | |

| 3,762,704 | |

| Powell Industries | |

| 62,377 | | |

| 13,847,070 | |

| Preformed Line Products | |

| 32,816 | | |

| 4,203,073 | |

| Vertiv Holdings Cl. A | |

| 48,194 | | |

| 4,794,821 | |

| | |

| | | |

| 41,213,985 | |

| Ground Transportation - 0.4% | |

| | | |

| | |

| ArcBest Corporation | |

| 681 | | |

| 73,855 | |

| Hertz Global Holdings 3 | |

| 220,614 | | |

| 728,026 | |

| Landstar System 1 | |

| 39,397 | | |

| 7,440,911 | |

| | |

| | | |

| 8,242,792 | |

| Machinery - 5.2% | |

| | | |

| | |

| Atmus Filtration Technologies | |

| 225,784 | | |

| 8,473,674 | |

| ATS Corporation 3 | |

| 12,000 | | |

| 348,168 | |

| Enpro | |

| 37,994 | | |

| 6,161,867 | |

| ESAB Corporation 1 | |

| 145,947 | | |

| 15,515,626 | |

| ESCO Technologies 1 | |

| 60,334 | | |

| 7,781,879 | |

| Helios Technologies 1 | |

| 44,900 | | |

| 2,141,730 | |

| John Bean Technologies 1 | |

| 168,146 | | |

| 16,564,062 | |

| Kadant 1 | |

| 30,651 | | |

| 10,360,038 | |

| Lincoln Electric Holdings 1 | |

| 5,225 | | |

| 1,003,305 | |

| Lindsay Corporation 1 | |

| 63,313 | | |

| 7,891,332 | |

| Miller Industries | |

| 55,372 | | |

| 3,377,692 | |

| Mueller Industries 1 | |

| 28,657 | | |

| 2,123,484 | |

| RBC Bearings 3 | |

| 5,200 | | |

| 1,556,776 | |

| Standex International | |

| 5,650 | | |

| 1,032,707 | |

| Tennant Company 1 | |

| 80,500 | | |

| 7,731,220 | |

| Timken Company (The) | |

| 17,072 | | |

| 1,438,999 | |

| Titan International 3 | |

| 87,873 | | |

| 714,407 | |

| Wabash National | |

| 64,415 | | |

| 1,236,124 | |

| Watts Water Technologies Cl. A 1 | |

| 46,400 | | |

| 9,613,616 | |

| | |

| | | |

| 105,066,706 | |

| Marine Transportation - 0.5% | |

| | | |

| | |

| Kirby Corporation 3 | |

| 70,349 | | |

| 8,612,828 | |

| Matson | |

| 4,777 | | |

| 681,296 | |

| | |

| | | |

| 9,294,124 | |

| Passenger Airlines - 0.1% | |

| | | |

| | |

| SkyWest 3 | |

| 13,677 | | |

| 1,162,819 | |

| Professional Services - 2.2% | |

| | | |

| | |

| Amentum Holdings 3 | |

| 22,500 | | |

| 725,625 | |

| CBIZ 1,3 | |

| 104,465 | | |

| 7,029,450 | |

| CSG Systems International | |

| 7,045 | | |

| 342,739 | |

| Dun & Bradstreet Holdings | |

| 356,363 | | |

| 4,101,738 | |

| Exponent | |

| 18,935 | | |

| 2,182,827 | |

| Forrester

Research 1,2,3 | |

| 367,728 | | |

| 6,622,781 | |

| Heidrick & Struggles International | |

| 12,944 | | |

| 503,004 | |

| Jacobs Solutions 1 | |

| 22,500 | | |

| 2,945,250 | |

| KBR 1 | |

| 139,154 | | |

| 9,063,100 | |

| Korn Ferry 1 | |

| 111,976 | | |

| 8,425,074 | |

| Paylocity Holding 3 | |

| 3,000 | | |

| 494,910 | |

| Resources Connection | |

| 80,720 | | |

| 782,984 | |

| Robert Half | |

| 11,685 | | |

| 787,686 | |

| Verra Mobility Cl. A 3 | |

| 48,078 | | |

| 1,337,049 | |

| | |

| | | |

| 45,344,217 | |

| Trading Companies & Distributors - 3.9% | |

| | | |

| | |

| Air Lease Cl. A 1 | |

| 456,365 | | |

| 20,668,771 | |

| Applied Industrial Technologies | |

| 30,658 | | |

| 6,840,719 | |

| Boise Cascade 1 | |

| 12,328 | | |

| 1,738,001 | |

| Distribution Solutions Group 3 | |

| 96,456 | | |

| 3,714,520 | |

| DNOW 3 | |

| 44,987 | | |

| 581,682 | |

| FTAI Aviation | |

| 134,581 | | |

| 17,885,815 | |

| GMS 3 | |

| 6,826 | | |

| 618,231 | |

| MSC Industrial Direct Cl. A | |

| 30,476 | | |

| 2,622,765 | |

| Teqnion 3,4 | |

| 191,300 | | |

| 3,616,899 | |

| Transcat 3 | |

| 149,849 | | |

| 18,097,264 | |

| WESCO International | |

| 18,450 | | |

| 3,099,231 | |

| | |

| | | |

| 79,483,898 | |

| Total | |

| | | |

| 512,252,787 | |

| | |

| | | |

| | |

| Information Technology – 16.4% | |

| | | |

| | |

| Communications Equipment - 0.7% | |

| | | |

| | |

| Ciena Corporation 3 | |

| 63,205 | | |

| 3,892,796 | |

| Digi International 3 | |

| 54,973 | | |

| 1,513,407 | |

| Extreme Networks 3 | |

| 105,229 | | |

| 1,581,592 | |

| Harmonic 3 | |

| 337,031 | | |

| 4,910,541 | |

| NetScout Systems 3 | |

| 66,785 | | |

| 1,452,574 | |

| | |

| | | |

| 13,350,910 | |

| Electronic Equipment, Instruments & Components - 7.4% | |

| | | |

| | |

| Badger Meter | |

| 2,699 | | |

| 589,489 | |

| Bel Fuse Cl. B | |

| 34,676 | | |

| 2,722,413 | |

| Benchmark Electronics | |

| 24,534 | | |

| 1,087,347 | |

| Cognex Corporation 1 | |

| 347,683 | | |

| 14,081,161 | |

| Coherent Corp. 1,3 | |

| 110,820 | | |

| 9,853,006 | |

| Crane NXT | |

| 145,166 | | |

| 8,143,813 | |

| CTS Corporation | |

| 25,889 | | |

| 1,252,510 | |

| ePlus 3 | |

| 16,390 | | |

| 1,611,793 | |

| Fabrinet 1,2,3 | |

| 58,093 | | |

| 13,735,509 | |

| FARO

Technologies 1,2,3 | |

| 228,848 | | |

| 4,380,151 | |

| Insight Enterprises 3 | |

| 12,048 | | |

| 2,595,019 | |

| IPG Photonics 3 | |

| 51,100 | | |

| 3,797,752 | |

| Kimball Electronics 1,3 | |

| 37,454 | | |

| 693,273 | |

| Littelfuse 1 | |

| 34,070 | | |

| 9,037,067 | |

| Luna Innovations 3 | |

| 657,869 | | |

| 1,545,992 | |

| Methode Electronics | |

| 2,572 | | |

| 30,761 | |

| Mirion Technologies Cl. A 3 | |

| 267,000 | | |

| 2,955,690 | |

| NAPCO Security Technologies | |

| 168,430 | | |

| 6,814,678 | |

| PAR Technology 1,2,3 | |

| 385,239 | | |

| 20,063,247 | |

| PC Connection | |

| 27,284 | | |

| 2,058,032 | |

| Richardson Electronics | |

| 433,407 | | |

| 5,348,242 | |

| Rogers Corporation 3 | |

| 120,795 | | |

| 13,651,043 | |

| Sanmina Corporation 3 | |

| 56,639 | | |

| 3,876,939 | |

| ScanSource 3 | |

| 20,505 | | |

| 984,855 | |

| Teledyne Technologies 3 | |

| 9,660 | | |

| 4,227,796 | |

| TTM

Technologies 1,2,3 | |

| 341,192 | | |

| 6,226,754 | |

| Vishay Intertechnology | |

| 29,900 | | |

| 565,409 | |

| Vishay Precision Group 3 | |

| 76,353 | | |

| 1,977,543 | |

| Vontier Corporation | |

| 172,365 | | |

| 5,815,595 | |

| | |

| | | |

| 149,722,879 | |

| IT Services - 0.9% | |

| | | |

| | |

| DXC Technology 3 | |

| 81,329 | | |

| 1,687,577 | |

| Hackett Group (The) 1 | |

| 392,058 | | |

| 10,299,364 | |

| Kyndryl Holdings 3 | |

| 289,529 | | |

| 6,653,376 | |

| | |

| | | |

| 18,640,317 | |

| Semiconductors & Semiconductor Equipment - 5.6% | |

| | | |

| | |

| Allegro MicroSystems 3 | |

| 3,821 | | |

| 89,029 | |

| Axcelis Technologies 3 | |

| 52,394 | | |

| 5,493,511 | |

| Camtek | |

| 50,480 | | |

| 4,030,828 | |

| Cirrus Logic 1,3 | |

| 78,775 | | |

| 9,784,643 | |

| Cohu 1,2,3 | |

| 124,992 | | |

| 3,212,294 | |

| Diodes 1,2,3 | |

| 82,585 | | |

| 5,292,873 | |

| FormFactor 3 | |

| 176,754 | | |

| 8,130,684 | |

| Impinj 1,2,3 | |

| 138,411 | | |

| 29,968,750 | |

| Kulicke & Soffa Industries 1 | |

| 107,092 | | |

| 4,833,062 | |

| MaxLinear 3 | |

| 17,037 | | |

| 246,696 | |

| MKS Instruments | |

| 80,991 | | |

| 8,804,532 | |

| Nova 3 | |

| 20,340 | | |

| 4,237,635 | |

| Onto

Innovation 1,2,3 | |

| 57,596 | | |

| 11,954,626 | |

| PDF Solutions 3 | |

| 12,000 | | |

| 380,160 | |

| Photronics 3 | |

| 240,517 | | |

| 5,955,201 | |

| Rambus 3 | |

| 2,239 | | |

| 94,530 | |

| Semtech Corporation 3 | |

| 10,500 | | |

| 479,430 | |

| Silicon Laboratories 3 | |

| 4,000 | | |

| 462,280 | |

| Silicon Motion Technology ADR | |

| 7,792 | | |

| 473,286 | |

| SiTime Corporation 3 | |

| 4,611 | | |

| 790,833 | |

| SMART Global Holdings 3 | |

| 13,670 | | |

| 286,386 | |

| Synaptics 3 | |

| 4,007 | | |

| 310,863 | |

| Ultra Clean Holdings 3 | |

| 185,283 | | |

| 7,398,350 | |

| | |

| | | |

| 112,710,482 | |

| Software - 1.8% | |

| | | |

| | |

| Adeia 1 | |

| 134,193 | | |

| 1,598,239 | |

| Agilysys 1,3 | |

| 69,787 | | |

| 7,604,689 | |

| Alkami Technology 1,3 | |

| 30,292 | | |

| 955,410 | |

| Computer Modelling Group | |

| 614,611 | | |

| 5,167,013 | |

| Consensus

Cloud Solutions 1,2,3 | |

| 62,282 | | |

| 1,466,741 | |

| Coveo Solutions 3 | |

| 114,000 | | |

| 517,550 | |

| CyberArk Software 3 | |

| 1,900 | | |

| 554,059 | |

| Descartes Systems Group (The) 3 | |

| 8,500 | | |

| 875,160 | |

| InterDigital 1 | |

| 11,303 | | |

| 1,600,844 | |

| JFrog 3 | |

| 217,500 | | |

| 6,316,200 | |

| NCR Voyix 3 | |

| 34,618 | | |

| 469,766 | |

| NextNav 3 | |

| 69,000 | | |

| 516,810 | |

| Progress Software | |

| 56,019 | | |

| 3,774,000 | |

| PROS Holdings 3 | |

| 46,664 | | |

| 864,217 | |

| Sapiens International | |

| 96,655 | | |

| 3,602,332 | |

| | |

| | | |

| 35,883,030 | |

| Technology Hardware, Storage & Peripherals - 0.0% | |

| | | |

| | |

| Xerox Holdings | |

| 36,854 | | |

| 382,545 | |

| Total | |

| | | |

| 330,690,163 | |

| | |

| | | |

| | |

| Materials – 7.5% | |

| | | |

| | |

| Chemicals - 3.7% | |

| | | |

| | |

| AdvanSix 1 | |

| 12,914 | | |

| 392,327 | |

| Aspen Aerogels 3 | |

| 118,727 | | |

| 3,287,551 | |

| Bioceres Crop Solutions 3 | |

| 24,147 | | |

| 190,037 | |

| Element Solutions 1 | |

| 554,565 | | |

| 15,061,985 | |

| Hawkins 1 | |

| 113,424 | | |

| 14,458,157 | |

| Ingevity Corporation 3 | |

| 193,886 | | |

| 7,561,554 | |

| Innospec 1 | |

| 132,056 | | |

| 14,934,213 | |

| NewMarket Corporation | |

| 8,000 | | |

| 4,415,120 | |

| Quaker Houghton | |

| 88,752 | | |

| 14,953,825 | |

| | |

| | | |

| 75,254,769 | |

| Construction Materials - 0.0% | |

| | | |

| | |

| Knife River 3 | |

| 6,300 | | |

| 563,157 | |

| Containers & Packaging - 0.1% | |

| | | |

| | |

| Silgan Holdings | |

| 52,391 | | |

| 2,750,527 | |

| Metals & Mining - 3.1% | |

| | | |

| | |

| Alamos Gold Cl. A | |

| 1,445,406 | | |

| 28,802,316 | |

| Arch Resources | |

| 10,384 | | |

| 1,434,653 | |

| Gold Fields ADR | |

| 536,500 | | |

| 8,235,275 | |

| Haynes International 1 | |

| 102,500 | | |

| 6,102,850 | |

| IAMGOLD Corporation 3 | |

| 500,000 | | |

| 2,615,000 | |

| Major Drilling Group International 3 | |

| 1,496,691 | | |

| 9,262,674 | |

| Materion Corporation | |

| 25,000 | | |

| 2,796,500 | |

| Metallus 3 | |

| 31,690 | | |

| 469,963 | |

| Olympic Steel | |

| 32,440 | | |

| 1,265,160 | |

| Warrior Met Coal | |

| 7,505 | | |

| 479,569 | |

| | |

| | | |

| 61,463,960 | |

| Paper & Forest Products - 0.6% | |

| | | |

| | |

| Clearwater Paper 3 | |

| 22,278 | | |

| 635,814 | |

| Louisiana-Pacific | |

| 43,708 | | |

| 4,696,862 | |

| Stella-Jones | |

| 49,375 | | |

| 3,241,529 | |

| Sylvamo Corporation 1 | |

| 35,577 | | |

| 3,054,286 | |

| | |

| | | |

| 11,628,491 | |

| Total | |

| | | |

| 151,660,904 | |

| | |

| | | |

| | |

| Real Estate – 3.5% | |

| | | |

| | |

| Diversified REITs - 0.0% | |

| | | |

| | |

| New York REIT 3,5 | |

| 15,000 | | |

| 163,200 | |

| Real Estate Management & Development - 3.5% | |

| | | |

| | |

| Colliers International Group | |

| 66,011 | | |

| 10,021,130 | |

| FirstService Corporation | |

| 94,535 | | |

| 17,248,856 | |

| FRP Holdings 1,3 | |

| 108,661 | | |

| 3,244,617 | |

| Kennedy-Wilson Holdings 1 | |

| 1,392,483 | | |

| 15,386,937 | |

| Marcus & Millichap 1 | |

| 369,112 | | |

| 14,627,909 | |

| St. Joe Company (The) 1 | |

| 78,800 | | |

| 4,594,828 | |

| Tejon

Ranch 1,2,3 | |

| 313,818 | | |

| 5,507,506 | |

| | |

| | | |

| 70,631,783 | |

| Total | |

| | | |

| 70,794,983 | |

| | |

| | | |

| | |

| Utilities – 0.2% | |

| | | |

| | |

| Electric Utilities - 0.2% | |

| | | |

| | |

| MGE Energy | |

| 11,668 | | |

| 1,067,038 | |

| Otter Tail | |

| 25,804 | | |

| 2,016,841 | |

| | |

| | | |

| 3,083,879 | |

| Gas Utilities - 0.0% | |

| | | |

| | |

| Chesapeake Utilities | |

| 4,708 | | |

| 584,593 | |

| Total | |

| | | |

| 3,668,472 | |

| | |

| | | |

| | |

| TOTAL COMMON STOCKS | |

| | | |

| | |

| (Cost $1,419,467,156) | |

| | | |

| 1,988,119,921 | |

| | |

| | | |

| | |

| INVESTMENT COMPANIES – 0.9% | |

| | | |

| | |

| Diversified Investment Companies – 0.0% | |

| | | |

| | |

| Closed-End Funds - 0.0% | |

| | | |

| | |

| Eagle Point Credit | |

| 54 | | |

| 532 | |

| Total | |

| | | |

| 532 | |

| | |

| | | |

| | |

| Materials – 0.9% | |

| | | |

| | |

| Metals & Mining - 0.9% | |

| | | |

| | |

| VanEck Junior Gold Miners ETF | |

| 393,758 | | |

| 19,219,328 | |

| Total | |

| | | |

| 19,219,328 | |

| | |

| | | |

| | |

| TOTAL INVESTMENT COMPANIES | |

| | | |

| | |

| (Cost $13,874,194) | |

| | | |

| 19,219,860 | |

| | |

| | | |

| | |

| REPURCHASE AGREEMENT – 2.2% | |

| | | |

| | |

Fixed Income Clearing Corporation,

4.25% dated 9/30/24, due 10/1/24,

maturity

value $44,079,183 (collateralized

by obligations of various U.S. Government

Agencies, 0.625%-4.625% due

08/15/30-08/15/41, valued at $44,955,585)

(Cost $44,073,980) | |

| | | |

| 44,073,980 | |

| | |

| | | |

| | |

| TOTAL INVESTMENTS – 101.5% | |

| | | |

| | |

| (Cost $1,477,415,330) | |

| | | |

| 2,051,413,761 | |

| | |

| | | |

| | |

LIABILITIES LESS CASH

AND OTHER

ASSETS – (1.5)% | |

| | | |

| (31,052,433 | ) |

| | |

| | | |

| | |

| NET ASSETS – 100.0% | |

| | | |

$ | 2,020,361,328 | |

ADR

– American Depository Receipt

1

All or a portion of these securities were pledged as collateral in connection with the Fund’s revolving credit

agreement as of September 30, 2024. Total market value of pledged securities as of September 30, 2024, was

$76,726,931.

2

As of September 30, 2024, a portion of these securities, in the aggregate amount of $33,321,224, were rehypothecated by

BNP Paribas Prime Brokerage International, Limited in connection with the Fund’s revolving

credit agreement.

3

Non-income producing.

4

These securities are defined as Level 2 securities due to fair value being based on quoted prices for similar

securities and/or due to the application of fair value factors.

5

Securities for which market quotations are not readily available represent 0.1% of net assets. These securities have

been valued at their fair value under procedures approved by the Fund’s Board of Directors. These securities are

defined as Level 3 securities due to the use of significant unobservable inputs in the determination of fair

value.

TAX

INFORMATION: The cost of total investments for Federal income tax purposes was $1,482,364,716. As of September 30, 2024, net

unrealized appreciation for all securities was $569,049,045, consisting of aggregate gross unrealized appreciation of $682,169,802

and aggregate gross unrealized depreciation of $113,120,757. The primary cause of the difference between book and tax basis cost

is the timing of the recognition of losses on securities sold.

Valuation

of Investments:

Royce

Small-Cap Trust, Inc. (formerly Royce Value Trust, Inc.) (the “Fund”), is a diversified closed-end investment company

that was incorporated under the laws of the State of Maryland on July 1, 1986. The Fund commenced operations on November 26, 1986.

Royce & Associates, LP, the Fund’s investment adviser, is a majority-owned subsidiary of Franklin Resources, Inc. and

primarily conducts business using the name Royce Investment Partners (“Royce”). Investment transactions are accounted

for on the trade date. Portfolio securities held by the Fund are valued as of the close of trading on the New York Stock Exchange

(“NYSE”) (generally 4:00 p.m. Eastern time) on the valuation date. Investments in money market funds are valued at

net asset value per share. Values for non-U.S. dollar denominated equity securities are converted to U.S. dollars daily based

upon prevailing foreign currency exchange rates as quoted by a major bank.

Portfolio

securities that are listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative

trading system, are valued: (i) on the basis of their last reported sales prices or official closing prices, as applicable, on

a valuation date; or (ii) at their highest reported bid prices in the event such equity securities did not trade on a valuation

date. Such inputs are generally referred to as “Level 1” inputs because they represent reliable quoted prices in active

markets for identical securities.

If

the value of a portfolio security held by the Fund cannot be determined solely by reference to Level 1 inputs, such portfolio

security will be “fair valued.” The Fund’s Board of Directors has designated Royce as valuation designee to

perform fair value determinations for such portfolio securities in accordance with Rule 2a-5 under the Investment Company Act

of 1940 (“Rule 2a-5”). Pursuant to Rule 2a-5, fair values are determined in accordance with policies and procedures

approved by the Fund’s Board of Directors and policies and procedures adopted by Royce in its capacity as valuation designee for

the Fund. Fair valued securities are reported as either “Level 2” or “Level 3” securities.

As

a general principle, the fair value of a security is the amount which the Fund might reasonably expect to receive for the security

upon its current sale. However, in light of the judgment involved in fair valuations, no assurance can be given that a fair value

assigned to a particular portfolio security will be the amount which the Fund might be able to receive upon its current sale.

When a fair value pricing methodology is used, the fair value prices used by the Fund for such securities will likely differ from

the quoted or published prices for the same securities.

Level

2 inputs are other significant observable inputs (e.g., dealer bid side quotes and quoted prices for securities with comparable

characteristics). Examples of situations in which Level 2 inputs are used to fair value portfolio securities held by the Fund

on a particular valuation date include:

| ● | Over-the-counter

equity securities other than those traded on OTC Market Group Inc.’s OTC Link ATS or other alternative trading system (collectively

referred to herein as “Other OTC Equity Securities”) are fair valued at their highest bid price when Royce receives

at least two bid side quotes from dealers who make markets in such securities; |

| ● | Certain

bonds and other fixed income securities may be fair valued by reference to other securities with comparable ratings, interest

rates, and maturities in accordance with valuation methodologies maintained by certain independent pricing services; and |

| ● | The

Fund uses an independent pricing service to fair value certain non-U.S. equity securities when U.S. market volatility exceeds

a certain threshold. This pricing service uses proprietary correlations it has developed between the movement of prices of non-U.S.

equity securities and indices of U.S.-traded securities, futures contracts, and other indications to estimate the fair value of

such non-U.S. securities. |

Level

3 inputs are significant unobservable inputs. Examples of Level 3 inputs include (without limitation) the last trade price for

a security before trading was suspended or terminated; discounts to last trade price for lack of marketability or otherwise; market

price information regarding other securities; information received from the issuer and/or published documents, including SEC filings

and financial statements; and other publicly available information. Pursuant to the above-referenced policies and procedures,

Royce may use various techniques in making fair value determinations based upon Level 3 inputs, which techniques may include (without

limitation): (i) workout valuation methods (e.g., earnings multiples, discounted cash flows, liquidation values, derivations of

book value, firm or probable offers from qualified buyers for the issuer’s ongoing business, etc.); (ii) discount or premium

from market, or compilation of other observable market information, for other similar freely traded securities; (iii) conversion

from the readily available market price of a security into which an affected security is convertible or exchangeable; and (iv)

pricing models or other formulas. In the case of restricted securities, fair value determinations generally start with the inherent

or intrinsic worth of the relevant security, without regard to the restrictive feature, and are reduced for any diminution in

value resulting from the restrictive feature. Due to the inherent uncertainty of such valuations, these fair values may differ

significantly from the values that would have been used had an active market existed.

A

security that is valued by reference to Level 1 or Level 2 inputs may drop to Level 3 on a particular valuation date for several

reasons, including if:

| ● | an

equity security that is listed on an exchange or Nasdaq, or traded on OTC Market Group Inc.’s OTC Link ATS or other alternative

trading system, has not traded and there are no bids; |

| ● | Royce

does not receive at least two bid side quotes for an Other OTC Equity Security; |

| ● | the

independent pricing services are unable to supply fair value prices; or |

| ● | the

Level 1 or Level 2 inputs become otherwise unreliable for any reason (e.g., a significant event occurs after the close of trading

for a security but prior to the time the Fund prices its shares). |

The

table below shows the aggregate value of the various Level 1, Level 2, and Level 3 securities held by the Fund as of September

30, 2024. Any Level 2 or Level 3 securities held by the Fund are noted in its Schedule of Investments. The inputs or methodology

used for valuing securities are not necessarily an indication of the risk associated with owning those securities.

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Common Stocks | |

| $1,979,756,270 | | |

| $ 5,945,191 | | |

| $2,418,460 | | |

| $1,988,119,921 | |

| Investment Companies | |

| 19,219,860 | | |

| – | | |

| – | | |

| 19,219,860 | |

| Repurchase Agreement | |

| – | | |

| 44,073,980 | | |

| – | | |

| 44,073,980 | |

Level 3 Reconciliation:

| | |

| | |

| | |

| | |

| | |

Net Change in

Unrealized Gain (Loss) |

|

|

| |

| | |

| Balance

as of

12/31/23 | | |

| Sales | | |

| Transfers

In1 | | |

| Realized

Gain

(Loss) | | |

Currently Held

Securities | |

|

Securities No

Longer Held | |

| Balance

as of

9/30/24 | |

| Common Stocks | |

| $995,360 | | |

| $1,040,200 | | |

| $2,255,260 | | |

| $(308,284) | | |

$0 | |

|

$516,324 | |

| $2,418,460 | |

1

Transfers into Level 3 represents a security for which there were no longer readily available market quotations at September

30, 2024.

Repurchase

Agreements:

The

Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy.

The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase

agreements, which are held until maturity of the repurchase agreements, are marked-to-market daily and maintained at a value at

least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve

certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability

of the Fund to dispose of its underlying securities. The remaining contractual maturity of the repurchase agreement held by the

Fund as of September 30, 2024, is next business day and continuous.

Borrowings:

The

Fund is party to a revolving credit agreement (the “credit agreement”) with BNP Paribas Prime Brokerage International,

Limited (BNPPI). The Fund pays a commitment fee of 0.50% per annum on the unused portion of the then-current maximum amount that

may be borrowed by the Fund under the credit agreement. The credit agreement has a 179-day rolling term that resets daily. The

Fund pledges eligible portfolio securities as collateral and has granted a security interest in such pledged securities to, and

in favor of, BNPPI as security for the loan balance outstanding. The amount of eligible portfolio securities required to be pledged

as collateral is determined by BNPPI in accordance with the credit agreement. In determining collateral requirements, the value

of eligible securities pledged as collateral is subject to discount by BNPPI based upon a variety of factors set forth in the

credit agreement. As of September 30, 2024, the market value of eligible securities pledged as collateral exceeded two times the

loan balance outstanding.

If

the Fund fails to meet certain requirements, or comply with other financial covenants set forth in the credit agreement, the Fund

may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, which may necessitate

the sale of portfolio securities at potentially inopportune times. BNPPI may terminate the credit agreement upon certain ratings

downgrades of its corporate parent, which would result in the Fund’s entire loan balance becoming immediately due and payable.

The occurrence of such ratings downgrades may necessitate the sale of portfolio securities at potentially inopportune times. BNPPI

may also terminate the credit agreement upon sixty (60) calendar days’ prior written notice to the Fund in the event the

Fund’s net asset value per share as of the close of business on the last business day of any calendar month declines by

thirty-five percent (35%) or more from the Fund’s net asset value per share as of the close of business on the last business

day of the immediately preceding calendar month.

The

credit agreement also permits, subject to certain conditions, BNPPI to rehypothecate portfolio securities pledged by the Fund

up to the amount of the loan balance outstanding. The Fund continues to receive payments in lieu of dividends and interest on

rehypothecated securities. The Fund also has the right under the credit agreement to recall the rehypothecated securities from

BNPPI on demand. If BNPPI fails to deliver the recalled security in a timely manner, the Fund is compensated by BNPPI for any

fees or losses related to the failed delivery or, in the event a recalled security is not returned by BNPPI, the Fund, upon notice

to BNPPI, may reduce the loan balance outstanding by the value of the recalled security failed to be returned. The Fund receives

a portion of the fees earned by BNPPI in connection with the rehypothecation of portfolio securities.

The

Fund and BNPPI have agreed that the current maximum amount the Fund may borrow under the credit agreement is $70,000,000. The

Fund has the right to further reduce the maximum amount it can borrow under the credit agreement upon one (1) business day’s

prior written notice to BNPPI. In addition, the Fund and BNPPI may agree to increase the maximum amount the Fund can borrow under

the credit agreement, which amount may not exceed $150,000,000.

As

of September 30, 2024, the Fund had outstanding borrowings of $35,000,000. During the nine-month period ended September 30, 2024,

the Fund had an average daily loan balance of $35,000,000. As of September 30, 2024, the aggregate value of rehypothecated securities

was $33,321,224.

Other

information regarding the Fund is available in the Fund’s most recent Report to Stockholders. This information is available

through Royce Investment Partners (www.royceinvest.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

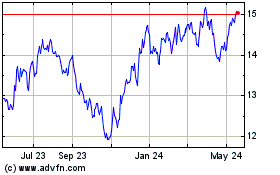

Royce Small Cap (NYSE:RVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Royce Small Cap (NYSE:RVT)

Historical Stock Chart

From Nov 2023 to Nov 2024