|

|

|

|

|

|

|

OMB

APPROVAL

|

|

OMB Number:

|

|

3235-0381

|

|

Expires:

|

|

July 31, 2012

|

|

Estimated average burden

|

|

hours per response

|

|

427

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

[Check one]

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

|

|

For the fiscal year ended

|

|

December 31, 2011

|

|

|

|

Commission File Number

|

|

001-10805

|

Rogers Communications Inc.

(Exact name of Registrant as specified in its charter)

Not

Applicable

(Translation of Registrant’s name into English (if applicable))

British Columbia

(Province or other jurisdiction

of incorporation or organization)

4812, 4813, 4822, 4832, 4833, 4841

(Primary Standard Industrial

Classification Code Number (if applicable))

Not Applicable

(I.R.S. Employer Identification

Number (if applicable))

|

|

|

|

|

333 Bloor Street East, 10th Floor

Toronto, Ontario M4W 1G9

|

|

(416) 935-7777

|

(Address and telephone number of Registrant’s principal executive offices)

|

|

|

|

|

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, New York

10011

|

|

(212) 894-8940

|

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

Title of each class

|

|

Name of each exchange on which registered

|

|

Class B Non-Voting

|

|

New York Stock Exchange

|

Securities registered or to be registered

pursuant to Section 12(g) of the Act.

Not Applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Class B Non-Voting Shares

(Title of Class)

|

|

|

|

|

|

|

SEC 2285 (04-09)

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control

number.

|

|

|

For annual reports, indicate by check mark the information filed with this Form:

þ

Annual information

form

¨

Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the

annual report.

112,462,014 Class A Voting shares; 412,395,406 Class B Non-Voting shares.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act

during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

þ

Yes

¨

No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such

files).

¨

Yes

82-

þ

No

DISCLOSURE CONTROLS AND PROCEDURES

The disclosure provided under the heading

Disclosure Controls and Procedures

on page 74 of Exhibit 99.2: Management’s Discussion and Analysis, is incorporated by reference herein.

MANAGEMENT’S ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING

The disclosure provided under the heading

Management’s Report on Internal Control Over Financial Reporting

on page 74 of Exhibit 99.2: Management’s Discussion and Analysis, is

incorporated by reference herein.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

The disclosure provided under the heading

Report of Independent Registered Public Accounting Firm

of Exhibit 99.2: Management’s Discussion

and Analysis, is incorporated by reference herein.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

The disclosure provided under the heading

Changes in Internal Control Over Financial Reporting and Disclosure Controls and Procedures

on page 74

of Exhibit 99.2: Management’s Discussion and Analysis, is incorporated by reference herein.

AUDIT COMMITTEE FINANCIAL EXPERT

The Board of Directors of Rogers Communications Inc. has determined that the Company has at least one “audit committee financial

expert” (as defined in paragraph 8(b) of General Instruction B of Form 40-F) serving on its Audit Committee. The audit committee financial expert is John H. Clappison, who has been determined by the Board to be an independent director as such

term is defined under the Canadian Securities Administrators’ National Instrument 52-110 (Audit Committees) and the standards under Rule 10A-3 of the U.S. Securities Exchange Act relating to the independence of audit committee members. The

Board’s designation of Mr. Clappison as an audit committee financial expert does not impose on Mr. Clappison any duties, obligations or liability that are greater than the duties, obligations and liability imposed on him as a member

of the Audit Committee and Board of Directors in the absence of such designation or identification. In addition, the designation of Mr. Clappison as an “audit committee financial expert” does not affect the duties, obligations or

liability of any other member of the Audit Committee or Board of Directors. See also

Item 17 – Audit Committee

on page 22, of the Company’s Annual Information Form, attached as Exhibit 99.1 and incorporated by reference herein.

CODE OF CONDUCT AND ETHICS

The Company has adopted a Code of Conduct and Ethics that applies to all directors and Business Conduct Guidelines that apply to all employees (the

Codes). The Codes have been posted on the Rogers website under the Corporate Governance section at rogers.com. A copy of the Codes will also be provided upon request to Investor Relations, 333 Bloor Street East, 10th Floor, Toronto, Ontario, M4W

1G9.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table presents fees for professional services rendered by KPMG LLP to the Company for the audit of the Company’s annual financial statements for 2011 and 2010, and fees billed for other

services rendered by KPMG LLP, during the period from January 1, 2010 to December 31, 2011.

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended December 31,

|

|

|

|

|

2011

|

|

|

2010

|

|

|

Audit Fees(1)

|

|

$

|

6,869,085

|

|

|

$

|

7,892,753

|

|

|

Audit-Related Fees(2)

|

|

|

512,731

|

|

|

|

363,375

|

|

|

Tax Fees(3)

|

|

|

1,197,300

|

|

|

|

1,410,326

|

|

|

All Other Fees(4)

|

|

|

2,073,755

|

|

|

|

1,140,305

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

10,652,871

|

|

|

$

|

10,806,759

|

|

|

|

|

|

|

|

|

|

|

|

NOTES:

|

(1)

|

Consist of fees related to statutory audits, related audit work in connection with registration statements and other filings with various regulatory authorities,

quarterly reviews of interim financial statements, accounting consultations related to audited financial statements and procedures on adoption of International Financial Reporting Standards (IFRS) in 2010.

|

|

(2)

|

Consist mainly of pension plan audits and other specified procedures engagements.

|

|

(3)

|

Consist of fees for tax consultation and compliance services, including indirect taxes.

|

|

(4)

|

Consist mainly of fees for operational advisory and risk management services and French translation of certain filings with regulatory authorities.

|

For the year ended December 31, 2011, none of the Company’s audit-related fees, tax fees or all other fees described

in the table above made use of the de minimis exception to pre-approval provisions contained in Rule 2-01 (c)(7)(i)(C) of U.S. Securities and Exchange Commission Regulation S-X or Section 2.4 of the Canadian Securities Administrators’

National Instrument 52-110 (Audit Committees).

The following is the pre-approval process:

|

1.

|

Annually the Company will provide the Audit Committee with a list of the audit-related and non-audit services that may be provided by the auditor during the year to the

Company. The Audit Committee will review the services with the auditor and management, considering whether the provision of the service is compatible with maintaining the auditor’s independence.

|

|

2.

|

Management may engage the auditor for specific engagements that are included in the list of pre-approved services referred to above if the estimated fees do not exceed

(i) $100,000 per engagement or (ii) $500,000 per quarter in aggregate amount on a consolidated basis for the Company.

|

|

3.

|

The Audit Committee delegates authority to the Chairman of the Audit Committee to approve requests for services not included in the pre-approved list of services or for

services not previously pre-approved by the Audit Committee. Any services approved by the Chairman will be reported to the full Audit Committee at the next meeting.

|

|

4.

|

A listing of all audit and non-audit services and fees rendered to the Company and its subsidiaries by KPMG LLP will be reviewed each quarter by the Audit Committee.

|

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance sheet arrangements other than those described under the heading

Off-Balance Sheet Arrangements

on page 54 of Exhibit 99.2: Management’s Discussion and

Analysis, which is incorporated by reference herein.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The information provided under the heading

Commitments and Other Contractual Obligations

on page 53 of Exhibit 99.2: Management’s Discussion

and Analysis, which is incorporated by reference herein.

IDENTIFICATION OF AUDIT COMMITTEE

Our Board of Directors has established an Audit Committee. The Audit Committee consists of five directors; Messrs Besse, Birchall, Burch, Clappison and

Watson who are appointed annually by our Board of Directors. Further disclosure is provided under

Item 17.2 — Composition of the Audit Committee

of the Company’s Annual Information Form, attached as Exhibit 99.1 and

incorporated by reference herein.

DISCLOSURE PURSUANT TO REQUIREMENTS OF THE NEW YORK STOCK EXCHANGE

The disclosure provided under the headings “

Composition of the Board

”, “

Controlled Company

Exemption

”, “

Foreign Private Issuer Status

” and “

Corporate Governance Practices

” and “

Ethical Business Conduct

” beginning on pages 19-21 of

the Company’s Annual Information Form, attached as Exhibit 99.1, is incorporated by reference herein.

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

Rogers Communications Inc. undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the

Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form

40-F arises; or transactions in said securities.

Rogers Communications Inc. has previously filed with the Commission a Form F-X in connection

with its securities. Any change to the name or address of the Company’s agent for service of process shall be communicated promptly to the Commission by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf

by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Registrant: Rogers Communications Inc.

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

“Nadir H. Mohamed”

|

|

|

|

|

|

“William W. Linton”

|

|

|

|

Nadir H. Mohamed

Director and

President and Chief Executive Officer

|

|

|

|

|

|

William W. Linton

Executive

Vice President, Finance and Chief Financial Officer

|

Date: February 24, 2012

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

23.1

|

|

Independent Registered Public Accounting Firm’s Consent

|

|

|

|

|

31.1

|

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

31.2

|

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

32.1

|

|

Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002†

|

|

|

|

|

99.1

|

|

Annual Information Form for the fiscal year ended December 31, 2011

|

|

|

|

|

99.2

|

|

Management’s Discussion and Analysis for the fiscal year ended December 31, 2011, including annual audited consolidated

financial statements filed with the Securities and Exchange Commission (“SEC”) under cover of a

Form 6-K dated

February 24, 2012.

|

|

†

|

This exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of

that section, nor shall it be deemed incorporated by reference on any filling under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation

language in any filings.

|

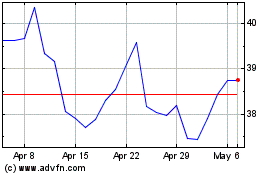

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Apr 2024 to May 2024

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From May 2023 to May 2024