00000528270001806931false00000528272023-10-302023-10-300000052827ryn:RayonierLimitedPartnershipMember2023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

October 30, 2023

COMMISSION FILE NUMBER 1-6780 (Rayonier Inc.)

COMMISSION FILE NUMBER: 333-237246 (Rayonier, L.P.)

RAYONIER INC.

Incorporated in the State of North Carolina

I.R.S. Employer Identification Number 13-2607329

RAYONIER, L.P.

Incorporated in the State of Delaware

I.R.S. Employer Identification Number 91-1313292

1 Rayonier Way

Wildlight, Florida 32097

(Principal Executive Office)

Telephone Number: (904) 357-9100

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol | Exchange |

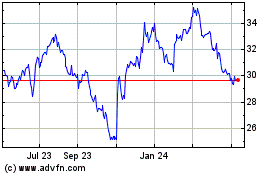

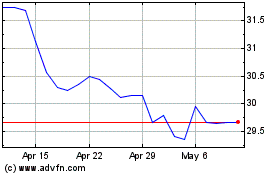

| Common Shares, no par value, of Rayonier Inc. | RYN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities

Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | | | | | | | | | | | | | |

| Rayonier Inc.: | Emerging growth company | ☐ |

| Rayonier, L.P.: | Emerging growth company | ☐ |

| | | | | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | |

| Rayonier Inc.: | ☐ |

| Rayonier, L.P.: | ☐ |

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| | | | | PAGE |

| Item 5.02 | | | | |

| Item 7.01 | | | | |

| Item 8.01 | | | | |

| Item 9.01 | | | | |

| | | | | |

| | | | | |

| ITEM 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On October 30, 2023, David L. Nunes, Chief Executive Officer and member of the Board of Director (the “Board”) of Rayonier Inc. (the “Company”), notified the Company that he will retire from both positions, effective on March 31, 2024. Mr. Nunes will continue to serve as Chief Executive Officer and on the Board until March 31, 2024. Mr. Nunes has agreed, pursuant to a Transition Agreement, dated October 30, 2023, to provide transitional support to the Company from April 1, 2024 (the “Transition Date”) to September 30, 2024 (such period, the “Transition Period”). In exchange for such agreement and a customary release, Mr. Nunes will:

•receive a base salary during the Transition Period at a rate equal to 50% of his salary rate in effect prior to the Transition Date;

•remain eligible for an annual bonus for 2024 at the target bonus rate currently in effect, with such bonus rate applied to the actual base pay received in 2024; and

•be eligible for equity compensation awards in 2024, with such award amounts as determined by the Compensation and Management Development Committee of the Board and expected to represent 50% of the grant date value of the equity compensation awards made to Mr. Nunes in 2023.

The foregoing description is qualified in its entirety by reference to the Transition Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

In connection with Mr. Nunes’ notification of his retirement, the Board elected Mark D. McHugh, age 48, as President and Chief Executive Officer, effective on the Transition Date. The Company also intends to appoint Mr. McHugh to the Board on the Transition Date. Mr. McHugh has served as President and Chief Financial Officer of the Company since January 2023 and will continue in such role until the Transition Date. Mr. McHugh previously served as Senior Vice President and Chief Financial Officer of the Company from December 2014 to January 2023. Mr. McHugh is not a party to any transaction described in Item 404(a) of Regulation S-K involving the Company or any of its subsidiaries.

In connection with Mr. McHugh’s election as President and Chief Executive Officer, the Board took the following actions regarding Mr. McHugh’s compensation, effective on the Transition Date:

•approved a new annual base salary rate of $800,000;

•approved a new target bonus percentage award of 125% of actual base pay received in 2024, subject to the terms and conditions of the Company’s Non-Equity Incentive Plan; and

•approved a target long-term incentive award opportunity of $2,800,000 (with any specific awards subject to approval at the time of grant).

No other actions were taken with respect to Mr. McHugh’s compensation in connection with his election as President and Chief Executive Officer, and Mr. McHugh will not receive any compensation for his services as a director on the Board.

In addition, April J. Tice, age 50, has been appointed as the Senior Vice President and Chief Financial Officer, effective on the Transition Date. Ms. Tice has served as Vice President and Chief Accounting Officer of the Company since April 2021 and will continue in such role until the Transition Date. Ms. Tice previously served as Vice President, Financial Services and Corporate Controller of the Company from March 2019 to April 2021 and has held multiple other positions of increasing responsibility since joining the Company in 2010. Ms. Tice is not a party to any transaction described in Item 404(a) of Regulation S-K involving the Company or any of its subsidiaries.

In connection with Ms. Tice’s election as Senior Vice President and Chief Financial Officer, the Board took the following actions regarding Ms. Tice’s compensation, effective on the Transition Date:

•approved a new annual base salary rate of $425,000;

•approved a new target bonus percentage award of 100% of actual base pay received in 2024, subject to the terms and conditions of the Company’s Non-Equity Incentive Plan; and

•approved a target long-term incentive award opportunity of $700,000 (with any specific awards subject to approval at the time of grant).

The Board also approved, effective October 30, 2023, Ms. Tice’s participation as a Tier II participant in the Company’s Executive Severance Pay Plan, which provides for specified severance payments in the event of a change in control. No other actions were taken with respect to Ms. Tice’s compensation in connection with her election as Senior Vice President and Chief Financial Officer.

A copy of the press release announcing the appointments is filed with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

On November 1, 2023, the Company posted an investor presentation relating to the capital structure realignment plan on the Company’s website at www.rayonier.com. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

On November 1, 2023, the Company issued a press release announcing (1) a capital structure realignment plan targeting $1 billion of select asset sales over the next 18 months and (2) the sale of 55,000 acres of timberland in Oregon for approximately $242 million. A copy of this press release is filed with this Current Report on Form 8-K as Exhibit 99.3 and is incorporated herein by reference.

| | | | | |

| ITEM 9.01. | Financial Statements and Exhibits. |

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 10.1 | | | |

| 99.1 | | | |

| 99.2 | | | |

| 99.3 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of l934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | RAYONIER INC. |

| | |

| BY: | | /s/ MARK R. BRIDWELL |

| | Mark R. Bridwell |

| | Senior Vice President, General Counsel and Corporate Secretary |

| | |

| | | | | | | | |

| | RAYONIER, L.P. |

| | |

| | By: RAYONIER INC., its sole general partner |

| | |

| BY: | | /s/ MARK R. BRIDWELL |

| | Mark R. Bridwell |

| | Senior Vice President, General Counsel and Corporate Secretary |

| | |

November 2, 2023

October 30, 2023

David L. Nunes

c/o Rayonier Inc.

1 Rayonier Way

Wildlight, FL 32097

Dear David:

This letter memorializes our recent discussions regarding your planned retirement from Rayonier Inc. (the “Company”) and your assistance with the Company’s leadership transition.

1. Transition Timing. You hereby agree that you will resign as Chief Executive Officer of the Company, effective as of the end of the day on March 31, 2024 (the “Transition Date”), and will (unless your employment has terminated prior to the Transition Date) continue to remain employed with the Company as a Senior Advisor to the Company’s board of directors (the “Board”) regarding public investor relations, shareholder engagement and such other matters as may be determined by the Board during the period (the “Transition Period”) from April 1, 2024 through September 30, 2024 (unless earlier terminated as set forth in Section 2(b) below), reporting jointly to the Board and to the Company’s new Chief Executive Officer. You hereby agree that you will resign, effective as of the Transition Date, from any offices, directorships and trusteeships that you hold with, or on behalf of, the Company or any of its affiliates.

2. Transition Matters.

(a) Compensation and Employee Benefits. During the Transition Period, you will receive a base salary at a rate equal to 50% of the rate currently in effect. You will remain eligible for an annual bonus for 2024 at the target bonus rate currently in effect, it being understood that such rate will be applied to your actual base pay received in 2024. You will remain eligible for equity compensation awards in 2024, the amount of which will be determined by the Compensation and Management Development Committee of the Board but is currently expected to represent 50% of the grant date value of the equity compensation awards made to you in 2023. For purposes of your equity compensation awards under the 2023 Rayonier Incentive Stock Plan and the Rayonier Incentive Stock Plan, as amended and effective October 16, 2020 (collectively, the “Equity Plans”), your termination of employment at the end of the scheduled Transition Period will be treated as a Retirement (as defined in the Supplemental Terms Applicable to the Performance Share and Restricted Stock Unit Award

Agreements In the Event of Retirement). During the Transition Period, you will remain a participant in the Company’s employee benefit plans.

(b) Termination of Employment. Nothing herein shall be construed to preclude either you or the Company from terminating your employment at any time, with any such termination to be subject to the applicable terms of the Company’s annual bonus plan, Equity Plans and award agreements thereunder, and, if applicable, the Company’s Severance Pay Plan for Salaried Employees and Executive Severance Pay Plan, it being understood that you will continue to be a Tier I participant in the Executive Severance Pay Plan. Upon any such termination during the Transition Period, the Transition Period shall automatically conclude.

3. Cooperation. From and after the termination of your employment with the Company, you agree to use your reasonable best efforts to respond and provide information to the Company regarding matters of which you have knowledge as a result of your relationship with the Company, and to provide reasonable assistance to the Company, its affiliates, and their representatives in defense of any claims that may be made against or by the Company and its affiliates. All reasonable out-of-pocket expenses that you incur in complying with this Section 3 will be borne by the Company. The Company hereby agrees that you will continue to be covered, at the Company’s expense, under the indemnification and insurance arrangements, in accordance with their terms, that the Company has in effect for current and former officers and directors of the Company and its affiliates.

4. Restrictive Covenants. You hereby reaffirm your obligations under all confidentiality, noncompete, nonsolicit and other restrictive covenants contained in agreements with or plans or policies of the Company, including without limitation the equity award agreements and supplemental terms thereto. In addition, you agree that you shall not make any disparaging statements about the Company or its affiliates. Notwithstanding the foregoing, nothing herein shall preclude you from responding truthfully to any legal process or truthfully testifying in a legal or regulatory proceeding, or from complying with applicable disclosure obligations. You agree that the terms of this Section 4 (including the covenants referenced herein) were agreed to by mutual assent of the parties hereto, are supported by adequate consideration, are reasonable in time and scope, and serve to protect the legitimate economic interests of the Company and its affiliates. You further acknowledge and agree that your breach of the provisions of this Section 4 will cause the Company irreparable harm which cannot be adequately compensated by money damages, and that if the Company elects to prevent you from breaching such provisions by obtaining an injunction against you, there is a reasonable probability of the Company’s eventual success on the merits. You agree that if you commit any such breach or threaten to commit any such breach, the Company will be entitled to temporary and permanent injunctive relief from a court of competent jurisdiction, without posting any bond or other security and without the necessity of proof of actual damage, in addition to, and not in lieu of, such other remedies as may be available to the Company for such breach, including the recovery of money damages.

5. Release of Claims. In consideration of, and as a condition to your receipt of, the compensation and benefits set forth herein in respect of the Transition Period, you agree to execute a release of claims against the Company and its affiliates on or within ten days following the Transition Date in the form attached as Exhibit A, and agree if requested to execute a release of claims in a substantially similar form upon the termination of your employment with the Company. The compensation and benefits set forth herein in respect of the Transition Period are contingent upon your execution and non-revocation of the releases contemplated by this Section 5.

6. Miscellaneous.

(a) Entire Agreement. This Agreement, the Executive Severance Pay Plan and applicable equity award agreements and supplemental terms thereto together constitute the entire agreement, and supersede any prior agreement or understanding, between you and the Company relating to your employment and service to the Company and its affiliates or any termination thereof. Except as specifically set forth herein, you shall not be entitled to any payment or other benefit relating to your service or termination of service with the Company, other than your vested rights under the employee benefit plans of the Company and its affiliates in which you participated. This Agreement may be amended only by written amendment duly executed by both parties hereto or their legal representatives and authorized by action of the Board.

(b) Successors. This Agreement shall be binding upon, and inure to the benefit of, any successors and assigns of the Company. This Agreement (including the payments and benefits contemplated by Section 2) is personal to you, and you may not assign or transfer any of your rights or obligations hereunder (including to any person, entity, estate, heir or otherwise).

(c) Severability. If any one or more of the provisions or parts of a provision contained in this Agreement (including, without limitation, Section 4) and the agreements herein shall for any reason be held to be invalid, illegal or unenforceable in any respect, such invalidity or unenforceability shall not affect any other provision or part of a provision of this Agreement and the agreements herein, but this Agreement and the agreements herein shall be reformed and construed as if such invalid, illegal or unenforceable provision or part of a provision had never been contained herein and such provisions or part thereof shall be reformed so that it would be valid, legal and enforceable to the maximum extent permitted by law.

(d) Governing Law. This Agreement shall be governed in accordance with the laws of the State of Florida without regard to conflict of laws provisions.

Please confirm your agreement with the terms set forth above by signing below.

| | | | | | | | |

| | Sincerely, |

| | |

| | /s/ Shelby Pyatt |

| | Shelby Pyatt |

| | On behalf of Rayonier, Inc. |

| | |

| | | | | | | | |

| Acknowledged and Agreed: | | |

| | |

| /s/ David Nunes | | |

| David Nunes | | |

| | |

| | |

Rayonier Announces Leadership Succession Plan

•Mark McHugh named President and CEO, effective April 1, 2024.

•Doug Long to serve as Executive Vice President and Chief Resource Officer, as previously announced.

•April Tice, currently Chief Accounting Officer, named Senior Vice President and Chief Financial Officer, effective April 1, 2024.

WILDLIGHT, Fla. – (BUSINESS WIRE) – Nov. 1, 2023 – Rayonier Inc. (NYSE:RYN) today announced that David Nunes will be retiring as Chief Executive Officer and a member of the Board, effective March 31, 2024. Pursuant to a multi-year succession planning process led by the Board of Directors, Mark McHugh, currently President and Chief Financial Officer, will become CEO and join the company’s Board at that time.

“Serving as Rayonier’s CEO over the past nine years has been extremely fulfilling,” said Mr. Nunes. “We emerged from the spin-off of our specialty pulp manufacturing business to become the leading pure-play timber REIT, growing the size and quality of our timberland portfolio while also launching a successful real estate development business. I’m very proud of the culture that we’ve built at Rayonier and very excited about the growth opportunities that lie ahead for the company and its next generation of leadership.”

“Mark’s strategic and financial acumen, as well as his diligence and integrity, have made him a valued partner to me over the years,” added Mr. Nunes. “I believe Rayonier is well positioned to prosper under his leadership.”

Dod Fraser, Chairman of Rayonier’s Board of Directors, said, “On behalf of the entire Board, I want to thank Dave for his many contributions to Rayonier. He will leave behind a legacy of steadfast leadership and dedication to our stakeholders. Dave has also done an excellent job of preparing the next generation of leaders at Rayonier, and the appointment of Mark is

Rayonier Inc., 1 Rayonier Way, Wildlight, Florida 32097 www.rayonier.com

the result of a well-constructed succession plan that has been a priority of the Board for the last several years. Mark is a highly respected and forward-thinking leader with a strong track record of effectively allocating capital, executing on strategic growth opportunities, and building relationships with our shareholders and other stakeholders. We are excited about the future of the company under his leadership.”

“I am honored that the Board has entrusted me to lead Rayonier at this pivotal time for the company and broader industry,” said Mr. McHugh. “As the only pure-play timber REIT, Rayonier is uniquely positioned to create value for our shareholders with an exceptional portfolio of timberlands and higher-and-better-use landholdings, as well as a burgeoning Land-Based Solutions business. I am extremely fortunate to be working alongside an experienced team of talented executives, including our Executive Vice President and Chief Resource Officer, Doug Long, who is spearheading our Land-Based Solutions initiative. I look forward to working closely with Doug and the rest of our outstanding senior leadership team and employees to execute our long-term strategic vision.”

As part of the leadership transition, April Tice, currently Vice President and Chief Accounting Officer, will assume the position of Senior Vice President and Chief Financial Officer, effective April 1, 2024. Mr. McHugh added, “April brings exceptional accounting expertise, a deep understanding of Rayonier, and a demonstrated track record of leadership that will translate to a seamless transition for our finance organization. April is an excellent addition to our senior leadership team, and I look forward to her continued contributions to our success.”

Background on Mark McHugh

Mark McHugh was appointed President and Chief Financial Officer in January 2023, having previously served as Senior Vice President and Chief Financial Officer since joining Rayonier in December 2014. Mark has over 20 years of experience in finance and capital markets, focused primarily on the forest products and REIT sectors. He joined Rayonier from Raymond James, where he served as a Managing Director in the firm’s Real Estate Investment Banking group, responsible for the firm’s timberland and agriculture sector coverage. Prior to Raymond James, Mark worked in the Investment Banking Division of Credit Suisse in New York and Los Angeles from 2000 to 2008, focused on the paper and

Rayonier Inc., 1 Rayonier Way, Wildlight, Florida 32097 www.rayonier.com

forest products sectors. Mark holds a B.S.B.A in Finance from the University of Central Florida and a JD from Harvard Law School.

Background on Doug Long

Doug Long was appointed Executive Vice President and Chief Resource Officer in January 2023, having previously served as Senior Vice President, Forest Resources since December 2015. Doug oversees Rayonier’s global forestry operations as well as emerging business opportunities associated with Land-Based Solutions. He joined Rayonier in 1995 and has held multiple positions of increasing responsibility within the forestry division. Doug holds a Bachelor’s and Master’s degree in Forest Resources and Conservation from the University of Florida.

Background on April Tice

April Tice was appointed Vice President and Chief Accounting Officer in April 2021, having previously served as Vice President, Financial Services and Corporate Controller. April joined Rayonier in 2010 and has held multiple positions of increasing responsibility within the finance and accounting departments. Prior to joining Rayonier, she was an Audit Manager at Deloitte & Touche. April holds a Bachelor of Fine Arts from Florida State University and a Master of Accountancy with a tax concentration from the University of North Florida, and is a Certified Public Accountant in the State of Florida.

About Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of September 30, 2023, Rayonier owned or leased under long-term agreements approximately 2.8 million acres of timberlands located in the U.S. South (1.90 million acres), U.S. Pacific Northwest (474,000 acres) and New Zealand (419,000 acres). More information is available at www.rayonier.com.

Contacts

Investors: Collin Mings, investorrelations@rayonier.com, 904-357-9100

Media: Alejandro Barbero, alejandro.barbero@rayonier.com

Rayonier Inc., 1 Rayonier Way, Wildlight, Florida 32097 www.rayonier.com

Shareholder Value Enhancement Initiatives SHAREHOLDER VALUE ENHANCEMENT INITIATIVES November 2023 Exhibit 99.2

Shareholder Value Enhancement Initiatives Forward-Looking Statements 1 Forward-Looking Statements - Certain statements in this communication regarding anticipated financial outcomes including Rayonier’s planned asset dispositions, use of proceeds, impact on debt and leverage levels and targets, impact on EBITDA and CAD trading multiples and expected cost of debt, earnings guidance, if any, business and market conditions, outlook, expected dividend rate, Rayonier’s business strategies, expected harvest schedules, timberland acquisitions and dispositions, the anticipated benefits of Rayonier’s business strategies, and other similar statements relating to Rayonier’s future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,” “anticipate” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. The following important factors, among others, could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document: the risk that the Oregon disposition will not be completed on a timely basis or at all; the risk that the remaining $1 billion of select assets sales does not occur on the contemplated timetable or at all; the risk that we will not be able to reduce our existing debt in accordance with the Plan; the risk that we will not be able to achieve our revised leverage target in accordance with the Plan; the risk that we will not be able to deploy net proceeds from the asset dispositions contemplated by the Plan in the manner and timeframe we anticipate, including the risk that such proceeds will not be sufficient to achieve the target leverage ratio described in the Plan or to return capital to shareholders; the risk that we will otherwise not be able to execute on the Plan; the uncertain outcome, impact, effects and results of the Plan or the announcement or execution of the Plan, including the diversion of management time and attention; the cyclical and competitive nature of the industries in which we operate; fluctuations in demand for, or supply of, our forest products and real estate offerings, including any downturn in the housing market; entry of new competitors into our markets; changes in global economic conditions and world events, including the war in Ukraine, conflict in the Middle East and escalating tensions between China and Taiwan; business disruptions arising from public health crises and outbreaks of communicable diseases; fluctuations in demand for our products in Asia, and especially China; the uncertainties of potential impacts of climate-related initiatives; the cost and availability of third party logging, trucking and ocean freight services; the geographic concentration of a significant portion of our timberland; our ability to identify, finance and complete timberland acquisitions; changes in environmental laws and regulations regarding timber harvesting, delineation of wetlands, endangered species and development of real estate generally, that may restrict or adversely impact our ability to conduct our business, or increase the cost of doing so; adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires; the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida and Washington, including changes in law, policy and political factors beyond our control; the availability of financing for real estate development and mortgage loans; changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors; changes in key management and personnel; and our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect beneficial tax treatment. For additional factors that could impact future results, please see Item 1A - Risk Factors in the Company’s most recent Annual Report on Form 10-K and similar discussion included in other reports that we subsequently file with the Securities and Exchange Commission (the “SEC”). Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent reports filed with the SEC. Non-GAAP Financial and Net Debt Measures – To supplement Rayonier’s financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Rayonier has presented forward-looking statements regarding “Adjusted EBITDA,” which is defined as earnings before interest, taxes, depreciation, depletion, amortization, the non-cash cost of land and improved development, non-operating income and expense, operating loss (income) attributable to noncontrolling interests in Timber Funds, costs related to the merger with Pope Resources, timber write-offs resulting from casualty events, the gain on investment in Timber Funds, Fund II Timberland Dispositions, costs related to shareholder litigation, gain on foreign currency derivatives, gain associated with the multi-family apartment sale attributable to NCI, internal review and restatement costs, net income from discontinued operations and Large Dispositions. Adjusted EBITDA is a non-GAAP measure that management uses to make strategic decisions about the business and that investors can use to evaluate the operational performance of the assets under management. It excludes specific items that management believes are not indicative of the Company’s ongoing operating results. Rayonier is unable to present a quantitative reconciliation of forward-looking Adjusted EBITDA to its most directly comparable forward-looking GAAP financial measures because such information is not available, and management cannot reliably predict all of the necessary components of such GAAP measures without unreasonable effort or expense. In addition, we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. The unavailable information could have a significant impact on Rayonier’s future financial results. These non-GAAP financial measures are preliminary estimates and are subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between the company's actual results and preliminary financial data set forth above may be material.

Shareholder Value Enhancement Initiatives Asset Disposition & Capital Structure Realignment Plan 2* Non-GAAP measure (see Appendix for definition). Rayonier is targeting ~$1 billion of select asset sales over the next 18 months (including the $242 million asset sale announced today) Asset disposition plan intended to enhance shareholder value by capturing significant disparity between public and private market timberland values Proceeds will be used to achieve new capital structure targets and return meaningful capital to shareholders DISPOSITION PLAN TARGETING ~$1BN OF ASSET SALES Rayonier is enhancing its credit ratio targets based on “higher for longer” rate outlook Reducing Net Debt / Adjusted EBITDA target from ≤ 4.5x to ≤ 3.0x and Net Debt / Asset Value target from ≤ 30% to ≤ 20% Enhanced credit ratio targets expected to improve CAD* per share and provide greater capital allocation flexibility ENHANCED CREDIT RATIO TARGETS Sale of ~55,000 acres in Oregon for $242 million (~$4,400 per acre) Sale price represents multiple of 42x 3-year Avg. EBITDA* (2021-23E) – a significant premium to Rayonier’s implied EBITDA* trading multiple Proceeds used to repay $150 million of floating-rate debt and retain cash on the balance sheet for further debt retirement / return of capital to shareholders Anticipating pro forma CAD* per share accretion of ~6% after application of proceeds DISPOSITION OF OREGON PROPERTIES

Shareholder Value Enhancement Initiatives 18.2x 23.1x 35.0x 53.2x 41.8x – 10.0x 20.0x 30.0x 40.0x 50.0x 60.0x Rayonier (2023E Adj. EBITDA) NCREIF U.S. South (LTM EBITDA) NCREIF U.S. PNW (LTM EBITDA) NZ Appraisal (LTM Timber EBITDA) Enterprise Value / Timber EBITDA Enterprise Value / Adjusted EBITDA Public vs. Private Disconnect / Arbitrage Opportunity Rayonier’s public market valuation is currently well below private market valuation benchmarks Rayonier’s Current Trading Multiples: Ent. Value / 2023E Adjusted EBITDA*: 18.2x Ent. Value / 2023E Timber EBITDA*: 23.1x (For better comparison to private market benchmarks) (1) Private Market Benchmarks: NCREIF U.S. South index implied multiples: ̶ Multiple of LTM (as of 3Q23) EBITDA: 35.0x ̶ Multiple of 5-year average (2018-22) EBITDA: 41.0x NCREIF U.S. Pacific Northwest index implied multiples: ̶ Multiple of LTM (as of 3Q23) EBITDA: 53.2x ̶ Multiple of 5-year average (2018-22) EBITDA: 31.5x New Zealand appraisal value as of 12/31/2022: ̶ Multiple of LTM (as of 3Q23) Timber EBITDA: 41.8x ̶ Multiple of 5-year average (2019-23E) Timber EBITDA: 22.3x 3 Key Observations Rayonier intends to capitalize on the historically wide disparity between public and private market timberland values through its announced asset disposition plan. Enterprise Value / EBITDA Multiple Comparison * Non-GAAP measure (see Appendix for definitions and reconciliations). Source: Multiples for NCREIF Indices based on current index value per acre divided by LTM EBITDA and 5-year average EBITDA per acre, respectively. Multiples for RYN based on Enterprise Value and midpoint of 2023E Adj. EBITDA guidance per Q2 2023 Financial Supplement. See Appendix for detailed calculations. (1) Enterprise Value to Timber EBITDA is intended to capture implied trading multiple of Timber Segments EBITDA for better comparison to private market benchmarks. Enterprise Value is not adjusted for any allocation of value to HBU real estate / development portfolio. (1)

Shareholder Value Enhancement Initiatives – $50 $100 $150 $200 $250 $300 $350 $400 $450 $500 2023 2024 2025 2026 2027 2028 2029 2030+ Hedged for Term Floating Hedged until 2024 Enhanced Target Capital Structure & Financial Policy 4 Credit Highlights & Ratio Targets Enhanced credit ratio targets will further strengthen Rayonier’s balance sheet and provide greater capital allocation flexibility amid anticipated “higher-for-longer” interest rate environment. Current Credit Ratings S&P: BBB- / Stable Moody’s: Baa3 / Stable Credit Highlights Strong Adj. EBITDA* margins High EBITDA-to-FCF conversion Significant asset coverage Weighted avg. cost of debt: – Current: ~3.2% / 90% fixed – Pro Forma for $150mm Paydown: ~2.8% / 100% fixed Credit Ratio Targets Committed to maintaining an investment grade credit profile Target credit metrics include: ̶ Net Debt / Adj. EBITDA*: ≤ 3.0x ≤ 4.5x ̶ Net Debt / Asset Value: ≤ 20% ≤ 30% * Non-GAAP measure (see Appendix for definitions and reconciliations). (1) Maturity profile excludes New Zealand minority shareholder loans, which are expected to be renewed at maturity. (2) Assumes transaction fees and expenses of $2.5 million. Pro Forma Adjusted EBITDA for OR disposition based on 3-year average EBITDA attributable to the property (2021-23E). Pro Forma Capitalization & Maturity Profile (1) ($ in millions) 9/30/2023 OR Sale (2) Pro Forma Total Debt (3) $1,519.0 ($150.0) $1,369.0 (–) Cash ($107.8) ($89.5) ($197.3) Net Debt $1,411.2 ($239.5) $1,171.7 Credit / Valuation Data 2023E Adjusted EBITDA (4) $287.5 ($5.8) $281.8 Shares / OP Units Outstanding 150.7 – 150.7 Enterprise Value (5) $5,234.5 ($239.5) $4,995.0 Credit Statistics Net Debt / Adjusted EBITDA* 4.9x – 4.2x Net Debt / Enterprise Value* (5) 27% – 23% ($ in millions) $150MM to be retired with OR sale proceeds New Targets Previous Targets Pro Forma Debt Cost $150MM of remaining floating rate exposure through 2025 (3) Debt reflects principal on long-term debt, gross of deferred financing costs and unamortized discounts. (4) Rayonier 2023E Adjusted EBITDA based on midpoint of full-year guidance per Q2 2023 Financial Supplement. (5) Enterprise value based on market capitalization (including Rayonier, L.P. “OP units”) plus net debt based on RYN share price of $25.37 (as of 10/30/23). Assumes constant share price pre and post disposition.

Shareholder Value Enhancement Initiatives Oregon Disposition – Overview / Rationale 5 Current private market valuations translate to significantly higher EBITDA and CAD multiples relative to Rayonier’s current trading multiples Historical EBITDA(2) of ~$6 million for Southwest Oregon implies an EBITDA multiple of ~42x Capitalizing on arbitrage opportunity enhances Rayonier’s intrinsic value per share CAPITALIZES ON PUBLIC- PRIVATE DISCONNECT Reduces net leverage by 0.7x – significant progress in achieving enhanced credit ratio targets First step in targeted asset dispositions to generate proceeds for de-leveraging and return of capital to shareholders IMPORTANT INITIAL STEP TOWARD ENHANCED CREDIT RATIO TARGETS While the disposition is a high-quality property, Rayonier has been unable to gain scale in Southwest Oregon since the acquisition of this property in 2016 Recent transactions in Oregon have been materially above Rayonier’s public market trading value CONSISTENT WITH ACTIVE PORTFOLIO MANAGEMENT STRATEGY $150 million of proceeds used to repay the only floating rate debt in Rayonier’s capital structure Remaining proceeds provide enhanced strategic and capital allocation flexibility Expected to generate pro forma CAD per share accretion of ~6% STRONG CAPITAL ALLOCATION FIT Minimal impacts to operating cash flow over the next decade due to relatively young age-class Distant from the vast majority of Rayonier’s Pacific Northwest portfolio located in Washington Minimal impact to residual productivity, Douglas-fir species mix, and age-class distribution MINIMAL IMPACTS TO RESIDUAL PACIFIC NORTHWEST PORTFOLIO Rayonier has entered into an agreement to sell 55,000 acres in Southwest Oregon to Manulife Investment Management on behalf of clients for a purchase price of $242 million (~$4,400 per acre) Allows Rayonier to capitalize on significant public-private disconnect and generate per share CAD accretion Closing anticipated to occur before year-end (contingent on customary closing conditions) Expected to reduce Rayonier’s Pacific Northwest sustainable yield by ~32 MMBF per year (1) Disposition Highlights (1) “Sustainable yield” is defined and provided in the Company’s latest report on Form 10-K. (2) Based on 3-year Average EBITDA attributable to Southwest Oregon for 2021-2023E.

Shareholder Value Enhancement Initiatives Sources Uses Oregon Sale Proceeds $242.0 Incremental Term Loan III Paydown $150.0 Transaction Fees & Expenses 2.5 Increase in Cash Balance 89.5 Total $242.0 Total $242.0 ($ in millions, except per share amounts) Sale of Oregon Timberlands Rayonier @ Transaction Pro 9/30/2023 Consequences (1) Forma Balance Sheet Debt $1,519.0 ($150.0) $1,369.0 (–) Cash (2) 107.8 89.5 197.3 Net Debt $1,411.2 ($239.5) $1,171.7 Adjusted EBITDA & CAD 2023E (3) Pro Forma Adj. EBITDA $287.5 ($5.8) $281.8 (–) CapEx 85.0 (1.2) 83.8 (–) Cash Interest (net) 44.1 (13.8) 30.3 (–) Cash Taxes 4.5 – 4.5 Implied CAD $153.9 $9.3 $163.2 Shares Outstanding (MMs) 150.7 – 150.7 CAD Accretion / (Dilution) Implied CAD per Share $1.02 – $1.08 Accretion / (Dilution) vs. Standalone – – 6.0% Pro Forma Credit Ratios Net Debt / Adj. EBITDA 4.9x – 4.2x Adj. EBITDA / Interest (net) 6.5x – 9.3x Sources & Uses / Pro Forma Transaction Consequences 6 (1) Assumes $150 million paydown of floating rate portion of Incremental Term Loan III at current effective cost of 6.2%. (2) Cash balance assumed to earn interest at 5.0% per annum (except $25 million of cash for working capital). (3) 2023 standalone Rayonier based on midpoint of full-year guidance provided in Q2 2023 Earnings Release, Financial Supplement, and Form 10-Q.

Shareholder Value Enhancement Initiatives Shareholder Value Enhancement Initiatives – Next Steps 7 The plan announced today will allow Rayonier to create value from the elevated disconnect between private market timberland values and the Company’s public market valuation Rayonier’s size, scale, and pure-play timber REIT structure provide the strategic flexibility to take these initiatives to unlock shareholder value Rayonier is targeting total dispositions of ~$1 Bn to achieve its enhanced capital structure targets OBJECTIVE Expect to complete dispositions over the next ~18 monthsTIMING Use of proceeds to be focused on balanced mix of debt retirement and return of capital to shareholders (i.e., share buybacks and/or special distributions)USE OF PROCEEDS Strategy focused on divesting less strategic assets and concentrating capital in markets with the strongest cash flow attributes and most favorable long-term growth prospects ACTIVE PORTFOLIO MANAGEMENT Further details will be provided as sales are completed and at our Investor Day on 2/28/24FUTURE UPDATES

Shareholder Value Enhancement Initiatives Appendix: Debt Profile & Floating Rate Exposure 8

Shareholder Value Enhancement Initiatives Rayonier Debt Profile @ 9/30/23 & 8/1/24 9 (1) Based on all-in effective rate taking account of interest rate swaps, spread over benchmark rate, and Farm Credit patronage refunds. (2) Based on daily simple SOFR rate of 5.31% as of 9/30/2023. (3) Maturity date of New Zealand minority shareholder loans based on weighted average maturity date of three tranches. Loans expected to be renewed at maturity. (4) Assumes $25 million of cash for working capital; balance of cash assumed to earn interest at 5.00%. (5) Based on SOFR forward curve; assumes 1-month term SOFR rate of 5.06% as of 8/1/2024. (6) Current swaps mature Aug-2024; thereafter, $200mm is swapped at ~1.37% and remaining $150mm is unhedged. Rayonier Debt Profile @ 9/30/2023 Denotes debt earmarked for near-term repayment with asset sale proceeds ($ in millions) Debt Balance Initial Term Years to Effective Annual Interest 9/30/2023 Pro Forma (Years) Maturity Maturity Rate (1) Current Pro Forma Senior Unsecured Notes II $450.0 $450.0 10.0 May-31 7.6 2.75% $12.4 $12.4 Incremental Term Loan II 200.0 200.0 8.0 Jun-29 5.7 1.53% 3.1 3.1 Term Loan 350.0 350.0 9.0 Apr-28 4.5 3.09% 10.8 10.8 Incremental Term Loan III (Swapped) 100.0 100.0 5.0 Dec-27 4.2 4.63% 4.6 4.6 Incremental Term Loan III (Floating) (2) 150.0 – 5.0 Dec-27 4.2 6.22% 9.3 – Incremental Term Loan 200.0 200.0 10.0 Apr-26 2.6 2.46% 4.9 4.9 Revolving Credit Facility (2) – – 5.0 Jun-26 2.7 6.56% – – NZ Minority SH Loans (3) 69.0 69.0 5.0 Jul-26 2.8 4.43% 3.1 3.1 Total / Weighted Avg. $1,519.0 $1,369.0 NA NA 5.2 3.17% $48.2 $38.9 % Fixed 90.1% 100.0% Implied Weighted Avg. Rate 3.17% 2.84% (–) Cash & Equivalents (4) 107.8 197.3 – – – 5.00% 4.1 8.6 Net Debt / Net Interest $1,411.2 $1,171.7 NA NA NA NA $44.1 $30.3 Rayonier Debt Profile @ 8/1/2024 Denotes debt earmarked for near-term repayment with asset sale proceeds ($ in millions) Debt Balance Initial Term Years to Effective Annual Interest 8/1/2024 Pro Forma (Years) Maturity Maturity Rate (1) 8/1/2024 Pro Forma Senior Unsecured Notes II $450.0 $450.0 10.0 May-31 6.8 2.75% $12.4 $12.4 Incremental Term Loan II 200.0 200.0 8.0 Jun-29 4.8 1.53% 3.1 3.1 Term Loan (Floating) (5)(6) 150.0 – 9.0 Apr-28 3.7 5.97% 9.0 – Term Loan (Swapped) (6) 200.0 200.0 9.0 Apr-28 3.7 2.28% 4.6 4.6 Incremental Term Loan III (Swapped) 100.0 100.0 5.0 Dec-27 3.4 4.63% 4.6 4.6 Incremental Term Loan 200.0 200.0 10.0 Apr-26 1.7 2.46% 4.9 4.9 Revolving Credit Facility (5) – – 5.0 Jun-26 1.8 6.31% – – NZ Minority SH Loans (3) 69.0 69.0 5.0 Jul-26 1.9 4.43% 3.1 3.1 Total / Weighted Avg. $1,369.0 $1,219.0 NA NA 4.5 3.04% $41.6 $32.6 % Fixed 89.0% 100.0% Implied Weighted Avg. Rate 3.04% 2.67% (–) Cash & Equivalents (4) 197.3 47.3 – – – 5.00% 8.6 1.1 Net Debt / Net Interest $1,171.7 $1,171.7 NA NA NA NA $32.9 $31.5

Shareholder Value Enhancement Initiatives 2023 2024 2025 2026 2027 2028 Thereafter (1) Total Debt Before Paydown $1,519.0 $1,369.0 $1,219.0 $1,219.0 $1,019.0 $919.0 $719.0 (–) Assumed Debt Paydown (150.0) (150.0) – (200.0) (100.0) (200.0) – Pro Forma Debt $1,369.0 $1,219.0 $1,219.0 $1,019.0 $919.0 $719.0 $719.0 Pro Forma Debt Metrics Assuming Debt Paydown At or Before Maturity Weighted Avg. Cost of Debt 2.84% 2.67% 2.67% 2.72% 2.51% 2.57% 2.57% % Fixed Rate 100% 100% 100% 100% 100% 100% 100% $150 $150 $200 $100 $200 $719 – $100 $200 $300 $400 $500 $600 $700 $800 2023 2024 2025 2026 2027 2028 Thereafter Current Floating Rate Debt Swap Maturity Debt Maturity Rayonier Maturity Profile & Floating Rate Exposure 10 Rayonier has a well-staggered maturity profile with limited near-term maturities. Proceeds from asset sales will facilitate debt repayment and maintain a low, fixed-rate cost of debt. (1) New Zealand minority shareholder loans are included in “Thereafter” category, as they are expected to be renewed at maturity. Floating Rate Exposure Through 2024: $300MM ($150MM after Term Loan Paydown) Through 2026: $500MM Through 2028: $800MM Earmarked for Near- term Repayment with Asset Sale Proceeds Rayonier Debt / Interest Rate Swap Maturity Profile (1)

Shareholder Value Enhancement Initiatives Appendix: NCREIF U.S. South Index Statistics 11

Shareholder Value Enhancement Initiatives – 10x 20x 30x 40x 50x 60x – $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 – $10 $20 $30 $40 $50 $60 U.S. South Historical Valuation Snapshot (NCREIF) 12 U.S. South EBITDA per Acre (NCREIF) U.S. South timberlands have traded at an average EBITDA multiple (excluding land sales) of ~40x over the last 23 years and ~39x over the last 10 years. Source: National Council of Real Estate Investment Fiduciaries. Note: Rate of harvest information is not available. U.S. South Value per Acre (NCREIF) U.S. South EBITDA Multiples (NCREIF) 2000-2022 Average = 40.0x 2013-2022 Average = 39.1x

Shareholder Value Enhancement Initiatives – 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 EBITDA Return 10-year UST (10.0%) (5.0%) – 5.0% 10.0% 15.0% 20.0% 25.0% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 EBITDA Return Appreciation Return Historical Components of U.S. South Timberland Returns (NCREIF) 13 NCREIF South Historical Returns U.S. South timberlands have historically been bid to EBITDA cap rates in the range of 2.5% to 3.0%. Source: National Council of Real Estate Investment Fiduciaries. Note: Rate of harvest information is not available. NCREIF South Historical EBITDA Returns vs. 10-Year Treasury 20-Year 10-Year Avg. EBITDA Return 2.6% 2.6% Avg. Spread to 10-yr UST (0.3%) 0.5% 20-Year 10-Year Avg. EBITDA Return 2.6% 2.6% Avg. Appreciation Return 3.7% 2.7%

Shareholder Value Enhancement Initiatives Appendix: NCREIF Pacific Northwest Index Statistics 14

Shareholder Value Enhancement Initiatives – $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 – $25 $50 $75 $100 $125 $150 $175 $200 – 10.0x 20.0x 30.0x 40.0x 50.0x Pacific Northwest Historical Valuation Snapshot (NCREIF) 15 U.S. PNW EBITDA per Acre (NCREIF) Pacific NW timberlands have traded at an average EBITDA multiple (excluding land sales) of ~28x over the last 23 years, although multiples have fluctuated significantly due to historical EBITDA volatility. Source: National Council of Real Estate Investment Fiduciaries. Note: NCREIF Northwest data includes eastside properties. Rate of harvest information is not available. U.S. PNW Value per Acre (NCREIF) U.S. Pacific Northwest EBITDA Multiples (NCREIF) 2000-2022 Average = 27.7x 2013-2022 Average = 30.4x 88x

Shareholder Value Enhancement Initiatives – 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 EBITDA Return 10-year UST (20.0%) (10.0%) – 10.0% 20.0% 30.0% 40.0% 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 EBITDA Return Appreciation Return Historical Components of PNW Timberland Returns (NCREIF) 16 NCREIF Northwest Historical Returns Over the past 15 years, PNW timberlands have been bid to EBITDA cap rates in the range of 2.5% to 4.5%. Source: National Council of Real Estate Investment Fiduciaries. Note: NCREIF Northwest data includes eastside properties. Rate of harvest information is not available. NCREIF Northwest Historical EBITDA Returns vs. 10-Year Treasury 20-Year 10-Year Avg. EBITDA Return 4.5% 3.6% Avg. Spread to 10-yr UST 1.5% 1.3% 20-Year 10-Year Avg. EBITDA Return 4.5% 3.6% Avg. Appreciation Return 5.1% 4.1%

Shareholder Value Enhancement Initiatives Appendix: Definitions & Reconciliations 17

Shareholder Value Enhancement Initiatives 18 Definitions of Non-GAAP Measures and Pro Forma Items Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, depletion, amortization, the non-cash cost of land and improved development, non-operating income and expense, timber write-offs resulting from casualty events and Large Dispositions. Adjusted EBITDA is a non-GAAP measure that management uses to make strategic decisions about the business and that investors can use to evaluate the operational performance of the assets under management. It excludes the impact of specific items that management believes are not indicative of the Company’s ongoing operating results. Cash Available for Distribution (CAD) is defined as cash provided by operating activities adjusted for capital spending (excluding timberland acquisitions and real estate development investments) and working capital and other balance sheet changes. CAD is a non- GAAP measure of cash generated during a period that is available for common stock dividends, distributions to Operating Partnership unitholders, distributions to noncontrolling interests, repurchase of the Company's common shares, debt reduction, timberland acquisitions and real estate development investments. CAD is not necessarily indicative of the CAD that may be generated in future periods. Pro Forma operating income (loss) is defined as operating income (loss) adjusted for timber write-offs resulting from casualty events and Large Dispositions. Rayonier believes that this non-GAAP financial measure provides investors with useful information to evaluate our core business operations because it excludes specific items that are not indicative of the Company's ongoing operating results. Net Debt is calculated as total debt less cash and cash equivalents. Timber write-offs resulting from casualty events include the write-off of merchantable and pre-merchantable timber volume destroyed by casualty events which cannot be salvaged.

Shareholder Value Enhancement Initiatives 19 Reconciliation of Net Debt ($ in millions) Q3 2023 Long-term debt, net of deferred financing costs and unamortized discounts $1,511.4 Plus - deferred financing costs 4.7 Plus - unamortized discounts 2.9 Total Debt, (Principal Only) $1,519.0 Cash and cash equivalents (107.8) Net Debt $1.411.2 ($ in millions) Pro Forma Total Debt, (Principal Only) @ 9/30/2023 $1,519.0 Less - repayment of floating rate portion of Incremental Term Loan III (150.0) Total Debt, (Principal Only) $1,369.0 Cash and cash equivalents @ 9/30/2023 (107.8) Cash proceeds from Oregon sale (242.0) Cash transaction fees and expenses 2.5 Cash used for repayment of floating rate portion of Incremental Term Loan III 150.00 Net Debt $1,171.7

Shareholder Value Enhancement Initiatives 20 Enterprise Value to Adjusted EBITDA Multiple Calculations ($ in millions, except per share and per acre amounts) Rayonier NCREIF U.S. South NCREIF U.S. South NCREIF U.S. PNW NCREIF U.S. PNW Appraisal New Zealand Appraisal New Zealand 2023 Guidance LTM EBITDA 5-Yr Average LTM EBITDA 5-Yr Average LTM Actual (1) 5-Yr Average (1) Timber Segment(s) $227.0 — — — — $27.0 $51.0 Real Estate 95.0 — — — — — — (-) Corporate / Other (34.5) — — — — — — Total Adjusted EBITDA (2) $287.5 — — — — $27.0 $51.0 Period Average Acres 2,681 — — — — 297 296 EBITDA per Acre NM $59.0 $50.4 $60.5 $102.2 $92.2 $173.1 Valuation Share Price @ 10/30/2023 $25.37 NA NA NA NA NA NA Shares and Units Outstanding (MMs) 150.7 NA NA NA NA NA NA Equity Market Capitalization $3,824 — — — — — — (+) Net Debt (2) 1,411 — — — — — — Enterprise Value / Index Value / Appraisal (3) $5,234 $16,666 $15,214 $7,058 $6,206 $1,141 $1,141 Implied Value per Acre NM $2,064 $2,064 $3,219 $3,219 $3,855 $3,855 EV / EBITDA Multiples Enterprise Value / Adjusted EBITDA (2) 18.2x 35.0x 41.0x 53.2x 31.5x 41.8x 22.3x Enterprise Value / Timber EBITDA (2)(4) 23.1x 35.0x 41.0x 53.2x 31.5x 41.8x 22.3x (1) Excludes contribution from carbon credits. (2) Non-GAAP measure. (3) NCREIF index values based on ending market value as of Q3-2023. New Zealand appraisal value as of 12/31/22 based on Matariki Forestry Group appraisal prepared for compliance with statutory financial reporting requirements. (4) Enterprise Value to Timber EBITDA is intended to capture implied trading multiple of Timber Segments EBITDA for better comparison to private market benchmarks. Enterprise Value is not adjusted for any allocation of value to HBU real estate / development portfolio.

Shareholder Value Enhancement Initiatives 21 Reconciliation of Operating Income (Loss) to Adjusted EBITDA by Segment ($ in millions) Southern Timber Pacific Northwest Timber New Zealand Timber Timber Funds Real Estate Trading Corporate and Other Total 2023E (1) Operating income $72.7 ($7.5) $19.2 — $52.8 — ($36.0) $101.2 Timber write-offs resulting from a casualty event (2) — — 2.3 — — — — 2.3 Pro forma operating income (loss) (2) $72.7 ($7.5) $21.5 — $52.8 — ($36.0) $103.5 Depreciation, depletion & amortization 79.8 39.5 21.0 — 15.2 — 1.5 157.0 Non-cash cost of land and improved development — — — — 27.0 — — 27.0 Adjusted EBITDA (2) $152.5 $32.0 $42.5 — $95.0 — ($34.5) $287.5 (1) Based on midpoint of 2023E Adj. EBITDA guidance per Q2 2023 Financial Supplement. (2) Non-GAAP measure.

RAYONIER ANNOUNCES INITIATIVES TO ENHANCE SHAREHOLDER VALUE

•Targeting $1 billion of select asset sales over the next 18 months

•Reducing target leverage to ≤3.0 Net Debt / Adjusted EBITDA

•Actions intended to enhance shareholder value by capturing the significant disparity between public and private timberland values, reinforce the Company’s balance sheet position, and return meaningful capital to shareholders

•Announcing $242 million asset sale in Oregon – first step toward effectuating the plan

WILDLIGHT, Fla. – November 1, 2023 – Rayonier Inc. (NYSE:RYN) today announced an asset disposition and capital structure realignment plan (the “Plan”) targeting $1 billion of select asset sales over the next 18 months. The proceeds of the asset sales will be used to reduce the Company’s leverage to ≤3.0x Net Debt / Adjusted EBITDA* and return meaningful capital to shareholders. The Plan is intended to enhance shareholder value by capturing the significant disparity between public and private timberland values and reducing the level of debt the Company maintains in a higher interest rate environment. The Plan will also improve the Company’s competitive positioning by divesting less strategic assets and concentrating capital in markets with the strongest cash flow attributes and most favorable long-term growth prospects. The Company today announced the first step toward effectuating the Plan with the sale of 55,000 acres in Oregon for $242 million.

“Rayonier remains committed to its nimble, value-added capital allocation strategy,” said David Nunes, Chief Executive Officer. “The disconnect between private market timberland values and the Company’s public market valuation is at an historically wide level, and the plan announced today will allow us to take advantage of this opportunity to create value for our shareholders as well as right-size our leverage to the current market environment. Our portfolio scale and pure-play timber REIT structure afford us the flexibility to take these initiatives, and we are confident that they will result in meaningful value accretion for our shareholders.”

Reducing Leverage Target

Pursuant to the Plan, Rayonier is adjusting its long-term leverage target from ≤4.5x Net Debt / Adjusted EBITDA* to ≤3.0x Net Debt / Adjusted EBITDA* and commensurately reducing its Net Debt / Asset Value target from ≤30% to ≤20%. “While Rayonier enjoys a long-dated and well-staggered debt maturity profile as well as a low-cost, primarily fixed-rate debt structure, these new credit ratio targets are intended to reduce future interest costs and mitigate refinancing exposure in a higher rate environment, as well as enhance our capital allocation flexibility,” said Mark McHugh, President and Chief Financial Officer. “Maintaining a conservative capital structure has always been a priority for Rayonier, and we believe the current interest rate environment and the ‘higher-for-longer’ rate outlook calls for a more cautious approach to debt utilization within our business. We plan to be selective and opportunistic in achieving our enhanced leverage target over the next 18 months.”

1 Rayonier Way, Wildlight, FL 32097 904-357-9100

Announcing Disposition of Oregon Properties

As an important first step toward effectuating the Plan, Rayonier is concurrently announcing an agreement for the sale of 55,000 acres of timberland in Oregon to Manulife Investment Management on behalf of clients for $242 million (~$4,400 per acre), which represents a significant premium to Rayonier’s implied EBITDA* and CAD* trading multiples as well as the per-acre value implied by the Company’s current public market valuation.

“We began evaluating this asset sale six months ago as a way to reduce leverage and take advantage of the significant disconnect between private market timberland values and the valuation implied by the company’s share price,” said Mr. Nunes. “This valuation disconnect has only widened since then, which motivated us to commit to a more transformational initiative to drive value accretion for our shareholders. We intend to remain disciplined and nimble as market conditions evolve, and we will adapt as needed to strengthen our competitive positioning and enhance long-term shareholder value.”

The Oregon disposition is expected to close in the fourth quarter. The Company plans to use $150 million of the proceeds to pay down its only floating rate debt, which will translate to annual interest savings of approximately $9.3 million. The remaining proceeds will be retained to retire debt or return capital to shareholders. Pro forma for the disposition and application of proceeds, the Company’s leverage will decline to 4.2x Net Debt / 2023E Pro Forma Adjusted EBITDA* (based on the midpoint of the Company’s latest full-year guidance adjusted for the Oregon disposition), its weighted average cost of debt will decline to approximately 2.8%, and 100% of its debt will be fixed. Pro forma for the disposition and the application of proceeds, the Company anticipates CAD per share accretion of approximately 6%.

Additional details on the Plan and the Oregon disposition can be found in a supplemental presentation posted to Rayonier’s website. Further details on Rayonier’s progress toward achieving $1 billion of targeted asset sales will be provided as future transactions are completed, as well as at an upcoming Investor Day on February 28, 2024 in New York City.

About Rayonier

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of September 30, 2023, Rayonier owned or leased under long-term agreements approximately 2.8 million acres of timberlands located in the U.S. South (1.90 million acres), U.S. Pacific Northwest (474,000 acres) and New Zealand (419,000 acres). More information is available at www.rayonier.com.

Forward-Looking Statements - Certain statements in this communication regarding anticipated financial outcomes including Rayonier’s planned asset dispositions, use of proceeds, impact on debt and leverage levels and targets, impact on EBITDA and CAD trading multiples and expected cost of debt, earnings guidance, if any, business and market conditions, outlook, expected dividend rate, Rayonier’s business strategies, expected harvest schedules, timberland acquisitions and dispositions, the anticipated benefits of Rayonier’s business strategies, and other similar statements relating to Rayonier’s future events, developments or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “should,” “expect,” “estimate,” “believe,” “intend,” “project,” “anticipate” and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these

1 Rayonier Way, Wildlight, FL 32097 904-357-9100

forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements.

The following important factors, among others, could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document: the risk that the Oregon disposition will not be completed on a timely basis or at all; the risk that the remaining $1 billion of select assets sales does not occur on the contemplated timetable or at all; the risk that we will not be able to reduce our existing debt in accordance with the Plan; the risk that we will not be able to achieve our revised leverage target in accordance with the Plan; the risk that we will not be able to deploy net proceeds from the asset dispositions contemplated by the Plan in the manner and timeframe we anticipate, including the risk that such proceeds will not be sufficient to achieve the target leverage ratio described in the Plan or to return capital to shareholders; the risk that we will otherwise not be able to execute on the Plan; the uncertain outcome, impact, effects and results of the Plan or the announcement or execution of the Plan, including the diversion of management time and attention; the cyclical and competitive nature of the industries in which we operate; fluctuations in demand for, or supply of, our forest products and real estate offerings, including any downturn in the housing market; entry of new competitors into our markets; changes in global economic conditions and world events, including the war in Ukraine; conflict in the Middle East and escalating tensions between China and Taiwan; business disruptions arising from public health crises and outbreaks of communicable diseases; fluctuations in demand for our products in Asia, and especially China; the uncertainties of potential impacts of climate-related initiatives; the cost and availability of third party logging, trucking and ocean freight services; the geographic concentration of a significant portion of our timberland; our ability to identify, finance and complete timberland acquisitions; changes in environmental laws and regulations regarding timber harvesting, delineation of wetlands, endangered species and development of real estate generally, that may restrict or adversely impact our ability to conduct our business, or increase the cost of doing so; adverse weather conditions, natural disasters and other catastrophic events such as hurricanes, wind storms and wildfires; the lengthy, uncertain and costly process associated with the ownership, entitlement and development of real estate, especially in Florida and Washington, including changes in law, policy and political factors beyond our control; the availability of financing for real estate development and mortgage loans; changes in tariffs, taxes or treaties relating to the import and export of our products or those of our competitors; changes in key management and personnel; and our ability to meet all necessary legal requirements to continue to qualify as a real estate investment trust (“REIT”) and changes in tax laws that could adversely affect beneficial tax treatment.

For additional factors that could impact future results, please see Item 1A - Risk Factors in the Company’s most recent Annual Report on Form 10-K and similar discussion included in other reports that we subsequently file with the Securities and Exchange Commission (the “SEC”). Forward-looking statements are only as of the date they are made, and the Company undertakes no duty to update its forward-looking statements except as required by law. You are advised, however, to review any further disclosures we make on related subjects in our subsequent reports filed with the SEC.

*Non-GAAP Financial Measures – To supplement Rayonier’s financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Rayonier uses certain non-GAAP measures, including “cash available for distribution,” “pro forma operating income (loss),” “pro forma net income,” and “Adjusted EBITDA”. Rayonier’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. These non-GAAP measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP.

Investors: Collin Mings, investorrelations@rayonier.com, 904-357-9100

Media: Alejandro Barbero, alejandro.barbero@rayonier.com

Source: Rayonier Inc

1 Rayonier Way, Wildlight, FL 32097 904-357-9100

Cover Page Cover Page

|

Oct. 30, 2023 |

| Cover [Abstract] |

|

| City Area Code |

904

|

| Document Period End Date |

Oct. 30, 2023

|

| Document Type |

8-K

|

| Entity Address, Address Line One |

1 Rayonier Way

|

| Entity Address, City or Town |

Wildlight

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32097

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity Registrant Name |

RAYONIER INC

|

| Local Phone Number |

357-9100

|

| Trading Symbol |

RYN

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Soliciting Material |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Amendment Flag |

false

|

| Entity File Number |

1-6780

|

| Entity Tax Identification Number |

13-2607329

|

| Title of 12(b) Security |

Common Shares, no par value, of Rayonier Inc.

|

| Entity Central Index Key |

0000052827

|

| Entity Information [Line Items] |

|

| Entity File Number |

1-6780

|

| Entity Registrant Name |

RAYONIER INC

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity Tax Identification Number |

13-2607329

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000052827

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 30, 2023

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

1 Rayonier Way

|

| Entity Address, City or Town |

Wildlight

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32097

|

| Rayonier Limited Partnership [Member] |

|

| Cover [Abstract] |

|

| Entity Address, Address Line One |

1 Rayonier Way

|

| Entity Address, City or Town |

Wildlight

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32097

|

| Entity Emerging Growth Company |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Registrant Name |

RAYONIER, L.P.

|

| Entity File Number |

333-237246

|

| Entity Tax Identification Number |

91-1313292

|

| Entity Central Index Key |

0001806931

|

| Entity Information [Line Items] |

|

| Entity File Number |

333-237246

|

| Entity Registrant Name |

RAYONIER, L.P.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

91-1313292

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001806931

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

1 Rayonier Way

|

| Entity Address, City or Town |

Wildlight

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32097

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |