S&P Equity Research Sees Continued Consolidation in the Steel Industry

July 31 2006 - 1:16PM

PR Newswire (US)

NEW YORK, July 31 /PRNewswire/ -- Despite Mittal's acquisition of

Arcelor, Standard & Poor's Equity Research Services sees the

global steel industry further consolidating over the next several

years. These and other findings are available in a semi-annual

report on the metals industry, Metals: Industrials Industry Survey,

published by Standard & Poor's, a leading provider of

independent investment research. Standard & Poor's Equity

Research sees the following companies as potential acquisition

candidates, Commercial Metals (NYSE:CMCNYSE:$22.04****), Quanex

Corp. (NYSE:NXNYSE:$36.35****) and Steel Dynamics

(NASDAQ:STLDNASDAQ: $57.91***). In our opinion, Commercial Metals

has attractive assets in steel manufacturing, steel fabrication and

scrap recycling. Quanex appears attractive for its strong market

position in engineered steel bar and its ample free cash flow.

Steel Dynamics has low-cost steel-making operations and a

diversified product mix serving the automotive, distributor and

nonresidential construction markets. There are several companies in

this industry that we believe have the financial wherewithal to

make acquisitions. According to Standard & Poor's Equity

Research, the most likely acquirers would be Nucor Corp.

(NYSE:NUENYSE: $51.60****) and U.S. Steel (NYSE:XNYSE:$62.48****).

Both of these companies may be looking to improve and expand its

capabilities in certain markets. "Sharply rising costs for raw

materials such as iron ore and ferrous scrap are creating pressure

for companies to merge. Steel producers have to become larger in

order to have greater clout to obtain more favorable contracts from

the iron ore miners. Also, larger companies would have the greater

financial strength required to engage directly in iron ore mining

or manufacture substitutes for ferrous scrap," said Leo Larkin,

Senior Metals and Mining Analyst, Standard & Poor's Equity

Research Services. "The imperative to reduce raw material costs

will, in our opinion, result in further industry consolidation."

Standard & Poor's Industry Surveys provide a broad and

fundamental overview of each industry's structure, its recent

performance, and an analysis of trends that are expected to

influence it in the future. Each Survey is organized into the

following sections: Current Environment, Industry Profile/Industry

Trends, How the Industry Operates, Key Industry Ratios and

Statistics, How to Analyze a Company, Industry References,

Comparative Company Analysis, and a Glossary of terms used in that

industry. Both text and data are provided, as are references to

additional sources of industry information. Two surveys on each

industry are published each year. Readers can purchase Standard

& Poor's Industry Surveys three ways: Online for immediate

download at http://sandp.ecnext.com/, by telephone at 212-438-4052,

or via e-mail order sent to . Members of the media can request a

copy from the communications contact listed at the end of this

release. The analyst quoted above is a Standard & Poor's equity

analyst. He has no affiliation with any company he covers, nor any

ownership interest in any companies he covers. About Standard &

Poor's Equity Research Services As the world's largest producer of

independent equity research, over 1,000 institutions license

Standard & Poor's research for their investors and advisors,

including 19 of the top 20 securities firms, 13 of the top 20

banks, and 11 of the top 20 life insurance companies. Standard

& Poor's team of 120 experienced U.S., European and Asian

equity analysts use a fundamental, bottom-up approach to assess a

global universe of approximately 2,000 equities across more than

120 industries worldwide. Follow Standard & Poor's equity

analysts' U.S. market commentary each day at

http://www.equityresearch.standardandpoors.com/. The equity

research reports and recommendations provided by Standard &

Poor's Equity Research Services are performed separately from any

other analytic activity of Standard & Poor's. Standard &

Poor's Equity Research Services has no access to non-public

information received by other units of Standard & Poor's.

Standard & Poor's does not trade on its own account. The

analytical and ethical conduct of Standard & Poor's equity

analysts is governed by the firm's Research Objectivity Policy, a

copy of which may also be found at

http://www.standardandpoors.com/. About Standard & Poor's

Standard & Poor's, a division of The McGraw-Hill Companies

(NYSE:MHP), is the world's foremost provider of financial market

intelligence, including independent credit ratings, indices, risk

evaluation, investment research and data. With approximately 7,500

employees, including wholly owned affiliates, located in 21

countries, Standard & Poor's is an essential part of the

world's financial infrastructure and has played a leading role for

more than 140 years in providing investors with the independent

benchmarks they need to feel more confident about their investment

and financial decisions. For more information, visit

http://www.standardandpoors.com/ DATASOURCE: Standard & Poor's

CONTACT: Ed Sweeney Communications Tel.: 212-438-6634 Web site:

http://www.standardandpoors.com/

http://www.equityresearch.standardandpoors.com/

http://sandp.ecnext.com/

Copyright

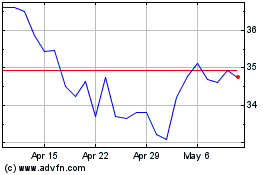

Quanex (NYSE:NX)

Historical Stock Chart

From Jun 2024 to Jul 2024

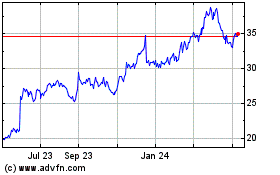

Quanex (NYSE:NX)

Historical Stock Chart

From Jul 2023 to Jul 2024