Firstrust Bank Expands Q2 Partnership to Strengthen Customer Engagement and Deposit Growth

February 13 2024 - 10:00AM

Business Wire

Firstrust Bank uses Q2 ClickSWITCH to provide

customers with a seamless digital account onboarding experience

Q2 Holdings, Inc. (NYSE: QTWO), a leading provider of digital

transformation solutions for financial services, announced today

that Firstrust Bank (Firstrust) has selected Q2 ClickSWITCH, a

patent-protected digital account switching software-as-a-service

(SaaS) solution, to help grow deposits, increase engagement and

provide its customers with a modernized digital account onboarding

experience. The expanded partnership between Q2 and Firstrust,

which began in 2019 when Firstrust deployed Q2’s digital banking

platform to power its online and mobile banking technology,

demonstrates the bank’s commitment to providing its customers with

best-in-class technology.

With over $5 billion in assets, Firstrust was founded in 1934

and remains committed to serving the financial needs of the greater

Philadelphia region. By adding Q2 ClickSWITCH to its technology

stack, Firstrust aims to increase the lifetime value of its

customers by making it simple for commercial account holders to

utilize Firstrust for their personal banking needs. Q2 ClickSWITCH

helps banks and credit unions speed up and simplify new account

onboarding by allowing customers to switch their existing direct

deposits and automatic payments quickly, securely and

seamlessly.

“Firstrust’s mission is centered on cultivating prosperity for

our customers, our employees and the communities we serve, and we

believe our expanded partnership with Q2 will help provide the best

digital experience for our customers,” said Tim Abell, CEO and

president of Firstrust Bank. “Additionally, deposit growth is a top

priority, and it’s critical for us to invest in technology that

makes it easier for our customers to bank with Firstrust.”

"Our goal is to build a relationship with everyone who joins

Firstrust. Today, the digital banking experience is the easiest and

most convenient way for our customers to interact with their money,

anytime, anywhere, anyplace,” said Abell. “Q2 ClickSWITCH enables

us to take friction away from that experience from the beginning

and helps convey who we are, a bank that can serve all their needs

in-person at our 18 branches or online through our digital banking

platform.”

“Deposits are the lifeblood of any financial institution,” said

Katharine Briggs, senior vice president, Customer Success, Q2.

"Firstrust’s decision to invest in Q2 ClickSWITCH underscores its

commitment to elevating the onboarding experience with a modernized

digital solution that helps banks and credit unions drive

engagement and strengthen account holder relationships."

Learn More

For more information about how Q2 ClickSWITCH helps financial

institutions to win deposits, engage account holders, and increase

profitability, go to

https://www.q2.com/consumer/account-switching.

For more information about Q2’s best-in-class digital banking

platform, go to https://www.q2.com/consumer.

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for

financial services, serving banks, credit unions, alternative

finance companies, and fintechs in the U.S. and internationally. Q2

enables its financial institutions and fintech companies to provide

comprehensive, data-driven digital engagement solutions for

consumers, small businesses and corporate clients. Headquartered in

Austin, Texas, Q2 has offices worldwide and is publicly traded on

the NYSE under the stock symbol QTWO. To learn more, please visit

Q2.com. Follow us on LinkedIn and X to stay up to date.

About Firstrust Bank

Founded in 1934, with assets of approximately $5 billion,

Firstrust Bank is the region’s largest family-owned financial

institution, one of the region’s largest and strongest full-service

commercial banks, and one of the most consistently top-performing

banks in the Nation. Founded by Samuel A. Green, who began the

business in his mother’s kitchen in South Philadelphia, Firstrust

is currently in its third generation of family management,

operating as Philadelphia’s Hometown Bank® for 90 years. Firstrust

offers a broad range of retail and commercial banking products and

services to individuals, businesses, and institutions. In

commercial banking, Firstrust provides a wide variety of solutions,

including commercial real estate finance, business banking,

asset-backed lending, and deposit and treasury management services.

Firstrust meets the need of its consumer customers by offering a

full range of deposit, lending, and residential mortgage products.

Firstrust is a Small Business Administration (SBA) Preferred

Lender, is a Top Workplaces employer, the Official Bank of the

Philadelphia Eagles and serves its customers through 18 branch

banking offices located in Southeastern PA, Cherry Hill, NJ, and

Towson, MD. For more information, visit firstrust.com or call

800-220-BANK. Member FDIC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213557406/en/

Carly Baker Q2 Holdings, Inc. +1 210-391-1706

Carly.baker@q2.com

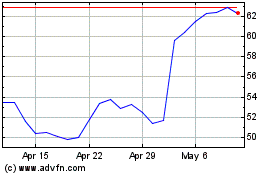

Q2 (NYSE:QTWO)

Historical Stock Chart

From Apr 2024 to May 2024

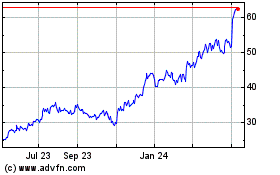

Q2 (NYSE:QTWO)

Historical Stock Chart

From May 2023 to May 2024