For Immediate Release

Chicago, IL – February 23, 2012 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Johnson &

Johnson ( JNJ),

Pfizer ( PFE), Merck (

MRK), Public Service Enterprise Group ( PEG)

and Consolidated Edison Inc. ( ED).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Wednesday’s Analyst

Blog:

J&J CEO Stepping Down

Johnson & Johnson ( JNJ) recently

announced that Bill Weldon, its Chief Executive Officer (CEO), will

be stepping down from his post. Mr. Weldon, however, will continue

to serve as Chairman of the Board of Directors.

Weldon, CEO at Johnson & Johnson since 2002, will be

replaced by Alex Gorsky, who currently holds the post of the Vice

Chairman of the Company's Executive Committee. Gorsky is also

responsible for the Medical Devices & Diagnostics Group, Global

Supply Chain, Health Care Compliance & Privacy and Government

Affairs & Policy.

The new CEO will take charge on April 26, 2012, the date of the

company's annual shareholder meeting.

Besides Gorsky, another contender for the post of the CEO was

Sheri S. McCoy. Sheri S. McCoy will continue in her role as Vice

Chairman of the Executive Committee. She will continue to lead the

Pharmaceuticals and Consumer Groups, and maintain responsibility

for Information Technology.

Change Expected

The announcement did not come as a huge surprise. During a part

of Weldon’s tenure, Johnson & Johnson has been beleaguered by

frequent product recalls, which affected the performance of its

consumer segment. The company has been facing these issues since

2009. While US Consumer segment sales declined 6.7% in 2011 to $5.2

billion with US OTC/nutritional sales declining 22.9%, 2010

revenues were impacted by about $900 million due to the

product-recall related issues. In addition to losing revenues,

consumer trust in the company was also affected.

The company has been working on resolving the situation.

However, just when it looked like the product recall situation was

somewhat under control, Johnson & Johnson announced yet another

recall (seven lots of Infants’ Tylenol Oral Suspension, 1 oz. Grape

distributed in the US) a few days back.

Neutral on Johnson & Johnson

We currently have a Neutral recommendation on Johnson &

Johnson, which carries a Zacks #3 Rank (short-term Hold rating). In

our view, the new CEO will have his or her hands full dealing with

the product recall issues and regaining consumer confidence.

Other companies that announced a change at the helm in the

recent past include Pfizer ( PFE)

and Merck ( MRK).

PEG Steady Biz Boosts Dividend

Public Service Enterprise Group ( PEG) has

increased its dividend by 3.6%, bringing the annualized dividend to

$1.42 per share from the previous payout of $1.37 per share. The

company’s strong balance sheet and cash flow generating abilities

ensure a steady rise to the dividend.

The company will now pay a quarterly dividend of 35.5 cents per

share compared with the prior quarterly dividend of 34.25 cents per

share. The dividend will be paid on March 31, 2012, to shareholders

of record at the close of business on March 9, 2012.

The company has been regularly paying dividends since 1907. The

last quarterly dividend increase came in February 2010 with a 3%

hike from 33.25 cents to 34.25 cents.

With the current dividend increase, the company revised its

payout policy. It had earlier committed to pay 40% to 50% of its

earnings as dividends. Now it plans to reward shareholders with a

greater percentage of its income.

The company stated that contribution from its stable regulated

business is steadily increasing, a trend that is expected to

continue. Besides, progress on operational, capital investment and

financial goals in 2011 would yield generous free cash flow,

supporting future dividend growth.

The company’s robust portfolio of regulated and non-regulated

utility assets offers a steady earnings base and significant

long-term growth prospects. Moreover, we believe that going forward

the company’s growth will be driven by a low-cost nuclear fleet,

assumed rate relief and added generating capacities.

However, the increasing cost of coal, higher pension and

financial costs, and power-price volatility are areas of concern.

The company presently retains a short-term Zacks #3 Rank (Hold)

that corresponds with our long-term Neutral recommendation on the

stock.

Public Service Enterprise Group is expected to release its

earnings tomorrow. The Zacks Consensus Estimates for fourth

quarter and fiscal year 2011 are currently at 46 cents per share

and $2.73 per share, respectively.

Recently its competitor, Consolidated Edison

Inc. ( ED) reported fourth quarter and fiscal 2011

results. In the reported quarter, earnings from continuing

operations came in at 74 cents, beating the Zacks Consensus

Estimate of 71 cents. Results also compared favorably with earnings

from continuing operations of 69 cents in the year-ago quarter.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

CONSOL EDISON (ED): Free Stock Analysis Report

JOHNSON & JOHNS (JNJ): Free Stock Analysis Report

MERCK & CO INC (MRK): Free Stock Analysis Report

PUBLIC SV ENTRP (PEG): Free Stock Analysis Report

PFIZER INC (PFE): Free Stock Analysis Report

To read this article on Zacks.com click here.

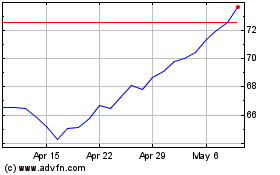

Public Service Enterprise (NYSE:PEG)

Historical Stock Chart

From Apr 2024 to May 2024

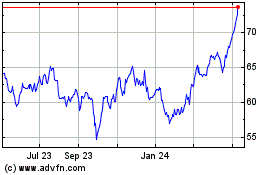

Public Service Enterprise (NYSE:PEG)

Historical Stock Chart

From May 2023 to May 2024