A.M. Best Affirms Ratings of Protective Life Corporation and Its Subsidiaries; Assigns Ratings to New Senior Notes

October 09 2009 - 9:36AM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A+ (Superior) and issuer credit ratings (ICR) of “aa-” of

the primary life/health subsidiaries of Protective Life

Corporation (Protective) (Wilmington, DE) (NYSE: PL), led by

Protective Life Insurance Company (PLIC) (Brentwood, TN).

Additionally, A.M. Best has affirmed the ICR of “a-” and debt

ratings of Protective. A.M. Best also has affirmed the debt ratings

of the outstanding notes issued for the various funding

agreement-backed securities (FABS) programs of PLIC. Concurrently,

A.M. Best has assigned debt ratings of “a-” to the newly issued 10,

15 and 30-year senior unsecured notes totaling $800 million of

Protective. The outlook for all ratings is negative. (See link

below for a detailed listing of the companies and ratings.)

The ratings reflect Protective’s diversified revenue and profit

sources, broad distribution capabilities and strong track record of

effectively integrating acquired insurance companies and blocks of

business. The ratings also acknowledge Protective’s seasoned block

of traditional life insurance as a stabilizing factor for its

earnings.

For the period ending June 30, 2009, the group reported GAAP net

income of $112.9 million after reporting a net loss of

approximately $42 million for 2008. A.M. Best notes that

Protective’s business mix of primarily traditional life insurance

provides for greater earnings stability than other companies with

large equity market exposures. The stable, recurring premiums

associated with Protective’s seasoned block of life business are a

source of strength, and the block contains significant embedded

profits.

The negative outlook reflects the likelihood of additional—and

possibly significant—investment losses given the current economic

environment. Despite the substantial improvement in Protective’s

GAAP net unrealized loss position (approximately $900 million as of

August 31, 2009 from $3 billion at year-end 2008 before tax and

deferred acquisition costs), additional investment losses are

likely to occur within its corporate bond and commercial mortgage

portfolios. However, A.M. Best notes that less than 0.5% of

Protective’s $3.8 billion mortgage loan portfolio was

non-performing as of June 30, 2009. The negative outlook also

recognizes the limitations on Protective’s financial flexibility as

a result of its current level of financial leverage. Protective’s

all-in adjusted financial leverage—senior debt plus hybrids—is

approximately 30% (excluding other comprehensive income and

incorporating significant equity credit for hybrids). Additionally,

Protective’s future earnings may be reduced due to a smaller

contribution from the stable value segment as unfavorable market

conditions continue to hamper sales. Protective’s ratio of deferred

acquisition costs to equity (excluding other comprehensive income)

is high relative to similarly rated peers (150% as of June 30,

2009) and may pressure the ratings should the ratio remain elevated

for an extended period. However, A.M. Best notes that this ratio is

somewhat inflated due to the effects of reinsurance.

The proceeds from the $800 million aggregate senior notes

offering will be utilized by Protective to purchase newly-issued

surplus notes from its special purpose financial captive, Golden

Gate Captive Insurance Company (Golden Gate). Golden Gate will then

use the surplus note proceeds to repurchase, at a discount, $800

million of surplus notes that it originally issued to third

parties. Therefore, the transaction’s only impact on the group’s

capital will be the gain recorded on the repurchase.

A.M. Best considers the new senior debt of Protective to be

mostly operating leverage as the newly-issued surplus notes of

Golden Gate will directly support redundant Regulation XXX term

insurance reserves. Additionally, interest payments received from

Golden Gate will largely cover Protective’s annual debt service on

its senior notes. However, since the transaction is contractually

recourse to Protective, A.M. Best will consider a portion of the

$800 million senior notes as debt for the purposes of determining

GAAP financial leverage and interest coverage. While Protective’s

GAAP financial leverage is high relative to its peers, it is within

A.M. Best’s guidelines for the company’s current ratings. The

group’s GAAP interest coverage, at least in the near term, will

continue to be pressured by lower earnings due to elevated

investment losses. However, A.M. Best notes that the group’s

current interest coverage ratio of approximately four times is

adequate.

For a complete listing of Protective Life Corporation’s FSRs,

ICRs and debt ratings, please visit

www.ambest.com/press/100902protective.pdf.

The principal methodologies used in determining these ratings,

including any additional methodologies and factors that may have

been considered, can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is a global full-service

credit rating organization dedicated to serving the financial and

health care service industries, including insurance companies,

banks, hospitals and health care system providers. For more

information, visit www.ambest.com.

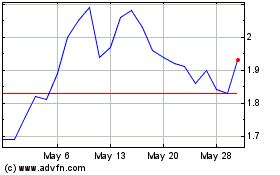

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From May 2024 to Jun 2024

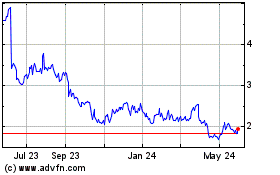

Planet Labs PBC (NYSE:PL)

Historical Stock Chart

From Jun 2023 to Jun 2024