UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to

§ 240.14a-12 |

PGT INNOVATIONS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary

materials. |

| ¨ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

[The

following material was used by PGT Innovations, Inc. (“PGTI”) in its discussion with employees and investors, in connection

with the proposed acquisition of PGTI by MIWD Holding Company LLC]

Talking Points for Team Members

| · | We have just announced the exciting news that PGTI has entered into a definitive

agreement to be acquired by MITER Brands, a privately owned company with several window and door brands. |

| · | We’re excited to reach this agreement with MITER which provides PGTI

shareholders $42.00 per share in cash, representing a ~60% premium to our unaffected closing share price on

October 9, 2023, the last trading day prior to the public disclosure of a proposal for the acquisition of PGTI. |

| · | As you know, we had previously reached an agreement to combine with Masonite.

However, after engaging with both MITER and Masonite in recent days, it became clear that MITER’s latest proposal, which provides

shareholders with increased value and added protections, is the best outcome for PGTI and our shareholders, customers, and employees.

|

| · | MITER Brands is a national supplier of precision-built and energy-efficient

windows and doors, serving homeowners, distributors and dealers, architects, builders, and contractors. |

| · | This marks the beginning of an exciting new chapter for PGTI and our team.

|

| · | We are confident that combining with MITER will help us expand our customer

base, enhance our portfolio and provide our people significant opportunities from being at a stronger combined company. |

| · | Today’s news is a clear testament to our team, which has done an outstanding

job of generating growth and serving increased customer demand while navigating challenging economic conditions and supply-chain headwinds.

|

| · | We should all be incredibly proud of how we’ve all shown up for our

customers and each other. |

| · | While today’s announcement is an important milestone, it is just the

first step in the process. |

| · | It remains business as usual at PGTI until the transaction closes, which is

expected to be by mid-year 2024, subject to PGTI shareholder and regulatory approvals. |

| · | Following the close, PGTI will become part of MITER and our common stock will

no longer trade on the NYSE. |

| · | PGTI’s commitment to our customers and focus on innovation has led us

to this great announcement – and we can’t let up now. The best thing all of us can do is to stay focused on our day-to-day

responsibilities, serving customers and producing the high-quality products that we are known for. |

| · | We

are committed to keeping you informed throughout the process. In the meantime, if you receive

any inquiries from third parties (including customers, members of the press, shareholders

or others), please do not respond or engage. Instead, forward them to Craig Henderson (CHenderson@pgtinnovations.com).

|

| · | Thank you for your hard work and dedication, and for being part of the PGTI

team. |

Investor Talking Points

| · | Our Board carefully reviewed MITER Brand’s revised all-cash proposal

of $42.00 in consultation with our independent financial and legal advisors. |

| · | The Board unanimously determined that MITER’s proposal constituted a

“superior proposal” as defined by our merger agreement with Masonite and adequately addressed the concerns we had with MITER’s

prior proposal. |

| o | MITER’s $42.00, all-cash offer maximizes value for PGTI stockholders and provides certain near-term value. |

| o | The offer price represents a ~60% premium PGTI’s undisturbed stock price on October 9, 2023, and a ~5.6% premium to the value

of the original agreement with Masonite based on their closing stock price on January 16th. |

| o | Financing for the transaction is fully committed from RBC, KeyBank and Koch Equity Development. |

| o | MITER agreed to other contractual provisions that greatly enhance the likelihood of the transaction closing. |

| o | MITER also agreed to pay, on behalf of PGTI, the $84 million termination fee to Masonite that was owed for terminating our agreement

with Masonite to enter into the agreement with MITER. |

| · | We informed Masonite that our Board believed MITER’s proposal was superior,

and they subsequently informed us that they would be waiving the right to improve the terms of its offer. |

| · | The transaction with MITER is expected to close by mid-year 2024, subject

to approval by the PGTI shareholders, as well as the receipt of required regulatory approvals, and satisfaction of other customary closing

conditions. |

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking

statements” within the United States Private Securities Litigation Reform Act of 1995. You can identify these statements and other

forward-looking statements in this document by words such as “may,” “will,” “should,”

“can,” “could,” “anticipate,” “estimate,” “expect,” “predict,”

“project,” “future,” “potential,” “intend,” “plan,” “assume,”

“believe,” “forecast,” “look,” “build,” “focus,” “create,” “work,”

“continue,” “target,” “poised,” “advance,” “drive,”

“aim,” “forecast,” “approach,” “seek,” “schedule,” “position,”

“pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,”

“commit,” “on track,” “objective,” “goal,” “strategy,” “opportunity,”

“ambitions,” “aspire” and similar expressions, and variations or negative of such terms or other variations

thereof. Words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking

statements.

Forward-looking statements by their nature address

matters that are, to different degrees, uncertain, such statements regarding the transactions contemplated by the Agreement and Plan of

Merger, dated as of January 16, 2024, among PGTI, MIWD Holding Company LLC and RMR MergeCo, Inc. (the “Transaction”),

including the expected time period to consummate the Transaction. All such forward-looking statements are based upon current plans, estimates,

expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of PGTI, that

could cause actual results to differ materially from those expressed in such forward-looking statements. Key factors that could cause

actual results to differ materially include, but are not limited to, the expected timing and likelihood of completion of the Transaction,

including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction; the occurrence

of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the possibility that

PGTI’s stockholders may not approve the Transaction; the risk that the parties may not be able to satisfy the conditions to the

Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the Transaction;

the risk that any announcements relating to the Transaction could have adverse effects on the market price of PGTI’s common stock;

the risk that the Transaction and its announcement could have an adverse effect on the parties’ business relationships and business

generally, including the ability of PGTI to retain customers and retain and hire key personnel and maintain relationships with their suppliers

and customers, and on their operating results and businesses generally; the risk of unforeseen or unknown liabilities; customer, shareholder,

regulatory and other stakeholder approvals and support; the risk of potential litigation relating to the Transaction that could be instituted

against PGTI or its directors and/or officers; the risk associated with third party contracts containing material consent, anti-assignment,

transfer or other provisions that may be related to the Transaction which are not waived or otherwise satisfactorily resolved; the risk

of rating agency actions and PGTI’s ability to access short- and long-term debt markets on a timely and affordable basis; the risk

of various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, cybersecurity

attacks, security threats and governmental response to them, and technological changes; the risks of labor disputes, changes in labor

costs and labor difficulties; and the risks resulting from other effects of industry, market, economic, legal or legislative, political

or regulatory conditions outside of PGTI’s control. All such factors are difficult to predict and are beyond our control, including

those detailed in PGTI’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available

on PGTI’s website at https://pgtinnovations.com and on the website of the Securities Exchange Commission (“SEC”)

at http://www.sec.gov. PGTI’s forward-looking statements are based on assumptions that PGTI’s believes to be reasonable but

that may not prove to be accurate. Other unpredictable or factors not discussed in this communication could also have material adverse

effects on forward-looking statements. PGTI does not assume an obligation to update any forward-looking statements, except as required

by applicable law. These forward-looking statements speak only as of the date hereof.

Additional Information and

Where to Find It

In connection

with the Transaction, PGTI will file with the SEC a proxy statement on Schedule 14A. The definitive proxy statement will be sent to the

stockholders of PGTI seeking their approval of the Transaction and other related matters.

INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT ON SCHEDULE 14A WHEN IT BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION REGARDING PGTI, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free

copies of these documents, including the proxy statement, and other documents filed with the SEC by PGTI through the website maintained

by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by PGTI will be made available free of charge by accessing PGTI’s

website at https://pgtinnovations.com or by contacting PGTI by submitting a message at https://ir.pgtinnovations.com/investor-contact

or by mail at 1070 Technology Drive, North Venice, FL 34275.

Participants

in the Solicitation

PGTI, its directors, executive officers and other

persons related to PGTI may be deemed to be participants in the solicitation of proxies from PGTI’s stockholders in connection with

the Transaction. Information about the directors and executive officers of PGTI and their ownership of PGTI common stock is also set forth

in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April

10, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm), PGTI’s

Current Report on Form 8-K filed with the SEC on July 3, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323009816/dp196528_8k.htm),

PGTI’s Current Report on Form 8-K filed with the SEC on August 8, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323011731/dp198129_8k.htm),

PGTI’s Current Report on Form 8-K filed with the SEC on November 6, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323016034/dp202537_8k.htm),

and PGTI’s Current Report on Form 8-K filed with the SEC on January 2, 2024 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010324000038/dp204648_8k.htm).

Information about the directors and executive officers of PGTI, their ownership of PGTI common stock, and PGTI’s transactions with

related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain Relationships and Related

Transactions, and Director Independence” included in PGTI’s annual report on Form 10-K for the fiscal year ended December

31, 2022, which was filed with the SEC on February 27, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095017023004543/pgti-20221231.htm),

and in the sections entitled “Board Highlights” and “Security Ownership of Certain Beneficial Owners and Management”

included in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC

on April 28, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm). Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the proxy statement and other relevant materials to be filed with the SEC in connection with

the proposed transaction when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote

of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

PGT (NYSE:PGTI)

Historical Stock Chart

From Apr 2024 to May 2024

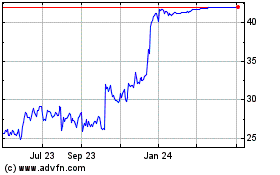

PGT (NYSE:PGTI)

Historical Stock Chart

From May 2023 to May 2024