Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 17 2024 - 8:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

month of January 2024

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

Pearson 2023 Trading Update (Unaudited)

|

17th January

2024

|

Strong execution delivers financial performance in line with

upgraded guidance. Pearson well positioned for 2024 and

beyond

|

Highlights

|

●

|

Underlying Group sales growth1 of

5% for the full year, excluding OPM2 and

the Strategic Review3 businesses.

|

|

●

|

Group adjusted operating profit of c.£570-575m at £:$ of

1.25 for the full year, up more than 30% on an underlying basis

compared to 2022, resulting in a margin of c.15.5%.

|

|

●

|

Strong full year performance driven by Assessment &

Qualifications and English Language Learning.

|

|

●

|

Cost efficiency programme successfully delivered £120m of

savings.

|

|

●

|

We're encouraged by how students are engaging with our generative

AI study tools and will be expanding the current beta to many more

MyLab and Mastering titles by Fall semester 2024. Higher Education

platform units also delivered encouraging growth.

|

|

●

|

Pearson+ passed the milestone of 1 million cumulative paid

subscriptions for the calendar year.

|

Omar Abbosh, Pearson's Chief

Executive, said:

"I am excited to be leading this high quality, purpose-driven

company and I would like to thank Andy for the strong progress made

under his leadership.

Pearson saw strong strategic and operational progress in 2023

leading to financial performance ahead of our initial expectations.

The Group is well positioned to seize growth opportunities and

deliver long-term future value for all of our stakeholders. I look

forward to leading the next phase in Pearson's ongoing

evolution."

Underlying sales

growth1 of

5% for 2023, excluding OPM2 and

Strategic Review3 businesses;

1% in aggregate

|

●

|

Assessment

& Qualifications sales were up 7% for the full year largely

driven by a strong performance in Pearson VUE with good progress in

IT and healthcare alongside the commencement of new contracts. VUE

test volumes4 grew 6% to

20.7m. There was also good growth across US Student Assessments,

Clinical and UK & International Qualifications, due to new

contract wins, good government funding and price increases. As

anticipated, Q4 sales growth of 3% was slower than in prior

quarters due to contract phasing.

|

|

●

|

Virtual Learning sales decreased 20% for the full year, primarily

due to an 87% expected decrease in the OPM business given the

previously announced ASU contract loss. Virtual Schools sales

declined 2% for the full year, with enrolments for the 2023/24

academic year lower due to the previously announced loss of a

larger partner school. Excluding this impact, enrolments were up

1%. Virtual Schools sales grew 5% in Q4, primarily driven by

improvements in funding, as well as growth associated with the

launch of Connections Academy Career Pathways.

|

|

●

|

Higher

Education sales were down 3% for the full year, in line with

expectations, driven by loss of adoptions to non-mainstream

publishers in the first half of the year, as well as pricing mix.

We saw strong growth in Inclusive Access sales to not-for-profit

institutions, which were up 22% for the year, and delivered 2%

growth in platform units. We're encouraged by how students are

engaging with our generative AI study tools and will be expanding

the current beta to many more MyLab and Mastering titles by Fall

semester 2024. Q4 sales were flat. Pearson+ performed well with

3.03m registered users and 516k paid subscriptions, representing

27% growth compared to the prior year Fall semester. Pearson+

passed the milestone of 1 million cumulative paid subscriptions for

the calendar year.

|

|

●

|

English

Language Learning sales increased 30% for the full year with all

three segments contributing to this growth. Pearson Test of English

(PTE) was the outstanding contributor, delivering volume growth of

49% against a backdrop of favourable migration policy in Australia

and market share gains in India. Q4 sales grew 22% largely driven

by PTE and Institutional. We launched PTE for Canadian Student

Direct Stream visa applications in the second half of 2023 and

expect to begin delivering PTE for Canadian economic immigration

visa applications in the first quarter of 2024. We are continuing

to invest in building our brand awareness and testing capacity in

the competitive Canadian market.

|

|

●

|

Workforce

Skills sales grew 11% for the full year, with a solid performance

in both Vocational Qualifications and Workforce Solutions. Sales

grew 28% in Q4, driven by strong growth in BTECs, both in the UK

and internationally.

|

Share buyback

|

●

|

The

previously announced buyback to repurchase £300m of shares

continued, with £188m of shares repurchased as at

31st December

2023.

|

|

●

|

As at

15th January 2024

£206m of shares had been repurchased at an average price of

918p per share, representing 69% of the total

programme.

|

Strong financial position

|

●

|

Pearson's

financial position remains robust, with a strong balance sheet, net

debt of less than £0.8bn and a strong 2023 cash

performance.

|

Financial calendar

|

●

|

Full year results will be announced on 1st March

2024. We will hold a virtual presentation and Q&A session,

during which we will outline the 2024 outlook.

|

|

●

|

A business and strategic update will be provided at our Interim

results in July.

|

|

Financial

summary

Underlying growth

for the fourth quarter and financial year ended 31st December 2023

compared to the equivalent period in 2022.

|

|

Sales

|

Q4

|

Full Year

|

|

Assessment

& Qualifications

|

3%

|

7%

|

|

Virtual

Learning

|

(22)%

|

(20)%

|

|

Higher

Education

|

0%

|

(3)%

|

|

English

Language Learning

|

22%

|

30%

|

|

Workforce

Skills

|

28%

|

11%

|

|

Strategic

Review3

|

(125)%

|

(74)%

|

|

Total

|

0%

|

1%

|

|

Total, excluding OPM2 and

Strategic Review3

|

6%

|

5%

|

For an accompanying data sheet providing 2023 metrics relating to

sales across select key businesses as well as a breakdown of US

Higher Education Courseware college units and Pearson+ metrics,

please follow this

link.

1Throughout this announcement

growth rates are stated on an underlying basis unless otherwise

stated. Underlying growth rates exclude currency movements, and

portfolio changes.

2We have completed the sale of

the Pearson Online Learning Services (POLS) business and as such

have removed from underlying measures throughout. Within this

specific measure we exclude our entire OPM business (POLS and ASU)

to aid comparison to guidance.

3Strategic Review is sales in

international courseware local publishing businesses being wound

down, which will continue to be reported separately until

dissipated.

4VUE test volumes include GED

tests but sales for GED are reflected in the Workforce Skills

division. PDRI test volumes are not currently included in this

metric.

Contacts

|

Investor Relations

|

Jo

Russell

James

Caddy

|

+44

(0) 7785 451 266

+44

(0) 7825 948 218

|

|

|

Gemma

Terry

Brennan

Matthews

|

+44

(0) 7841 363 216

+1

(332) 238-8785

|

|

Media

Teneo

Pearson

|

Charles

Armitstead

Laura

Ewart

|

+44

(0) 7703 330 269

+44

(0) 7798 846 805

|

About

Pearson

At

Pearson, our purpose is simple: to add life to a lifetime of

learning. We believe that every learning opportunity is a chance

for a personal breakthrough. That's why our Pearson employees are

committed to creating vibrant and enriching learning experiences

designed for real-life impact. We are the world's leading learning

company, serving customers with digital content, assessments,

qualifications, and data. For us, learning isn't just what we do.

It's who we are. Visit us at pearsonplc.com

Notes

Forward looking statements: Except for the historical

information contained herein, the matters discussed in this

statement include forward-looking statements. In particular, all

statements that express forecasts, expectations and projections

with respect to future matters, including trends in results of

operations, margins, growth rates, overall market trends, the

impact of interest or exchange rates, the availability of

financing, anticipated cost savings and synergies and the execution

of Pearson's strategy, are forward-looking statements. By their

nature, forward-looking statements involve risks and uncertainties

because they relate to events and depend on circumstances that will

occur in future. They are based on numerous assumptions regarding

Pearson's present and future business strategies and the

environment in which it will operate in the future. There are a

number of factors which could cause actual results and developments

to differ materially from those expressed or implied by these

forward-looking statements, including a number of factors outside

Pearson's control. These include international, national and local

conditions, as well as competition. They also include other risks

detailed from time to time in Pearson's publicly-filed documents

and you are advised to read, in particular, the risk factors set

out in Pearson's latest annual report and accounts, which can be

found on its website (www.pearsonplc.com). Any forward-looking

statements speak only as of the date they are made, and Pearson

gives no undertaking to update forward-looking statements to

reflect any changes in its expectations with regard thereto or any

changes to events, conditions or circumstances on which any such

statement is based. Readers are cautioned not to place undue

reliance on such forward-looking statements.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date: 17

January 2024

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

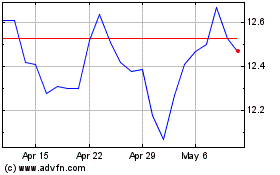

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2024 to May 2024

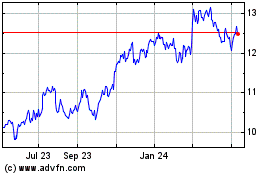

Pearson (NYSE:PSO)

Historical Stock Chart

From May 2023 to May 2024