Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 27 2023 - 3:30PM

Edgar (US Regulatory)

Nuveen

Municipal

Income

Fund,

Inc.

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

LONG-TERM

INVESTMENTS

-

98.4%

X

–

MUNICIPAL

BONDS

-

98

.4

%

X

97,465,763

Alabama

-

3.6%

$

1,255

Limestone

County

Water

&

Sewer

Authority,

Alabama,

Water

and

Sewer

Revenue

Bonds,

Series

2022,

5.000%,

12/01/45

6/32

at

100.00

AA-

$

1,353,141

1,000

Southeast

Energy

Authority,

Alabama,

Commodity

Supply

Revenue

Bonds,

Project

4,

Series

2022B-1,

5.000%,

5/01/53,

(Mandatory

Put

8/01/28)

5/28

at

100.34

A2

1,032,060

1,000

Southeast

Energy

Authority,

Alabama,

Commodity

Supply

Revenue

Bonds,

Project

5,

Series

2023A,

5.250%,

1/01/54,

(Mandatory

Put

7/01/29)

4/29

at

100.18

A1

1,045,070

100

Tuscaloosa

County

Industrial

Development

Authority,

Alabama,

Gulf

Opportunity

Zone

Bonds,

Hunt

Refining

Project,

Refunding

Series

2019A,

5.250%,

5/01/44,

144A

5/29

at

100.00

N/R

90,606

Total

Alabama

3,520,877

Arizona

-

5.0%

600

Arizona

Health

Facilities

Authority,

Revenue

Bonds,

Scottsdale

Lincoln

Hospitals

Project,

Refunding

Series

2014A,

5.000%,

12/01/39

12/24

at

100.00

A+

604,050

275

Arizona

Industrial

Development

Authority

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2023,

5.250%,

7/01/43

7/31

at

100.00

BB+

267,701

1,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2018A,

5.000%,

7/01/48

1/28

at

100.00

AA-

1,006,730

1,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

KIPPC

NYC

Public

Charter

Schools

-

Macombs

Facility

Project,

Series

2021A,

4.000%,

7/01/41

7/31

at

100.00

BBB-

905,450

1,495

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Junior

Lien

Series

2019A,

5.000%,

7/01/49

7/29

at

100.00

Aa3

1,579,692

515

Salt

Verde

Financial

Corporation,

Arizona,

Senior

Gas

Revenue

Bonds,

Citigroup

Energy

Inc

Prepay

Contract

Obligations,

Series

2007,

5.250%,

12/01/28

No

Opt.

Call

A3

539,040

Total

Arizona

4,902,663

Arkansas

-

0.4%

200

Arkansas

Development

Finance

Authority,

Arkansas,

Environmental

Improvement

Revenue

Bonds,

United

States

Steel

Corporation,

Green

Series

2022,

5.450%,

9/01/52,

(AMT),

144A

9/25

at

105.00

BB

199,990

200

Arkansas

Development

Finance

Authority,

Arkansas,

Environmental

Improvement

Revenue

Bonds,

United

States

Steel

Corporation,

Green

Series

2023,

5.700%,

5/01/53,

(AMT)

5/26

at

105.00

BB

202,976

Total

Arkansas

402,966

California

-

4.7%

2,120

Brea

Olinda

Unified

School

District,

Orange

County,

California,

General

Obligation

Bonds,

Series

1999A,

0.000%,

8/01/23

-

FGIC

Insured

No

Opt.

Call

Aa2

2,120,000

500

California

Health

Facilities

Financing

Authority,

California,

Revenue

Bonds,

Sutter

Health,

Series

2018A,

4.000%,

11/15/42

11/27

at

100.00

A+

500,380

500

California

Infrastructure

and

Economic

Development

Bank,

Revenue

Bonds,

Brightline

West

Passenger

Rail

Project,

Series

2020A,

3.650%,

1/01/50,

(AMT),

(Mandatory

Put

1/31/24)

8/23

at

100.00

N/R

497,895

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

California

(continued)

$

365

California

Statewide

Communities

Development

Authority,

California,

Revenue

Bonds,

Loma

Linda

University

Medical

Center,

Series

2016A,

5.250%,

12/01/56,

144A

6/26

at

100.00

BB+

$

365,157

275

California

Statewide

Communities

Development

Authority,

Revenue

Bonds,

Front

Porch

Communities

&

Services

Project,

Series

2017A,

4.000%,

4/01/36

4/27

at

100.00

A

275,332

15

California

Statewide

Community

Development

Authority,

Revenue

Bonds,

Daughters

of

Charity

Health

System,

Series

2005A,

5.500%,

7/01/39

(4),(5)

9/23

at

100.00

N/R

15,071

300

M-S-R

Energy

Authority,

California,

Gas

Revenue

Bonds,

Citigroup

Prepay

Contracts,

Series

2009A,

7.000%,

11/01/34

No

Opt.

Call

A

371,361

500

San

Joaquin

Hills

Transportation

Corridor

Agency,

Orange

County,

California,

Toll

Road

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014B,

5.250%,

1/15/44

1/25

at

100.00

A-

509,290

Total

California

4,654,486

Colorado

-

12.7%

1,000

Boulder

Valley

School

District

RE2,

Boulder

County,

Colorado,

General

Obligation

Bonds,

Series

2019A,

4.000%,

12/01/48

6/29

at

100.00

AA+

973,860

Central

Platte

Valley

Metropolitan

District,

Colorado,

General

Obligation

Bonds,

Refunding

Series

2013A:

150

5.125%,

12/01/29,

(Pre-refunded

12/01/23)

12/23

at

100.00

BBB (6)

150,810

250

5.375%,

12/01/33,

(Pre-refunded

12/01/23)

12/23

at

100.00

BBB (6)

251,552

350

Colorado

Health

Facilities

Authority,

Colorado,

Health

Facilities

Revenue

Bonds,

The

Evangelical

Lutheran

Good

Samaritan

Society

Project,

Refunding

Series

2017,

5.000%,

6/01/42,

(Pre-refunded

6/01/27)

6/27

at

100.00

N/R (6)

376,183

1,000

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

AdventHealth

Obligated

Group,

Series

2019A,

4.000%,

11/15/43

11/29

at

100.00

AA

983,200

500

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

Christian

Living

Neighborhoods

Project,

Refunding

Series

2016,

5.000%,

1/01/37

1/24

at

102.00

N/R

454,345

1,000

Colorado

Health

Facilities

Authority,

Colorado,

Revenue

Bonds,

CommonSpirit

Health,

Series

2019A-2,

5.000%,

8/01/44

8/29

at

100.00

A-

1,031,860

750

Colorado

Springs,

Colorado,

Utilities

System

Revenue

Bonds,

Improvement

Series

2013B-1,

5.000%,

11/15/38

11/23

at

100.00

AA+

752,318

1,395

Denver

City

and

County,

Colorado,

Airport

System

Revenue

Bonds,

Subordinate

Lien

Series

2018A,

5.000%,

12/01/43,

(AMT)

12/28

at

100.00

A+

1,436,125

700

Erie

Farm

Metropolitan

District,

Erie,

Boulder

County,

Colorado,

General

Obligation

Limited

Tax

Bonds,

Refunding

&

Improvement,

Series

2021,

5.000%,

12/01/46

-

AGM

Insured

12/31

at

100.00

AA

754,306

700

Falcon

Area

Water

and

Wastewater

Authority

(El

Paso

County,

Colorado),

Tap

Fee

Revenue

Bonds,

Series

2022A,

6.750%,

12/01/34,

144A

9/27

at

103.00

N/R

700,406

1,000

Lewis

Pointe

Metropolitan

District,

Thornton,

Colorado,

Limited

Tax

General

Obligation

Bonds,

Refunding

Series

2021,

4.000%,

12/01/47

-

BAM

Insured

12/31

at

100.00

AA

947,390

500

Park

Creek

Metropolitan

District,

Colorado,

Senior

Limited

Property

Tax

Supported

Revenue

Bonds,

Refunding

Series

2015A,

5.000%,

12/01/45

12/25

at

100.00

A

501,955

650

Park

Creek

Metropolitan

District,

Colorado,

Senior

Limited

Property

Tax

Supported

Revenue

Bonds,

Series

2018A,

4.000%,

12/01/51

12/28

at

100.00

A

576,589

125

Public

Authority

for

Colorado

Energy,

Natural

Gas

Purchase

Revenue

Bonds, Colorado

Springs

Utilities,

Series

2008,

6.125%,

11/15/23

No

Opt.

Call

AA-

125,705

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Colorado

(continued)

$

1,100

Rampart

Range

Metropolitan

District

1,

Lone

Tree,

Colorado,

Limited

Tax

Supported

and

Special

Revenue

Bonds,

Refunding

&

Improvement

Series

2017,

5.000%,

12/01/42

12/27

at

100.00

AA

$

1,136,674

463

Tallyn's

Reach

Metropolitan

District

3,

Aurora,

Colorado,

General

Obligation

Bonds,

Limited

Tax

Convertible

to

Unlimited

Tax,

Refunding

&

Improvement

Series

2013,

5.000%,

12/01/33,

(Pre-

refunded

12/01/23),

144A

12/23

at

100.00

N/R (6)

465,315

525

Waterview

II

Metropolitan

District,

El

Paso

County,

Colorado,

Limited

Tax

General

Obligation

Bonds,

Series

2022A,

4.500%,

12/01/31

3/27

at

103.00

N/R

482,008

500

West

Globeville

Metropolitan

District

1,

Denver,

Colorado,

General

Obligation

Limited

Tax

Bonds,

Series

2022,

6.750%,

12/01/52

12/29

at

103.00

N/R

471,445

Total

Colorado

12,572,046

Delaware

-

0.1%

100

Delaware

Health

Facilities

Authroity,

Revenue

Bonds,

Beebe

Medical

Center

Project,

Series

2018,

5.000%,

6/01/48

12/28

at

100.00

BBB

101,404

Total

Delaware

101,404

District

of

Columbia

-

0.1%

105

Metropolitan

Washington

Airports

Authority,

District

of

Columbia,

Dulles

Toll

Road

Revenue

Bonds,

Dulles

Metrorail

&

Capital

improvement

Projects,

Refunding

&

Subordinate

Lien

Series

2019B,

4.000%,

10/01/49

10/29

at

100.00

A-

99,335

Total

District

of

Columbia

99,335

Florida

-

4.3%

840

Bay

County,

Florida,

Educational

Facilities

Revenue

Refunding

Bonds,

Bay

Haven

Charter

Academy,

Inc.

Project,

Series

2013A,

5.000%,

9/01/33

9/23

at

100.00

BBB

840,798

700

Florida

Development

Finance

Corporation,

Florida,

Surface

Transportation

Facility

Revenue

Bonds,

Brightline

Passenger

Rail

Project,

Green

Series

2019B,

7.375%,

1/01/49,

(AMT),

144A

1/24

at

107.00

N/R

696,150

Florida

Development

Finance

Corporation,

Florida,

Surface

Transportation

Facility

Revenue

Bonds,

Virgin

Trains

USA

Passenger

Rail

Project,

Series

2019A:

350

6.375%,

1/01/49,

(AMT),

(Mandatory

Put

1/01/26),

144A

8/23

at

102.00

N/R

338,894

380

6.500%,

1/01/49,

(AMT),

(Mandatory

Put

1/01/29),

144A

8/23

at

102.00

N/R

366,704

500

Florida

Development

Finance

Corporation,

Revenue

Bonds,

Brightline

Passenger

Rail

Expansion

Project,

Series

2022A,

7.250%,

7/01/57,

(AMT),

(Mandatory

Put

10/03/23),

144A

8/23

at

104.00

N/R

510,260

500

Greater

Orlando

Aviation

Authority,

Florida,

Orlando

Airport

Facilities

Revenue

Bonds,

Priority

Subordinated

Series

2017A,

5.000%,

10/01/42,

(AMT)

10/27

at

100.00

A+

511,285

1,145

Hillsborough

County

Industrial

Development

Authority,

Florida,

Hospital

Revenue

Bonds,

Florida

Health

Sciences

Center

Inc

D/B/A

Tampa

General

Hospital,

Series

2020A,

4.000%,

8/01/55

2/31

at

100.00

A

1,009,524

Total

Florida

4,273,615

Georgia

-

2.2%

455

Atlanta

Development

Authority,

Georgia,

Revenue

Bonds,

New

Downtown

Atlanta

Stadium

Project,

Senior

Lien

Series

2015A-1,

5.250%,

7/01/40

7/25

at

100.00

A1

464,987

210

Atlanta

Urban

Residential

Finance

Authority,

Georgia,

Multifamily

Housing

Revenue

Bonds,

Testletree

Village

Apartments,

Series

2013A,

4.000%,

11/01/25

11/23

at

100.00

B

198,167

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Georgia

(continued)

$

500

Fulton

County

Development

Authority,

Georgia,

Hospital

Revenue

Bonds,

Wellstar

Health

System,

Inc

Project,

Series

2017A,

4.000%,

4/01/50

4/30

at

100.00

A+

$

467,705

1,000

Main

Street

Natural

Gas

Inc.,

Georgia,

Gas

Supply

Revenue

Bonds,

Series

2023B,

5.000%,

7/01/53,

(Mandatory

Put

3/01/30)

12/29

at

100.31

Aa1

1,049,030

Total

Georgia

2,179,889

Hawaii

-

1.8%

250

Hawaii

Department

of

Budget

and

Finance,

Special

Purpose

Revenue

Bonds,

Hawaii

Pacific

University,

Series

2013A,

6.625%,

7/01/33,

144A

8/23

at

100.00

BB

250,285

1,500

Hawaii

State,

Airport

System

Revenue

Bonds,

Series

2022,

5.000%,

7/01/47,

(AMT)

7/32

at

100.00

AA-

1,577,625

Total

Hawaii

1,827,910

Illinois

-

12.4%

250

Chicago

Board

of

Education,

Illinois,

Dedicated

Capital

Improvement

Tax

Revenue

Bonds,

Series

2016,

6.000%,

4/01/46

4/27

at

100.00

A

263,620

500

Chicago

Board

of

Education,

Illinois,

Dedicated

Capital

Improvement

Tax

Revenue

Bonds,

Series

2023,

5.750%,

4/01/48

4/33

at

100.00

A

549,325

435

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Refunding

Series

2018D,

5.000%,

12/01/46

12/28

at

100.00

BB+

427,313

650

Chicago

Board

of

Education,

Illinois,

General

Obligation

Bonds,

Dedicated

Revenues,

Series

2016A,

7.000%,

12/01/44

12/25

at

100.00

BB+

681,382

1,000

Chicago,

Illinois,

General

Airport

Revenue

Bonds,

O'Hare

International

Airport,

Senior

Lien

Series

2022A,

5.500%,

1/01/55

1/32

at

100.00

A+

1,069,330

1,000

Illinois

Educational

Facilities

Authority,

Revenue

Bonds,

Field

Museum

of

Natural

History,

Series

2002.RMKT,

4.500%,

11/01/36

11/24

at

100.00

A

1,008,140

500

Illinois

Finance

Authority,

Revenue

Bonds,

Bradley

University,

Refunding

Series

2021A,

4.000%,

8/01/51

8/31

at

100.00

BBB+

409,995

1,000

Illinois

Finance

Authority,

Revenue

Bonds,

Northshore

-

Edward-

Elmhurst

Health

Credit

Group,

Series

2022A,

5.000%,

8/15/51

8/32

at

100.00

AA-

1,051,790

1,105

Illinois

Finance

Authority,

Revenue

Bonds,

OSF

Healthcare

System,

Series

2015A,

5.000%,

11/15/45

11/25

at

100.00

A

1,112,448

200

Illinois

Finance

Authority,

Revenue

Bonds,

Silver

Cross

Hospital

and

Medical

Centers,

Refunding

Series

2015C,

5.000%,

8/15/44

8/25

at

100.00

A3

200,188

540

Illinois

State,

General

Obligation

Bonds,

June

Series

2022A,

5.500%,

3/01/47

3/32

at

100.00

A-

588,433

500

Illinois

State,

General

Obligation

Bonds,

March

Series

2021A,

5.000%,

3/01/46

3/31

at

100.00

A-

522,220

400

Illinois

State,

General

Obligation

Bonds,

May

Series

2020,

5.500%,

5/01/39

5/30

at

100.00

A-

437,420

1,000

Illinois

State,

General

Obligation

Bonds,

October

Series

2022C,

5.500%,

10/01/41

10/32

at

100.00

A-

1,110,610

1,900

Illinois

Toll

Highway

Authority,

Toll

Highway

Revenue

Bonds,

Senior

Lien

Series

2019A,

5.000%,

1/01/44

7/29

at

100.00

AA-

2,005,279

200

Metropolitan

Pier

and

Exposition

Authority,

Illinois,

McCormick

Place

Expansion

Project

Bonds,

Series

2015A,

5.500%,

6/15/53

12/25

at

100.00

A

204,252

205

Metropolitan

Pier

and

Exposition

Authority,

Illinois,

Revenue

Bonds,

McCormick

Place

Expansion

Project,

Series

2002A,

0.000%,

12/15/35

-

NPFG

Insured

No

Opt.

Call

A

124,218

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Illinois

(continued)

$

490

University

of

Illinois,

Health

Services

Facilities

System

Revenue

Bonds,

Series

2013,

6.000%,

10/01/32

10/23

at

100.00

A2

$

492,455

Total

Illinois

12,258,418

Indiana

-

2.7%

735

Gary

Local

Public

Improvement

Bond

Bank,

Indiana,

Economic

Development

Revenue

Bonds,

Drexel

Foundation

for

Educational

Excellence

Project,

Refunding

Series

2020A,

5.875%,

6/01/55,

144A

6/30

at

100.00

N/R

630,417

1,000

Indiana

Finance

Authority,

Environmental

Improvement

Revenue

Bonds,

Fulcrum

CenterPoint,

LLC

Project,

Series

2022,

4.500%,

12/15/46,

(AMT),

(Mandatory

Put

11/15/23)

8/23

at

100.00

Aaa

998,030

1,000

Indiana

Finance

Authority,

Hospital

Revenue

Bonds,

Indiana

University

Health

Obligation

Group,

Fixed

Rate

Series

2023A,

5.000%,

10/01/53

10/33

at

100.00

AA

1,071,520

Total

Indiana

2,699,967

Iowa

-

0.5%

500

Iowa

Finance

Authority,

Iowa,

Midwestern

Disaster

Area

Revenue

Bonds,

Iowa

Fertilizer

Company

Project,

Refunding

Series

2022,

5.000%,

12/01/50

12/29

at

103.00

BBB-

505,915

Total

Iowa

505,915

Kansas

-

0.5%

500

Ellis

County

Unified

School

District

489

Hays,

Kansas,

General

Obligation

Bonds,

Refunding

&

Improvement

Series

2022B,

5.000%,

9/01/47

-

AGM

Insured

9/31

at

100.00

AA

534,765

Total

Kansas

534,765

Louisiana

-

3.2%

1,000

East

Baton

Rouge

Parish

Capital

Improvement

District,

Louisiana,

MOVEBR

Sales

Tax

Revenue

Bonds,

Series

2019,

5.000%,

8/01/48

8/29

at

100.00

AA+

1,049,170

1,230

Louisiana

Local

Government

Environmental

Facilities

and

Community

Development

Authority,

Louisiana,

Revenue

Bonds,

Womans

Hospital

Foundation

Project,

Refunding

Series

2017A,

5.000%,

10/01/41

10/27

at

100.00

A

1,258,093

810

Louisiana

Stadium

and

Exposition

District,

Revenue

Bonds,

Senior

Series

2023A,

5.000%,

7/01/48

7/33

at

100.00

A2

871,763

Total

Louisiana

3,179,026

Maryland

-

0.5%

500

Maryland

Health

and

Higher

Educational

Facilities

Authority,

Revenue

Bonds,

Peninsula

Regional

Medical

Center

Issue,

Refunding

Series

2015,

5.000%,

7/01/45,

(Pre-refunded

7/01/24)

7/24

at

100.00

A (6)

507,065

Total

Maryland

507,065

Massachusetts

-

0.6%

50

Massachusetts

Development

Finance

Agency,

Revenue

Bonds,

Atrius

Health

Issue,

Series

2019A,

4.000%,

6/01/49,

(Pre-refunded

6/01/29)

6/29

at

100.00

N/R (6)

53,705

500

Massachusetts

Development

Finance

Agency,

Revenue

Bonds,

UMass

Memorial

Health

Care,

Series

2016I,

5.000%,

7/01/46

7/26

at

100.00

A-

501,460

Total

Massachusetts

555,165

Michigan

-

1.0%

1,000

Michigan

State

University,

General

Revenue

Bonds,

Refunding

Series

2019C,

4.000%,

2/15/44

8/29

at

100.00

AA

987,160

Total

Michigan

987,160

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Minnesota

-

2.1%

$

75

Baytown

Township,

Minnesota

Charter

School

Lease

Revenue

Bonds,

Saint

Croix

Preparatory

Academy,

Refunding

Series

2016A,

4.250%,

8/01/46

8/26

at

100.00

BB+

$

59,794

265

Dakota

County

Community

Development

Agency,

Minnesota,

Multifamily

Housing

Revenue

Bonds,

Ree-Aster

House

Apartments,

Series

2020,

4.125%,

6/01/24

8/23

at

100.00

Aaa

264,995

1,000

Duluth

Economic

Development

Authority,

Minnesota,

Health

Care

Facilities

Revenue

Bonds,

Essentia

Health

Obligated

Group,

Series

2018A,

5.000%,

2/15/53

2/28

at

100.00

A-

1,004,790

300

Saint

Paul

Park,

Minnesota,

Senior

Housing

and

Health

Care

Revenue

Bonds,

Presbyterian

Homes

Bloomington

Project,

Refunding

Series

2017,

4.250%,

9/01/37

9/24

at

100.00

N/R

277,725

500

West

Saint

Paul-Mendota

Heights-Eagan

Independent

School

District

197,

Dakota

County,

Minnesota,

General

Obligation

Bonds,

School

Buidling

Series

2018A,

4.000%,

2/01/39

2/27

at

100.00

AAA

506,245

Total

Minnesota

2,113,549

Mississippi

-

1.0%

1,000

Mississippi

Hospital

Equipment

and

Facilities

Authority,

Revenue

Bonds,

Baptist

Memorial

Healthcare,

Series

2016A,

5.000%,

9/01/41

9/26

at

100.00

BBB+

1,009,550

Total

Mississippi

1,009,550

Missouri

-

2.8%

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

Southwest

Baptist

University

Project,

Series

2012,

5.000%,

10/01/33

8/23

at

100.00

BBB-

991,910

125

Missouri

Health

and

Educational

Facilities

Authority,

Educational

Facilities

Revenue

Bonds,

University

of

Central

Missouri,

Series

2013C-2,

5.000%,

10/01/34

10/23

at

100.00

A+

125,122

1,000

Missouri

Health

and

Educational

Facilities

Authority,

Health

Facilities

Revenue

Bonds,

Mosaic

Health

System,

Series

2019A,

4.000%,

2/15/54

2/29

at

100.00

AA-

925,170

215

Saint

Louis

County

Industrial

Development

Authority,

Missouri,

Revenue

Bonds,

Friendship

Village

Saint

Louis

Obligated

Group,

Series

2018A,

5.250%,

9/01/53

9/25

at

103.00

BB+

183,933

335

Saline

County

Industrial

Development

Authority,

Missouri,

First

Mortgage

Revenue

Bonds,

Missouri

Valley

College,

Series

2017,

4.500%,

10/01/40

10/23

at

100.00

N/R

287,051

225

Taney

County

Industrial

Development

Authority,

Missouri,

Sales

Tax

Revenue

Improvement

Bonds,

Big

Cedar

Infrastructure

Project

Series

2023,

6.000%,

10/01/49,

144A

10/30

at

100.00

N/R

222,633

Total

Missouri

2,735,819

Nebraska

-

1.6%

500

Central

Plains

Energy

Project,

Nebraska,

Gas

Project

3

Revenue

Bonds,

Refunding

Crossover

Series

2017A,

5.000%,

9/01/42

No

Opt.

Call

A

520,725

1,000

Douglas

County

School

District

54,

Ralston,

Nebraska,

General

Obligation

Bonds,

Series

2023,

5.000%,

12/15/48

,

(WI/DD)

12/32

at

100.00

Aa3

1,087,390

Total

Nebraska

1,608,115

New

Jersey

-

2.7%

35

Gloucester

County

Pollution

Control

Financing

Authority,

New

Jersey,

Pollution

Control

Revenue

Bonds,

Logan

Project,

Refunding

Series

2014A,

5.000%,

12/01/24,

(AMT),

(ETM)

No

Opt.

Call

N/R (6)

35,248

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

New

Jersey

(continued)

$

110

New

Jersey

Health

Care

Facilities

Financing

Authority,

Revenue

Bonds,

University

Hospital

Issue,

Refunding

Series

2015A,

5.000%,

7/01/46

-

AGM

Insured

7/25

at

100.00

AA

$

110,934

545

New

Jersey

Transportation

Trust

Fund

Authority,

Transportation

System

Bonds,

Series

2015AA,

5.000%,

6/15/45

6/25

at

100.00

A2

551,246

1,000

New

Jersey

Transportation

Trust

Fund

Authority,

Transportation

System

Bonds,

Series

2019BB,

4.000%,

6/15/44

12/28

at

100.00

A2

976,440

1,000

Tobacco

Settlement

Financing

Corporation,

New

Jersey,

Tobacco

Settlement

Asset-Backed

Bonds,

Series

2018A,

5.000%,

6/01/46

6/28

at

100.00

BBB+

1,022,730

Total

New

Jersey

2,696,598

New

York

-

3.9%

60

Buffalo

and

Erie

County

Industrial

Land

Development

Corporation,

New

York,

Revenue

Bonds,

Catholic

Health

System,

Inc.

Project,

Series

2015,

5.250%,

7/01/35

7/25

at

100.00

B-

52,441

1,500

Dormitory

Authority

of

the

State

of

New

York,

State

Personal

Income

Tax

Revenue

Bonds,

General

Purpose

Series

2022A,

5.000%,

3/15/46

3/32

at

100.00

AA+

1,638,150

250

Genesee

County

Funding

Corporation,

New

York,

Revenue

Bonds,

Rochester

Regional

Health

Project,

Series

2022A,

5.250%,

12/01/52

12/32

at

100.00

BBB+

259,747

315

Metropolitan

Transportation

Authority,

New

York,

Transportation

Revenue

Bonds,

Green

Climate

Bond

Certified

Series

2020C-1,

5.250%,

11/15/55

5/30

at

100.00

A3

330,917

500

New

York

City

Transitional

Finance

Authority,

New

York,

Future

Tax

Secured

Bonds,

Subordinate

Fiscal

2021

Subseries

E-1,

4.000%,

2/01/42

2/31

at

100.00

AAA

494,900

500

New

York

Liberty

Development

Corporation,

New

York,

Liberty

Revenue

Bonds,

3

World

Trade

Center

Project,

Class

1

Series

2014,

5.000%,

11/15/44,

144A

11/24

at

100.00

N/R

491,600

500

Triborough

Bridge

and

Tunnel

Authority,

New

York,

Payroll

Mobility

Tax

Bonds,

Senior

Lien

Green

Bonds,

Series

2022D-2,

5.250%,

5/15/47

11/32

at

100.00

AA+

558,135

Total

New

York

3,825,890

North

Carolina

-

2.1%

2,000

North

Carolina

Turnpike

Authority,

Triangle

Expressway

System

Revenue

Bonds,

Senior

Lien

Series

2019,

5.000%,

1/01/49

1/30

at

100.00

Aa1

2,073,480

Total

North

Carolina

2,073,480

North

Dakota

-

0.1%

100

Grand

Forks,

North

Dakota,

Senior

Housing

&

Nursing

Facilities

Revenue

Bonds,

Valley

Homes

and

Services

Obligated

Group,

Series

2017,

5.000%,

12/01/36

12/26

at

100.00

N/R

90,222

Total

North

Dakota

90,222

Ohio

-

0.9%

1,000

Cleveland-Cuyahoga

County

Port

Authroity,

Ohio,

Cultural

Facility

Revenue

Bonds,

The

Cleveland

Museum

of

Natural

History

Project,

Series

2021,

4.000%,

7/01/51

7/31

at

100.00

A3

884,990

Total

Ohio

884,990

Oklahoma

-

0.7%

670

Oklahoma

Development

Finance

Authority,

Health

System

Revenue

Bonds,

OU

Medicine

Project,

Series

2018B,

5.500%,

8/15/57

8/28

at

100.00

BB-

659,803

Total

Oklahoma

659,803

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Oregon

-

0.1%

$

55

Clackamas

County

Hospital

Facility

Authority,

Oregon,

Revenue

Bonds,

Rose

Villa

Inc.,

Series

2020A,

5.250%,

11/15/50

11/25

at

102.00

N/R

$

50,664

Total

Oregon

50,664

Pennsylvania

-

1.8%

1,000

Berks

County

Municipal

Authority,

Pennsylvania,

Revenue

Bonds,

Reading

Hospital

&

Medical

Center

Project,

Series

2012A,

5.000%,

11/01/40

8/23

at

100.00

B

649,470

500

Lancaster

County

Hospital

Authority,

Pennsylvania,

Revenue

Bonds,

Penn

State

Health,

Series

2021,

5.000%,

11/01/51

11/29

at

100.00

A

518,910

560

Montgomery

County

Industrial

Development

Authority,

Pennsylvania,

Health

System

Revenue

Bonds,

Albert

Einstein

Healthcare

Network

Issue,

Series

2015A,

5.250%,

1/15/36,

(Pre-refunded

1/15/25)

1/25

at

100.00

N/R (6)

576,016

Total

Pennsylvania

1,744,396

Puerto

Rico

-

1.8%

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1:

200

4.550%,

7/01/40

7/28

at

100.00

N/R

193,838

1,760

0.000%,

7/01/51

7/28

at

30.01

N/R

375,936

500

4.750%,

7/01/53

7/28

at

100.00

N/R

474,740

745

5.000%,

7/01/58

7/28

at

100.00

N/R

726,941

Total

Puerto

Rico

1,771,455

South

Carolina

-

0.4%

620

South

Carolina

Jobs-Economic

Development

Authority,

Economic

Development

Revenue

Bonds,

Bishop

Gadsden

Episcopal

Retirement

Community,

Series

2019A,

4.000%,

4/01/49

4/26

at

103.00

BBB-

443,994

Total

South

Carolina

443,994

South

Dakota

-

1.4%

100

Sioux

Falls,

South

Dakota,

Health

Facilities

Revenue

Bonds,

Dow

Rummel

Village

Project,

Series

2017,

5.125%,

11/01/47

11/26

at

100.00

BB

86,596

1,300

South

Dakota

Health

and

Educational

Facilities

Authority,

Revenue

Bonds,

Avera

Health

System,

Series

2014,

5.000%,

7/01/44

7/24

at

100.00

AA-

1,308,827

Total

South

Dakota

1,395,423

Tennessee

-

1.1%

870

Knox

County

Health,

Educational

and

Housing

Facilities

Board,

Tennessee,

Revenue

Bonds,

University

Health

System,

Inc.,

Series

2016,

5.000%,

9/01/47

9/26

at

100.00

BBB

845,683

250

Metropolitan

Nashville

Airport

Authority,

Tennessee,

Airport

Improvement

Revenue

Bonds,

Series

2022B,

5.500%,

7/01/42,

(AMT)

7/32

at

100.00

A1

277,893

Total

Tennessee

1,123,576

Texas

-

7.8%

250

Bexar

County

Hospital

District,

Texas,

Certificates

of

Obligation,

Series

2023,

5.000%,

2/15/48

,

(WI/DD)

8/32

at

100.00

Aa1

269,557

670

Central

Texas

Regional

Mobility

Authority,

Revenue

Bonds,

Senior

Lien,

Series

2015A,

5.000%,

1/01/40,

(Pre-refunded

7/01/25)

7/25

at

100.00

A (6)

693,423

1,000

Dallas-Fort

Worth

International

Airport,

Texas,

Joint

Revenue

Bonds,

Refunding

Series

2021A,

4.000%,

11/01/46

11/30

at

100.00

A1

969,060

335

Grand

Parkway

Transportation

Corporation,

Texas,

System

Toll

Revenue

Bonds,

Frst

Tier

Series

2013A,

5.125%,

10/01/43

10/23

at

100.00

A+

335,275

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Texas

(continued)

$

500

Grand

Parkway

Transportation

Corporation,

Texas,

System

Toll

Revenue

Bonds,

Refunding

First

Tier

Series

2020C,

4.000%,

10/01/45

4/30

at

100.00

A+

$

486,580

500

Lower

Colorado

River

Authority,

Texas,

Transmission

Contract

Revenue

Bonds,

LCRA

Transmission

Services

Corporation

Project,

Refunding

Series

2015,

5.000%,

5/15/40

5/25

at

100.00

A+

508,725

125

Mission

Economic

Development

Corporation,

Texas,

Revenue

Bonds,

Natgasoline

Project,

Senior

Lien

Series

2018,

4.625%,

10/01/31,

(AMT),

144A

8/23

at

104.00

BB-

121,963

1,000

New

Hope

Cultural

Education

Facilities

Finance

Corporation,

Texas,

Student

Housing

Revenue

Bonds,

CHF-Collegiate

Housing

Foundation

-

College

Station

I

LLC

-

Texas

A&M

University

Project,

Series

2014A,

5.000%,

4/01/46

-

AGM

Insured

4/24

at

100.00

AA

1,001,160

200

North

Texas

Tollway

Authority,

Special

Projects

System

Revenue

Bonds,

Convertible

Capital

Appreciation

Series

2011C,

0.000%,

9/01/43,

(Pre-refunded

9/01/31)

(7)

9/31

at

100.00

N/R (6)

251,942

500

North

Texas

Tollway

Authority,

System

Revenue

Bonds,

Refunding

Second

Tier,

Series

2015A,

5.000%,

1/01/38

1/25

at

100.00

A+

505,445

240

Reagan

Hospital

District

of

Reagan

County,

Texas,

Limited

Tax

Revenue

Bonds,

Series

2014A,

5.000%,

2/01/34

2/24

at

100.00

Ba1

241,987

295

SA

Energy

Acquisition

Public

Facilities

Corporation,

Texas,

Gas

Supply

Revenue

Bonds,

Series

2007,

5.500%,

8/01/27

No

Opt.

Call

A2

307,664

1,000

Texas

Private

Activity

Bond

Surface

Transporation

Corporation,

Senior

Lien

Revenue

Bonds,

NTE

Mobility

Partners

Segments

3

LLC

Segments

3C

Project,

Series

2019,

5.000%,

6/30/58,

(AMT)

6/29

at

100.00

Baa2

1,011,170

1,000

Texas

Transportation

Commission,

Central

Texas

Turnpike

System

Revenue

Bonds,

Refunding

Second

Tier

Series

2015C,

5.000%,

8/15/32

8/24

at

100.00

A-

1,012,390

Total

Texas

7,716,341

Utah

-

0.4%

410

Salt

Lake

City,

Utah,

Airport

Revenue

Bonds,

International

Airport

Series

2023A,

5.250%,

7/01/48,

(AMT)

,

(WI/DD)

7/33

at

100.00

A+

441,574

Total

Utah

441,574

Virgin

Islands

-

0.4%

380

Matching

Fund

Special

Purpose

Securitization

Corporation,

Virgin

Islands,

Revenue

Bonds,

Series

2022A,

5.000%,

10/01/30

No

Opt.

Call

N/R

384,993

Total

Virgin

Islands

384,993

Virginia

-

2.1%

1,265

Virginia

Small

Business

Financing

Authority,

Private

Activity

Revenue

Bonds,

Transform

66

P3

Project,

Senior

Lien

Series

2017,

5.000%,

12/31/56,

(AMT)

6/27

at

100.00

BBB

1,275,196

750

Virginia

Small

Business

Financing

Authority,

Revenue

Bonds,

95

Express

Lanes

LLC

Project,

Refunding

Senior

Lien

Series

2022,

5.000%,

12/31/47,

(AMT)

12/32

at

100.00

Baa1

774,150

Total

Virginia

2,049,346

Washington

-

1.1%

1,000

Port

of

Seattle,

Washington,

Revenue

Bonds,

Refunding

Intermediate

Lien

Private

Activity

Series

2022B,

5.000%,

8/01/42,

(AMT)

8/32

at

100.00

AA-

1,059,490

Total

Washington

1,059,490

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

West

Virginia

-

1.0%

$

1,000

West

Virginia

Hospital

Finance

Authority,

Hospital

Revenue

Bonds,

West

Virginia

United

Health

System

Obligated

Group,

Series

2018A,

5.000%,

6/01/52

6/28

at

100.00

A

$

1,027,220

Total

West

Virginia

1,027,220

Wisconsin

-

4.8%

Public

Finance

Authority

of

Wisconsin,

Conference

Center

and

Hotel

Revenue

Bonds,

Lombard

Public

Facilities

Corporation,

Second

Tier

Series

2018B:

4

0.000%,

1/01/46,

144A

(4)

No

Opt.

Call

N/R

88

4

0.000%,

1/01/47,

144A

(4)

No

Opt.

Call

N/R

80

4

0.000%,

1/01/48,

144A

(4)

No

Opt.

Call

N/R

76

4

0.000%,

1/01/49,

144A

(4)

No

Opt.

Call

N/R

71

3

0.000%,

1/01/50,

144A

(4)

No

Opt.

Call

N/R

65

4

0.000%,

1/01/51,

144A

(4)

No

Opt.

Call

N/R

68

98

1.000%,

7/01/51,

144A

(4)

3/28

at

100.00

N/R

56,613

4

0.000%,

1/01/52,

144A

(4)

No

Opt.

Call

N/R

63

4

0.000%,

1/01/53,

144A

(4)

No

Opt.

Call

N/R

59

4

0.000%,

1/01/54,

144A

(4)

No

Opt.

Call

N/R

55

4

0.000%,

1/01/55,

144A

(4)

No

Opt.

Call

N/R

52

4

0.000%,

1/01/56,

144A

(4)

No

Opt.

Call

N/R

49

4

0.000%,

1/01/57,

144A

(4)

No

Opt.

Call

N/R

45

4

0.000%,

1/01/58,

144A

(4)

No

Opt.

Call

N/R

43

3

0.000%,

1/01/59,

144A

(4)

No

Opt.

Call

N/R

40

3

0.000%,

1/01/60,

144A

(4)

No

Opt.

Call

N/R

38

3

0.000%,

1/01/61,

144A

(4)

No

Opt.

Call

N/R

35

3

0.000%,

1/01/62,

144A

(4)

No

Opt.

Call

N/R

33

3

0.000%,

1/01/63,

144A

(4)

No

Opt.

Call

N/R

31

3

0.000%,

1/01/64,

144A

(4)

No

Opt.

Call

N/R

29

3

0.000%,

1/01/65,

144A

(4)

No

Opt.

Call

N/R

27

3

0.000%,

1/01/66,

144A

(4)

No

Opt.

Call

N/R

25

42

0.000%,

1/01/67,

144A

(4)

No

Opt.

Call

N/R

293

500

Public

Finance

Authority

of

Wisconsin,

Pollution

Control

Revenue

Bonds,

Duke

Energy

Progress

Project,

Refunding

Series

2022A-2,

3.300%,

10/01/46,

(Mandatory

Put

10/01/26)

No

Opt.

Call

Aa3

496,770

200

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Dickson

Hollow

Project.

Series

2014,

5.125%,

10/01/34

8/23

at

102.00

N/R

182,092

200

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Oakwood

Lutheran

Senior

Ministries,

Series

2021,

4.000%,

1/01/57

1/27

at

103.00

N/R

135,140

1,000

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

PHW

Oconomowoc,

Inc.

Project,

Series

2018,

5.125%,

10/01/48

10/23

at

102.00

N/R

862,690

1,000

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

ProHealth

Care,

Inc.

Obligated

Group,

Refunding

Series

2015,

5.000%,

8/15/39

8/24

at

100.00

A+

1,006,730

500

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Rogers

Memorial

Hospital,

Inc.,

Series

2014B,

5.000%,

7/01/44

7/24

at

100.00

A

503,930

545

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

Saint

John's

Communities

Inc.,

Series

2018A,

5.000%,

9/15/50,

(Pre-refunded

9/15/23)

9/23

at

100.00

BBB- (6)

545,943

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

Wisconsin

(continued)

$

1,000

Wisconsin

Health

and

Educational

Facilities

Authority,

Wisconsin,

Revenue

Bonds,

ThedaCare

Inc,

Series

2015,

5.000%,

12/15/44

12/24

at

100.00

AA-

$

1,005,330

Total

Wisconsin

4,796,603

Total

Municipal

Bonds

(cost

$98,453,506)

97,465,763

Total

Long-Term

Investments

(cost

$98,453,506)

97,465,763

Principal

Amount

(000)

Description

(1)

Optional

Call

Provisions

(2)

Ratings

(3)

Value

SHORT-TERM

INVESTMENTS

-

1.6%

X

–

MUNICIPAL

BONDS

-

1

.6

%

X

1,600,000

Colorado

-

1.6%

$

1,600

Colorado

Springs,

Colorado,

Utilities

System

Revenue

Bonds,

Refunding

Series

2009C,

3.980%,

11/01/28,

(Mandatory

Put

8/7/2023)

(8)

7/23

at

100.00

AA+

$

1,600,000

Total

Colorado

1,600,000

Total

Municipal

Bonds

(cost

$1,600,000)

1,600,000

Total

Short-Term

Investments

(cost

$1,600,000)

1,600,000

Total

Investments

(cost

$

100,053,506

)

-

100

.0

%

99,065,763

Other

Assets

&

Liabilities,

Net

- (0.0)%

(

1,545

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

99,064,218

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

97,450,692

$

15,071

$

97,465,763

Short-Term

Investments:

Municipal

Bonds

–

1,600,000

–

1,600,000

Total

$

–

$

99,050,692

$

15,071

$

99,065,763

Nuveen

Municipal

Income

Fund,

Inc.

(continued)

Portfolio

of

Investments

July

31,

2023

(Unaudited)

(1)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(2)

Optional

Call

Provisions:

Dates

(month

and

year)

and

prices

of

the

earliest

optional

call

or

redemption.

There

may

be

other

call

provisions

at

varying

prices

at

later

dates.

Certain

mortgage-backed

securities

may

be

subject

to

periodic

principal

paydowns.

(3)

For

financial

reporting

purposes,

the

ratings

disclosed

are

the

highest

of

Standard

&

Poor’s

Group

(“Standard

&

Poor’s”),

Moody’s

Investors

Service,

Inc.

(“Moody’s”)

or

Fitch,

Inc.

(“Fitch”)

rating.

This

treatment

of

split-rated

securities

may

differ

from

that

used

for

other

purposes,

such

as

for

Fund

investment

policies.

Ratings

below

BBB

by

Standard

&

Poor’s,

Baa

by

Moody’s

or

BBB

by

Fitch

are

considered

to

be

below

investment

grade.

Holdings

designated

N/R

are

not

rated

by

any

of

these

national

rating

agencies.

(4)

Defaulted

security.

A

security

whose

issuer

has

failed

to

fully

pay

principal

and/or

interest

when

due,

or

is

under

the

protection

of

bankruptcy.

(5)

For

fair

value

measurement

disclosure

purposes,

investment

classified

as

Level

3.

(6)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

(7)

Step-up

coupon

bond,

a

bond

with

a

coupon

that

increases

("steps

up"),

usually

at

regular

intervals,

while

the

bond

is

outstanding.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(8)

Investment

has

a

maturity

of

greater

than

one

year,

but

has

variable

rate

and/or

demand

features

which

qualify

it

as

a

short-term

investment.

The

rate

disclosed,

as

well

as

the

reference

rate

and

spread,

where

applicable,

is

that

in

effect

as

of

the

end

of

the

reporting

period.

This

rate

changes

periodically

based

on

market

conditions

or

a

specified

market

index.

144A

Investment

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

investments

may

only

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

AMT

Alternative

Minimum

Tax

ETM

Escrowed

to

maturity

WI/DD

Purchased

on

a

when-issued

or

delayed

delivery

basis.

Nuveen Muni Income (NYSE:NMI)

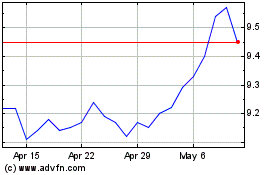

Historical Stock Chart

From Apr 2024 to May 2024

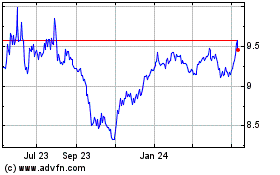

Nuveen Muni Income (NYSE:NMI)

Historical Stock Chart

From May 2023 to May 2024