North American Energy Partners Inc. ("NAEP" or "the Company") (TSX:

NOA) (NYSE: NOA) today announced results for the three months ended

June 30, 2011.

The Company has prepared its consolidated financial statements

in conformity with accounting principles generally accepted in the

United States (US GAAP). Unless otherwise specified, all dollar

amounts discussed are in Canadian dollars.

Highlights of the Three Months Ended June 30, 2011

- Consolidated revenues increased 5.7% compared to the same

period last year.

- Piling revenues increased 64.7% on improving commercial and

industrial construction market demand.

- The Company secured two new pipeline contracts in British

Columbia (BC) and Alberta with a combined value of $92.5

million.

- Subsequent to the quarter end, NAEP signed a previously

disclosed five-year master services contract to supply reclamation,

overburden removal and light and heavy civil construction services

to Suncor Energy Inc.'s ("Suncor") oil sands mine operations near

Fort McMurray, Alberta.

Consolidated Financial Highlights

(dollars in thousands, Three Months Ended June 30,

except per share amounts) 2011 2010

----------------------------------------------------------------------------

Revenue $ 194,023 $ 183,594

Gross profit $ 6,611 $ 15,620

Gross profit margin 3.4% 8.5%

General and administrative expenses $ 10,601 $ 13,729

Operating (loss) income $ (5,669) $ 1,064

Operating margin -2.9% 0.6%

Net (loss) income $ (9,014) $ (10,309)

Per share information

Net (loss) income - basic $ (0.25) $ (0.29)

Net (loss) income - diluted $ (0.25) $ (0.29)

Consolidated EBITDA(1) $ 6,176 $ 12,179

Capital spending $ 7,508 $ 6,589

(1) For a definition of Consolidated EBITDA and reconciliation to net

income, see "Non-GAAP Financial Measures" and "Consolidated EBITDA" at

the end of this release.

In the three-month period ended June 30, 2011, consolidated

revenues increased by 5.7% compared to the same period last year,

despite adverse operating conditions across most of the Company's

business areas.

"Extensive wildfires in the Fort McMurray region shut down a

major part of our oil sands business for more than two weeks while

abnormally high precipitation levels across southern Canada

hampered project start-ups for our Piling division," said Rod

Ruston, NAEP's President and CEO. "These events not only reduced

the available operating time but also significantly impacted

productivity due to the intermittent nature of the delays."

"Revenue performance also reflects a more considered approach

being taken by customers towards the awarding of work," said

Ruston. "We are seeing awards being delayed because our clients are

very focused on controlling the cost of their projects.

Accordingly, their emphasis is now on completing more detailed

engineering and design before the project starts rather than

adhering strictly to planned construction dates."

The increase in consolidated revenues despite these challenges

primarily reflects higher Piling revenues as a result of the

Cyntech acquisition and significantly improved demand in the

industrial and commercial construction markets. These gains were

partially offset by a year-over-year decline in Pipeline

revenue.

Heavy Construction and Mining division results were in line with

last year's results. This was achieved despite mine site

evacuations and shutdowns related to wildfires and the suspension

of overburden removal operations at Canadian Natural Resources

Limited's ("Canadian Natural") Horizon Project midway through the

quarter. Increased civil construction, muskeg removal and

tailings-related construction activity at Shell Canada Energy's

("Shell") sites, increased reclamation and heavy civil work at

Suncor sites and significant light civil work at Harvest Operations

Corp.'s (Harvest) BlackGold steam assisted gravity drainage

("SAGD") project were key factors in maintaining year-over-year

revenue performance.

Gross profit margins were below expectations for the three-month

period primarily due to the negative impact of weather and

wildfires on volumes and productivity, coupled with high equipment

costs as a result of first-quarter equipment maintenance

activities. Gross margins were also negatively impacted by the

increased use of rental equipment as a result of the high demand

for smaller equipment supporting increased project development and

summer muskeg work in the current period.

"As we move into the second quarter, we are starting to see the

positive impact of our recent contract wins and we are continuing

to build on this base with a number of new contracts," said Mr.

Ruston. "We are mobilizing additional fleet over to Suncor to

accommodate increasing volumes under our newly signed five-year

contract and we have commenced the preliminary work on the

foundation for a major mine train relocation at Syncrude. In

Piling, we are starting to work through a significant backlog of

projects and in Pipeline we have begun work on two new contracts

with a combined value of $92.5 million. Our volumes are recovering

and provided the weather cooperates, we should see stronger

performance from all three of our divisions over the remainder of

the fiscal year."

Segment Results

Heavy Construction and Mining

Three Months Ended June 30,

(dollars in thousands) 2011 2010

----------------------------------------------------------------------------

Segment revenue $ 163,391 $ 163,609

Segment profit 21,781 22,247

Segment margin 13.3% 13.6%

For the three months ended June 30, 2011, revenue from the Heavy

Construction and Mining segment was $163.4 million, similar to

$163.6 million during the same period last year.

Activity in the current period benefitted from increases in

heavy civil construction and a high volume of summer muskeg

removal, related to tailings remediation, at Shell's Jackpine site.

The division also increased tailings-related activity at Shell's

MRM site. Increased activity at Suncor's Base Mine resulted from

reclamation and heavy civil construction work under the recently

signed five-year master services agreement.

What would otherwise have been a strong three-month period of

activity for the segment was interrupted by wildfires in the Fort

McMurray area. Encroaching fires and thick smoke caused the

evacuation of all personnel from the Shell and Canadian Natural

sites for up to three weeks. These evacuations negatively affected

segment revenues by approximately $12 million for the period and

reduced margins due to increased costs resulting from lower

productivity. Subsequent to the wildfire evacuation at the Horizon

site, Canadian Natural suspended activity under the long-term

overburden removal contract until January 2, 2012 while they repair

and restart the plant damaged by a fire earlier in the year.

For the three months ended June 30, 2011, Heavy Construction and

Mining segment profit margin was 13.3% of revenue, compared to

13.6% last year. The current year segment margin includes the

negative impact of recognizing zero-margin on revenues from the

Canadian Natural overburden removal contract. NAEP has formed a

joint working group with Canadian Natural that will be responsible

for identifying indices that will more closely reflect the

inflationary conditions that have occurred in the market place. The

working group has been meeting to discuss the relevant facts and

this group is expected to deliver recommendations by the target

date of August 31, 2011. Any resulting changes to the indices will

apply both prospectively and retrospectively. Excluding revenues

and profits from the Canadian Natural overburden contract from both

periods, segment margin for the current three-month period would

have been 16.7% of revenue, comparable with the results from same

period last year.

Piling

Three Months Ended June 30,

(dollars in thousands) 2011 2010

----------------------------------------------------------------------------

Segment revenue $ 31,534 $ 19,146

Segment profit 2,589 1,394

Segment margin 8.2% 7.3%

For the three months ended June 30, 2011, Piling segment

revenues climbed to $31.5 million, an increase of $12.4 million

from same period last year. This increase reflects the resurgence

of activity in the commercial and industrial construction markets,

including increased shoring activity in Ontario and driven pile

activity in Vancouver. It also reflects $6.8 million of tank

services and screw piling manufacturing activity from the Cyntech

assets acquired by NAEP in November 2010.

These gains were partially offset by a reduction in drilled pile

activity in Calgary and Regina. Higher-than-normal precipitation

levels across Canada also constrained revenues by delaying the

start-up of some projects and slowing production on projects

already underway.

While Piling segment margins improved on a year-over-year basis,

they were lower than the margins typically achieved by this segment

as a result of the weather impacts. The adverse weather conditions

resulted in lower productivity due to the discontinuous activity

and increased overhead costs in the anticipation of supporting

higher activity that was subsequently deferred to future

periods.

Pipeline

Three Months Ended June 30,

(dollars in thousands) 2011 2010

----------------------------------------------------------------------------

Segment revenue $ (902) $ 839

Segment loss (1,948) (723)

For the three months ended June 30, 2011, Pipeline reported

negative revenue of $0.9 million, compared to $0.8 million positive

revenue last year. The negative revenue was the result of a change

in the estimated future costs to close out two fixed-price

projects. This, in turn, reduced the percent complete calculation

for each project and resulted in a reduction in the amount of

revenue reported. This revenue will be recognized in future periods

as the work is completed.

For the three months ended June 30, 2011, the Pipeline segment

incurred a loss of $1.9 million compared to a loss of $0.7 million

last year. This reflects an increase in the estimated cost to

complete spring clean-up and warranty work on a project in Northern

BC as a result of adverse weather conditions. It also reflects an

estimated loss for the completion of a large-diameter pipeline

project in Southern BC.

Outlook

The Company anticipates that work volumes and margins will begin

to strengthen in the latter part of the second quarter and remain

strong through the balance of the year.

In Heavy Construction and Mining, the suspension of activity at

Canadian Natural is expected to be partially offset by the ramp up

of higher-margin activity under the Company's new multi-year

contracts for mining services and heavy civil construction with

Syncrude, Suncor and Shell. At Syncrude, NAEP was recently awarded

the preliminary work on the foundation for a major mine train

relocation at this customer's Base Plant site. At Suncor, in

addition to civil works already underway, mining services activity

is expected to begin ramping up with the recent signing of a new

five-year contract. At Shell, NAEP expects to continue executing on

several large tailings-related civil construction projects.

Although the Company anticipates that activity levels under the new

contracts will grow during the year, the timing of this work is

dependent on NAEP's clients as they work through the completion of

engineering and design for their mine plans prior to issuing the

awards.

The Company also continues to build on its Tailing and

Environmental Construction business with new projects on multiple

oil sands sites that will utilize NAEP's highly specialized

tailings equipment fleet, which includes dredging equipment,

tailings dozers, bitumen skimmers, hoverbarges and an amphirol

(Mudmaster), used to dewater mature fine tailings. NAEP intends to

continue pursuing unique equipment and services to build and

differentiate its full service Tailings and Environmental

Construction offering. In the past year, this new division has

performed work on every operating site in the oil sands. Although

much of the industry is still in the experimental stages, the

Company believes it has been recognized as a primary supplier in

this space and that this will be a key advantage to further

expanding the business as the industry moves from testing to full

scale operation.

Demand for the Company's piling services has been strong this

year due to increased project development activity in the oil sands

and an upsurge in commercial construction opportunities in Toronto

and Calgary. Second and third quarter activity levels are expected

to be strong as this division works through a large backlog of

weather-delayed projects.

Pipeline activity is also expected to ramp up in the second and

third quarters, with work commencing on two new pipeline contracts

in BC and Alberta. The two projects have a combined anticipated

value of $92.5 million and the majority of work is expected to be

completed by March 2012. The prospects for improved performance

from NAEP's Pipeline division have strengthened as a result of both

internal and external factors. Internally, the division has

restructured its management team and enhanced project controls,

while externally, customers have adopted a longer-term view with an

emphasis on value and quality driven by the increasing need for

environmental and safety excellence. NAEP believes these changes

have improved this segment to the point where it can become a

steady contributor to the business. As a result, the Company's

outlook for the balance of the year and beyond is positive with a

wide array of new pipeline projects coming to market and the

Company's intention to expand into the pipeline maintenance

business.

Overall, assuming normal weather conditions, the Company

anticipates improving financial performance over the remainder of

the year as work under new contracts commences and volumes

recover.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

its financial results for the three months ended June 30, 2011

tomorrow, Thursday, August 4, 2011 at 9:00 am Eastern time.

The call can be accessed by dialing:

Toll free: 1-877-407-9210 or International: 1-201-689-8049

A replay will be available through September 2, 2011 by

dialing:

Toll Free: 1-877-660-6853 or International: 1-201-612-7415

(Account: 286 Conference ID: 376545).

Non-GAAP Financial Measures

This release contains non-GAAP financial measures. These

measures do not have standardized meanings under US GAAP and are

therefore unlikely to be comparable to similar measures used by

other companies. The non-GAAP financial measure disclosed by the

Company in this release is Consolidated EBITDA (as defined within

the credit agreement). The Company provides a reconciliation of

Consolidated EBITDA to net income reported in accordance with US

GAAP below. Investors and readers are encouraged to review the

reconciliation of this non-GAAP financial measure to reported net

income.

Consolidated EBITDA

Consolidated EBITDA is a measure defined by the Company's credit

agreement. This measure is defined as EBITDA (which is calculated

as net income before interest, income taxes, depreciation and

amortization) excluding the effects of unrealized foreign exchange

gain or loss, realized and unrealized gain or loss on derivative

financial instruments, non-cash stock-based compensation expense,

gain or loss on disposal of property, plant and equipment the

impairment of goodwill, the amendment related to the $42.5 million

revenue writedown on the Canadian Natural overburden removal

contract, for the three months and fiscal year ended March 31, 2011

and certain other non-cash items included in the calculation of net

income. The credit agreement requires the Company to maintain a

minimum interest coverage ratio and a maximum senior leverage

ratio, which are calculated using Consolidated EBITDA.

Non-compliance with these financial covenants could result in the

Company being required to immediately repay all amounts outstanding

under its credit facility. Consolidated EBITDA should not be

considered as an alternative to operating income or net income as a

measure of operating performance or cash flows as a measure of

liquidity. Consolidated EBITDA has important limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analysis of the Company's results as reported under

US GAAP. For example, Consolidated EBITDA:

- does not reflect cash expenditures or requirements for capital

expenditures or capital commitments;

- does not reflect changes in cash requirements for working

capital needs;

- does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on debt;

- excludes tax payments that represent a reduction in cash

available to the Company; and

- does not reflect any cash requirements for assets being

depreciated and amortized that may have to be replaced in the

future.

Consolidated EBITDA also excludes unrealized foreign exchange

gains and losses and realized and unrealized gains and losses on

derivative financial instruments, which, in the case of unrealized

losses, may ultimately result in a liability that will need to be

paid and in the case of realized losses, represents an actual use

of cash during the period.

A reconciliation of net income to Consolidated EBITDA is as follows:

Three Months Ended June 30,

(dollars in thousands) 2011 2010

----------------------------------------------------------------------------

Net loss $ (9,014) $ (10,309)

Adjustments:

Interest expense 7,377 7,729

Income taxes benefit (3,610) (2,013)

Depreciation 9,596 8,203

Amortization of intangible assets 1,878 588

Realized and unrealized (gain) loss on derivative

financial instruments (337) 3,008

Loss on disposal of property, plant and equipment 398 (4)

Stock-based compensation expense 485 410

Equity in (earnings) loss of unconsolidated joint

venture (597) 243

Loss on debt extinguishment - 4,324

---------------------------

Consolidated EBITDA $ 6,176 $ 12,179

---------------------------

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is information that is subject to known

and unknown risks and other factors that may cause future actions,

conditions or events to differ materially from the anticipated

actions, conditions or events expressed or implied by such

forward-looking information. Forward-looking information is

information that does not relate strictly to historical or current

facts and can be identified by the use of the future tense or other

forward-looking words such as "believe", "expect", "anticipate",

"intend", "plan", "estimate", "should", "may", "could", "would",

"target", "objective", "projection", "forecast", "continue",

"strategy", "position" or the negative of those terms or other

variations of them or comparable terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following: that the Company

will see stronger performance from all three of our divisions over

the remainder of the fiscal year; that the joint working committee

is expected to deliver recommendations by the target date of August

31, 2011; that the recommended new indices will apply both

prospectively and retrospectively; that work volumes and margins

will begin to strengthen in the latter part of the second quarter

and remain strong through the balance of the year; that the

suspension of activity at Canadian Natural is expected to be

partially offset by the ramp up of higher-margin activity under the

Company's new multi-year contracts for mining services and heavy

civil construction with Syncrude, Suncor and Shell; that at Suncor,

mining services activity is expected to begin ramping up with the

signing of a new five-year contract; that at Shell, NAEP expects to

continue executing on several large tailings-related civil

construction projects; that NAEP intends to continue pursuing

unique equipment and services to build and differentiate its full

service Tailings and Environmental Construction offering; that the

Company believes it has been recognized as a primary supplier in

this space and that this will be a key advantage to further

expanding the business as the industry moves from testing to full

scale operation; that second and third quarter activity levels are

expected to be strong as this division works through a large

backlog of weather-delayed projects; that activity in the Pipeline

division is expected to ramp up in the second and third quarters;

that the majority of work on the Company's two new pipeline

contracts is expected to be completed by March 2012; that the

Pipeline division can become a steady contributor to the business;

that the Company anticipates improving financial performance over

the remainder of the year as new contracts commence and work

volumes recover.

There can be no assurance that forward-looking information will

prove to be accurate, as actual results and future events could

differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. Each of the forward-looking statements

in this news release is subject to significant risks and

uncertainties and is based on a number of assumptions which may

prove to be incorrect. The material factors or assumptions used to

develop the above forward-looking statements and the risks and

uncertainties that could cause actual results to differ materially

from the information presented in the above are discussed in NAEP's

Management Discussion & Analysis for the three months ended

June 30, 2011. While management anticipates that subsequent events

and developments may cause its views to change, the Company does

not intend to update this forward-looking information, except as

required by applicable securities laws. This forward-looking

information represents management's views as of the date of this

document and such information should not be relied upon as

representing their views as of any date subsequent to the date of

this document.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599 (FAX)

krowand@nacg.ca

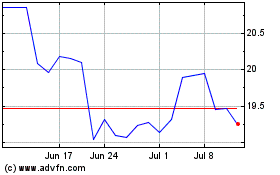

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2024 to Aug 2024

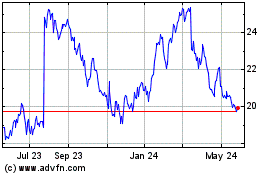

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Aug 2023 to Aug 2024