Conference Call

Management will hold a conference call today, Wednesday, May

18th at 9:00 am EST to discuss the contents of this release.

The call can be accessed by dialing: 1-877-407-9205 or

International: 1-201-689-8054

North American Energy Partners Inc. ("NAEP" or "the Company")

(TSX: NOA) (NYSE: NOA) today announced that it expects to take a

writedown of $40 million to $45 million in its financial results

for the fiscal year ended March 31, 2011 related to the long-term

overburden removal contract between its subsidiary North American

Construction Group Inc. ("NACG") and Canadian Natural Resources

Limited ("Canadian Natural") for the Horizon Oil Sands ("Horizon")

mine near Fort McMurray, Alberta. This writedown would be applied

primarily to reduce unbilled revenue and is expected to reduce net

income by $30 million to $34 million for the same period.

The contract with Canadian Natural includes certain escalation

indices, determined at the time of the initial negotiations, which

were intended to adjust pricing annually to reflect changes in

economic conditions over the 10-year term of the contract. The

contract specifically states that the indices were not intended to

benefit either party at the expense of the other party and includes

a mechanism for reviewing the indices if they are deemed to be no

longer representative of the actual changes in the market over

time. NAEP believes that the actual inflationary environment in

Fort McMurray has varied significantly versus the indices per the

contract. NACG has met with Canadian Natural and formed a joint

working group that will be responsible for identifying indices that

will more closely reflect the inflationary conditions that have

occurred in the market place.

"NACG expects this group to deliver its recommendations by

August 31, 2011 and that the new indices will apply both

prospectively and retrospectively. At that time, if the indices are

adjusted as expected, part or all of the amount written down in

fiscal 2011 may be recognized as profit," said Rod Ruston,

President and CEO of NAEP. "Our intention is to arrive at a fair

outcome within the terms of the contact and we believe the approach

taken by Canadian Natural in regard to the issue demonstrates their

support for that outcome," added Mr. Ruston.

"We value our relationship with Canadian Natural and take pride

in the fact that we have met all the major milestones we committed

to under this contract," Mr. Ruston said. "We are a company with a

long history of positive, long-term customer relationships. We do

not expect any impact from this issue on our other business

operations."

If the parties are not able to agree upon the appropriate

adjustments, a further writedown may be required in respect of all

or a portion of unbilled revenue related to this contract, of up to

$72 million. In this event, NACG will pursue any remedies it may

have available.

As a result of the writedown, NAEP is not in compliance with

certain covenants under its credit facility and NAEP is working

with its lenders to obtain an amendment in connection with such

covenants. The lead bank in the syndicate has already provided

conditional approval of this waiver.

Operations at Canadian Natural

As a result of a fire at Canadian Natural's Horizon primary

upgrading facility in January 2011, oil production at Horizon was

suspended.

"While we continue with overburden removal at the site, we

anticipate that production levels could be affected during the

repair period," said Rod Ruston. "Should this occur, we may have

the opportunity to remove equipment from this site to work on other

projects in the region. This equipment relocation may allow us to

replace some of the lost revenue through higher margin work at

other locations in Fort McMurray."

"Given our recently announced contract wins at Shell and

Syncrude and the expected signing of a new five-year contract with

Suncor covering overburden, site reclamation and light civil

construction, the availability of this equipment in the short term

could be a valuable addition to our general contract fleet," added

Ruston.

The Canadian Natural contract, which is NAEP's single largest

long-term contract, represented approximately 23.4% of NAEP's

consolidated revenue for the 12 months ended December 31, 2010. The

gross profit on this project represented 9.7% of the consolidated

gross profit for the 12 months ended December 31, 2010.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. The

Company maintains one of the largest independently owned equipment

fleets in the region.

Forward Looking Statements

The information provided in this release contains

forward-looking statements. Forward-looking statements include

statements preceded by, followed by or that include the words

"may", "could", "would", "should", "believe", "expect",

"anticipate", "plan", "estimate", "target", 'project", "intend",

"continue", "further" or similar expressions. Actual results could

differ materially from those contemplated by such forward-looking

statements as a result of any number of factors and uncertainties,

many of which are beyond our control. Examples of forward looking

information in this release include, but are not limited to, the

working group delivering appropriate adjustments to the indices by

August 31, 2011 and that if appropriate adjustments are delivered,

part or all amount written down may be recognized as profit; the

expectation that overburden production levels could be affected

during the repair period at the Horizon site; the expectation that

there will be opportunities to move equipment from the Canadian

Natural site to other projects in the region; and our expectation

to sign a new five year contract with Suncor covering overburden,

site reclamation and light civil construction . The material

factors or assumptions used to develop such forward-looking

statements and the risks and uncertainties that could cause a

actual results to differ materially from those contemplated by such

forward-looking statements include our ability, through the working

group, to come to an agreement with Canadian Natural on appropriate

adjustments and that work on other projects in the region will

require additional equipment, and that we will successfully

conclude negotiations with Suncor with respect to the new five year

contract..:

These factors are not intended to represent a complete list of

the factors that could affect the Company. See the risk factors

highlighted in materials filed with the securities regulatory

authorities in the United States and Canada from time to time,

including but not limited to the most recent Management's

Discussion and Analysis filed respectively in the United States and

Canada. Undue reliance should not be placed upon forward-looking

statements and we undertake no obligation, other than those

required by applicable law, to update or revise those

statements.

For more complete information about us you should read our

disclosure documents that we have filed with the SEC and the CSA.

You may obtain these documents for free by visiting EDGAR on the

SEC website at www.sec.gov or on the CSA website at

www.sedar.com.

Contacts: North American Energy Partners Inc. Kevin Rowand

Director, Investor Relations & Strategic Planning (780)

960-4531 (780) 960-7103 (FAX) krowand@nacg.ca

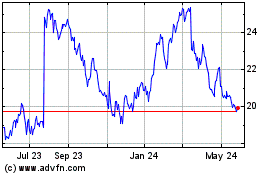

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jun 2024 to Jul 2024

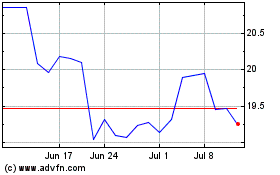

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2023 to Jul 2024