North American Energy Partners Inc. ("NAEP" or "the Company") (TSX:

NOA) (NYSE: NOA) today announced results for the three and nine

months ended December 31, 2010. The three-month period represents

the third quarter of NAEP's 2011 fiscal year.

Conversion to US GAAP

The Company has prepared its consolidated financial statements

in conformity with accounting principles generally accepted in the

United States (US GAAP). All comparative financial information

contained herein has been revised to reflect the Company's results

as if they had been historically reported in accordance with US

GAAP. Unless otherwise specified, all dollar amounts discussed are

in Canadian dollars.

Highlights of the Three Months Ended December 31, 2010

- Consolidated revenue increased 19.9% compared to the same

period last year, with all three business segments posting

year-over-year gains.

- Project development revenues continued to increase as a result

of improving economic conditions and renewed investment in the oil

sands, although margins are yet to respond to these

improvements.

- NAEP was awarded two new, long-term recurring services

contracts with major oil sands customers for work expected to

commence in the fourth quarter.

- The Piling segment achieved significant volume and margin

increases on improving commercial and industrial construction

market demand.

- On November 1, 2010, NAEP acquired the assets of Cyntech

Corporation, a Calgary-based designer and manufacturer of screw

piles and pipeline anchoring systems, as well as a provider of

recurring tank maintenance services to the petro-chemical

industry.

Consolidated Financial Highlights

Three Months Ended Nine Months Ended

(dollars in thousands, December 31, December 31,

except per share amounts) 2010 2009 2010 2009

----------------------------------------------------------------------------

Revenue $ 265,086 $ 221,175 $ 683,538 $ 538,396

Gross profit $ 30,807 $ 47,626 $ 75,524 $ 106,562

Gross profit margin 11.6% 21.5% 11.0% 19.8%

General and administrative

costs $ 16,482 $ 14,532 $ 45,497 $ 43,426

Operating income $ 11,254 $ 31,272 $ 24,623 $ 60,347

Operating margin 4.2% 14.1% 3.6% 11.2%

Net income (loss) $ 3,742 $ 14,936 $ (4,198) $ 29,162

Per share information

Net income (loss) - basic $ 0.10 $ 0.41 $ (0.12) $ 0.81

Net income (loss) - diluted $ 0.10 $ 0.41 $ (0.12) $ 0.79

Consolidated EBITDA (1) $ 25,309 $ 43,844 $ 60,097 $ 95,216

Capital spending $ 11,307 $ 4,774 $ 30,108 $ 48,039

Cash and cash equivalents $ 748 $ 94,877 $ 748 $ 94,877

(1) For a definition of Consolidated EBITDA and reconciliation to net

income, see "Non-GAAP Financial Measures" and "Consolidated EBITDA" at

the end of this release.

"Improving economic conditions and renewed investment in the oil

sands contributed to stronger top-line results for the three and

nine months ended December 31, 2010," said Rod Ruston, NAEP's

President and CEO. "All three of our business segments posted

year-over-year revenue gains. Given that margin movement tends to

trail revenue changes by six to nine months, this increase in

revenue signals higher demand and bodes well for our margins on our

shorter-term contracts and master services agreements in the latter

part of calendar 2011."

For the three months ended December 31, 2010, consolidated

revenue increased by 19.9% compared to the same period last year on

increased project development revenues. In the oil sands, the

completion of tailings-related construction projects and mine site

development projects were key factors. Outside of the oil sands,

improving commercial and industrial construction market conditions

and more stable weather conditions led to an increase in the volume

of piling projects. Pipeline revenues were also higher

year-over-year as a result of activity on two projects in northern

British Columbia (BC).

Recurring services revenues declined in the three-month period,

reflecting reduced demand for services at Shell Canada Energy's

(Shell) Jackpine mine during the mine's commissioning. Now that

this mine has commenced operation, NAEP expects new service

opportunities to arise as the mine expands. The decline at Jackpine

was partially offset by increased demand for recurring services

from Canadian Natural Resources Limited's (Canadian Natural)

Horizon mine while demand from other oil sands customers remained

stable.

Gross profit margins were below expectations for the three-month

period due to rental costs for equipment that was sourced with an

expectation of being used for winter reclamation and overburden

work starting in late November and continuing through December.

However, this equipment was not put to work until January due to

client-related start-up delays. In addition, the Company incurred

losses on two pipeline contracts due to increases in project scope

and adverse weather conditions. Gross profit, Net Income and

Consolidated EBITDA for both the three-month and nine-month periods

declined year-over-year as a result of these impacts.

"The two pipeline contracts concerned have been substantially

completed and we are developing change order requests for the

additional costs we incurred," said Mr. Ruston. "In Heavy

Construction and Mining, while the delayed start-up resulted in a

margin impact in the third quarter, the additional rental equipment

capacity coupled with our owned equipment gives us the capability

to undertake a significant volume of work through the remaining

winter months."

The Company's cash balance as at December 31, 2010 was $0.7

million, down from $94.9 million as at December 31, 2009.

Approximately half of the reduced cash balance is due to the

completion of two strategic initiatives executed by the Company

earlier in the year. The first initiative was the refinancing of

the Company's senior notes in April, during which NAEP successfully

reduced its cost of debt and total debt outstanding. The second

initiative was NAEP's successful entry into the screw piling market

with the acquisition of Cyntech in November. The remainder of

reduced cash balance is primarily due to near-term higher working

capital requirements.

Looking forward, NAEP anticipates some continued margin pressure

in the Heavy Construction and Mining segment, with revenue growth

continuing to outpace margin growth in the near term. The Company's

longer term outlook remains positive with an improving economy and

new oil sands contracts positioning NAEP for continued growth and

eventual margin recovery.

New Contracts

The Company has confirmed the award of two new multi-year

contracts with key oil sands producers. The new awards include a

three-year muskeg removal contract with Shell Canada Energy (Shell)

and a four-year master services agreement covering a range of

activities including muskeg removal, reclamation and site

construction projects with another major oil sands customer. Under

the new four-year contract, NAEP has received authorization for

approximately $45 million of work to be executed during the winter

period. The new muskeg removal contract with Shell is a time and

materials contract and is in addition to NAEP's existing three-year

master services agreement with Shell.

Segment Results

Heavy Construction and Mining

Three Months Ended Nine Months Ended

December 31, December 31,

(dollars in thousands) 2010 2009 2010 2009

----------------------------------------------------------------------------

Segment revenue $ 185,325 $ 183,631 $ 520,562 $ 469,512

Segment profit 20,293 36,237 64,774 81,730

Segment profit percentage 10.9% 19.7% 12.4% 17.4%

For the three months ended December 31, 2010, revenue from the

Heavy Construction and Mining segment increased $1.7 million to

$185.3 million. This gain reflects higher project development

activity in the oil sands, including the completion of

tailings-related construction projects for Shell and mine

development projects for Exxon and Canadian Natural. Recurring

services revenues decreased year-over-year during the commissioning

of Shell's Jackpine mine. The decline in activity at Shell was

partially offset by increased activity under the Company's

long-term overburden contract with Canadian Natural and increased

reclamation and overburden activity at both Syncrude and Suncor.

For the nine months ended December 31, 2010, segment revenue

increased by $51.1 million on higher project development activity.

Recurring services revenues for the nine-month period were lower

primarily as a result of reduced demand from Shell related to the

commissioning of the Jackpine mine.

For the three months ended December 31, 2010, Heavy Construction

and Mining segment profit margin was 10.9% of revenue, compared to

19.7% last year. The change in segment profit margin reflects

continuing competitive pressure on margins, an increased volume of

lower-margin overburden removal work in the mix and the cost of

equipment rentals secured for November/December work that did not

eventuate due to client start-up delays on winter work programs.

Also included in the current period was a loss of margin at Shell

due to a contractual pain/gain sharing mechanism whereby NAEP

missed its safety performance targets. Although the financial

impact was negative in the third quarter, NAEP typically exceeds

these targets. Similarly, for the nine months ended December 31,

2010, Heavy Construction and Mining profit margin decreased to

12.4% of revenue, from 17.4% last year. The change in margin

reflects the aforementioned impacts plus lower project efficiency

resulting from adverse weather conditions earlier in the year. NAEP

is currently developing change order requests to recover costs

related to start-up and weather delays in contracts where these are

shared risks.

Piling

Three Months Ended Nine Months Ended

December 31, December 31,

(dollars in thousands) 2010 2009 2010 2009

----------------------------------------------------------------------------

Segment revenue $ 37,594 $ 20,592 $ 83,303 $ 50,268

Segment profit 10,324 4,505 16,500 9,139

Segment profit percentage 27.5% 21.9% 19.8% 18.2%

For the three and nine months ended December 31, 2010, Piling

segment revenues climbed to $37.6 million and $83.3 million,

reflecting increases of $17.0 million and $33.0 respectively from

same periods last year. Revenue increases in both the three-month

and nine-month periods were driven by a higher level of activity in

the commercial and industrial construction markets, including an

increase in large oil sands projects. The stronger revenues in the

three-month period also reflect the completion of jobs originally

delayed by both weather and the late contract awards during the

previous quarters. In addition, current results include a full nine

months of contribution from the new piling company in Ontario,

compared to five months contribution in the prior-year period, as

well as two months of revenue contribution from Cyntech, which was

acquired on November 1, 2010.

For the three months ended December 31, 2010, Piling profit

margin increased to 27.5% of revenue, from 21.9% last year. This

increase reflects the processing of change-orders outstanding from

prior periods and improving market conditions. For the nine months

ended December 31, 2010, segment margins increased to 19.8% from

18.2%, as a result of improving market conditions, partially offset

by lower productivity earlier in the first half of the fiscal year

due to adverse weather conditions.

Pipeline

Three Months Ended Nine Months Ended

December 31, December 31,

(dollars in thousands) 2010 2009 2010 2009

----------------------------------------------------------------------------

Segment revenue $ 42,167 $ 16,952 $ 79,673 $ 18,616

Segment (loss) profit (1,641) 1,072 (1,485) 1,301

Segment profit percentage -3.9% 6.3% -1.9% 7.0%

For the three months ended December 31, 2010, the Pipeline

segment increased revenues to $42.2 million, an improvement of

$25.2 million compared to a year ago. For the nine months ended

December 31, 2010, Pipeline revenues increased to $79.7 million, a

year-over-year increase of $61.1 million. The increased segment

revenues primarily reflect activity on two projects in northern BC,

both of which were substantially completed in the three-month

period ended December 31, 2010.

For the three months ended December 31, 2010, the Pipeline

segment incurred a loss of $1.6 million compared to segment profit

of $1.1 million last year. The change in segment profit reflects

reduced productivity related to adverse weather conditions on one

contract and changes in project scope on a second contract in

northern BC. For the nine months ended December 31, 2010, the

Pipeline segment incurred a loss of $1.5 million compared to

segment profit of $1.3 million last year. This change reflects

lower productivity related to start-up delays and adverse weather

conditions on one contract and project scope impacts on a second

contract in northern BC as well as completion delays on a project

in southern BC. All three projects are unit-price contracts and the

Company is currently developing change-order requests for start-up

delays, weather impacts and changes to project scope in accordance

with the terms of the contracts.

Outlook

While improving economic conditions and increased opportunities

are starting to provide some relief from the competitive margin

pressure experienced over the past 12 to 18 months, NAEP expects

that revenue growth will continue to outpace margin growth in the

near term. Longer term, the Company's outlook continues to improve

as a result of growing demand and recent contract wins described

above under "New Contracts."

Work on the Company's existing long-term overburden removal

contract with Canadian Natural could be temporarily affected by a

fire that damaged the Horizon Mine's upgrader, however, the

customer's initial assessment appears to suggests that the impact

on NAEP is expected to be minimal. To date, there has been no

request for a slowdown in production. However, should a production

adjustment be required, NAEP believes that some equipment can be

profitably redeployed to other customers' sites to lessen the

impact. Overall, the Company expects its recurring services work to

increase through the fourth quarter and into fiscal 2012.

High oil prices and a renewed commitment among oil sands

producers continue to support a positive outlook for new oil sands

project developments. Syncrude recently announced capital spending

plans that include an investment of $480 million in tailings

management, four mine train relocations to be completed by 2014 and

further development of the Aurora South mine. Suncor also recently

announced 2011 capital plans that include an investment of $670

million in tailings management, as well as development of the Fort

Hills mine, Voyageur upgrader and Joslyn mine in partnership with

Total. These and other developments are expected to translate into

increased project tendering opportunities during the next fiscal

year.

In the Piling segment, activity levels are expected to be

moderate in the fourth quarter, however, the longer-term outlook

remains positive. Improving conditions in the commercial and

industrial construction markets, growing opportunities in the oil

sands and the recent acquisition of Cyntech are expected to

generate new opportunities. In particular, the innovative screw

pile technology acquired through Cyntech enhances NAEP's ability to

access SAGD oil sands projects.

In the Pipeline division, fourth quarter activity is expected to

be minimal and the Company expects to be focused on negotiating the

settlement of change orders and evaluating and bidding some

significant pipeline work which has recently been put out to

tender. While some improvement in market demand is anticipated

during fiscal 2012, conditions in this market remain

challenging.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

its financial results for the three and nine months ended December

31, 2010 tomorrow, Wednesday, February 2, 2011 at 9:00 am Eastern

time.

The call can be accessed by dialing:

Toll free: 1-877-407-9205 or International: 1-201-689-8054

A replay will be available through March 2, 2011 by dialing:

Toll Free: 1-877-660-6853 or International: 1-201-612-7415

(Account: 286 Conference ID: 366296).

Non-GAAP Financial Measures

This release contains non-GAAP financial measures. These

measures do not have standardized meanings under Canadian GAAP or

US GAAP and are therefore unlikely to be comparable to similar

measures used by other companies. The non-GAAP financial measure

disclosed by the Company in this release is Consolidated EBITDA (as

defined within the credit agreement). The Company provides a

reconciliation of Consolidated EBITDA to net income reported in

accordance with US GAAP below. Investors and readers are encouraged

to review the reconciliation of this non-GAAP financial measure to

reported net income.

Consolidated EBITDA

Consolidated EBITDA is a measure defined by the Company's credit

agreement. This measure is defined as EBITDA (which is calculated

as net income before interest, income taxes, depreciation and

amortization) excluding the effects of unrealized foreign exchange

gain or loss, realized and unrealized gain or loss on derivative

financial instruments, non-cash stock-based compensation expense,

gain or loss on disposal of property, plant and equipment and

certain other non-cash items included in the calculation of net

income. The credit agreement requires the Company to maintain a

minimum interest coverage ratio and a maximum senior leverage

ratio, which are calculated using Consolidated EBITDA.

Non-compliance with these financial covenants could result in the

Company being required to immediately repay all amounts outstanding

under its credit facility. Consolidated EBITDA should not be

considered as an alternative to operating income or net income as a

measure of operating performance or cash flows as a measure of

liquidity. Consolidated EBITDA has important limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analysis of the Company's results as reported under

Canadian GAAP or US GAAP. For example, Consolidated EBITDA:

- does not reflect cash expenditures or requirements for capital

expenditures or capital commitments;

- does not reflect changes in cash requirements for working

capital needs;

- does not reflect the interest expense or the cash requirements

necessary to service interest or principal payments on debt;

- excludes tax payments that represent a reduction in cash

available to the Company; and

- does not reflect any cash requirements for assets being

depreciated and amortized that may have to be replaced in the

future.

Consolidated EBITDA also excludes unrealized foreign exchange

gains and losses and realized and unrealized gains and losses on

derivative financial instruments, which, in the case of unrealized

losses, may ultimately result in a liability that will need to be

paid and in the case of realized losses, represents an actual use

of cash during the period.

A reconciliation of net income to Consolidated EBITDA is as follows:

Three Months Ended Nine Months Ended

December 31, December 31,

(dollars in thousands) 2010 2009 2010 2009

----------------------------------------------------------------------------

Net income (loss) $ 3,742 $ 14,936 $ (4,198) $ 29,162

Adjustments:

Interest expense 7,193 6,764 22,630 19,725

Income taxes 2,374 6,540 3,857 10,401

Depreciation 10,501 10,543 26,758 30,693

Amortization of intangible

assets 992 528 2,252 1,438

Unrealized foreign exchange

gain on senior notes - (5,120) - (42,720)

Realized and unrealized (gain)

loss on derivative financial

instruments (2,040) 8,010 (340) 43,185

Loss on disposal of property,

plant and equipment and

assets held for sale 1,720 1,392 2,276 1,417

Stock-based compensation

expense 468 349 1,662 1,981

Equity in loss (earnings) of

unconsolidated joint venture 359 (98) 876 (66)

Loss on debt extinguishment - - 4,324 -

---------------------------------------------

Consolidated EBITDA $ 25,309 $ 43,844 $ 60,097 $ 95,216

---------------------------------------------

---------------------------------------------

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is information that is subject to known

and unknown risks and other factors that may cause future actions,

conditions or events to differ materially from the anticipated

actions, conditions or events expressed or implied by such

forward-looking information. Forward-looking information is

information that does not relate strictly to historical or current

facts and can be identified by the use of the future tense or other

forward-looking words such as "believe", "expect", "anticipate",

"intend", "plan", "estimate", "should", "may", "could", "would",

"target", "objective", "projection", "forecast", "continue",

"strategy", "position" or the negative of those terms or other

variations of them or comparable terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following: that work will

commence in the fourth quarter under the Company's two new

long-term recurring services contracts; that the Company will

undertake a significant volume of work through the remaining winter

months; that revenue growth will continue to outpace margin growth

in the near term; that if a production adjustment is made with

respect to the long-term overburden removal contract with Canadian

natural, that some equipment can be profitably redeployed to other

customers' sites to lessen the impact of the adjustment; that oil

sands project developments will translate into more project

tendering opportunities for the Company during the next fiscal

year; that activities in the Piling segment will be moderate in the

fourth quarter and positive in the longer-term; that improving

conditions in the commercial and industrial construction markets,

growing opportunities in the oil sands and the recent acquisition

of Cyntech will generate new opportunities; that activities in the

Pipeline division will be minimal in the fourth quarter; and that

demand will improve in the Pipeline market.

There can be no assurance that forward-looking information will

prove to be accurate, as actual results and future events could

differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. Each of the forward-looking statements

in this news release is subject to significant risks and

uncertainties and is based on a number of assumptions which may

prove to be incorrect. The material factors or assumptions used to

develop the above forward-looking statements and the risks and

uncertainties that could cause actual results to differ materially

from the information presented in the above are discussed in NAEP's

Management Discussion & Analysis for the three and nine months

ended December 31, 2010. While management anticipates that

subsequent events and developments may cause its views to change,

the Company does not intend to update this forward-looking

information, except as required by applicable securities laws. This

forward-looking information represents management's views as of the

date of this document and such information should not be relied

upon as representing their views as of any date subsequent to the

date of this document.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599 (FAX)

krowand@nacg.ca www.naepi.ca

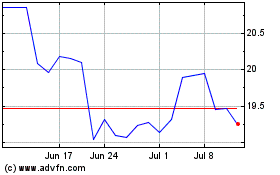

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2024 to Aug 2024

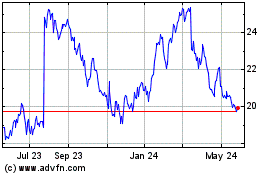

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Aug 2023 to Aug 2024