North American Energy Partners Files Revised Quarterly Management's Discussion and Analysis

August 05 2010 - 8:26PM

Marketwired

North American Energy Partners Inc. ("NAEP" or "the Company") (TSX:

NOA) (NYSE: NOA) today announced that it has filed a revised

Management's Discussion and Analysis ("MD&A") for the three

months ended June 30, 2010.

The revised MD&A supersedes the MD&A filed on August 4,

2010 and corrects errors in the figures summarizing the Company's

backlog. The correction resulted in a $35 million increase to

backlog for the Pipeline segment as at June 30th 2010.

(dollars in thousands) June 30, 2010 March 31, 2010 June 30, 2009

----------------------------------------------------------------------------

By Segment

Heavy Construction

and Mining $807,111 $725,767 $696,412

Piling 16,579 16,423 5,731

Pipeline 40,989 6,861 -

-------------------------------------------------

Total $864,679 $749,051 $702,143

By Contract Type

Unit-Price $796,670 $722,710 $698,550

Lump-Sum 63,383 18,429 2,165

Time-and-Materials

and Cost-Plus 4,626 7,912 1,428

-------------------------------------------------

Total $864,679 $749,051 $702,143

The Company is currently preparing to commence work on two new

pipeline construction contracts. Although one of these contracts

qualified for inclusion in the calculation of backlog as at June

30, 2010, it was not included in the backlog figures the Company

previously reported. It has now been included in the revised

filing. The second contract did not qualify for inclusion in the

calculation of backlog as at June 30th, 2010 but is expected to

contribute to revenues in the second and third quarters.

"Our expectation for total Pipeline segment revenues during

fiscal 2011 is approximately $55-$65 million," said Rod Ruston,

President and CEO. "On our conference call this morning we

indicated a lower range for total Pipeline segment revenues based

on incomplete information and we apologize for any confusion this

may have caused."

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is information that is subject to known

and unknown risks and other factors that may cause future actions,

conditions or events to differ materially from the anticipated

actions, conditions or events expressed or implied by such

forward-looking information. Forward-looking information is

information that does not relate strictly to historical or current

facts and can be identified by the use of the future tense or other

forward-looking words such as "believe", "expect", "anticipate",

"intend", "plan", "estimate", "should", "may", "could", "would",

"target", "objective", "projection", "forecast", "continue",

"strategy", "position" or the negative of those terms or other

variations of them or comparable terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following, each of which is

subject to significant risks and uncertainties and is based on a

number of assumptions which may prove to be incorrect:

Information related to the level of activity in the Company's

key markets and demand for the Company's services, including the

Pipeline segment's ability to achieve revenues of $55-$65 million

during fiscal 2011; is subject to the risks and uncertainties that:

continued reduced demand for oil and other commodities as a result

of slowing market conditions in the global economy may result in

reduced oil production and a decline in oil prices; anticipated new

major capital projects in the oil sands may not materialize; demand

for the Company's services may be adversely impacted by regulations

affecting the energy industry; failure by the Company's customers

to obtain required permits and licenses may affect the demand for

the Company's services; changes in the Company's customers'

perception of oil prices over the long-term could cause its

customers to defer, reduce or stop their capital investment in oil

sands projects, which would, in turn, reduce the Company's revenue

from those customers; reduced financing as a result of the

tightening credit markets may affect the Company's customers'

decisions to invest in infrastructure projects; insufficient

pipeline, upgrading and refining capacity or lack of sufficient

governmental infrastructure to support growth in the oil sands

region could cause the Company's customers to delay, reduce or

cancel plans to construct new oil sands projects or expand existing

projects, which would, in turn, reduce the Company's revenue from

those customers; a change in strategy by the Company's customers to

reduce outsourcing could adversely affect the Company's results;

cost overruns by the Company's customers on their projects may

cause its customers to terminate future projects or expansions

which could adversely affect the amount of work the Company

receives from those customers; because most of the Company's

customers are Canadian energy companies, a further downturn in the

Canadian energy industry could result in a decrease in the demand

for its services; and unanticipated short term shutdowns of the

Company's customers' operating facilities may result in temporary

cessation or cancellation of projects in which the Company is

participating.

While management anticipates that subsequent events and

developments may cause its views to change, the Company does not

intend to update this forward-looking information, except as

required by applicable securities laws. This forward-looking

information represents management's views as of the date of this

document and such information should not be relied upon as

representing their views as of any date subsequent to the date of

this document. The Company has attempted to identify important

factors that could cause actual results, performance or

achievements to vary from those current expectations or estimates

expressed or implied by the forward-looking information. However,

there may be other factors that cause results, performance or

achievements not to be as expected or estimated and that could

cause actual results, performance or achievements to differ

materially from current expectations. There can be no assurance

that forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

expected or estimated in such statements. Accordingly, readers

should not place undue reliance on forward-looking information.

These factors are not intended to represent a complete list of the

factors that could affect the Company. See the risk factors

highlighted in materials filed with the securities regulatory

authorities in the United States and Canada from time to time,

including but not limited to the most recent Management's

Discussion and Analysis filed respectively in the United States and

Canada.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.naepi.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599 (FAX)

krowand@nacg.ca

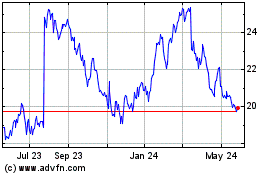

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jun 2024 to Jul 2024

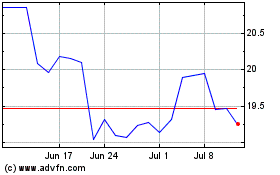

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2023 to Jul 2024