North American Energy Partners Inc. ("NAEP" or "the Company") (TSX:

NOA) (NYSE: NOA) today announced results for the three months ended

June 30, 2010.

Conversion to US GAAP

The Company has prepared its consolidated financial statements

in conformity with accounting principles generally accepted in the

United States (US GAAP). All comparative financial information

contained herein has been revised to reflect the Company's results

as if they had been historically reported in accordance with US

GAAP. Unless otherwise specified, all dollar amounts discussed are

in Canadian dollars.

Consolidated Financial Highlights

Three Months Ended June 30,

(dollars in thousands) 2010 2009

----------------------------------------------------------------------------

Revenue $ 183,594 $ 146,519

Gross profit $ 15,620 $ 25,140

Gross profit margin 8.5% 17.2%

Operating income $ 1,064 $ 10,138

Operating margin 0.6% 6.9%

Net (loss) income $ (10,309) $ 9,927

Consolidated EBITDA $ 12,179 $ 19,394

Capital expenditures $ 6,589 $ 19,710

Cash and cash equivalents $ 78,868 $ 79,989

"We achieved 25% growth in consolidated revenue during the three

months ended June 30, 2010," said President and CEO, Rod Ruston.

"Volumes in our recurring services business were particularly

strong with significantly higher activity at Canadian Natural's

Horizon project and steady work volumes with our other key oil

sands customers despite a reduction of activity at Shell's oil

sands operations as this client shutdown to both commission the

Jackpine project and undertake a major maintenance program. Piling

volumes were also up 30% over last year in spite of severe weather

conditions that hampered much of our work throughout the

quarter."

Gross profit was negatively impacted by a heavy workload of

planned equipment repair and maintenance activity during the spring

break-up period, primarily on leased equipment units where major

maintenance costs are expensed rather than capitalized. This,

together with a negative foreign exchange impact on our long-term

overburden removal contract and an abnormally high volume of

unsigned change orders in the Piling segment at the end of the

quarter, resulted in a reduction in gross margins.

"Our first quarter margin performance largely reflects one-time

items compounded by our standard first-quarter equipment

maintenance program," said Ruston. "We expect margins to return to

normal levels as we move into the second quarter and we'll also

benefit as the outstanding change orders are processed."

"Our outlook going forward remains positive and it's reflected

in our growing backlog," Mr. Ruston added. "We are seeing a strong

level of activity throughout the oil sands and increasing momentum

as the project development side of this business begins to recover.

Commercial and industrial construction demand is also starting to

recover and we are beginning to benefit from our move into the

Ontario market. Overall, we are encouraged by the momentum we see

returning to our business and anticipate improving operating

performance as the year progresses," said Mr. Ruston.

Consolidated Results for the Three Months Ended June 30, 2010

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Revenue $ 183,594 $ 146,519 $ 37,075

For the three months ended June 30, 2010, consolidated revenues

increased to $183.6 million, from $146.5 million during the same

period last year. The $37.1 million improvement reflects an

increase in recurring services and in Piling segment activity.

Recurring services accounted for 88% of the Company's oil sands'

revenue in the period, compared to 87% in the same period last

year.

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Gross profit $ 15,620 $ 25,140 $ (9,520)

Gross profit margin 8.5% 17.2%

Gross profit for the three months ended June 30, 2010 was $15.6

million (8.5% of revenue), compared to $25.1 million ($17.2% of

revenue) during the same period last year. The reduction in gross

profit margin is partly related to a $2.3 million reduced profit on

the long-term overburden removal contract in the Heavy Construction

and Mining segment resulting from the negative impact of a stronger

Canadian dollar on the value of the contract. Gross profit was also

negatively affected by reduced margin in the Piling segment due to

delays in executing change orders, as well as by higher equipment

costs due to increased repair maintenance activity during the

spring break-up period.

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Operating income $ 1,064 $ 10,138 $ (9,074)

Operating margin 0.6% 6.9%

For the three months ended June 30, 2010, operating income was

$1.1 million (0.6% of revenue), compared to an operating income of

$10.1 million (6.9% of revenue) during the same period last year

largely due to lower gross margins as discussed above. In addition,

general and administrative expense decreased by $1.2 million

year-over-year. Prior-year general and administrative costs were

impacted by higher stock-based compensation costs related to

deferred performance share units and director share units due to

increases in our share price in the prior-year period.

(dollars in thousands, except Three Months Ended June 30,

per share amounts) 2010 2009 Change

----------------------------------------------------------------------------

Net (loss) income $ (10,309) $ 9,927 $ (20,236)

Per share information

Net (loss) income - basic $ (0.29) $ 0.28 $ (0.57)

Net (loss) income - diluted $ (0.29) $ 0.27 $ (0.56)

The Company recorded a net loss of $10.3 million (basic and

diluted loss per share of $0.29) for the three months ended June

30, 2010, compared to a net income of $9.9 million (basic income

per share of $0.28 and diluted income per share of $0.27) during

the same period last year. The non-cash items affecting results in

the most recent period included a loss related to the write-off of

deferred financing costs related to the extinguishment of the 8

3/4% senior notes, a loss on the cross-currency and interest rate

swaps and a loss relating to embedded derivatives in long-term

supplier contracts. These items were partially offset by the

positive foreign exchange impact of the strengthening Canadian

dollar on the extinguishment of the 8 3/4% senior notes and a gain

relating to embedded derivatives in a long-term customer contract.

Net income for the same period last year was positively affected by

the foreign exchange impact of the strengthening Canadian dollar on

the 8 3/4% senior notes, a gain related to embedded derivatives in

an early redemption option on the 8 3/4% senior notes and a gain

relating to embedded derivatives in long-term supplier contracts,

partially offset by a loss on the cross-currency and interest rate

swaps and a loss relating to embedded derivatives in a long-term

customer contract. Excluding the above items, net loss for the

three months ended June 30, 2010 would have been $4.1 million

(basic and diluted loss per share of $0.11), compared to net income

of $0.1 million (basic and diluted income per share of $nil) during

the same period last year.

Segment Results

Heavy Construction and Mining

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Segment revenue $ 163,609 $ 131,826 $ 31,783

Segment profit 22,247 23,514 $ (1,267)

Segment profit percentage 13.6% 17.8%

For the three months ended June 30, 2010, revenue from the Heavy

Construction and Mining segment increased $31.8 million to $163.6

million, primarily as a result of higher recurring services

revenue. The growth in recurring services revenue was driven by a

return to planned operational levels on the long-term overburden

removal contract at Canadian Natural and increased activity at

Suncor's site under the Company's truck rental agreement. The

recurring services gains were partially offset by lower activity

levels with Shell Albian as a result of the shutdown at this

customer's operation in preparation for the transition to

production at the Jackpine mine. Project development revenues also

increased in the current period as a result of a construction

project executed for Imperial Oil's Kearl project.

Segment margins for the three months ended June 30, 2010 were

13.6%, compared to 17.8% during the same period last year. The

change in profit margin primarily reflects a $2.3 million profit

reduction in the forecast for the long-term overburden removal

contract as a result of a reduction in the US exchange rate of the

Canadian dollar. In the prior-year period, results included a $4.0

million profit increase in the forecast for this same project as a

result of an increase in the US exchange rate of the Canadian

dollar. Lower project efficiency during the spring break-up period

also contributed to the reduced segment profit.

Piling

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Segment revenue $ 19,146 $ 14,618 $ 4,528

Segment profit 1,394 $ 2,684 $ (1,290)

Segment profit percentage 7.3% 18.4%

For the three months ended June 30, 2010, Piling segment

revenues were $19.1 million compared to $14.6 million in the same

period last year. The improvement in Piling revenues reflects a

partial recovery in activity levels in the commercial and

industrial construction markets. These gains were made despite

abnormally high precipitation levels in Western Canada during the

spring break-up period, which delayed some piling work to future

periods.

Segment margins decreased to 7.3%, from 18.4%, reflecting the

delay in the execution of change orders in the current period.

Pipeline

Three Months Ended June 30,

(dollars in thousands) 2010 2009 Change

----------------------------------------------------------------------------

Segment revenue $ 839 $ 75 $ 764

Segment (loss) profit (723) $ 367 $ (1,090)

Segment (loss) profit

percentage -86.2% 489.3%

For the three months ended June 30, 2010, Pipeline revenues

increased to $0.8 million, from $0.1 million in the same period

last year, reflecting the partial resumption of work on a contract

in British Columbia. The segment losses were a result of fixed

project costs incurred during a temporary shutdown of work on a

contract in British Columbia.

Outlook

While spring break-up weather conditions have extended into the

second quarter, the Company still anticipates a gradual

strengthening of demand for services through the balance of the

year.

In the oil sands, demand for recurring services is expected to

remain strong and the Company is currently active with all four of

the operational oil sands producers. NAEP is also continuing to

develop its new environmental and tailings pond reclamation

services offering, which over time, is expected to provide

opportunities to further expand the recurring services business.

Currently, discussions are underway with several customers to

develop pilot projects related to their tailings pond management

strategies.

The outlook for project development in the oil sands also

remains positive. NAEP continues to win piling and heavy

construction-related projects at Exxon's Kearl site and sees

opportunities to further expand its business with this customer.

Other new developments such as Husky Energy Inc.'s Sunrise,

ConocoPhillips' Surmont and Suncor's Firebag in situ projects are

moving forward and could eventually provide additional project

development opportunities as they reach the construction phase.

In the Piling division, activity levels are beginning to ramp up

as weather conditions in Western Canada improve and projects

delayed by the earlier rainy conditions, get underway. The Piling

division built up a significant backlog of projects over the past

three months and anticipates it will be able to work through these

projects by the end of the fiscal year. The division has also been

successful in attracting a growing volume of business in the

Ontario market, including its first significant commercial

development piling project.

The Pipeline division anticipates a stronger second and third

quarter with work on two new projects getting underway in August

2010. These include TransCanada Pipelines' NPS Groundbirch Mainline

project, which involves construction of a 77 km, 36-inch pipeline

in British Columbia. The Pipeline division will also commence work

on the second phase of Spectra Energy's Maxhamish Loop project,

which involves construction of a 30 km, 24-inch pipeline also in

British Columbia. Both projects are scheduled for completion in

November 2010.

Overall the Company is encouraged by the improving market

conditions and by its steadily increasing backlog of work.

Conference Call and Webcast

Management will hold a conference call and webcast to discuss

its financial results for the three months ended June 30, 2010

tomorrow, Thursday, August 5, 2010 at 9:00 am Eastern time.

The call can be accessed by dialing:

Toll free: 1-877-407-9205 or International: 1-201-689-8054

A replay will be available through September 7, 2010 by

dialing:

Toll Free: 1-877-660-6853 or International: 1-201-612-7415

(Account: 286 Conference ID: 354813)

Interim Consolidated Balance Sheets

(Expressed in thousands of Canadian dollars)

June 30, 2010 March 31, 2010

------------------------------

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents $ 78,868 $ 103,005

Accounts receivable, net (allowance for

doubtful accounts of $773, March 2010 -

$1,691) 89,925 111,884

Unbilled revenue 90,284 84,702

Inventories 10,385 5,659

Prepaid expenses and deposits 10,744 6,881

Deferred tax assets 2,843 3,481

------------------------------

283,049 315,612

Prepaid expenses and deposits 3,573 4,005

Assets held for sale 838 838

Property, plant and equipment 326,550 328,743

Intangible assets, net (accumulated

amortization of $5,179, March 2010 - $4,591) 7,652 7,669

Deferred financing costs 8,539 6,725

Investment in and advances to unconsolidated

joint venture 3,215 2,917

Goodwill 25,111 25,111

Deferred tax assets 24,112 10,997

------------------------------

$ 682,639 $ 702,617

------------------------------

------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 71,847 $ 66,876

Accrued liabilities 32,818 47,191

Billings in excess of costs incurred and

estimated earnings on uncompleted contracts 3,067 1,614

Current portion of capital lease obligations 4,699 5,053

Current portion of derivative financial

instruments 2,550 22,054

Current portion of term facilities 10,000 6,072

Deferred tax liabilities 21,527 16,781

------------------------------

146,508 165,641

Deferred lease inducements 734 761

Long term accrued liabilities 15,317 14,943

Capital lease obligations 7,314 8,340

Term facilities 65,946 22,374

8 3/4% senior notes - 203,120

Series 1 debentures 225,000 -

Director deferred stock unit liability 2,674 2,548

Restricted share unit liability 1,333 1,030

Derivative financial instruments 14,291 75,001

Asset retirement obligation 368 360

Deferred tax liabilities 31,931 27,441

------------------------------

511,416 521,559

Shareholders' equity:

Common shares (authorized - unlimited number

of voting and non-voting common shares;

issued and outstanding - June 30, 2010 -

36,062,036 voting common shares (March 31,

2010 - 36,049,276 voting common shares) 303,593 303,505

Additional paid-in capital 7,825 7,439

Deficit (140,195) (129,886)

------------------------------

171,223 181,058

------------------------------

$ 682,639 $ 702,617

------------------------------

------------------------------

Interim Consolidated Statements of Operations and Comprehensive Income

(Loss)

(Expressed in thousands of Canadian dollars, except per share amounts)

Three months ended June 30,

------------------------------

2010 2009

------------------------------

Revenue $ 183,594 $ 146,519

Project costs 77,277 54,262

Equipment costs 65,003 46,044

Equipment operating lease expense 17,491 12,349

Depreciation 8,203 8,724

------------------------------

Gross profit 15,620 25,140

General and administrative costs 13,729 14,976

(Gain) loss on disposal of property, plant and

equipment (4) 41

Gain on disposal of assets held for sale - (317)

Amortization of intangible assets 588 493

Equity in loss (earnings) of unconsolidated

joint venture 243 (191)

------------------------------

Operating income before the undernoted 1,064 10,138

Interest expense, net 7,729 6,552

Foreign exchange gain (1,697) (19,436)

Realized and unrealized loss on derivative

financial instruments 3,008 10,021

Loss on debt extinguishment 4,346 -

Other expense - 533

------------------------------

(Loss) income before income taxes (12,322) 12,468

Income taxes (benefit)

Current 1,228 -

Deferred (3,241) 2,541

------------------------------

Net (loss) income and comprehensive (loss)

income for the period (10,309) 9,927

------------------------------

------------------------------

Net (loss) income per share - basic $ (0.29) $ 0.28

------------------------------

------------------------------

Net (loss) income per share - diluted $ (0.29) $ 0.27

------------------------------

------------------------------

Intrim Consolidated Statements of Cash Flows

(Expressed in thousands of Canadian dollars)

Three months ended June 30,

------------------------------

2010 2009

------------------------------

Cash provided by (used in):

Operating activities:

Net (loss) income for the period $ (10,309) $ 9,927

Items not affecting cash:

Depreciation 8,203 8,724

Equity in loss (earnings) of unconsolidated

joint venture 243 (191)

Amortization of intangible assets 588 493

Amortization of deferred lease inducements (27) (26)

Amortization of deferred financing costs 526 805

(Gain) loss on disposal of property, plant

and equipment (4) 41

Gain on disposal of assets held for sale - (317)

Unrealized foreign exchange gain on 8 3/4%

senior notes (732) (19,540)

Unrealized loss on derivative financial

instruments measured at fair value 3,008 6,685

Loss on debt extinguishment 4,346 -

Stock-based compensation expense 839 1,817

Accretion of asset retirement obligation 8 9

Deferred income taxes (benefit) (3,241) 2,541

Net changes in non-cash working capital 12,356 (18,690)

------------------------------

15,804 (7,722)

Investing activities:

Purchase of property, plant and equipment (6,018) (19,221)

Addition to intangible assets (571) (489)

Investment in and advances to unconsolidated

joint venture (541) (500)

Proceeds on disposal of property, plant and

equipment 60 138

Proceeds on disposal of assets held for sale - 960

Net changes in non-cash working capital (2,768) (1,272)

------------------------------

(9,838) (20,384)

Financing activities:

Repayment of term facilities (2,500) -

Increase in term facilities 50,000 11,800

Financing costs (7,704) (1,115)

Redemption of 8 3/4% senior notes (202,410) -

Issuance of series 1 debentures 225,000 -

Settlement of swap liabilities (91,125) -

Proceeds from stock options exercised 64 -

Repayment of capital lease obligations (1,428) (1,470)

------------------------------

(30,103) 9,215

------------------------------

Decrease in cash and cash equivalents (24,137) (18,891)

Cash and cash equivalents, beginning of

period 103,005 98,880

------------------------------

Cash and cash equivalents, end of period $ 78,868 $ 79,989

------------------------------

------------------------------

Consolidated EBITDA

Consolidated EBITDA is a measure defined by the Company's credit

agreement. This measure is defined as EBITDA (which is calculated

as net income before interest, income taxes, depreciation and

amortization) excluding the effects of unrealized foreign exchange

gain or loss, realized and unrealized gain or loss on derivative

financial instruments, non-cash stock-based compensation expense,

gain or loss on disposal of property, plant and equipment and

certain other non--cash items included in the calculation of net

income. The credit agreement requires the Company to maintain a

minimum interest coverage ratio and a maximum senior leverage

ratio, which are calculated using Consolidated EBITDA.

Non-compliance with these financial covenants could result in the

Company being required to immediately repay all amounts outstanding

under its credit facility. Consolidated EBITDA should not be

considered as an alternative to operating income or net income as a

measure of operating performance or cash flows as a measure of

liquidity. Consolidated EBITDA has important limitations as an

analytical tool and should not be considered in isolation or as a

substitute for analysis of the Company's results as reported under

Canadian GAAP or US GAAP. For example, Consolidated EBITDA:

-- does not reflect cash expenditures or requirements for capital

expenditures or capital commitments;

-- does not reflect changes in cash requirements for working capital needs;

-- does not reflect the interest expense or the cash requirements necessary

to service interest or principal payments on debt;

-- excludes tax payments that represent a reduction in cash available to

the Company; and

-- does not reflect any cash requirements for assets being depreciated and

amortized that may have to be replaced in the future.

Consolidated EBITDA also excludes unrealized foreign exchange

gains and losses and realized and unrealized gains and losses on

derivative financial instruments, which, in the case of unrealized

losses, may ultimately result in a liability that will need to be

paid and in the case of realized losses, represents an actual use

of cash during the period.

A reconciliation of net (loss) income to Consolidated EBITDA is

as follows:

Forward-Looking Information

This release contains forward-looking information that is based

on expectations and estimates as of the date of this release.

Forward-looking information is information that is subject to known

and unknown risks and other factors that may cause future actions,

conditions or events to differ materially from the anticipated

actions, conditions or events expressed or implied by such

forward-looking information. Forward-looking information is

information that does not relate strictly to historical or current

facts and can be identified by the use of the future tense or other

forward-looking words such as "believe", "expect", "anticipate",

"intend", "plan", "estimate", "should", "may", "could", "would",

"target", "objective", "projection", "forecast", "continue",

"strategy", "position" or the negative of those terms or other

variations of them or comparable terminology.

Examples of such forward-looking information in this release

include but are not limited to, the following, each of which is

subject to significant risks and uncertainties and is based on a

number of assumptions which may prove to be incorrect:

(A) information related to the level of activity in the

Company's key markets and demand for the Company's services,

including (1) a gradual strengthening of demand for services

through the balance of the year, (2) demand for recurring services

remains strong, (3) the Company's new environmental and tailings

pond reclamation services offering provides opportunities to expand

the recurring services business, (4) the Company's ability to

further expand its business with Exxon, (5) new in situ

developments eventually providing project development

opportunities, (6) the Piling division executing its backlog by

year-end and (7) stronger second and third quarter results in

Pipeline as projects get underway in August; is subject to the

risks and uncertainties that: continued reduced demand for oil and

other commodities as a result of slowing market conditions in the

global economy may result in reduced oil production and a decline

in oil prices; anticipated new major capital projects in the oil

sands may not materialize; demand for the Company's services may be

adversely impacted by regulations affecting the energy industry;

failure by the Company's customers to obtain required permits and

licenses may affect the demand for the Company's services; changes

in the Company's customers' perception of oil prices over the

long-term could cause its customers to defer, reduce or stop their

capital investment in oil sands projects, which would, in turn,

reduce the Company's revenue from those customers; reduced

financing as a result of the tightening credit markets may affect

the Company's customers' decisions to invest in infrastructure

projects; insufficient pipeline, upgrading and refining capacity or

lack of sufficient governmental infrastructure to support growth in

the oil sands region could cause the Company's customers to delay,

reduce or cancel plans to construct new oil sands projects or

expand existing projects, which would, in turn, reduce the

Company's revenue from those customers; a change in strategy by the

Company's customers to reduce outsourcing could adversely affect

the Company's results; cost overruns by the Company's customers on

their projects may cause its customers to terminate future projects

or expansions which could adversely affect the amount of work the

Company receives from those customers; because most of the

Company's customers are Canadian energy companies, a further

downturn in the Canadian energy industry could result in a decrease

in the demand for its services; and unanticipated short term

shutdowns of the Company's customers' operating facilities may

result in temporary cessation or cancellation of projects in which

the Company is participating; and

(B) information related to the future performance of the

Company, including (1) margins returning to normal levels in the

second quarter, (2) the Company's ability to realize the benefits

of outstanding change orders as they are processed and (3)improving

operating performance as the year progresses; is subject to the

risks and uncertainties that: shortages of qualified personnel or

significant labour disputes could adversely affect the Company's

business; if the Company is unable to obtain surety bonds or

letters of credit required by some of its customers, the Company's

business could be impaired; the Company is dependent on its ability

to lease equipment and a tightening of this form of credit could

adversely affect the Company's ability to bid for new work and/or

supply some of its existing contracts; a deterioration of credit

market conditions may restrict the Company's ability to secure new

debt financing and/or increase the cost; the Company's business is

highly competitive and competitors may outbid the Company on major

projects that are awarded based on bid proposals; the Company's

customer base is concentrated and the loss of or a significant

reduction in business from a major customer could adversely impact

the Company's financial condition; lump-sum and unit-price

contracts expose the Company to losses when its estimates of

project costs are lower than actual costs; the Company's operations

are subject to weather-related factors that may cause delays in its

project work; and environmental laws and regulations may expose the

Company to liability arising out of its operations or the

operations of its customers.

While management anticipates that subsequent events and

developments may cause its views to change, the Company does not

intend to update this forward-looking information, except as

required by applicable securities laws. This forward-looking

information represents management's views as of the date of this

document and such information should not be relied upon as

representing their views as of any date subsequent to the date of

this document. The Company has attempted to identify important

factors that could cause actual results, performance or

achievements to vary from those current expectations or estimates

expressed or implied by the forward-looking information. However,

there may be other factors that cause results, performance or

achievements not to be as expected or estimated and that could

cause actual results, performance or achievements to differ

materially from current expectations. There can be no assurance

that forward-looking information will prove to be accurate, as

actual results and future events could differ materially from those

expected or estimated in such statements. Accordingly, readers

should not place undue reliance on forward-looking information.

These factors are not intended to represent a complete list of the

factors that could affect the Company. See the risk factors

highlighted in materials filed with the securities regulatory

authorities in the United States and Canada from time to time,

including but not limited to the most recent Management's

Discussion and Analysis filed respectively in the United States and

Canada.

For more complete information about NAEP, you should read the

disclosure documents filed with the SEC and the CSA. You may obtain

these documents for free by visiting the SEC website at www.sec.gov

or SEDAR on the CSA website at www.sedar.com.

About the Company

North American Energy Partners Inc. (www.nacg.ca) is one of the

largest providers of heavy construction, mining, piling and

pipeline services in Western Canada. For more than 50 years, NAEP

has provided services to large oil, natural gas and resource

companies, with a principal focus on the Canadian oil sands. NAEP

maintains one of the largest independently owned equipment fleets

in the region.

Contacts: North American Energy Partners Inc. Kevin Rowand

Investor Relations (780) 969-5528 (780) 969-5599 (FAX)

krowand@nacg.ca www.nacg.ca

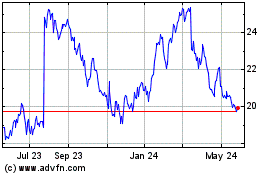

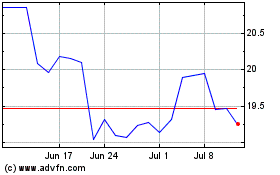

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jun 2024 to Jul 2024

North American Construct... (NYSE:NOA)

Historical Stock Chart

From Jul 2023 to Jul 2024