Navios Maritime Partners L.P. Reports Financial Results for the

Third Quarter and Nine Months Ended September 30, 2013

MONACO--(Marketwired - Oct 31, 2013) - Navios Maritime Partners

L.P. ("Navios Partners") (NYSE: NMM)

- $275.0 million acquisition of five 6,800 TEU container vessels

- Chartered out for 10 years at $30,150 net per day per

vessel

- $39.5 million annual EBITDA

- $386.5 million aggregate EBITDA

- $27.5 million annual free cash flow

- 58.0% increase in average charter duration to 3.8 years

- $189.5 million add-on to Term Loan B facility

- Net Income:

- $13.1 million in Q3; $48.9 million for the nine

months

- EBITDA:

- $35.6 million in Q3; $117.7 million for the nine months

- Dividend of $0.4425 per common unit

Navios Maritime Partners L.P. ("Navios Partners") (NYSE: NMM),

an owner and operator of dry cargo vessels, today reported its

financial results for the third quarter and nine months ended

September 30, 2013.

Angeliki Frangou, Chairman and Chief Executive Officer of Navios

Partners, stated: "I am pleased with the results of this

quarter. In addition to strengthening our balance sheet through

equity and debt capital market activities, we achieved $35.6

million of EBITDA and $13.1 million of Net Income."

Angeliki Frangou continued, "We are announcing a quarterly

distribution of $0.44 and a quarter cent. This represents an

annual distribution of $1.77 and an attractive current yield of

about 11.7%. With the transformative acquisition of the five

container vessels, we are not only committed to this minimum

distribution through the end of 2014, but we believe that we are

positioned to increase distributions in the medium term as the dry

bulk market improves."

RECENT DEVELOPMENTS

Cash Distribution

The Board of Directors of Navios Partners declared a cash

distribution for the third quarter of 2013 of $0.4425 per unit. The

cash distribution is payable on November 13, 2013 to unitholders of

record on November 8, 2013.

$275 million acquisition of five container vessels with 10 year

charters

Navios Partners has agreed to acquire the following five South

Korean-built containers for a total consideration of $275.0

million.

| |

|

|

|

|

|

Container Vessels |

Year Built |

TEU |

Delivery |

Charter rate, net |

|

Navios TBN1 |

2006 |

6,800 |

Q4 2013 |

$30,150 |

|

Navios TBN2 |

2006 |

6,800 |

Q4 2013 |

$30,150 |

|

Navios TBN3 |

2006 |

6,800 |

Q4 2013 |

$30,150 |

|

Navios TBN4 |

2006 |

6,800 |

Q4 2013 |

$30,150 |

|

Navios TBN5 |

2006 |

6,800 |

Q4 2013 |

$30,150 |

| |

|

|

|

|

The vessels are chartered out for 10 years (with Navios

Partners' option to terminate after year seven), at $30,150 net per

day per vessel. The total acquisition cost will be funded partially

by the issuance of a $189.5 million add-on to the existing Term

Loan B facility and available cash. The vessels are expected to

generate approximately $39.5 million annual EBITDA and $386.5

million aggregate EBITDA for the 10 years of the charter period.

EBITDA estimates assume expenses approximating operating cost

structure under the amended Management Agreement and 360 revenue

days per year.

Add-on to the Term Loan

B

In October 2013, Navios Partners announced the issuance of a

$189.5 million add-on to its existing Term Loan B facility. The

add-on to the Term Loan B bears an interest rate of LIBOR +425

basis points and has a five year term, with a 1% amortization

profile. Navios Partners intends to use the net proceeds to

partially finance the acquisition of the five container

vessels.

Acquisition of the

Navios Joy and the Navios Harmony

On September 11, 2013, Navios Partners acquired from an

unrelated third party the Navios Joy, a 181,389 dwt Japanese

newbuild Capesize vessel, for a cash purchase price of $47.0

million. The Navios Joy has been chartered out to an investment

grade counterparty for three years at a rate of $19,000 net per

day. The charterer has been granted an option to extend the charter

for two optional years, the first at $22,325 net per day and the

second at $25,650 net per day. The vessel is expected to generate

approximately $4.6 million annual EBITDA or $12.9 million aggregate

EBITDA for the three years of the initial charter period. EBITDA

estimates assume expenses approximating current operating costs and

360 revenue days per year.

On October 11, 2013, Navios Partners acquired from an unrelated

third party the Navios Harmony, an 82,790 dwt 2006 Japanese-built

Panamax vessel, for a cash purchase price of $17.8 million. The

Navios Harmony has been chartered out to a high quality

counterparty for four to six months at a rate of $14,725 net per

day.

Renewal of Management

Agreement Fees

Navios Partners renewed the fees under its existing Management

Agreement with Navios Shipmanagement Inc. (the "Manager"), a

subsidiary of Navios Maritime Holdings Inc. ("Navios Holdings"),

fixing the rate for shipmanagement services of its owned fleet

through December 31, 2015, excluding drydock and special survey

costs that will be paid lumpsum at occurrence. The new operating

costs including estimated daily drydock and special survey costs

are: (a) $4,750 daily rate per Ultra-Handymax vessel; (b) $4,800

daily rate per Panamax vessel; (c) $5,700 daily rate per Capesize

vessel; and (d) $7,500 daily rate per Container vessel.

Long-Term and Insured

Cash Flow

Navios Partners has entered into medium to long-term time

charter-out agreements for its vessels with a remaining average

term of 3.8 years, providing a stable base of revenue and

distributable cash flow. Navios Partners has currently contracted

out 99.7% of its available days for 2013, 60.5% for 2014 and 48.2%

for 2015, generating revenues of approximately $192.9 million,

$183.2 million and $158.6 million, respectively. The average

contractual daily charter-out rate for the fleet is $23,909,

$27,844 and $30,046 for 2013, 2014 and 2015, respectively. The

average daily charter-in rate for the charter-in vessels is $13,513

for 2013.

We have insured certain of our long-term charter-out contracts

of the drybulk vessels for credit default occurring until the end

of 2016, either through a "AA" rated European Union insurance

provider up to a maximum cash payment of $120.0 million initially

or through a separate agreement with Navios Holdings up to a

maximum cash payment of $20.0 million.

FINANCIAL HIGHLIGHTS

For the following results and the selected financial data

presented herein, Navios Partners has compiled consolidated

statements of income for the three and nine month periods ended

September 30, 2013 and 2012. The quarterly 2013 and 2012

information was derived from the unaudited condensed consolidated

financial statements for the respective periods. EBITDA and

Operating Surplus are non-GAAP financial measures and should not be

used in isolation or substitution for Navios Partners' results.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month |

|

|

Three Month |

|

|

Nine Month |

|

|

Nine Month |

|

|

|

|

Period ended |

|

|

Period ended |

|

|

Period ended |

|

|

Period ended |

|

|

(in $'000 except per |

|

September 30, 2013 |

|

|

September 30, 2012 |

|

|

September 30, 2013 |

|

|

September 30, 2012 |

|

|

unit data) |

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

Revenue |

|

$ |

46,578 |

|

|

$ |

55,540 |

|

|

$ |

146,013 |

|

|

$ |

152,649 |

|

| Net

income |

|

$ |

13,123 |

|

|

$ |

22,143 |

|

|

$ |

48,880 |

|

|

$ |

55,761 |

|

|

EBITDA |

|

$ |

35,642 |

|

|

$ |

43,030 |

|

|

$ |

117,742 |

|

|

$ |

116,192 |

|

|

Earnings per Common unit (basic and diluted) |

|

$ |

0.19 |

|

|

$ |

0.36 |

|

|

$ |

0.72 |

|

|

$ |

0.95 |

|

|

Operating Surplus |

|

$ |

28,187 |

|

|

$ |

35,642 |

|

|

$ |

99,410 |

|

|

$ |

94,729 |

|

|

Maintenance and Replacement Capital expenditure reserve |

|

$ |

(3,516 |

) |

|

$ |

(4,941 |

) |

|

$ |

(10,450 |

) |

|

$ |

(13,927 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three month periods

ended September 30, 2013 and 2012

Time charter and voyage revenues for the three month period

ended September 30, 2013 decreased by $9.0 million or 16.1% to

$46.5 million, as compared to $55.5 million for the same period in

2012. The decrease in time charter and voyage revenues was due

to the decrease in time charter equivalent ("TCE") to $23,202 for

the three month period ended September 30, 2013, from $29,341 for

the three month period ended September 30, 2012. The above decrease

was partially mitigated by the increase in time charter and

voyage revenues due to the acquisitions of the Navios Soleil

on July 24, 2012, the Navios Helios on July 27, 2012 and the Navios

Joy on September 11, 2013. As a result of the vessel acquisitions,

available days of the fleet increased to 1,952 days for the three

month period ended September 30, 2013, as compared to 1,882 days

for the three month period ended September 30, 2012.

EBITDA decreased by $7.4 million to $35.6 million for the three

month period ended September 30, 2013, as compared to $43.0 million

for the same period in 2012. The decrease in EBITDA was due to a

$9.0 million decrease in revenue, a $1.0 million increase in time

charter and voyage expenses due to increase in voyage expenses

incurred, a $0.3 million increase in management fees due to the

increased number of vessels and a $0.1 million increase in general

and administrative expenses. The above decrease was partially

mitigated by a $3.0 million increase in other income/expenses, net,

attributable to upfront payments from one of our charterers during

an interim suspension period.

The reserve for estimated maintenance and replacement capital

expenditures for the three month periods ended September 30, 2013

and 2012 was $3.5 million and $4.9 million, respectively (please

see Reconciliation of Non-GAAP Financial Measures in Exhibit

3).

Navios Partners generated an Operating Surplus for the three

month period ended September 30, 2013 of $28.2 million, as compared

to $35.6 million for the three month period ended September 30,

2012. Operating Surplus is a non-GAAP financial measure used by

certain investors to assist in evaluating a partnership's ability

to make quarterly cash distributions (please see Reconciliation of

Non-GAAP Financial Measures in Exhibit 3).

Net income for the three months ended September 30, 2013

amounted to $13.1 million compared to $22.1 million for the three

months ended September 30, 2012. The decrease in net income by $9.0

million was due to a $7.4 million decrease in EBITDA and a $1.9

million increase in interest expense and finance cost partially

offset by a $0.3 million decrease in depreciation and amortization

expense due to write-off of part of Navios Melodia favorable

lease.

Nine month periods

ended September 30, 2013 and 2012

Time charter and voyage revenues for the nine month period ended

September 30, 2013 decreased by $6.6 million or 4.3% to $146.0

million, as compared to $152.6 million for the same period in 2012.

The decrease in time charter and voyage revenues was due to

the decrease in time charter equivalent to $24,903 for the nine

month period ended September 30, 2013, from $29,513 for the nine

month period ended September 30, 2012. The above decrease was

partially mitigated by the increase in time charter and

voyage revenues due to the acquisitions of the Navios Soleil

on July 24, 2012, the Navios Helios on July 27, 2012 and the Navios

Joy on September 11, 2013. As a result of the vessel acquisitions,

available days of the fleet increased to 5,736 days for the nine

month period ended September 30, 2013, as compared to 5,088 days

for the nine month period ended September 30, 2012.

EBITDA increased by $1.5 million to $117.7 million for the nine

month period ended September 30, 2013, as compared to $116.2

million for the same period in 2012. The increase in EBITDA was due

to an increase of $13.0 million in other income due to upfront

payments covering hire revenues during an interim suspension

period, which was partially mitigated by a decrease of $6.6 million

in revenue, a $0.7 million increase in time charter and voyage

expenses due to increase in voyage expenses incurred, a $2.9

million increase in management fees due to the increased number of

vessels, a $0.6 million increase in general and administrative

expenses and a $0.7 million increase in other expenses.

The reserve for estimated maintenance and replacement capital

expenditures for the nine month periods ended September 30, 2013

and 2012 was $10.4 million and $13.9 million, respectively (please

see Reconciliation of Non-GAAP Financial Measures in Exhibit

3).

Navios Partners generated an Operating Surplus for the nine

month period ended September 30, 2013 of $99.4 million, as compared

to $94.7 million for the nine month period ended September 30,

2012. Operating Surplus is a non-GAAP financial measure used by

certain investors to assist in evaluating a partnership's ability

to make quarterly cash distributions (please see Reconciliation of

Non-GAAP Financial Measures in Exhibit 3).

Net income for the nine months ended September 30, 2013 amounted

to $48.9 million compared to $55.8 million for the nine months

ended September 30, 2012. The decrease in net income by $6.9

million was due to a $3.1 million increase in interest expense and

finance cost and a $5.3 million increase in depreciation and

amortization expense due to the acquisitions of the vessels and the

favorable lease terms recognized in relation to the Navios Buena

Ventura partially mitigated by a $1.5 million increase in

EBITDA.

Fleet Employment

Profile

The following table reflects certain key indicators of Navios

Partners' core fleet performance for the three and nine month

periods ended September 30, 2013 and 2012.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month |

|

|

Three Month |

|

|

Nine Month |

|

|

Nine Month |

|

|

|

Period ended |

|

|

Period ended |

|

|

Period ended |

|

|

Period ended |

|

|

|

September 30, 2013 |

|

|

September 30, 2012 |

|

|

September 30, 2013 |

|

|

September 30, 2012 |

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Available Days (1) |

|

1,952 |

|

|

|

1,882 |

|

|

|

5,736 |

|

|

|

5,088 |

|

|

Operating Days (2) |

|

1,950 |

|

|

|

1,870 |

|

|

|

5,729 |

|

|

|

5,072 |

|

| Fleet

Utilization (3) |

|

99.9 |

% |

|

|

99.4 |

% |

|

|

99.9 |

% |

|

|

99.7 |

% |

| Time

Charter Equivalent (per day) (4) |

$ |

23,202 |

|

|

$ |

29,341 |

|

|

$ |

24,903 |

|

|

$ |

29,513 |

|

|

Vessels operating at period end |

|

22 |

|

|

|

21 |

|

|

|

22 |

|

|

|

21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Available days for the fleet represent total

calendar days the vessels were in our possession for the relevant

period after subtracting off-hire days associated with scheduled

repairs, drydockings or special surveys. The shipping industry uses

available days to measure the number of days in a relevant period

during which a vessel is capable of generating revenues. |

|

|

|

|

(2) |

Operating days is the number of available

days in the relevant period less the aggregate number of days that

the vessels are off-hire due to any reason, including unforeseen

circumstances. The shipping industry uses operating days to measure

the aggregate number of days in a relevant period during which

vessels actually generate revenues. |

|

|

|

|

(3) |

Fleet

utilization is the percentage of time that our vessels were

available for revenue generating available days, and is determined

by dividing the number of operating days during a relevant period

by the number of available days during that period. The shipping

industry uses fleet utilization to measure efficiency in finding

employment for vessels and minimizing the amount of days that its

vessels are off-hire for reasons other than scheduled repairs,

drydockings or special surveys. |

|

|

|

|

(4) |

Time

Charters Equivalents ("TCE") rates are defined as voyage and time

charter revenues less voyage expenses during a period divided by

the number of available days during the period. The TCE rate is a

standard shipping industry performance measure used primarily to

present the actual daily earnings generated by vessels on various

types of charter contracts for the number of available days of the

fleet. |

|

|

|

Conference Call

details:

Navios Partners' management will host a conference call today,

Thursday, October 31, 2013 to discuss the results for the third

quarter ended September 30, 2013.

Conference Call details:

Call Date/Time: Thursday, October 31, 2013 at 08:30 am ET Call

Title: Navios Partners Q3 2013 Financial Results Conference Call US

Dial In: +1.866.394.0817 International Dial In: +1.706.679.9759

Conference ID: 6828 0489

The conference call replay will be available two hours after the

live call and remain available for one week at the following

numbers:

US Replay Dial In: +1.800.585.8367 International Replay Dial In:

+1.404.537.3406 Conference ID: 6828 0489

Slides and audio webcast: There will also be a live webcast of

the conference call, through the Navios Partners website

(www.navios-mlp.com) under "Investors". Participants to the live

webcast should register on the website approximately 10 minutes

prior to the start of the webcast.

A supplemental slide presentation will be available on the

Navios Partners' website under the "Investors" section by 8:00 am

ET on the day of the call.

About Navios Maritime Partners L.P.

Navios Partners (NYSE: NMM) is a publicly traded master limited

partnership which owns and operates dry cargo vessels. For more

information, please visit our website at www.navios-mlp.com

Forward-Looking Statements

This press release contains forward-looking statements (as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended)

concerning future events and Navios Partners' growth strategy and

measures to implement such strategy; including expected vessel

acquisitions and entering into further time charters. Words

such as "may", "expects", "intends", "plans", "believes",

"anticipates", "hopes", "estimates", and variations of such words

and similar expressions are intended to identify forward-looking

statements. Such statements include comments regarding

expected revenue and time charters. Although the Navios Partners

believes that the expectations reflected in such forward-looking

statements are reasonable, no assurance can be given that such

expectations will prove to have been correct. These statements

involve known and unknown risks and are based upon a number of

assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Partners. Actual results may

differ materially from those expressed or implied by such

forward-looking statements. Factors that could cause actual

results to differ materially include, but are not limited to

changes in the demand for dry bulk vessels, competitive factors in

the market in which Navios Partners operates; risks associated with

operations outside the United States; and other factors listed from

time to time in the Navios Partners' filings with the Securities

and Exchange Commission. Navios Partners expressly disclaims any

obligations or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in Navios Partners' expectations with respect

thereto or any change in events, conditions or circumstances on

which any statement is based.

| |

| |

| EXHIBIT 1 |

| NAVIOS MARITIME PARTNERS L.P. |

| CONDENSED CONSOLIDATED BALANCE SHEET |

| (Expressed in thousands of U.S. Dollars except unit

data) |

|

|

|

|

|

|

|

September 30, 2013 (unaudited) |

|

December 31, 2012 |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

| Cash

and cash equivalents |

$ |

145,824 |

|

$ |

32,132 |

|

Restricted cash, short-term portion |

|

1,017 |

|

|

29,529 |

|

Accounts receivable, net |

|

15,533 |

|

|

7,778 |

|

Prepaid expenses and other current assets |

|

260 |

|

|

594 |

| Total

current assets |

|

162,634 |

|

|

70,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vessels, net |

|

742,366 |

|

|

721,391 |

|

Deposits for vessels acquisitions |

|

8,954 |

|

|

-- |

|

Deferred financing costs, net |

|

4,910 |

|

|

2,767 |

| Other

long term assets |

|

184 |

|

|

282 |

|

Intangible assets |

|

128,727 |

|

|

160,479 |

|

Restricted cash, long-term portion |

|

51,178 |

|

|

-- |

| Total

non-current assets |

|

936,319 |

|

|

884,919 |

|

|

|

|

|

|

|

| Total

assets |

$ |

1,098,953 |

|

$ |

954,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND PARTNERS' CAPITAL |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

4,926 |

|

$ |

2,090 |

|

Accrued expenses |

|

3,122 |

|

|

3,599 |

|

Deferred voyage revenue |

|

1,729 |

|

|

9,112 |

|

Current portion of long-term debt |

|

2,971 |

|

|

23,727 |

|

Amounts due to related parties |

|

15,542 |

|

|

21,748 |

| Total

current liabilities |

|

28,290 |

|

|

60,276 |

|

|

|

|

|

|

|

|

Long-term debt, net of current portion and discount |

|

341,693 |

|

|

275,982 |

| Total

non-current liabilities |

|

341,693 |

|

|

275,982 |

|

|

|

|

|

|

|

| Total

liabilities |

$ |

369,983 |

|

$ |

336,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

-- |

|

|

-- |

|

Partners' capital: |

|

|

|

|

|

|

Common Unitholders (71,034,163 and 60,109,163 units issued and

outstanding at September 30, 2013 and December 31, 2012,

respectively) |

|

724,492 |

|

|

616,604 |

|

General Partner (1,449,681 and 1,226,721 units issued and

outstanding at September 30, 2013 and December 31, 2012,

respectively) |

|

4,478 |

|

|

2,090 |

| Total

partners' capital |

$ |

728,970 |

|

$ |

618,694 |

|

|

|

|

|

|

|

| Total

liabilities and partners' capital |

$ |

1,098,953 |

|

$ |

954,952 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NAVIOS MARITIME PARTNERS L.P. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

|

| (Expressed in thousands of U.S. Dollars except unit

and per unit amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month Period ended September 30, 2013

(unaudited) |

|

|

Three Month Period ended September 30, 2012

(unaudited) |

|

|

Nine Month Period ended September 30, 2013

(unaudited) |

|

|

Nine Month Period ended September 30, 2012

(unaudited) |

|

| Time

charter and voyage revenues (includes related party revenue of

$9,100 and $16,662 for the three and nine months ended

September 30, 2013, respectively, and $2,347 and $4,297 for the

three and nine months ended September 30 2012, respectively) |

$ |

46,578 |

|

|

$ |

55,540 |

|

|

$ |

146,013 |

|

|

$ |

152,649 |

|

| Time

charter and voyage expenses |

|

(3,787 |

) |

|

|

(2,772 |

) |

|

|

(10,557 |

) |

|

|

(9,935 |

) |

|

Management fees |

|

(8,788 |

) |

|

|

(8,452 |

) |

|

|

(25,865 |

) |

|

|

(23,009 |

) |

|

General and administrative expenses |

|

(1,395 |

) |

|

|

(1,322 |

) |

|

|

(4,452 |

) |

|

|

(3,874 |

) |

|

Depreciation and amortization |

|

(18,206 |

) |

|

|

(18,496 |

) |

|

|

(58,232 |

) |

|

|

(52,974 |

) |

|

Interest expense and finance cost, net |

|

(4,320 |

) |

|

|

(2,415 |

) |

|

|

(10,652 |

) |

|

|

(7,611 |

) |

|

Interest income |

|

7 |

|

|

|

24 |

|

|

|

22 |

|

|

|

179 |

|

| Other

income |

|

3,319 |

|

|

|

61 |

|

|

|

13,446 |

|

|

|

403 |

|

| Other

expense |

|

(285 |

) |

|

|

(25 |

) |

|

|

(843 |

) |

|

|

(67 |

) |

| Net

income |

$ |

13,123 |

|

|

$ |

22,143 |

|

|

$ |

48,880 |

|

|

$ |

55,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per unit:

|

|

|

|

|

|

|

|

|

|

|

Three Month Period ended September 30, 2013

(unaudited) |

|

Three Month Period ended September 30, 2012

(unaudited) |

|

Nine Month Period ended September 30, 2013

(unaudited) |

|

Nine Month Period ended September 30, 2012

(unaudited) |

| Net

income |

$ |

13,123 |

|

$ |

22,143 |

|

$ |

48,880 |

|

$ |

55,761 |

|

Earnings per unit: |

|

|

|

|

|

|

|

|

|

|

|

|

Common unit (basic and diluted) |

$ |

0.19 |

|

$ |

0.36 |

|

$ |

0.72 |

|

$ |

0.95 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NAVIOS MARITIME PARTNERS L.P. |

|

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

| (Expressed in thousands of U.S. Dollars) |

|

|

|

|

|

|

|

|

|

|

Nine Month Period Ended September 30, 2013

(unaudited) |

|

|

Nine Month Period Ended September 30, 2012

(unaudited) |

|

|

OPERATING ACTIVITIES |

|

|

|

|

|

|

|

| Net

income |

$ |

48,880 |

|

|

$ |

55,761 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

58,232 |

|

|

|

52,974 |

|

|

Amortization and write-off of deferred financing cost |

|

3,349 |

|

|

|

420 |

|

|

Amortization of deferred dry dock costs |

|

-- |

|

|

|

25 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Increase in restricted cash |

|

(2 |

) |

|

|

(1 |

) |

|

Increase in accounts receivable |

|

(7,755 |

) |

|

|

(3,391 |

) |

|

Decrease in prepaid expenses and other current assets |

|

334 |

|

|

|

1,448 |

|

|

Decrease/(increase) in other long term assets |

|

98 |

|

|

|

(244 |

) |

|

Increase/(decrease) in accounts payable |

|

2,836 |

|

|

|

(37 |

) |

|

(Decrease)/increase in accrued expenses |

|

(477 |

) |

|

|

190 |

|

|

Decrease in deferred voyage revenue |

|

(7,383 |

) |

|

|

(6,620 |

) |

|

(Decrease)/increase in amounts due to related parties |

|

(6,206 |

) |

|

|

14,932 |

|

| Net

cash provided by operating activities |

|

91,906 |

|

|

|

115,457 |

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Acquisition of vessels |

|

(47,455 |

) |

|

|

(88,505 |

) |

|

Deposits for acquisition of vessels |

|

(8,954 |

) |

|

|

-- |

|

|

Acquisition of intangibles |

|

-- |

|

|

|

(21,193 |

) |

|

Increase in restricted cash |

|

(51,178 |

) |

|

|

-- |

|

| Net

cash used in investing activities |

|

(107,587 |

) |

|

|

(109,698 |

) |

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

| Cash

distributions paid |

|

(89,808 |

) |

|

|

(79,315 |

) |

|

Proceeds from issuance of general partner units |

|

3,167 |

|

|

|

1,472 |

|

|

Proceeds from issuance of common units, net of offering costs |

|

148,037 |

|

|

|

68,563 |

|

|

Proceeds from long term debt, net of discount |

|

245,000 |

|

|

|

44,000 |

|

|

Decrease/(increase) in restricted cash |

|

28,514 |

|

|

|

(19,596 |

) |

|

Repayment of long-term debt and payment of principal |

|

(200,314 |

) |

|

|

(44,208 |

) |

| Debt

issuance costs |

|

(5,223 |

) |

|

|

(1,088 |

) |

| Net

cash provided by/(used in) financing activities |

|

129,373 |

|

|

|

(30,172 |

) |

|

Increase/(decrease) in cash and cash equivalents |

|

113,692 |

|

|

|

(24,413 |

) |

| Cash

and cash equivalents, beginning of period |

|

32,132 |

|

|

|

48,078 |

|

| Cash

and cash equivalents, end of period |

$ |

145,824 |

|

|

$ |

23,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EXHIBIT

2 |

| |

|

Owned Vessels |

|

Type |

|

Built |

|

Capacity (DWT) |

|

Charter Expiration Date |

|

Charter-Out Rate (1) |

|

|

Navios Apollon |

|

Ultra-Handymax |

|

2000 |

|

52,073 |

|

February 2014 |

|

$ |

13,500 |

(2) |

|

Navios Soleil |

|

Ultra-Handymax |

|

2009 |

|

57,337 |

|

December 2013 |

|

$ |

8,906 |

|

|

Navios La Paix(3) |

|

Ultra-Handymax |

|

2014 |

|

61,000 |

|

-- |

|

|

-- |

|

|

Navios Gemini S |

|

Panamax |

|

1994 |

|

68,636 |

|

February 2014 |

|

$ |

24,225 |

|

|

Navios Libra II |

|

Panamax |

|

1995 |

|

70,136 |

|

September 2015 |

|

$ |

12,000 |

(2) |

|

Navios Felicity |

|

Panamax |

|

1997 |

|

73,867 |

|

May 2014 |

|

$ |

12,000 |

(4) |

|

Navios Galaxy I |

|

Panamax |

|

2001 |

|

74,195 |

|

February 2018 |

|

$ |

21,937 |

|

|

Navios Helios |

|

Panamax |

|

2005 |

|

77,075 |

|

December 2013 |

|

$ |

7,838 |

|

|

Navios Hyperion |

|

Panamax |

|

2004 |

|

75,707 |

|

April 2014 |

|

$ |

37,953 |

|

|

Navios Alegria |

|

Panamax |

|

2004 |

|

76,466 |

|

February 2014 |

|

$ |

16,984 |

(5) |

|

Navios Orbiter |

|

Panamax |

|

2004 |

|

76,602 |

|

April 2014 |

|

$ |

38,052 |

|

|

Navios Hope |

|

Panamax |

|

2005 |

|

75,397 |

|

July 2014 |

|

$ |

10,000 |

|

|

Navios Sagittarius |

|

Panamax |

|

2006 |

|

75,756 |

|

November 2018 |

|

$ |

26,125 |

|

|

Navios Harmony |

|

Panamax |

|

2006 |

|

82,790 |

|

March 2014 |

|

$ |

14,725 |

|

|

Navios Sun(3) |

|

Panamax |

|

2005 |

|

76,619 |

|

-- |

|

|

-- |

|

|

Navios Fantastiks |

|

Capesize |

|

2005 |

|

180,265 |

|

March 2014 |

|

$ |

14,678 |

|

|

Navios Aurora II |

|

Capesize |

|

2009 |

|

169,031 |

|

November 2019 |

|

$ |

41,325 |

|

|

Navios Pollux |

|

Capesize |

|

2009 |

|

180,727 |

|

April 2019 |

|

$ |

40,888 |

|

|

Navios Fulvia |

|

Capesize |

|

2010 |

|

179,263 |

|

September 2015 |

|

$ |

50,588 |

|

|

Navios Melodia(6) |

|

Capesize |

|

2010 |

|

179,132 |

|

September 2022 |

|

$ |

29,356 |

(7) |

|

Navios Luz |

|

Capesize |

|

2010 |

|

179,144 |

|

November 2020 |

|

$ |

29,356 |

(8) |

|

Navios Buena Ventura |

|

Capesize |

|

2010 |

|

179,259 |

|

October 2020 |

|

$ |

29,356 |

(8) |

|

Navios Joy |

|

Capesize |

|

2013 |

|

181,389 |

|

June 2016 |

|

|

19,000 |

(9) |

| Chartered-in Vessels |

|

|

|

|

|

|

|

|

|

|

|

|

| Navios Prosperity (10) |

|

Panamax |

|

2007 |

|

82,535 |

|

May 2014 |

|

$ |

12,000 |

(4) |

| Navios Aldebaran (11) |

|

Panamax |

|

2008 |

|

76,500 |

|

June 2014 |

|

$ |

11,000 |

(12) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Container Vessels |

|

Type |

|

Built |

|

TEU |

|

Charter Expiration Date |

|

Charter-Out Rate (1) |

|

Navios TBN 1(13) |

|

Container |

|

2006 |

|

6,800 |

|

November 2023 |

|

$ |

30,150 |

|

Navios TBN 2(13) |

|

Container |

|

2006 |

|

6,800 |

|

November 2023 |

|

$ |

30,150 |

|

Navios TBN 3(13) |

|

Container |

|

2006 |

|

6,800 |

|

November 2023 |

|

$ |

30,150 |

|

Navios TBN 4(13) |

|

Container |

|

2006 |

|

6,800 |

|

November 2023 |

|

$ |

30,150 |

|

Navios TBN 5(13) |

|

Container |

|

2006 |

|

6,800 |

|

November 2023 |

|

$ |

30,150 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Daily charter-out rate, net of commissions or net insurance

or settlement proceeds, where applicable.

(2) Profit sharing 50% on the actual results above the period

rates.

(3) Expected to be delivered in the first quarter of 2014.

(4) Profit sharing: The owners will receive 100% of the first

$1,500 in profits above the base rate and thereafter all profits

will be split 50% to each party.

(5) Profit sharing 50% above $16,984/ day based on Baltic

Exchange Panamax TC Average.

(6) In January 2011, Korea Line Corporation ("KLC") filed for

receivership. The charter was affirmed and will be performed

by KLC on its original terms, following an interim suspension

period during which Navios Partners trades the vessel directly.

(7) Profit sharing 50% above $37,500/ day based on Baltic

Exchange Capesize TC Average.

(8) Profit sharing 50% above $38,500/ day based on Baltic

Exchange Capesize TC Average.

(9) The charterer has been granted an option to extend the

charter for two optional years, the first at $22,325 (net) per day

and the second at $25,650 (net) per day.

(10) The Navios Prosperity is chartered-in for seven years until

June 2014 and we have options to extend for two one-year periods.

We have the option to purchase the vessel after June 2012 at a

purchase price that is initially 3.8 billion Yen declining each

year by 145 million Yen.

(11) The Navios Aldebaran is chartered-in for seven years until

March 2015 and we have options to extend for two one-year periods.

We have the option to purchase the vessel after March 2013 at a

purchase price that is initially 3.6 billion Yen declining each

year by 150 million Yen.

(12) Profit sharing: The owners will receive 100% of the first

$2,500 in profits above the base rate and thereafter all profits

will be split 50% to each party.

(13) Expected to be delivered in the fourth quarter of 2013. The

vessels are fixed on ten year charters with Navios Partners' option

to terminate after year 7.

| |

|

EXHIBIT 3 |

| Disclosure of Non-GAAP Financial

Measures |

| |

1. EBITDA

EBITDA represents net income plus interest and finance costs

plus depreciation and amortization and income taxes.

EBITDA is presented because Navios Partners believes that EBITDA

is a basis upon which liquidity can be assessed and present useful

information to investors regarding Navios Partners' ability to

service and/or incur indebtedness, pay capital expenditures, meet

working capital requirements and pay dividends. EBITDA is a

"non-GAAP financial measure" and should not be considered a

substitute for net income, cash flow from operating activities and

other operations or cash flow statement data prepared in accordance

with accounting principles generally accepted in the United States

or as a measure of profitability or liquidity.

While EBITDA is frequently used as a measure of operating

results and the ability to meet debt service requirements, the

definition of EBITDA used here may not be comparable to that used

by other companies due to differences in methods of

calculation.

2. Operating Surplus

Operating Surplus represents net income adjusted for

depreciation and amortization expense, non-cash interest expense

and estimated maintenance and replacement capital expenditures.

Maintenance and replacement capital expenditures are those capital

expenditures required to maintain over the long term the operating

capacity of, or the revenue generated by, Navios Partners' capital

assets.

Operating Surplus is a quantitative measure used in the

publicly-traded partnership investment community to assist in

evaluating a partnership's ability to make quarterly cash

distributions. Operating Surplus is not required by accounting

principles generally accepted in the United States and should not

be considered a substitute for net income, cash flow from operating

activities and other operations or cash flow statement data

prepared in accordance with accounting principles generally

accepted in the United States or as a measure of profitability or

liquidity.

3. Available Cash

Available Cash generally means for each fiscal quarter, all cash

on hand at the end of the quarter:

- less the amount of cash reserves established by the Board of

Directors to:

- provide for the proper conduct of Navios Partners' business

(including reserve for maintenance and replacement capital

expenditures);

- comply with applicable law, any of Navios Partners' debt

instruments, or other agreements; or

- provide funds for distributions to the unitholders and to the

general partner for any one or more of the next four quarters;

- plus all cash on hand on the date of determination of available

cash for the quarter resulting from working capital borrowings made

after the end of the quarter. Working capital borrowings are

generally borrowings that are made under any revolving credit or

similar agreement used solely for working capital purposes or to

pay distributions to partners.

Available Cash is a quantitative measure used in the

publicly-traded partnership investment community to assist in

evaluating a partnership's ability to make quarterly cash

distributions. Available cash is not required by accounting

principles generally accepted in the United States and should not

be considered a substitute for net income, cash flow from operating

activities and other operations or cash flow statement data

prepared in accordance with accounting principles generally

accepted in the United States or as a measure of profitability or

liquidity.

4. Reconciliation of Non-GAAP Financial Measures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month Period ended September 30, 2013 ($ '000)

(unaudited) |

|

|

Three Month Period ended September 30, 2012 ($ '000)

(unaudited) |

|

|

Nine Month Period ended September 30, 2013 ($ '000)

(unaudited) |

|

|

Nine Month Period ended September 30, 2012 ($ '000)

(unaudited) |

|

| Net

cash provided by operating activities |

|

$ |

40,760 |

|

|

$ |

42,960 |

|

|

$ |

91,906 |

|

|

$ |

115, 457 |

|

| Net

(increase)/decrease in operating assets |

|

|

(7,337 |

) |

|

|

3,993 |

|

|

|

7,325 |

|

|

|

2,188 |

|

| Net

(decrease)/increase in operating liabilities |

|

|

(1,533 |

) |

|

|

(6,166 |

) |

|

|

11,230 |

|

|

|

(8,465 |

) |

| Net

interest cost |

|

|

4,313 |

|

|

|

2,391 |

|

|

|

10,630 |

|

|

|

7,432 |

|

|

Amortization and write-off of deferred financing costs |

|

|

(561 |

) |

|

|

(148 |

) |

|

|

(3,349 |

) |

|

|

(420 |

) |

|

EBITDA(1) |

|

$ |

35,642 |

|

|

$ |

43,030 |

|

|

$ |

117,742 |

|

|

$ |

116,192 |

|

| Cash

interest income |

|

|

9 |

|

|

|

8 |

|

|

|

25 |

|

|

|

196 |

|

| Cash

interest paid |

|

|

(3,948 |

) |

|

|

(2,455 |

) |

|

|

(7,907 |

) |

|

|

(7,732 |

) |

|

Maintenance and replacement capital expenditures |

|

|

(3,516 |

) |

|

|

(4,941 |

) |

|

|

(10,450 |

) |

|

|

(13,927 |

) |

|

Operating Surplus |

|

$ |

28,187 |

|

|

$ |

35,642 |

|

|

$ |

99,410 |

|

|

$ |

94,729 |

|

| Cash

distribution paid relating to the first half |

|

|

-- |

|

|

|

-- |

|

|

|

(59,872 |

) |

|

|

(54,486 |

) |

| Cash

reserves |

|

|

4,386 |

|

|

|

(8,079 |

) |

|

|

(6,965 |

) |

|

|

(12,680 |

) |

|

Available cash for distribution |

|

$ |

32,573 |

|

|

$ |

27,563 |

|

|

$ |

32,573 |

|

|

$ |

27,563 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Month Period ended September 30, 2013 ($ '000)

(unaudited) |

|

|

Three Month Period ended September 30, 2012 ($ '000)

(unaudited) |

|

|

Nine Month Period ended September 30, 2013 ($ '000)

(unaudited) |

|

|

Nine Month Period ended September 30, 2012 ($ '000)

(unaudited) |

|

| Net

cash provided by operating activities |

|

$ |

40,760 |

|

|

$ |

42,960 |

|

|

$ |

91,906 |

|

|

$ |

115, 457 |

|

| Net

cash used in investing activities |

|

$ |

(6,047 |

) |

|

$ |

(50,197 |

) |

|

$ |

(107,587 |

) |

|

$ |

(109,698 |

) |

| Net

cash provided by/(used in) financing activities |

|

$ |

48,762 |

|

|

$ |

(10,159 |

) |

|

$ |

129,373 |

|

|

$ |

(30,172 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contacts Investor Relations Contact: Navios Maritime Partners

L.P. +1 (212) 906 8645 Investors@navios-mlp.com Nicolas Bornozis

Capital Link, Inc. naviospartners@capitallink.com

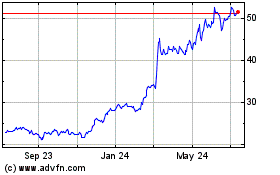

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Jun 2024 to Jul 2024

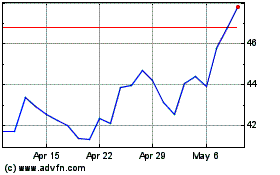

Navios Maritime Partners (NYSE:NMM)

Historical Stock Chart

From Jul 2023 to Jul 2024