Merck Raises 2019 Revenue, Adjusted Earnings Guidance

October 29 2019 - 8:02AM

Dow Jones News

By Dave Sebastian

Merck & Co. (MRK) raised its full-year outlook for revenue

and adjusted earnings.

The company now sees full-year revenue of $46.5 billion to $47

billion. It previously guided revenue of $45.2 billion to $46.2

billion. Analysts polled by FactSet are expecting $45.94

billion.

The guidance includes the impact of the Gardasil 9 human

papillomavirus infection vaccine stockpile borrowing from the

Centers for Disease and Control and Prevention, which is expected

to reduce Gardasil 9 sales in the fourth quarter by about $120

million, Merck said.

Merck cut its per-share earnings to between $3.75 and $3.80 from

between $3.78 and $3.88.

The company now expects adjusted per-share earnings to be

between $5.12 and $5.17, compared with its prior guidance of $4.84

to $4.94. Analysts are expecting $4.92 a share.

Merck also narrowed its guidance for its full-year effective tax

rate to about 16.5%, compared with its previously guided range of

16% to 17%. It narrowed its non-GAAP effective tax rate to about

17.5% from it previous guidance of 16.5% to 17.5%.

Merck reaffirmed its guidance for operating expenses to be

higher than 2018 by a low single digit rate.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

October 29, 2019 07:47 ET (11:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

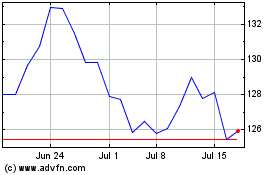

Merck (NYSE:MRK)

Historical Stock Chart

From Aug 2024 to Sep 2024

Merck (NYSE:MRK)

Historical Stock Chart

From Sep 2023 to Sep 2024