Mastercard Forecasts Slower Revenue, Expense Growth in 2020 -- Update

January 29 2020 - 2:10PM

Dow Jones News

By Allison Prang

Mastercard Inc. is expecting its adjusted revenue and operating

expenses to both rise at a slower pace in 2020.

The company affirmed it is expecting adjusted revenue in 2020 to

climb by a percentage in the low teens and said also it expects for

adjusted operating expenses to climb by a high single-digit

percentage. In 2019, adjusted revenue rose 16%, while adjusted

operating expenses rose 12%.

Mastercard's adjusted metrics adjust for items including

currency changes.

Mastercard's revenue guidance is on par with the three-year

guidance the company gave a year ago, calling for compound annual

revenue growth in a low-teens percentage from 2019 through

2021.

In the fourth-quarter, net income at the company jumped to $2.1

billion, or $2.07 a share. Profit more than doubled from a year ago

when Mastercard logged more than $750 million in litigation

charges. Adjusted earnings were $1.96 a share, up from $1.55 a

share.

Analysts had estimated earnings of $1.87 a share, according to

FactSet.

Mastercard also recorded a net gain on its equity investments of

$119 million in the fourth quarter.

Net revenue at the company was $4.41 billion, up 16%. Analysts

were expecting $4.4 billion.

The volume of Mastercard's card transactions was $1.73 trillion,

up 11%.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 29, 2020 13:55 ET (18:55 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

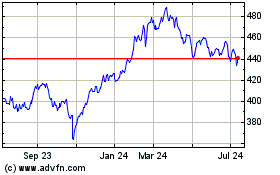

MasterCard (NYSE:MA)

Historical Stock Chart

From Aug 2024 to Sep 2024

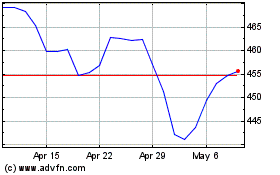

MasterCard (NYSE:MA)

Historical Stock Chart

From Sep 2023 to Sep 2024