UPDATE: Nvidia's 1Q Profits Fall, But Tegra Chip Sales Rise

May 12 2011 - 6:00PM

Dow Jones News

Nvidia Corp. (NVDA) fiscal first-quarter profit slid 1.7% on

lower revenue, but results and second-quarter guidance were better

than expected on solid results at the semiconductor company's core

graphics business and emerging mobile business.

The Santa Clara, Calif.-based maker of graphics chips used for

video games and other visually intensive applications has benefited

of late from its strong position in smartphones and tablets. Its

Tegra applications processor has netted many key design wins,

including the Xoom tablet from Motorola Mobility Holdings Inc.

(MMI), and has helped offset sluggish PC sales.

"This quarter, our Tegra mobile business took off," President

and Chief Executive Jen-Hsun Huang said.

The company has said revenue from Tegra could total $400 million

to $600 million this year, pegging the first quarter level at

"easily over" $100 million. Nvidia on Thursday said its consumer

products business, which includes Tegra and embedded products,

posted revenue of $122.6 million in the quarter, up 78%

sequentially.

"The real question is going to be what the guide is for Tegra in

the next quarter," Needham analyst Rajvindra Gill said. "What we

might have seen was companies building orders [in the first period]

and drawing down inventory in the next quarter as they see what

sell-through is. If this run rate is [over $100 million] and

ramping, that's pretty good."

Nvidia shares, up 40% over the past 12 months through Thursday's

close, slipped 1% to $20.30 in after-hours trading.

Over the past year, the stock has outperformed the 19% rise in

the Philadelphia Semiconductor Index, due to Nvidia's perceived

turnaround. After several quarters of product delays and other

struggles, Nvidia in 2010 posted revenue growth for the first time

in a couple years and it has positioned itself as a leader in the

mobile market.

To strengthen its foothold in that industry, Nvidia on Monday

said it agreed to buy wireless chip maker Icera for $367 million in

cash. The acquisition, expected to close by the beginning of June,

will allow the company to eventually integrate its applications

processor with a modem on the same piece of silicon, appealing to

lower-end smartphones. Nvidia expects the deal to slightly trim its

operating profit through the first half of the 2012 calendar year

and add to it in the second half of next year.

The company also has set its sights on the mainstream computing

market, saying earlier this year that it's developing a chip that

makes it a direct challenger to Intel Corp. (INTC) and Advanced

Micro Devices Inc. (AMD).

For the quarter ended May 1, Nvidia reported a profit of $135.2

million, or 22 cents a share, down from $137.6 million, or 23 cents

a share, a year earlier. Excluding stock-based compensation and

other impacts, adjusted per-share earnings fell to 27 cents from 29

cents. Analysts polled by Thomson Reuters expected a profit of 19

cents a share.

Revenue declined 4% to $962 million. In February, the company

projected revenue would rise 6% to 8% from the fourth quarter,

placing the range at about $939.6 million to $957.3 million.

Results benefited from one month of revenue from a patent

cross-license agreement with Intel. Intel agreed to pay Nvidia $1.5

billion over five years under a deal that also ended litigation

between the companies.

Gross margin widened to 50.4% from 45.6%.

Looking ahead, the company forecast current-quarter revenue

would rise 4% to 6% sequentially to $1 billion to $1.02 billion,

excluding the Icera deal. Analysts expected a 3.1% increase to $992

million.

-By Shara Tibken, Dow Jones Newswires; 212-416-2189;

shara.tibken@dowjones.com

(John Kell contributed to this report.)

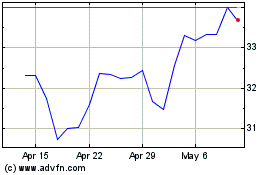

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From May 2024 to Jun 2024

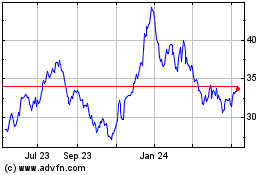

Marcus and Millichap (NYSE:MMI)

Historical Stock Chart

From Jun 2023 to Jun 2024