Form PX14A6G - Notice of exempt solicitation submitted by non-management

September 18 2023 - 5:07PM

Edgar (US Regulatory)

U.S. Securities and

Exchange Commission

Washington, DC 20549

Notice of Exempt Solicitation

Submitted Pursuant

to Rule 14a-6(g)

1. Name of the Registrant: Magellan

Midstream Partners, L.P.

2. Name of person relying on exemption: Energy

Income Partners, LLC.

3. Address of person relying on exemption:

10 Wright Street, Westport, Connecticut 06880.

4. Written materials are submitted

pursuant to Rule 14a-6(g)(1):

Attachment 1: Text of LinkedIn post from Energy Income Partners, LLC:

The proxy advisory firm ISS released its recommendation on the Magellan

transaction with ONEOK. EIP worked with ISS in its assessment process. The engagement resulted is a qualified recommendation

for the merger “with caution.”

ISS notes that:

·

“certain unitholders may prefer to continue holding MMP on a standalone basis given their tax considerations and investment preferences.”

·

“The board's decision to forgo an auction process is a cause for concern, since investors lack market-based evidence that the deal

presented in fact represents the best value alternative.”

·

They highlight the tax benefit to ONEOK as the biggest strategic rationale - “most clear and significant financial benefit for

OKE is expected from the tax basis step-up.” This ONEOK tax benefit is a direct transfer paid by Magellan unitholders.

ISS reasons that Magellan received a fair offer at 12.9x P/E(1). As

an investor with 20 years experience, we see no reason why Magellan should trade at such a deep discount to the 20x market multiple of

the S&P because Magellan has higher growth, higher ROIC, more stable earnings and a 6.3% yield(2).

We encourage other top 20 institutional investors like SS&C

ALPS, Janus Henderson Investors, Blackstone, Tortoise Capital Advisors, Mirae Asset Global Investments,

ClearBridge Investments, and Chickasaw Capital Management, LLC to vote against the merger because this deal

offers a negative after tax premium and has weak strategic rationale based on shaky long-range assumptions about future petroleum product

demand and its impact on per share earnings growth. EIP has done extensive work on the financial implications of the proposed merger

which is available on votemmp.com for others to use as they see fit.

#ACTIVEMANAGEMENT #ENERGYINVESTING #ENGAGED #MMP

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card. EIP is not able to vote your proxies.

(1) Source: ISS – Magellan Midstream Partners, L.P. September

7, 2023

(2) Source: Bloomberg as of September 11, 2023 https://lnkd.in/eZ_mxdXr

EIP Response: ISS Recommends Magellan Midstream

Holders Vote 'For' with CAUTION.

prnewswire.com

Disclosures:

This is not a solicitation of authority to vote your

proxy. Please DO NOT send us your proxy card. Energy Income Partners, LLC is not able to vote your proxies, nor does this communication

contemplate such an event. The proponent urges shareholders to vote against the proposed merger or not vote which will have the same

effect as voting no.

The views expressed are those of Energy Income Partners, LLC as

of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be

a forecast of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information

provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be

assumed that investments in such securities have been or will be profitable. This piece is for informational purposes and should not

be construed as a research report.

Energy Income Partners, LLC conducted its own analysis

based upon information available to it at the time of the analysis which may change at any time without notice and does not make any

warranty as to the accuracy or completeness of any analysis, data point, assumption or opinion presented herein.

Distribution of this letter, regardless of the means

or format of its delivery, does not constitute the provision of tax advice by EIP, nor should any general analysis piece be relied upon

for the formulation of any targeted tax strategy. For more information regarding specific personal or corporate tax matters, including,

but not limited to, personal tax implications relating to specific portfolio transactions, please consult a qualified tax professional.

CONTACT: Investor Relations, 203-349-8232 or ir@eipinvestments.com

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From Apr 2024 to May 2024

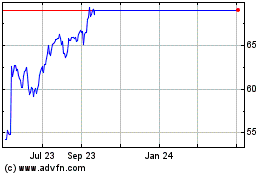

Magellan Midstream Partn... (NYSE:MMP)

Historical Stock Chart

From May 2023 to May 2024