false000139603300013960332023-07-062023-07-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 06, 2023 |

LL Flooring Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-33767 |

27-1310817 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4901 Bakers Mill Lane |

|

Richmond, Virginia |

|

23230 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 804 463-2000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

LL |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 6, 2023, LL Flooring Holdings, Inc. (the “Company”) announced that the Board of Directors appointed Robert L. Madore, Jr., age 58, as the Company’s Executive Vice President and Chief Financial Officer. Mr. Madore’s employment with the Company is expected to begin on or about July 10, 2023.

Prior to his appointment, Mr. Madore most recently served as Interim Chief Financial Officer of F45 Training Holdings, Inc. (NYSE: FXLV), a global fitness franchisor, since February 15, 2023. Prior to joining F45, Madore was the Chief Financial Officer of Cronos Group (NASDAQ: CRON) from 2021 - 2022 and EVP and Chief Financial Officer of American Eagle Outfitters, Inc. (NYSE: AEO) from 2016-2020. From 2004 until 2016, Mr. Madore was with Ralph Lauren Corporation (NYSE: RL), as Chief Financial Officer from 2015-2016, SVP Corporate Finance from 2011-2014, and Chief Financial Officer/SVP of Operations of Ralph Lauren Retail Group from 2004 - 2011. Mr. Madore is a Certified Public Accountant.

Mr. Madore was appointed pursuant to the terms of an offer letter, dated June 9, 2023 (the “Offer Letter Agreement”). In connection with Mr. Madore’s appointment as Chief Financial Officer, Mr. Madore will receive an annual base salary of $650,000, a sign-on cash bonus of $150,000, and a one-time cash bonus of $75,000 net of taxes to support initial commuting expenses. Mr. Madore will be eligible to participate in the annual bonus plan for executive management, with a target payout of 80% of his annual base salary, with any bonus for 2023 pro-rated from his date of hire. Subject to the approval of the Compensation Committee, it is expected that Mr. Madore will receive inducement equity awards comprised of (i) a time-based restricted stock award with a grant date fair value of $425,000 vesting ratably over three years and (ii) a performance-based restricted stock unit award with a three-year performance period based on TSR performance, a three-year cliff vesting, and a grant date value of $175,000. These awards will be granted without shareholder approval and outside of the Company’s 2023 Equity Compensation Plan (the “2023 Plan”) as “employment inducement awards” under the NYSE Listed Company Manual Rule 303A.08, but will generally be subject to the same terms and conditions as apply to awards granted under the 2023 Plan. With respect to the restricted stock award, (i) if as part of a Change in Control of the Company (as defined in the 2023 Plan) or during the two (2) year period following a Change in Control of the Company, Mr. Madore’s employment with the Company is terminated by him for “good reason” or is terminated by the Company without “Cause” or (ii) if Mr. Madore’s employment is terminated as a result of death or disability, the restricted stock award will become 100% vested. With respect to the performance-based restricted stock unit award, upon a Change in Control before the end of the performance period, the target number of performance-based restricted stock units shall become eligible to vest and become payable (i) to the extent such award is not assumed or substituted upon such Change in Control and Mr. Madore remains employed through such Change in Control, upon such Change of Control and (ii) to the extent such award is assumed or substituted and Mr. Madore remains employed through the applicable date, the end of such performance period or, if earlier, the date on which Mr. Madore’s employment with the Company is terminated by him for “good reason” or is terminated by the Company without “cause”. In the event Mr. Madore’s employment is terminated as a result of death or disability prior to the end of the performance period, he will be eligible to vest into a pro-rated number of performance-based restricted stock units based on actual performance over the performance period; provided if such termination occurs following a Change in Control (and such awards were assumed or substituted) such pro-ration shall be applied to the target number of performance-based restricted stock units. The foregoing description of the Offer Letter Agreement is qualified in its entirety by reference to the full text of the Offer Letter Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

In addition, the Company and Mr. Madore entered into a severance agreement. The terms of the severance agreement are substantially the same as the terms of the Form of Severance Agreement for Executive Officers (other than CEO) filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K, filed on December 30, 2022 and described in Item 5.02 of that Form 8-K.

The Company also announced on July 6, 2023 that Terry Blanchard will step down as Interim Chief Financial Officer when Mr. Madore’s employment commences. A copy of the press release containing these announcements is attached hereto as Exhibit 99.1 and is incorporated by reference into item 5.02 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LL FLOORING HOLDINGS, INC. |

|

|

|

|

Date: |

July 6, 2023 |

By: |

/s/ Alice G. Givens |

|

|

|

Chief Legal, Ethics and Compliance Officer and Corporate Secretary |

Exhibit 10.1

|

|

|

4901 Bakers Mill Lane, Richmond, VA 23230 www.llflooring.com |

|

June 5, 2023

VIA EMAIL

Mr. Robert Madore

Re: Offer Letter

Dear Robert,

This letter confirms our offer of employment to you with LL Flooring Holdings, Inc. or one of its subsidiaries (individually and collectively, as applicable, or “LL Flooring” or the “Company”). The details of our offer are as follows:

•Title: Executive Vice President, Chief Financial Officer

•Location: Richmond, Virginia (A minimum of three weeks per month is required in Richmond, Virginia exclusive of Paid Time Off weeks and Company recognized holidays)

•Reports to: Charles Tyson, President and CEO

•Start Date: July 10, 2023

•Annual Base Salary: $650,000. LL Flooring currently processes payroll on a weekly basis. This is subject to change. We strongly encourage associates to receive their pay via direct deposit.

•Incentive Plan: You will be eligible to participate in the Annual Bonus Plan for Executive Management (the “Bonus Plan”). Your 100% target payout under the Bonus Plan will be equal to 80% of your annual base salary, with the opportunity to earn a maximum of 200% of your target payout based on LL Flooring’s performance against certain financial objectives. For 2023, any earned bonus payout will be pro-rated for your date of hire in 2023. Notwithstanding the foregoing, the awarding (or decision not to award) a payment under the Bonus Plan and the amount thereof, is a decision left to the sole discretion of the Compensation Committee of the Company’s Board of Directors (the “Compensation Committee”). Further, the Bonus Plan is subject to amendment, modification and/or termination by the Compensation Committee in its sole and absolute discretion. To the extent there is any conflict between this Offer Letter and the language of the Bonus Plan, the Bonus Plan shall control.

•Inducement Equity Awards: As a material inducement for you to accept this offer, LL Flooring will recommend to the Compensation Committee that you receive inducement equity awards with a total cumulative grant date value of $600,000. The Company will recommend the inducement awards be comprised of (i) a time-based restricted stock award with a grant date value of $425,000, $250,000 of which is to compensate you for incentive awards that were forfeited at your previous employer as a result of your resignation and (ii) a performance-based restricted stock unit award with time-based vesting and a grant date value of $175,000. The time-based restricted stock award would vest ratably over three years. Subject to meeting the applicable performance targets set forth in the Company’s grant agreement, 100% of the performance-based restricted stock unit award would cliff vest on the three-year anniversary of the grant date. The actual amount of performance-based restricted stock units earned will range from 0 to 200% of the target award, depending on the Company’s actual performance against the performance targets. If approved by the Compensation Committee, such inducement equity awards will be evidenced by, and subject to the terms and conditions of, a grant agreement. The agreement will specify, among other things, the vesting schedule, consequences of termination of employment and other applicable terms and conditions. The timing of such award to you is subject to your actual start date of employment and to the absolute discretion of the

1

Compensation Committee. You may be eligible for future annual equity awards based on an assessment of your job performance and recommendation made by the CEO. All awards require approval at the absolute discretion of the Compensation Committee. As an associate, you will be subject to the expectations and restrictions of LL Flooring’s Insider Trading Policy, a copy of which is provided at the time of hire and is available upon request to Human Resources.

•Sign-On Cash Incentives: The Company will pay you a sign-on cash Bonus totaling $150,000, less standard deductions, to compensate you for a FY 2023 Annual Bonus that was forfeited at your previous employer as a result of your resignation. Additionally, the Company will provide you with a “one time” $75,000 net cash Bonus to support your commute from New York to Richmond weekly. These cash Bonuses are payable within 30 days of your hire date, subject to repayment if you voluntarily resign or your employment is terminated for cause prior to the second anniversary of your hire date and will be prorated.

•Director and Officer Stock Ownership Guidelines: In order to align the financial interests of executives with those of the Company’s stockholders and to further promote the Company’s commitment to sound corporate governance, you will be subject to the Company’s Stock Ownership Guidelines. Directors and Executive Officers subject to the Stock Ownership Guidelines are expected to meet the applicable guideline no more than five (5) years after first becoming subject to them and are expected to continuously own sufficient shares to meet the applicable guideline once attained. Stock that may be considered in determining compliance with the Stock Ownership Guidelines includes:

i.Shares owned directly by the participant or indirectly by the participant through (a) his or her immediate family members (as defined in the Stock Ownership Guidelines) residing in the same household or (b) trusts for the benefit of the participant or his or her immediate family members;

ii.Vested shares of restricted stock held by the participant

The Compensation Committee shall be responsible for monitoring the application of the Stock Ownership Guidelines and has sole discretion to alter or change these requirements at any time.

•Severance Benefit: In consideration of your continued employment with the Company and its subsidiaries, LL Flooring will enter into the Company’s form of Severance Agreement with you in order to ameliorate the financial and career impact on you should your employment with the Company be terminated under certain circumstances.

•Performance Review and Merit Increase: Your performance will be reviewed periodically with you by your supervisor, but no less than annually. Merit increases are discretionary based on performance and business considerations.

•Benefits Eligibility: You will be eligible to participate in benefit plans offered through LL Flooring per the terms and conditions of those plans. During your orientation, you will be given more information regarding these plans and a copy of our current benefits summary if you did not previously receive one. Following your first day of employment, you will also be able to access the full Benefits Guide on our Company intranet.

•Paid Time Off (PTO): Per the terms and conditions of the LL Flooring Paid Time Off (“PTO”) Policy, you will be eligible to accrue up to a maximum of 200 hours of PTO annually and thereafter. Your 2023 accrual will be pro-rated based on your actual date of hire. Additionally, LL Flooring observes six scheduled holidays each year. Those holidays currently are New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day. The holiday schedule is established in advance of each year and is subject to change.

This offer of employment is contingent on (1) satisfactory completion of all pre-hire assessments and evaluations, (2) satisfactory results of a drug screening test, (3) executive background verification, (4) your executing the Company’s Confidentiality, Non-Solicitation and Non-Competition Agreement, and (5) your ability to show that you are eligible to work in the United States.

On your first day of employment, you will be required to provide proof of identity and employment eligibility in order to complete an Employment Eligibility Verification (I-9) form. A list of acceptable documents is enclosed. Please note that, if you do not have one document from List A, you must bring one document from List B and one document from List C.

2

Please acknowledge your acceptance of this offer by signing and returning a copy of this letter no later than the close of business on June 9, 2023 to me via email to: margano@llflooring.com.

By signing this offer, you are, among other things, representing to LL Flooring that there are no agreements or restrictions that would prevent, limit, impair or otherwise compromise your ability to comply with the terms of this offer and perform on behalf of LL Flooring.

Please note that your employment with LL Flooring is at-will and neither this document nor any other oral or written representations may be considered a contract of employment for any specific length of time. You retain the option, as does LL Flooring, of ending your employment with LL Flooring at any time, with or without notice and with or without cause.

If you have questions regarding any of the above, please feel free to contact me directly.

Robert, we look forward to you joining the LL Flooring team and working with you to further our success.

Sincerely,

Matt T. Argano, Ph.D.

SVP, Human Resources

ACKNOWLEDGEMENT and AGREEMENT: As indicated by my signature below on this letter, I acknowledge its receipt and my understanding and acceptance of its contents. I agree that should I terminate employment with LL Flooring or if my employment is terminated for cause, any monies owed for reimbursement of expenses or other sums under this offer letter will be deducted from my final paychecks.

|

|

|

|

|

|

|

Signature: |

|

/s/ Robert Madore |

|

Date: |

|

6/9/2023 |

|

|

Robert Madore |

|

|

|

|

|

|

|

|

|

|

|

cc: |

|

Charles Tyson, President and CEO |

|

|

|

|

3

EXHIBIT 99.1

For Immediate Release

LL FLOORING ANNOUNCES LEADERSHIP APPOINTMENTS

Robert L. Madore Appointed Executive Vice President, Chief Financial Officer

Andrew W. Wadhams Appointed Senior Vice President, Retail & Commercial Sales

Laura Massaro Appointed Senior Vice President, Chief Marketing Officer

RICHMOND, Va., July 6, 2023 – LL Flooring Holdings, Inc. (“LL Flooring” or “Company”) (NYSE: LL), a leading specialty retailer of hard-surface flooring in the U.S., today announced three new leadership team appointments, all effective July 10, 2023. Mr. Robert L. Madore has been appointed as Executive Vice President, Chief Financial Officer, replacing Interim Chief Financial Officer Terry Blanchard; Andrew W. Wadhams has been named as Senior Vice President, Retail and Commercial Sales; and Laura Massaro has been named as Senior Vice President, Chief Marketing Officer.

Charles Tyson, President and Chief Executive Officer, said, “The Board of Directors and I are pleased to welcome an executive of Bob’s caliber as LL Flooring’s next CFO, and look forward to benefitting from his deep retail, financial and leadership experience. Bob has a proven track record of building strong finance organizations that help support sustainably growing brands, and we’re excited to leverage his wealth of knowledge as we execute our growth strategies to continue positioning the Company for long term success.”

Mr. Madore commented, “LL Flooring is a leading specialty retailer with a unique offering in the flooring space, and I am honored to join the team at a critical point in the Company’s journey. I look forward to collaborating with Charles and the entire executive team as we look to capture the opportunities ahead, and I am confident that my skillsets and expertise will allow me to help lead the successful execution of our strategies and drive value for all stakeholders.”

Mr. Tyson added, “We are also pleased to welcome Laura as LL Flooring’s Chief Marketing Officer and Andrew to lead our retail and commercial sales organization. Laura has developed and led marketing campaigns for some of the most well-known brands in the world, and we are excited to leverage her experience and insight as we continue building awareness of our brand. In addition, Andrew is a seasoned sales executive with an acute understanding of how to deliver an extraordinary customer experience and a proven track record of exceeding growth and profitability goals. Laura and Andrew are highly talented brand-building executives who will be strong assets to our leadership team as we continue to deliver the high touch service of an independent flooring retailer combined with the value and convenience of a national brand serving both the professional and consumer segments.”

Mr. Wadhams said, “LL Flooring has built an exceptional customer-centric business focused on high-touch service supported by a sales organization focused on expertise. I am thrilled to be joining the Company and look forward to working with the leadership and field teams to maximize growth and optimize the customer experience.”

Ms. Massaro said, “I am excited to join LL Flooring and to oversee its marketing initiatives as I leverage my prior experience and expertise to deliver the best outcome for LL Flooring and all of our stakeholders. I look forward to hitting the ground running as we work to increase awareness, drive engagement and capture additional opportunities.”

Robert L. Madore

Mr. Madore brings more than 30 years of public company management, finance and accounting experience, a record of leading and scaling financial operations while strengthening business performance, and extensive knowledge of the retail industry. He has served as an agent of change in leading matrix organizations and cross-functional teams, with proven success in implementing process improvements, and executing strategies that positively impact the bottom line and

1

increase market share. Mr. Madore most recently served as Interim Chief Financial Officer of F45 Training Holdings, Inc. (NYSE: FXLV), a global fitness franchisor, since February 15, 2023. Prior to joining F45, Mr. Madore served as CFO of The Cronos Group (NASDAQ: CRON), a global cannabinoid company, where he rebuilt and managed financial and accounting systems, controls processes and people teams. Prior to that, Mr. Madore served as CFO of American Eagle Outfitters, Inc. (NYSE: AEO) and CFO of Ralph Lauren Corporation (NYSE: RL).

Andrew W. Wadhams

An accomplished retail and consumer products executive, Mr. Wadhams most recently served as Principal of The Wadhams Group, a company he founded to help brands define their offering, align and streamline practices and deepen connections to customers. Prior to this, he spent half a decade at California Closets, where he served as COO. Previously, Mr. Wadhams served in a number of operational roles at One Medical Group, Inc. and Knowledge Universe. In addition, Mr. Wadhams spent over twelve years in field leadership positions with Gap, Inc. (NYSE: GPS).

Laura Massaro

Ms. Massaro brings more than 20 years of marketing experience across a variety of brands and sectors. Most recently, Ms. Massaro served as Director of Integrated Marketing at Delta Air Lines (NYSE: DAL), where she led and supported teams across media, social, CRM, MarTech, operations and analytics. Prior to joining Delta Air Lines, Ms. Massaro served as Vice President and Deputy Head of Planning for Publicis Groupe’s Arc Worldwide in London, where she directed digital and retail strategy across a range of clients. Previously, Ms. Massaro held various executive marketing positions at Ogilvy (NYSE: WPP), The Coca-Cola Company (NYSE: KO) and Kraft Foods (NYSE: KHC).

About LL Flooring

LL Flooring is one of the country’s leading specialty retailers of hard-surface flooring with more than 440 stores nationwide. The Company seeks to offer the best customer experience online and in stores, with more than 500 varieties of hard-surface floors featuring a range of quality styles and on-trend designs. LL Flooring's online tools also help empower customers to find the right solution for the space they've envisioned. LL Flooring's extensive selection includes waterproof hybrid resilient, waterproof vinyl plank, solid and engineered hardwood, laminate, bamboo, porcelain tile, and cork, with a wide range of flooring enhancements and accessories to complement. LL Flooring stores are staffed with flooring experts who provide advice, Pro partnership services and installation options for all of LL Flooring's products, the majority of which is in stock and ready for delivery.

Learn More about LL Flooring

•Our commitment to quality, compliance, the communities we serve and corporate giving: https://llflooring.com/corp/quality.html

•Follow us on social media: Facebook, Instagram and Twitter.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release includes statements of the Company’s expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meanings of the Private Securities Litigation Reform Act of 1995. These statements, which may be identified by words such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” "assumes," “believes,” “thinks,” “estimates,” “seeks,” “predicts,” “could,” “projects,” "targets," “potential,” "will likely result," and other similar terms and phrases, are based on the beliefs of the Company’s management, as well as assumptions made by, and information currently available to, the Company’s management as of the date of such statements. These statements are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond the Company’s control.

The Company specifically disclaims any obligation to update these statements, which speak only as of the dates on which such statements are made, except as may be required under the federal securities laws. For a discussion of the risks and uncertainties that could cause actual results to differ from those contained in the forward-looking statements, see the “Risk

2

Factors” section of the Company’s annual report on Form 10-K for the year ended December 31, 2022, and the Company’s other filings with the Securities and Exchange Commission (“SEC”). Such filings are available on the SEC’s website at www.sec.gov and the Company’s Investor Relations website at https://investors.llflooring.com.

For further information contact:

LL Flooring Investor Relations

ICR

Bruce Williams

ir@llflooring.com

Tel: 804-420-9801

3

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

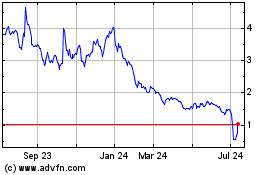

LL Flooring (NYSE:LL)

Historical Stock Chart

From Apr 2024 to May 2024

LL Flooring (NYSE:LL)

Historical Stock Chart

From May 2023 to May 2024