|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Amendment to Credit Agreement

On May 6, 2020, Leggett & Platt, Incorporated (the “Company,” “us,” “we” or “our”) entered into Amendment No. 1 (the “Amendment”) to the Third Amended and Restated Credit Agreement (the “Credit Agreement”) with JPMorgan Chase Bank, N.A., as administrative agent (“JPMorgan”) and the Lenders listed below. The Amendment was effective on May 6, 2020. Reference is made to the Credit Agreement, dated December 12, 2018, filed December 14, 2018 as Exhibit 10.1 to our Form 8-K.

The Credit Agreement is a multi-currency credit facility providing us the ability, from time to time subject to certain customary conditions, to borrow, repay and re-borrow up to $1.2 billion under a revolving facility maturing in January 2024, at which time our ability to borrow under this facility will terminate. The Credit Agreement also provided for a one-time draw of up to $500 million under a five-year term loan facility, of which we fully borrowed against in January 2019 to fund the acquisition of Elite Comfort Solutions.

Capitalized terms used but not defined herein have the meanings set forth in the Amendment or Credit Agreement.

The Amendment to the Credit Agreement included, among other things:

|

|

(1)

|

Leverage Ratio. The Credit Agreement contained a covenant that required the Company to maintain, as of the last day of each fiscal quarter, a Leverage Ratio of Consolidated Funded Indebtedness to Consolidated EBITDA for the trailing four fiscal quarters of not greater than 4.25 to 1.00, with a single step-down to 3.50 to 1.00 on March 31, 2020. The Amendment changed the covenant in two ways: (i) the calculation of the Leverage Ratio now subtracts Unrestricted Cash from Consolidated Funded Indebtedness; and (ii) the applicable Leverage Ratio was changed as set forth below:

|

|

|

|

|

|

|

|

Quarter End Date

|

|

Ratio

|

|

|

Each Fiscal Quarter End Date Through March 31, 2021

|

|

|

4.75 to 1.00

|

|

|

June 30, 2021

|

|

|

4.25 to 1.00

|

|

|

September 30, 2021

|

|

|

3.75 to 1.00

|

|

|

December 31, 2021 and Each Fiscal Quarter End Date Thereafter

|

|

|

3.25 to 1.00

|

|

“Unrestricted Cash” means unrestricted cash and cash equivalents held or owned by, credited to the account of, or otherwise reflected as an asset on the balance sheet of the Company.

|

|

(2)

|

Limitations on Liens. The Credit Agreement contained a covenant that limited the outstanding principal amount of Indebtedness and other monetary obligations secured by Liens to 15% of Consolidated Total Assets. After the Amendment, the amount of Indebtedness and other monetary obligations secured by Liens is limited to 5% of our Consolidated Total Assets until December 31, 2021, at which time the covenant reverts back to 15% of Consolidated Total Assets.

|

|

|

(3)

|

Applicable Rate Table. Prior to the Amendment, the pricing table, which is contained under the definition of “Applicable Rate” was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratings for Index Debt

|

|

ABR

Spread

|

|

|

Fixed

Spread

|

|

|

Commitment

Fee Rate

|

|

|

>= A+ / A1

|

|

|

0.000

|

%

|

|

|

0.750

|

%

|

|

|

0.060

|

%

|

|

= A / A2

|

|

|

0.000

|

%

|

|

|

0.875

|

%

|

|

|

0.070

|

%

|

|

= A- / A3

|

|

|

0.000

|

%

|

|

|

1.000

|

%

|

|

|

0.090

|

%

|

|

= BBB+ / Baa1

|

|

|

0.125

|

%

|

|

|

1.125

|

%

|

|

|

0.110

|

%

|

|

<= BBB / Baa2

|

|

|

0.250

|

%

|

|

|

1.250

|

%

|

|

|

0.150

|

%

|

After the Amendment, the new pricing table is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratings for Index Debt

|

|

ABR

Spread

|

|

|

Fixed

Spread

|

|

|

Commitment

Fee Rate

|

|

|

>= A+ / A1

|

|

|

0.000

|

%

|

|

|

1.000

|

%

|

|

|

0.100

|

%

|

|

= A / A2

|

|

|

0.125

|

%

|

|

|

1.125

|

%

|

|

|

0.150

|

%

|

|

= A- / A3

|

|

|

0.250

|

%

|

|

|

1.250

|

%

|

|

|

0.200

|

%

|

|

= BBB+ / Baa1

|

|

|

0.875

|

%

|

|

|

1.875

|

%

|

|

|

0.250

|

%

|

|

= BBB / Baa2

|

|

|

1.000

|

%

|

|

|

2.000

|

%

|

|

|

0.300

|

%

|

|

<BBB/Baa2

|

|

|

1.500

|

%

|

|

|

2.500

|

%

|

|

|

0.500

|

%

|

|

|

(4)

|

Interest Rate Floors Increased. Pursuant to the Amendment, the interest rate floor for the Alternate Base Rate was increased from 0% to 2%. Also, interest rate floors for the Canadian Dollar Offered Rate (“CDOR”) Screen Rate, the Fixed Rate, the Interpolated Rate, the London Interbank Offered (“LIBO”) Screen Rate and the Reference Bank Rate were increased from 0% to 1%.

|

|

|

(5)

|

Anti-Cash Hoarding. A provision was added to the Credit Agreement that limits Borrowing if, at the time of the Borrowing and immediately after giving effect of such Borrowing and the use of the proceeds, the Company has a pro forma Consolidated Cash Balance in excess of the Consolidated Cash Balance Limit. The Consolidated Cash Balance Limit is generally defined as $300 million, plus (i) any payments reasonably expected to be made by the Company within five business days for trade payables, Indebtedness, taxes, payroll, or other obligations certified in writing by JPMorgan, as the administrative agent; (ii) any amounts to be used in connection with the consummation of transactions permitted by the Credit Agreement (including any Acquisition and/or the payment of any dividends or distributions) that is contemplated in good faith to be consummated within 30 business days; and (iii) any amounts to be used for the refinancing or other payment of commercial paper.

|

General Terms under the Credit Agreement

The Revolving Commitments under the Revolving Facility and each Lender’s Revolving Commitment are as follows:

|

|

|

|

|

|

|

Lenders

|

|

Revolving

Commitment

|

|

|

JPMorgan Chase Bank, N.A.

|

|

$

|

173,128,342.24

|

|

|

Wells Fargo Bank, National Association

|

|

$

|

128,114,973.27

|

|

|

U.S. Bank National Association

|

|

$

|

128,114,973.27

|

|

|

MUFG Bank, Ltd.

|

|

$

|

128,114,973.27

|

|

|

Bank of America, N.A.

|

|

$

|

128,114,973.27

|

|

|

SunTrust Bank1

|

|

$

|

91,764,705.88

|

|

|

PNC Bank, National Association

|

|

$

|

91,764,705.88

|

|

|

BMO Harris Bank, N.A.

|

|

$

|

63,529,411.76

|

|

|

The Toronto Dominion Bank

|

|

$

|

63,529,411.76

|

|

|

Branch Bank and Trust Company1

|

|

$

|

63,529,411.76

|

|

|

Banco Bilbao Vizcaya Argentaria, S.A. New York Branch

|

|

$

|

63,529,411.76

|

|

|

Svenska Handelsbanken AB (PUBL) New York Branch2

|

|

$

|

45,000,000.00

|

|

|

Arvest Bank

|

|

$

|

31,764,705.88

|

|

|

|

|

|

|

|

|

|

|

$

|

1,200,000,000

|

|

|

1

|

SunTrust Bank and Branch Bank and Trust Company merged. The combined Lender is called Truist Bank.

|

|

2

|

Due to time constraints, Svenska Handelsbanken AB (PUBL) New York Branch did not sign the Amendment, but, pursuant to the applicable provisions in the Credit Agreement, is bound by the terms of the Amendment.

|

The proceeds of Revolving Loans under the Revolving Facility will be used for working capital and other general corporate purposes of the Company and its subsidiaries. Amounts repaid under the Revolving Facility may be re-borrowed, subject to satisfaction of certain Borrowing conditions. As of the date of this Form 8-K, there is no Borrowing under the Revolving Facility. The Credit Agreement serves as support for our commercial paper program. As of the date of this Form 8-K, we had $233 million of commercial paper outstanding.

The Company may elect the type of Borrowing under the Credit Agreement, which determines the rate of interest to be paid on the outstanding principal balance, as follows:

|

(A)

|

ABR Borrowing . Under an ABR loan, we will pay interest at the Alternate Base Rate plus the Applicable Rate.

|

(1) Alternate Base Rate. The Alternate Base Rate is the highest of (a) the Prime Rate last quoted by The Wall Street Journal as the “prime rate” in the United States; (b) the NYFRB Rate, which is the greater of (i) the rate based on federal funds transactions by depository institutions and published as the Federal Funds Effective Rate by the Federal Reserve Bank of New York, or (ii) the Overnight Bank Funding Rate published by the Federal Reserve Bank of New York; each in effect for such day, plus 1/2 of 1%; or (c) the Adjusted Fixed Rate for a one month Interest Period, which is the Fixed Rate (as defined below) multiplied by the Statutory Reserve Rate (a fraction with a numerator of 1, and a denominator of 1 minus the aggregate of the maximum reserve percentages established by the Federal Reserve Board to which JPMorgan is subject for Eurocurrency funding), plus 1%.

(2) Applicable Rate. The Applicable Rate equals an ABR Spread based on the higher of S&P and Moody’s credit ratings of our senior unsecured long-term debt.

|

(B)

|

Fixed Rate Borrowing . Under a Fixed Rate loan, we will pay interest at the Adjusted Fixed Rate for the Interest Period and Major Currency plus the Applicable Rate.

|

(1) Adjusted Fixed Rate. The Adjusted Fixed Rate is the Fixed Rate multiplied by the Statutory Reserve Rate, as defined above. The Fixed Rate for any Borrowing denominated (a) in Dollars, Euros, British Pounds Sterling and Swiss Francs equals the LIBO Screen Rate (the London interbank offered rate) for such Interest Period; (b) in Mexican Pesos equals the Mexican Peso Negotiated Rate for such Interest Period; and (c) in Canadian Dollars equals the CDOR Screen Rate for such Interest Period; provided that if the LIBO Screen Rate or CDOR Screen Rate is not available, then the interest will be at the Interpolated Rate (a rate per annum interpolated by JPMorgan, if possible), and if not possible at the mean of rates offered by certain Referenced Banks.

(2) Applicable Rate. The Applicable Rate equals a Fixed Spread based on the higher of S&P and Moody’s credit ratings of our senior unsecured long-term debt.

|

(C)

|

Dollar Swingline Loans . Under a Dollar Swingline loan (which may be, but is not required to be made by JPMorgan, as Swingline Lender, usually for short-term administrative convenience on same day notice) we would pay interest at a rate per annum equal to the Alternate Base Rate plus the Applicable Rate for an ABR Borrowing.

|

|

(D)

|

Competitive Loans . Under a Competitive Loan, we will pay interest at a rate equal to a competitive variable or fixed rate accepted by us.

|

Payment of Interest and Principal

Revolving Facility. The Company is required to (a) periodically pay accrued interest on any outstanding principal balance under the Revolving Facility at time intervals based upon the selected interest rate and the selected Interest Period, and (b) pay the outstanding principal of the Revolving Facility upon the maturity date. We can also repay the outstanding principal prior to maturity, except for loans denominated in Mexican Pesos.

Tranche A Term Facility. As of the date of this Form 8-K, there was $450 million outstanding under the Tranche A Term Facility. The Company must pay interest on the Tranche A Term Loan based on ABR or Fixed Rate Borrowing at time intervals based upon the selected interest rate and selected Interest Period. The Company is required to (a) pay $12.5 million in principal on the Tranche A Term Facility each quarter (on the last day of March, June, September and December), and (b) pay the remaining outstanding principal under the Tranche A Term Facility upon the maturity date in January 2024. Principal amounts borrowed under a Tranche A Term Loan can be prepaid.

Letters of Credit. Our ability to borrow under the Revolving Facility is reduced by the amount of outstanding Letters of Credit issued pursuant to the Credit Agreement. The amount of Letters of Credit is limited to $125 million. As of the date of this Form 8-K, there are no Letters of Credit outstanding under the Credit Agreement.

Acceleration of Indebtedness

Subject to certain customary cure periods, the Credit Agreement provides that if we breach any representation or warranty, do not comply with any covenant, fail to pay principal, interest or fees in a timely manner, or if any Event of Default (as defined in the Credit Agreement) otherwise occurs, then the Credit Agreement may be terminated. Upon termination, all outstanding Indebtedness under the Credit Agreement will accelerate.

The foregoing is only a summary of certain terms of the Amendment and the Credit Agreement and is qualified in its entirety by reference to the Amendment and the Credit Agreement, which are filed as Exhibit 10.1 and Exhibit 10.2 to this Form 8-K and are incorporated herein by reference.

JPMorgan, the listed Lenders and their affiliates have provided, from time to time, and continue to provide commercial banking and related services, as well as investment banking, financial advisory and other services to us and/or to our affiliates, for which we have paid, and intend to pay, customary fees, and, in some cases, out-of-pocket expenses.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided in Item 1.01 above is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

10.1*

|

|

|

Amendment No. 1 to the Third Amended and Restated Credit Agreement, dated as of May 6, 2020 among the Company, JPMorgan Chase Bank, N.A. as administrative agent, and the Lenders named therein.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Third Amended and Restated Credit Agreement, dated as of December 12, 2018 among the Company, JPMorgan Chase Bank, N.A. as administrative agent, and the Lenders named therein, including Revolving Loans and Tranche A Term Loans, filed December 14, 2018 as Exhibit 10.1 to the Company’s Form 8-K, is incorporated by reference. (SEC File No. 001-07845)

|

|

|

|

|

|

|

|

|

101.INS

|

|

|

Inline XBRL Instance Document (the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the inline XBRL document)

|

|

|

|

|

|

|

|

|

101.SCH*

|

|

|

Inline XBRL Taxonomy Extension Schema

|

|

|

|

|

|

|

|

|

101.LAB*

|

|

|

Inline XBRL Taxonomy Extension Label Linkbase

|

|

|

|

|

|

|

|

|

101.PRE*

|

|

|

Inline XBRL Taxonomy Extension Presentation Linkbase

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the inline XBRL document contained in Exhibit 101)

|

|

*

|

Denotes filed herewith.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

LEGGETT & PLATT, INCORPORATED

|

|

|

|

|

|

|

|

|

|

Date: May 7, 2020

|

|

|

|

By:

|

|

/s/ Scott S. Douglas

|

|

|

|

|

|

|

|

Scott S. Douglas

|

|

|

|

|

|

|

|

Senior Vice President –

General Counsel & Secretary

|

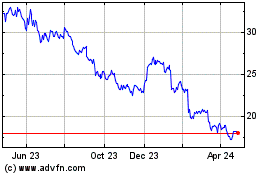

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

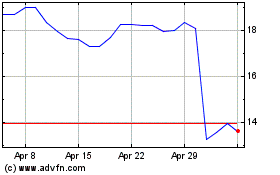

Leggett and Platt (NYSE:LEG)

Historical Stock Chart

From Apr 2023 to Apr 2024