Las Vegas Sands Posts Loss Amid Coronavirus Shutdown -- Update

April 22 2020 - 7:16PM

Dow Jones News

By Katherine Sayre

Casino operator Las Vegas Sands Corp. reported a 51% drop in

revenue, with Las Vegas shut down in response to the coronavirus

pandemic and reopened casinos in Macau struggling to recover.

On Wednesday, Sands posted $1.78 billion in net revenue for the

three months ended March 31, down from $3.6 billion at year

earlier. The company had a net loss of $51 million for the quarter,

compared with $744 million in net income a year earlier.

Casinos across the U.S. were shut down in mid-March in response

to the pandemic, and it is unclear when the industry will be

allowed to reopen. Sands' portfolio includes the Venetian on the

Las Vegas Strip and resorts in Singapore and the Chinese territory

of Macau, the world's largest gambling market.

"We are confident that travel and tourism spending in each of

our markets, and around the world, will eventually recover," Chief

Executive Sheldon Adelson, the company's biggest shareholder, said

Wednesday.

Casinos in Macau were closed for two weeks in February, but

business hasn't bounced back since they reopened. In March,

industrywide gambling revenue in Macau was down nearly 80%,

according to government data.

Sands China Ltd., the company's subsidiary in Macau, reported a

net loss of $166 million for the first quarter, compared with $557

million in net income a year earlier. Sands China's total revenue

declined 65% to $814 million. Las Vegas Sands has suspended its

quarterly dividend program.

Robert Goldstein, president and chief operating officer of

Sands, said casino business will return more quickly in Asia than

in the U.S. as travel restrictions from China to Macau are

lifted.

Marina Bay Sands in Singapore is closed until June 1 as part of

the government's response to the pandemic.

Casino operations will include safety measures like gloves,

masks and temperature checks, Mr. Goldstein said. In Hong Kong,

people are out at restaurants and stores while taking health

precautions, "and that's what I hope we can do in Las Vegas as well

and adapt to the new environment," he said.

Nevada Gov. Steve Sisolak hasn't issued a date for when casinos

will be allowed to reopen. Mr. Sisolak said this week that he will

reopen the economy in phases.

Sands had a cash balance of $2.6 billion and total debt at $12.3

billion as of March 31. The company said it also has $3.9 billion

available for borrowing.

Write to Katherine Sayre at katherine.sayre@wsj.com

(END) Dow Jones Newswires

April 22, 2020 19:01 ET (23:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

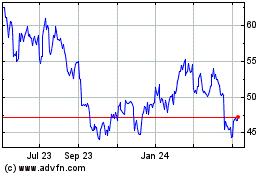

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

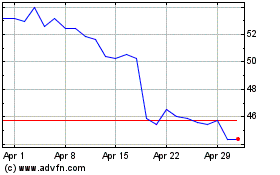

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024