Kimberly-Clark Hikes Dividend - Analyst Blog

March 01 2012 - 10:22AM

Zacks

Kimberly-Clark Corporation (KMB), with its

quarterly dividend hike to 74 cents per share from 70 cents per

share, boasts of a record of dividend increase for 40 years

consecutively.

The company hiked its dividend by 6% and the increased dividend

is payable on April 3, 2012 to shareholders of record on March 9,

2012.

The move comes a month after the company posted outstanding

fourth quarter and fiscal 2011 earnings of $1.28 and $4.80 per

share, which were 7.0% and 2.6% higher than the year-ago earnings.

The growth was mainly attributable to sales growth, cost savings

and a lower share count. However, these were partially offset by

rising input cost inflation, higher effective tax rate and lower

net income from equity companies.

Though the company did not repurchase any common stock in the

fourth quarter of 2011, Kimberly-Clark‘s total buybacks in fiscal

2011 totaled 19.0 million shares at a cost of $1.24 billion. In

addition, share repurchases are expected to total $900 million to

$1.1 billion in fiscal 2012, subject to market conditions.

Kimberly-Clark was anticipating this dividend increase although

cash provided by operations in the fourth quarter of 2011 amounted

to $517 million as compared to $948 million in the prior-year

quarter. The decline was driven by increased working capital

compared to a significant decrease in the year-ago period, along

with higher defined benefit pension plan contributions, partially

offset by improved cash earnings.

Cash provided by operations in fiscal 2011 was also lower than

2010 at $2.29 billion, driven by higher pension contributions in

2011.

Capital spending in the fourth quarter of 2011 was $312 million

as compared to $353 million in 2010, whereas it amounted to $968

million in fiscal 2011. However, the capital spending in fiscal

2012 is expected to be in line with the company's long-term target

of 4.5% to 5.5% of net sales, in the range of $1.0 to $1.1

billion.

Recently, The Coca Cola Company (KO) also hiked

its quarterly dividend by 8.5% to 51 cents per share from 47 cents

per share. The dividend is payable on April 1, 2012 to

shareholders of record on March 15, 2012.

Kimberly-Clark, which competes with Procter & Gamble

Co. (PG), currently holds a Zacks #3 Rank, which

translates into a short-term Hold rating. On a long-term basis, we

maintain a Neutral rating on the stock.

KIMBERLY CLARK (KMB): Free Stock Analysis Report

COCA COLA CO (KO): Free Stock Analysis Report

PROCTER & GAMBL (PG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

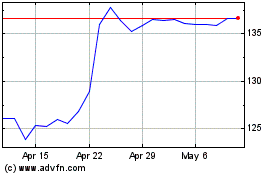

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2024 to May 2024

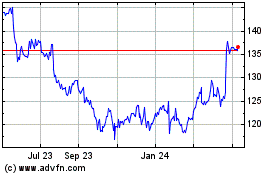

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From May 2023 to May 2024