For Immediate Release

Chicago, IL – March 2, 2012 – Zacks Equity Research highlights:

Texas Capital Bancshares ( TCBI) as the Bull

of the Day and KB Home ( KBH) as the Bear of

the Day. In addition, Zacks Equity Research provides analysis on

State Street Corporation ( STT),

Deutsche Bank AG ( DB) and Bank of America

Corporation ( BAC).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

We are upgrading our recommendation on Texas

Capital Bancshares ( TCBI) to Outperform from Neutral

following a better-than-expected fourth quarter 2011 earnings

result which was backed by an increase in net interest income. The

improvements in the credit quality metrics were also quite

impressive.

Texas Capital's business model remains a chief growth driver.

Additionally, the gain in market share from its competitors as well

as organic growth augurs well. The company's efforts to hire

experienced bankers and expand its presence are encouraging.

Though the resultant expenses that continue to grow remain a

concern, going forward we believe that with an eventual improvement

in the Texan economy, the company would be further poised to

experience an increase in earnings. Our six-month target price of

$39.00 equates to 16.6x our earnings estimate for 2012. This price

target implies an expected total return of 18.7% over that

period.

Bear of the Day:

KB Home ( KBH) faces a fragile housing

market. Increased availability of housing alternatives may keep the

company's earnings under pressure. Furthermore, the company's

housing market is highly concentrated, which poses threats to its

earnings performance.

The company did post a profit of $0.18 per share during the

fourth quarter of fiscal 2011, which was much higher than the Zacks

Consensus Estimate of $0.03. Nevertheless, the negative factors

have led us to downgrade the recommendation on shares of KB Home

from Neutral to Underperform with a target price of $10.00.

Our long-term Underperform recommendation on the stock indicates

that it will perform lower than the overall market. Our $10 target

price, 25.0X our 2013 EPS estimate, reflects this view.

Latest Posts on the Zacks Analyst Blog:

State Street Fined for Failed CDO

State Street Corporation ( STT) has been

penalized by Massachusetts state regulators for its alleged role in

marketing and selling risky collateralized debt obligation (CDO)

without disclosing proper information to its clients. The company

has been asked to pay a total of about $5 million ($3.54 million as

fees and profits earned on the deal and $1.45 million as

penalty).

In 2006, as an investment manager for a CDO, known as Carina CDO

Ltd., State Street was helped by Magnetar Capital LLC, a hedge fund

in selecting the assets that were included in the CDO. In addition

to this, the company was approached by Deutsche Bank

AG’s ( DB) Deutsche Bank Securities unit to market and

sale the CDO.

However, Magnetar had placed a bet that some of the assets that

were included in the CDO would fail and State Street failed to

inform the investors who bought the CDO about this predicted mess.

Thus, the investors failed to make an informed investment decision

as they were unaware of the conflict of interest between Magnetar

and other Carina investors.

State Street allegedly harmed the investors by leaving them with

a loss of nearly $450 million when Carina failed. However, at this

moment, State Street is neither admitting nor denying the findings

of the Massachusetts regulators or the conclusions regarding

information contained in the offering documents for the CDO.

Massachusetts state regulators have been trying to find out how

the banks structured and sold a large number of debt products,

prior to the financial crisis in 2008. Last month, Massachusetts

regulators stated that they were investigating

whether Bank of America Corporation (

BAC) had knowingly inflated the value of assets in two loan

portfolios that were sold to the investors in the form of

collateralized loan obligations. These loan portfolios led to

nearly $150 million of losses to the investors.

Conclusion

We believe that by penalizing State Street, Massachusetts

regulators have shown that financial institutions are liable for

fines if they do not disclose correct information to the investors.

Moreover, the inquiries and fines will lead to proper disclosures

of the loan values and other debts by the banks and other financial

institutions, which they sell to the investors.

Currently, State Street retains a Zacks #3 Rank, which

translates into a short-term ‘Hold’ rating.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

BANK OF AMER CP (BAC): Free Stock Analysis Report

DEUTSCHE BK AG (DB): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

STATE ST CORP (STT): Free Stock Analysis Report

TEXAS CAP BCSHS (TCBI): Free Stock Analysis Report

To read this article on Zacks.com click here.

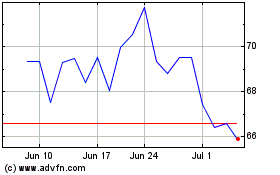

KB Home (NYSE:KBH)

Historical Stock Chart

From May 2024 to Jun 2024

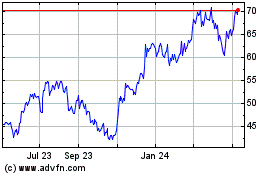

KB Home (NYSE:KBH)

Historical Stock Chart

From Jun 2023 to Jun 2024